Want to invest in a THEME that is set to 60x?

Let’s ask Floyd Mayweather, Dave Portnoy, Ashton Kutcher, and Alan from the movie “The Hangover” what it is.

Because they all have skin in the game.

Time for a thread 👇👇👇

Let’s ask Floyd Mayweather, Dave Portnoy, Ashton Kutcher, and Alan from the movie “The Hangover” what it is.

Because they all have skin in the game.

Time for a thread 👇👇👇

Welcome to the lovely basement of the gambling world where degenerates and debutants alike rub elbows to SPORTS BET.

This week, let’s look at Online Sports Betting (OSB) in <5 mins:

Why OSB? 👉 Mobile-first Generation

Market 👉 Size & Catalysts

‘Wall Street Quality’ Analysis 👉 Customer Acquisition Costs & Lifetime Value (Unit Economics)

Let’s get started!

Why OSB? 👉 Mobile-first Generation

Market 👉 Size & Catalysts

‘Wall Street Quality’ Analysis 👉 Customer Acquisition Costs & Lifetime Value (Unit Economics)

Let’s get started!

1.1/ Why OSB? 👉 Mobile-first Generation

Over 40% of the US population tunes in to NFL football games throughout the season and around 20% watch baseball and basketball.

Sports is one of the few remaining sacred artifacts of television.

Over 40% of the US population tunes in to NFL football games throughout the season and around 20% watch baseball and basketball.

Sports is one of the few remaining sacred artifacts of television.

1.2/ SPORTS!

Mark Cuban, on an episode of Shark Tank, pointed out that advertisements in sports are so valuable because it’s the only entertainment form that must be consumed live.

In the battle for attention: Sports are a staple.

Mark Cuban, on an episode of Shark Tank, pointed out that advertisements in sports are so valuable because it’s the only entertainment form that must be consumed live.

In the battle for attention: Sports are a staple.

1.3/ PLUGGED IN

However, the Millennial & Gen Z generations have grown up on smartphones. Show them a floppy disk and they’ll think it is a coaster. Add them on Facebook and they’ll call you a boomer.

They are over-stimulated, over-entertained, and plugged in at all times.

However, the Millennial & Gen Z generations have grown up on smartphones. Show them a floppy disk and they’ll think it is a coaster. Add them on Facebook and they’ll call you a boomer.

They are over-stimulated, over-entertained, and plugged in at all times.

1.4/ BETTING!

This hyper-connectivity has changed their form of consumption from passive (linear) to interactive (multiple screens and input nodes at the same time).

By adding a betting layer, a new medium of interactivity is born. They can now have real-time skin in the game.

This hyper-connectivity has changed their form of consumption from passive (linear) to interactive (multiple screens and input nodes at the same time).

By adding a betting layer, a new medium of interactivity is born. They can now have real-time skin in the game.

1.5/

OSB transform sports from passive into interactive entertainment.

Which is extremely LUCRATIVE.

OSB transform sports from passive into interactive entertainment.

Which is extremely LUCRATIVE.

2.1/ Market 👉 Size & Catalysts

Any time you can get ahead of a massive policy unlock whereby something that was illegal is now legal, you win.

The earlier you are to betting on legalization, the higher the risk, but also the higher reward.

Any time you can get ahead of a massive policy unlock whereby something that was illegal is now legal, you win.

The earlier you are to betting on legalization, the higher the risk, but also the higher reward.

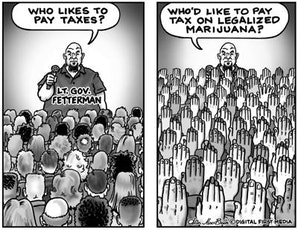

2.2/ GOV & LEGALIZATION

Governments say they make this legalization shift because the negative impacts have been misunderstood.

But, really it always comes down to MONEY and how they can tax it and get their piece of the pie.

Governments say they make this legalization shift because the negative impacts have been misunderstood.

But, really it always comes down to MONEY and how they can tax it and get their piece of the pie.

2.3/ CASINOS

We are NOW seeing this in OSB: The Next Frontier

According to Equibase, casinos account for over $75 BILLION (~94%) of the US gambling market, with sports betting only taking up a small fraction.

We are NOW seeing this in OSB: The Next Frontier

According to Equibase, casinos account for over $75 BILLION (~94%) of the US gambling market, with sports betting only taking up a small fraction.

