Broadly since the 1970s, but especially since the 1990s, the US ran structural trade deficits, which displaced part of the industrial sector.

The imbalance isn't only with China, but with Europe and other developed countries as well.

The imbalance isn't only with China, but with Europe and other developed countries as well.

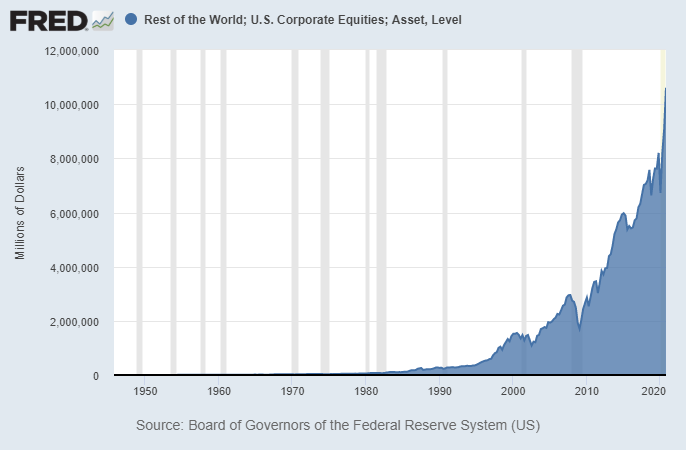

The foreign sector took those dollar surpluses, and reinvested them initially into Treasuries, but then increasingly into US stocks and real estate.

The foreign sector now owns $10+ trillion in US equity, and the US has a deeply negative net international investment position.

The foreign sector now owns $10+ trillion in US equity, and the US has a deeply negative net international investment position.

Whether this "financialization" was good or not depends on what one does.

If you work in finance, education, healthcare, government, or tech, you get most of the benefits and your assets go up.

If you want to make things or don't have a lot of equities, it's been rough.

If you work in finance, education, healthcare, government, or tech, you get most of the benefits and your assets go up.

If you want to make things or don't have a lot of equities, it's been rough.

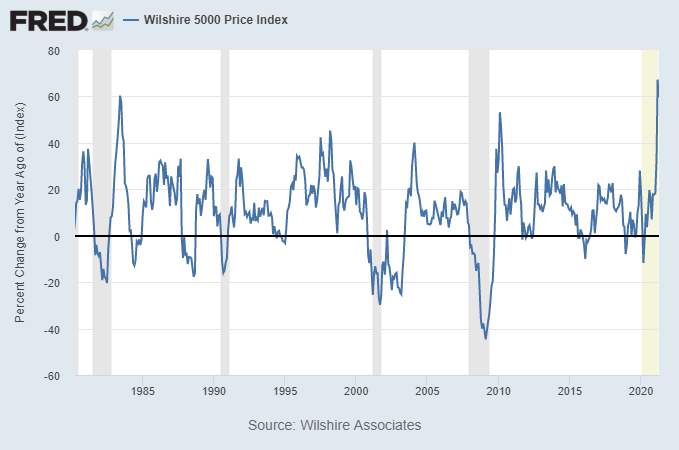

Hollowing out the industrial base and recycling those trade deficits back into US equities was great for investors.

Unfortunately, 88% of equities are owned by the top 10% of the population, so those who benefited were in the minority.

Unfortunately, 88% of equities are owned by the top 10% of the population, so those who benefited were in the minority.

My latest article covers this process:

lynalden.com/market-capital…

And my petrodollar article goes into more depth: lynalden.com/fraying-petrod…

lynalden.com/market-capital…

And my petrodollar article goes into more depth: lynalden.com/fraying-petrod…

• • •

Missing some Tweet in this thread? You can try to

force a refresh