Crazy stuff happens in a liquidation waterfall. But if you want reasons for the selldown... the markets were levered very long. (@coinbase euphoria perhaps?)

Funding rates were about 2x the current 1/

Funding rates were about 2x the current 1/

Then this (nonsense) was published —

the Treasury isn’t in charge of justice or criminal activity

2/

the Treasury isn’t in charge of justice or criminal activity

2/

https://twitter.com/fxhedgers/status/1383611847144730626

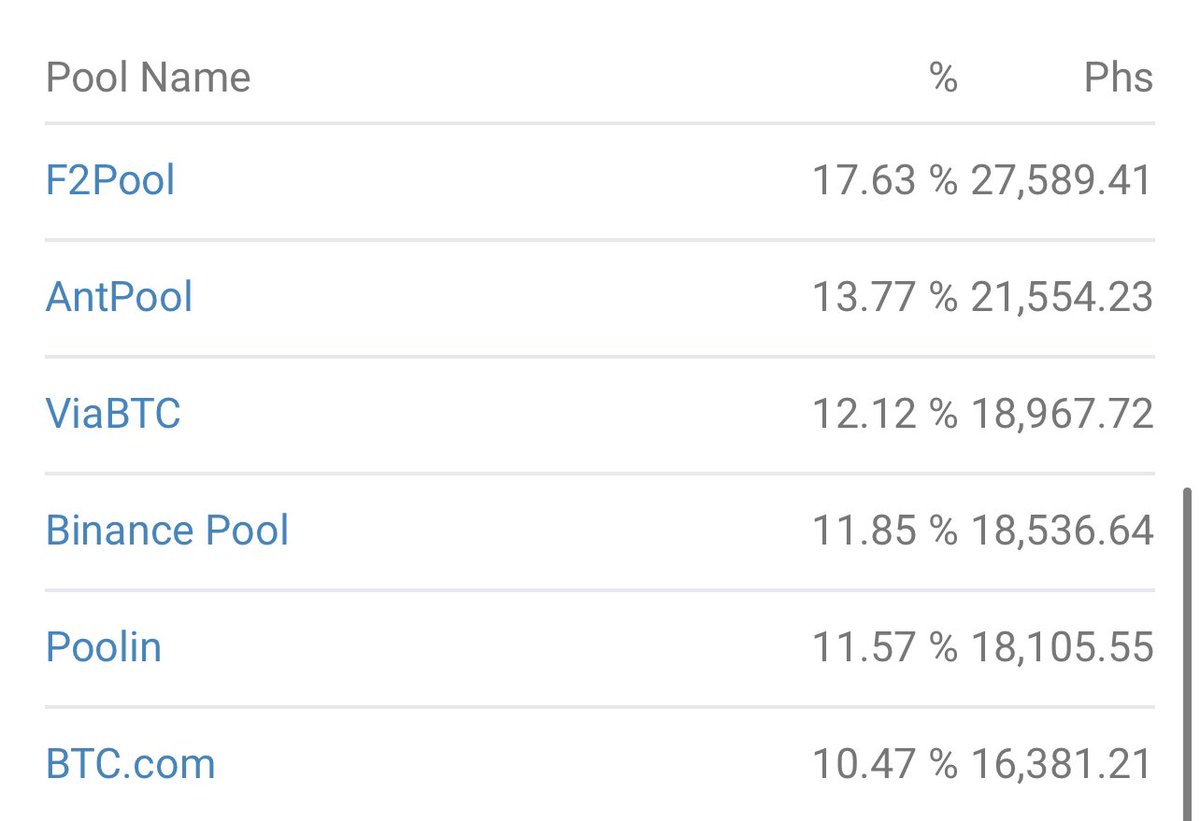

It didn’t help that, a couple days ago, #Bitcoin mining farms had to suspend operations — due to power outage safety inspections after a coal mining accident in Xinjiang

3/

bbc.co.uk/news/world-asi…

3/

bbc.co.uk/news/world-asi…

Hash rate temporarily collapses until the $BTC miners are back online. Which seems to be the case

4/

4/

https://twitter.com/woonomic/status/1383672529995190281

• • •

Missing some Tweet in this thread? You can try to

force a refresh