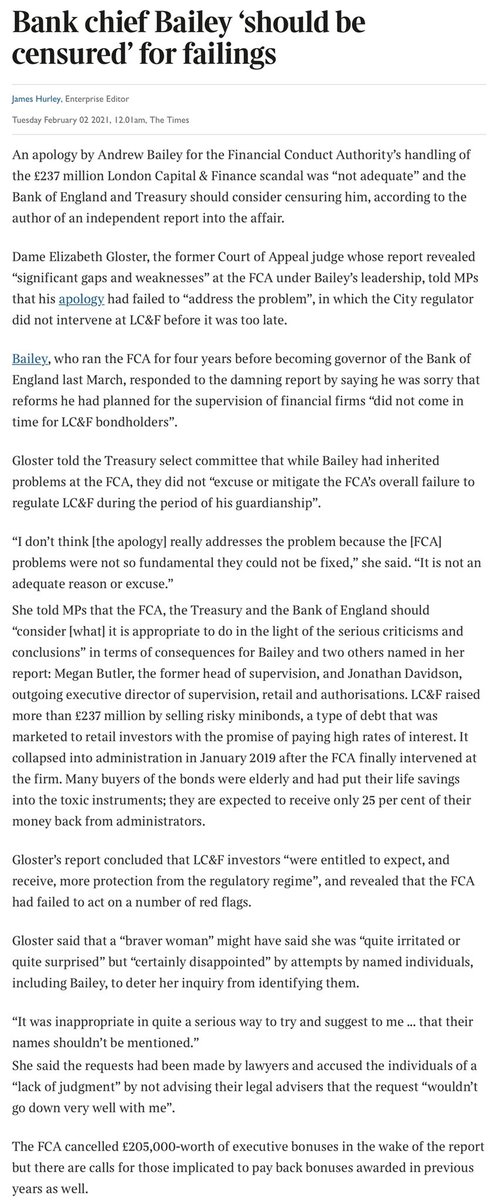

@ArmitageJim @premnsikka 1/ @TheFCA authorised Insurance Broker Alsford Page & Gems Limited (“#APG”) censured + ordered to compensate customers £400k.’ (fca.org.uk/news/press-rel…). But this is not just about the FCA’s notorious ‘extended warranty insurance’ cesspit & ...

2/ cold calling cowboys ... it’s also about the porous nature of the FCA’s pitifully small regulatory perimeter - i.e. it’s Appointed Rep. regime (aka the regulatory catflap) - a large chunk of the FCA register where the FCA has no clue who or what firms are A.R.’s + ...

3/ what they are doing. We’ve seen before notorious fraudsters & alleged ex-cons authorised via the ‘regulatory catflap’ (eg

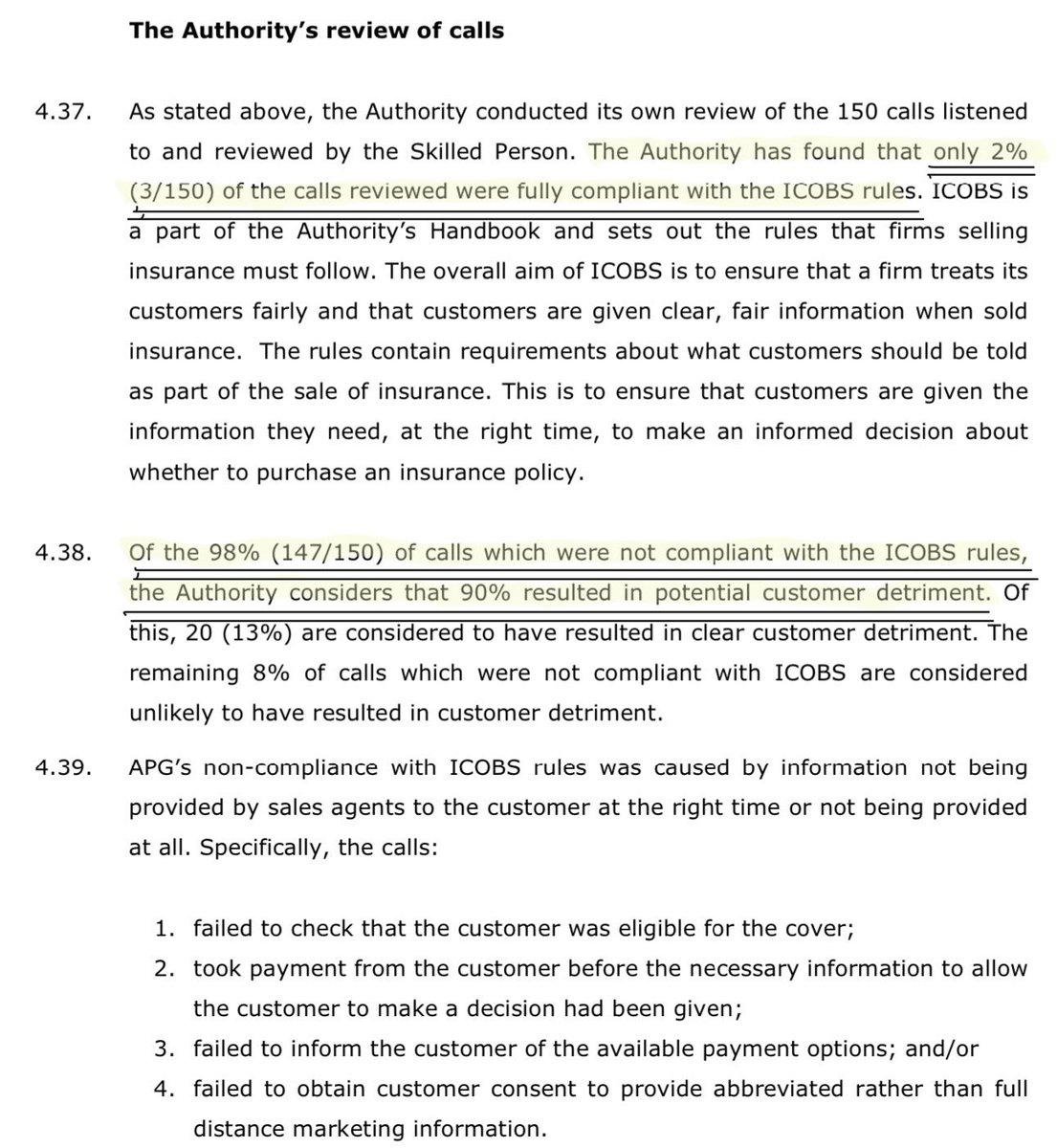

https://twitter.com/ianbeckett/status/1216770845714063361). The FCA gave scant detail, merely stating APG had packaged ‘appliance warranty insurance’, appointed 6 ‘A.R.’s ...

4/ to peddle it, that “no controls were in place” + there was a significant risk of miss-sold policies. The FCA’s response with its extra special tickling stick was to make APG’s parent company pay compensation to APG’s punters equal to APG’s commission. Astonishingly the ...

5/ FCA declare it’s “current” FCA made senior honchos at APG “had no involvement” .. so who did? & are they still FCA made men/women?. The FCA fails yet again on detection, deterrent, punishment + protection, but succeeds yet again on running cover for it’s FCA made men/women.

6/6 Unsurprisingly the FCA apparatchiki’s solution to the large chunk of its register (A.R.’s a risk to the public) isn’t to get rid of A.R.’s completely ... it’s to wet their own beaks and charge £250 per A.R. (financialreporter.co.uk/regulation/fca…) .. what could possibly go right !

• • •

Missing some Tweet in this thread? You can try to

force a refresh