Btw, when I was managing funds in MENA, I was trading Saudi Arabia (bigger and liquid part of any MENA fund) and that was adding my work days to 6.

I feel for #cryptocurrency traders. You need some time to unwind, think, read & study. 7 days a week... come on.

I feel for #cryptocurrency traders. You need some time to unwind, think, read & study. 7 days a week... come on.

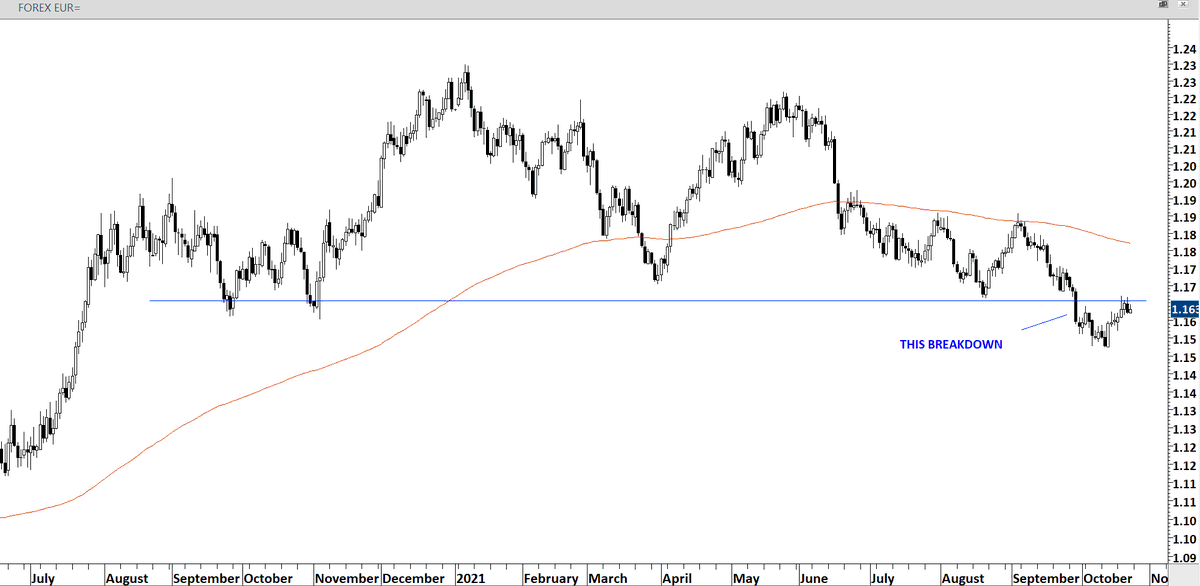

For #cryptocurrency traders out there that are still in front of charts on a weekend, here are some updates for you, some well-defined ranges on select few:

$BTCUSD Rising wedge is still in play. 43K can become the target as a breakdown from wedge can retrace back to the beginning of wedge.

• • •

Missing some Tweet in this thread? You can try to

force a refresh