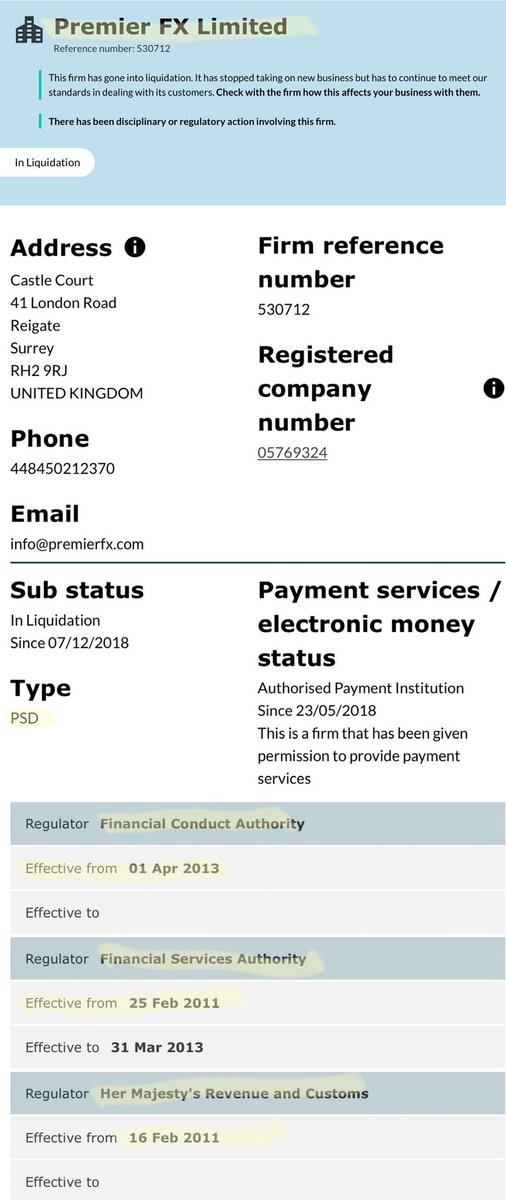

@ArmitageJim @premnsikka 1/ The Telegraph’s @Will_Kirkman writes of yet another of @theFCA’s made men in the infamous #PremierFX scandal(

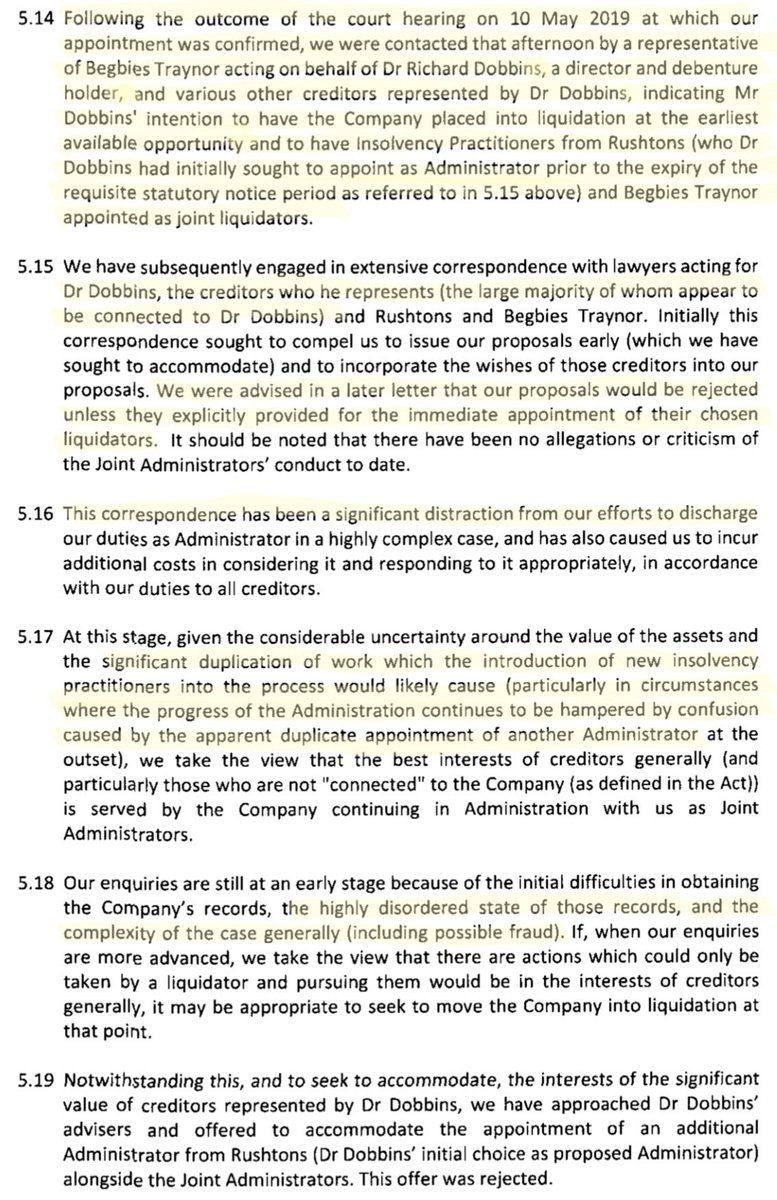

https://twitter.com/ianbeckett/status/1365434395214118915). PremierFX operated in the FCA’s notorious #Emoney/#API cesspit of #MoneyLaundering & fraud facilitation, but ...