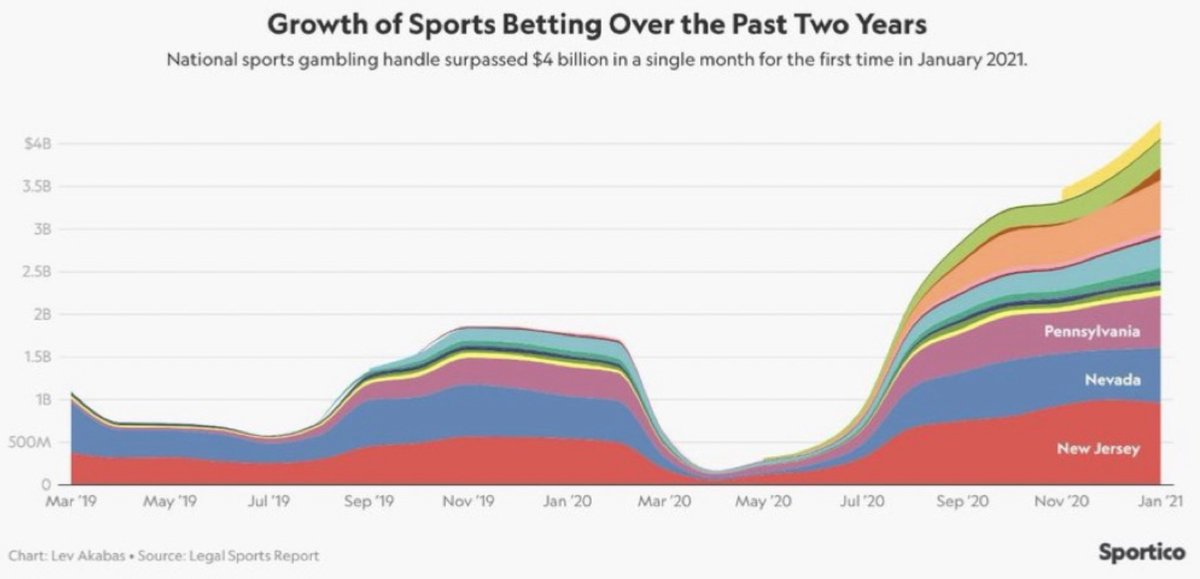

2.4/

When you look at markets where activity has been legal for a long time, the online markets TOWER over “in-person” markets.

This points to the HUGE growth potential for US legal online sports betting markets from ~$430mil to about $26 Billion over time – that’s 60x growth!

When you look at markets where activity has been legal for a long time, the online markets TOWER over “in-person” markets.

This points to the HUGE growth potential for US legal online sports betting markets from ~$430mil to about $26 Billion over time – that’s 60x growth!

2.5/ RECURRING!

The key market here is males aged 25-34. Of this group, 73% have bet on sports AND 43% of them bet weekly.

Talk about not only a huge Total Addressable Market (TAM), but also repeat customers. Helllooooooo recurring revenue!

The key market here is males aged 25-34. Of this group, 73% have bet on sports AND 43% of them bet weekly.

Talk about not only a huge Total Addressable Market (TAM), but also repeat customers. Helllooooooo recurring revenue!

3.1/ ‘Wall Street Quality Analysis’ 👉 CAC & LTV (Unit Economics)

Wall Street writes boring research reports with <10% open rates. Grit writes a gripping yet insightful newsletter with 40% open rates.

Goal is to arm you with the same insights without the jargon.

Wall Street writes boring research reports with <10% open rates. Grit writes a gripping yet insightful newsletter with 40% open rates.

Goal is to arm you with the same insights without the jargon.

3.2/ So how do OSB companies generate PROFIT?

These companies share similar goals to internet platform companies like Amazon:

These companies share similar goals to internet platform companies like Amazon:

3.3/ 3 GOALS:

👉 Increase users on the platform at a low cost (decrease customer acquisition cost)

👉 Keep users on the platform (lower churn) and increase their activity (higher average revenue per user)

👉 Decrease cost to keep the user (annual support costs).

👉 Increase users on the platform at a low cost (decrease customer acquisition cost)

👉 Keep users on the platform (lower churn) and increase their activity (higher average revenue per user)

👉 Decrease cost to keep the user (annual support costs).

3.4/ THE RATIO

The LTV:CAC ratio is KEY. It attempts to capture everything mentioned above.

LTV = Life-time value of the customer

CAC = Customer acquisition cost

The LTV:CAC ratio is KEY. It attempts to capture everything mentioned above.

LTV = Life-time value of the customer

CAC = Customer acquisition cost

3.5/ You want a LTV:CAC ratio of 3!

Meaning, the value of that customer to you should be 3 times more than the cost to acquire them.

Anything less than that, you are spending too much to acquire them.

Anything more than that, you’ll be laughing all the way to the bank.

Meaning, the value of that customer to you should be 3 times more than the cost to acquire them.

Anything less than that, you are spending too much to acquire them.

Anything more than that, you’ll be laughing all the way to the bank.

3.6/

In OSB a common expense in acquiring the customer is bonusing. “Come play and we’ll start you off with $20 for every $100 you put in”

Another expense is marketing, whereby OSBs plaster their names all over floorboards, NASCAR tracks, TikTok, Instagram, etc…

In OSB a common expense in acquiring the customer is bonusing. “Come play and we’ll start you off with $20 for every $100 you put in”

Another expense is marketing, whereby OSBs plaster their names all over floorboards, NASCAR tracks, TikTok, Instagram, etc…

3.7/ BRAND RECOGNITION

This is called brand recognition, and trust is very valuable when separating a person from their money.

The larger the scale of the company, the more data they collect on their users. This leads to more effective marketing campaigns increasing the LTV.

This is called brand recognition, and trust is very valuable when separating a person from their money.

The larger the scale of the company, the more data they collect on their users. This leads to more effective marketing campaigns increasing the LTV.

3.8/ How do they profit?

To oversimplify, OSBs primarily make money through what is called a “rake.”

The rake is the percentage of the total amount of money bet that the OSB takes. Think of it as a transaction fee.

To oversimplify, OSBs primarily make money through what is called a “rake.”

The rake is the percentage of the total amount of money bet that the OSB takes. Think of it as a transaction fee.

3.9/ MY PICKS

Want to see what stocks I'M buying?

Get more analysis and MY STOCK PICKS with my newsletter!

👇👇👇

Want to see what stocks I'M buying?

Get more analysis and MY STOCK PICKS with my newsletter!

👇👇👇

4/ GRIT NEWSLETTER

Every week I write a newsletter to +23k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to see how we’re playing this! 👇

gritcapital.substack.com/welcome

Every week I write a newsletter to +23k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to see how we’re playing this! 👇

gritcapital.substack.com/welcome

@GNOnlineCasino @ChurchillDowns @RSInteractive_ @monarchcasino @ScientificGames @boydgaming @PNGamingInc @LasVegasSands @WynnLasVegas @MGMResortsIntl @DraftKings

• • •

Missing some Tweet in this thread? You can try to

force a refresh