#AMC before I get into our new SEC filing I was about to let this pass but this is how I’m looking at everyone back tracking their no dilution comments after weeks of me saying it wouldn’t happen and that it was necessary for the health of the co. Be prepared for the excuses to

follow. Trust had AA not said anything they still would’ve voted no. 🤣🤣🤣 But I’m glad they were able to have an epiphany about voting for the shares and not against it. 🤣 Now before I get into the New SEC filing I’m still working on last nights DD here is status it’s typed up

and just needs to be recorded and posted here and on Reddit. Moving on...this was pointed out to me by @KateGentle7 as she saw a new filing before I had a chance and let me know what’s up. The Additional definitive proxy soliciting materials has been updated. The point in re.

to the update is Adam Arons pledge to make a binding promise enforceable under contract law and good faith that if the shareholders approve of the first measure. You all know the one where it’s to approve the authorization of the 500M new shares for the co.

But quite a few in our community were worried about how the share price dilution would affect the squeeze even though it was for the better of the co. Mmhmm, well Adam Aaron is now promising each shareholder he will not use any of those 500M shares this year. That if necessary

they have on hand 43M shares available to use if they need cash in the short term. But as of right now this is a NON FACTOR!!!! I repeat the additional 43M as of 4/15 a NON THREAT TO THE SQUEEZE! Okay so what how does this affect me short term if I’m not a long holder? Well in

the short term this would disallow more of the new shares on the market and continue to squeeze/bleed HF and MM until we #moon. In the long term, this will improve the health and longevity of the company keeping it alive n well. I hope that helps. Please please all

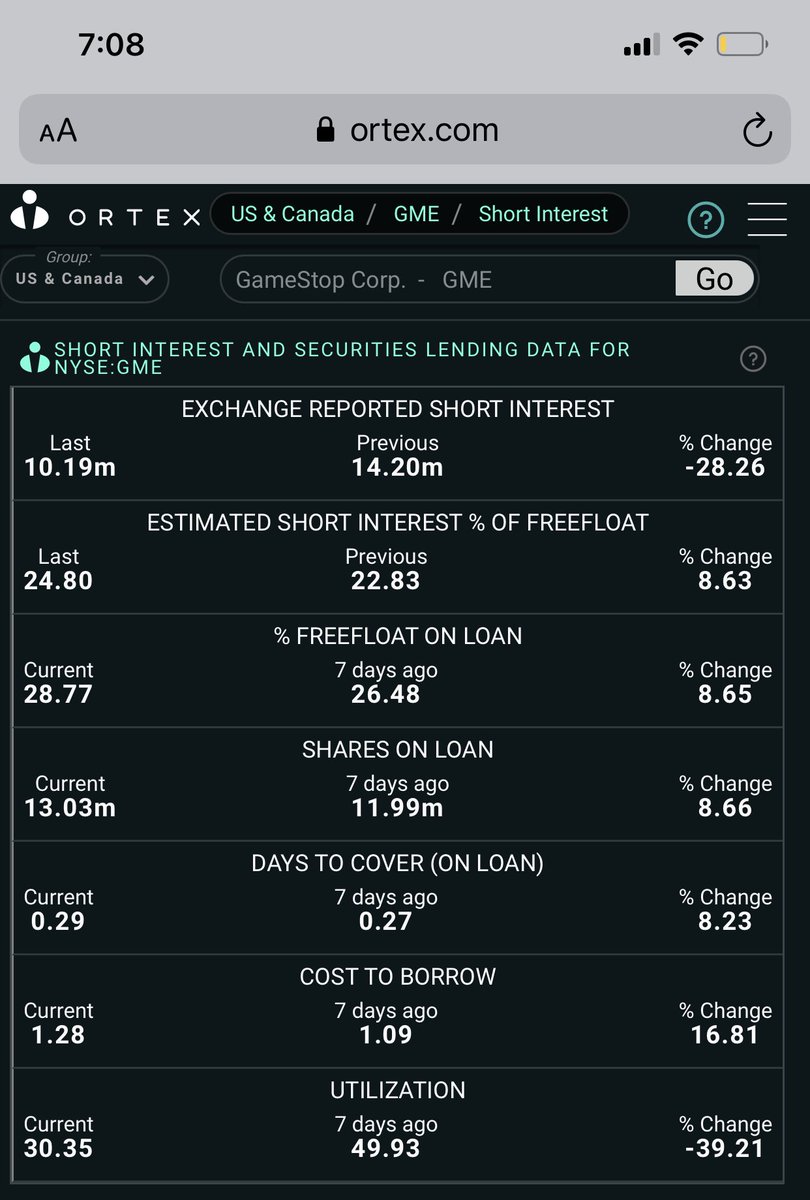

Vote yes. I will work on what we need to do as far as the other measures go. I will try to make a video to explain it later on but please be prepared to switch your vote. If you need help to do so, I can post a guide next after ortex data update. If folks think it’ll help.

Have a wonderful day. Don’t let anyone steal your joy. 😎😎 #stonks #wallstreetbets #mooning #nodilution #AMCtothemoon #weready. @threadreaderapp unroll.

• • •

Missing some Tweet in this thread? You can try to

force a refresh