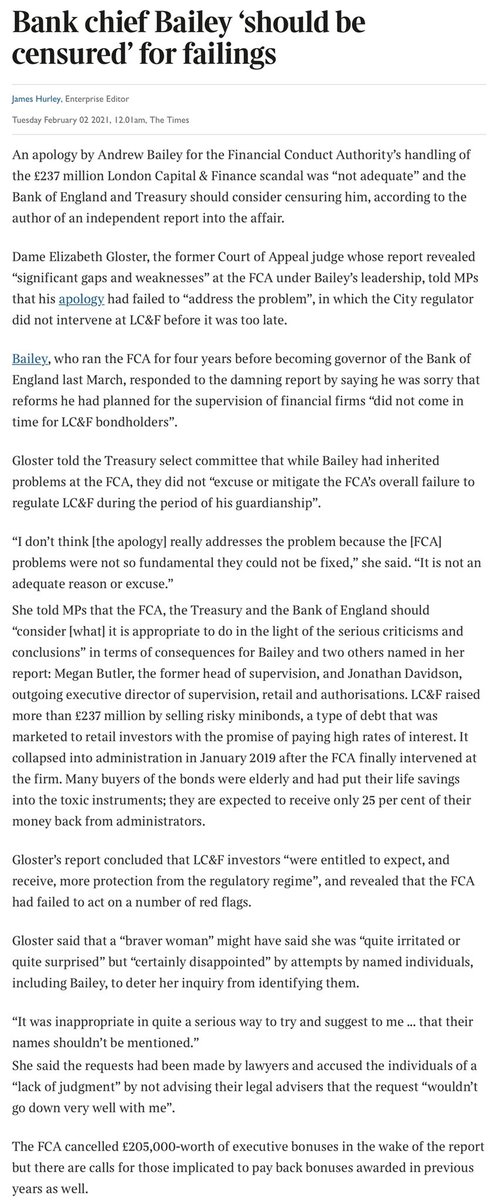

2/ scratch the surface + as if #Wirecard’s fingerprints were not enough it’s the same familiar tale we saw in the #LCF scandal (+ many more) of the FCA not just asleep at the wheel, but actively turning a blind eye to multiple red flags. In the case of #PremierFX, ...

3/ the FCA astonishingly ignored #PremierFX itself reporting to the FCA that it had been fined by the Bank of Portugal for operating illegally. In yet another parallel to the damning Dame Gloster #LCF report lashing the FCA, we also saw in the PremierFX scandal the ...

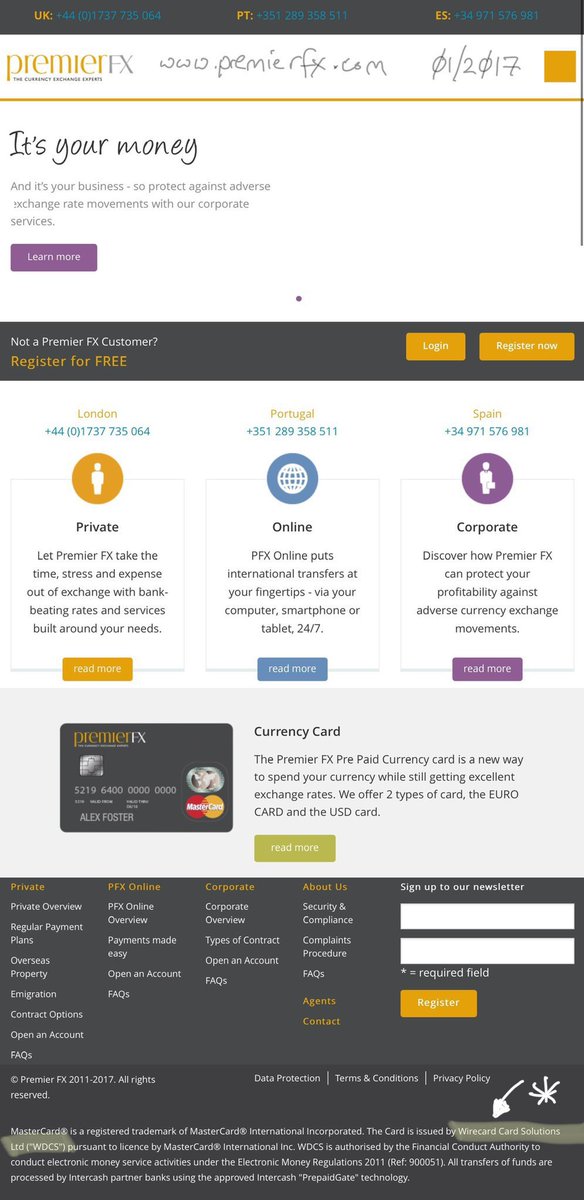

4/ “Halo Effect” of a “FCA sticker” being used to trick punters in to believing that all of #PremierFX’s activities were #FCA authorised & regulated/#FSCS insured. Bank Of Portugal fine aside, if the FCA had even bothered to look at PremierFX’s website they couldn’t fail to ...

5/5 notice unauthorised activities taking place - more red flags missed + again a striking parallel to Dame Gloster’s scathing #LCF report on the FCA’s gross regulatory failure.

• • •

Missing some Tweet in this thread? You can try to

force a refresh