BUY THE DIP, SHORT THE VIX!

Ever wonder…

WTF this ACTUALLY means?

Time for a Thread 👇👇👇

Ever wonder…

WTF this ACTUALLY means?

Time for a Thread 👇👇👇

1/ What is volatility?

Volatility is a measure of how much a stock changes in price over a period of time.

If the share price is more stable, it has lower volatility.

If it changes quickly and hits lots of highs and lows over a short period of time, it has high volatility.

Volatility is a measure of how much a stock changes in price over a period of time.

If the share price is more stable, it has lower volatility.

If it changes quickly and hits lots of highs and lows over a short period of time, it has high volatility.

2/ How is it used?

Investors use volatility to measure the emotions of the market, such as the level of FEAR and GREED..

High Volatility = means FEAR and investors are BEARISH

Low Volatility = means GREED and investors are BULLISH.

Investors use volatility to measure the emotions of the market, such as the level of FEAR and GREED..

High Volatility = means FEAR and investors are BEARISH

Low Volatility = means GREED and investors are BULLISH.

3/ How can we measure volatility?

The CBOE Volatility Index, or “The VIX”, is calculated from the prices of a particular basket of S&P 500 options, whose value to their holders depends importantly on the future level of S&P 500 volatility.

The CBOE Volatility Index, or “The VIX”, is calculated from the prices of a particular basket of S&P 500 options, whose value to their holders depends importantly on the future level of S&P 500 volatility.

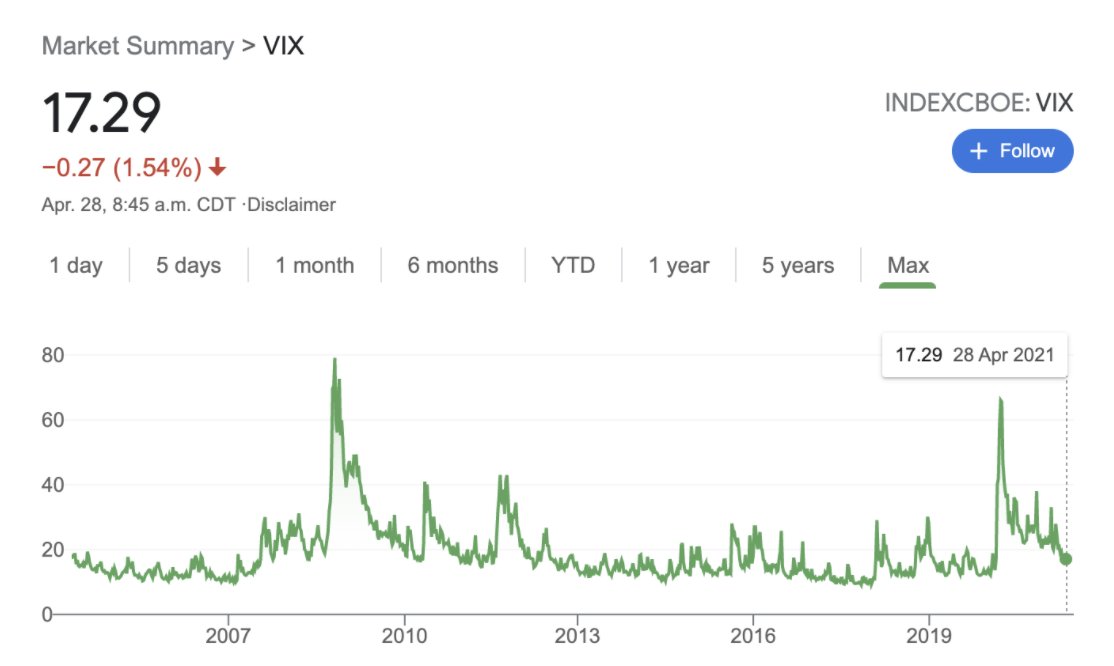

4/ What’s a regular score on the VIX?

Above a 20 on the VIX is high.

Below a 12 is low.

Somewhere in between is normal.

Above a 20 on the VIX is high.

Below a 12 is low.

Somewhere in between is normal.

5/ NOTE

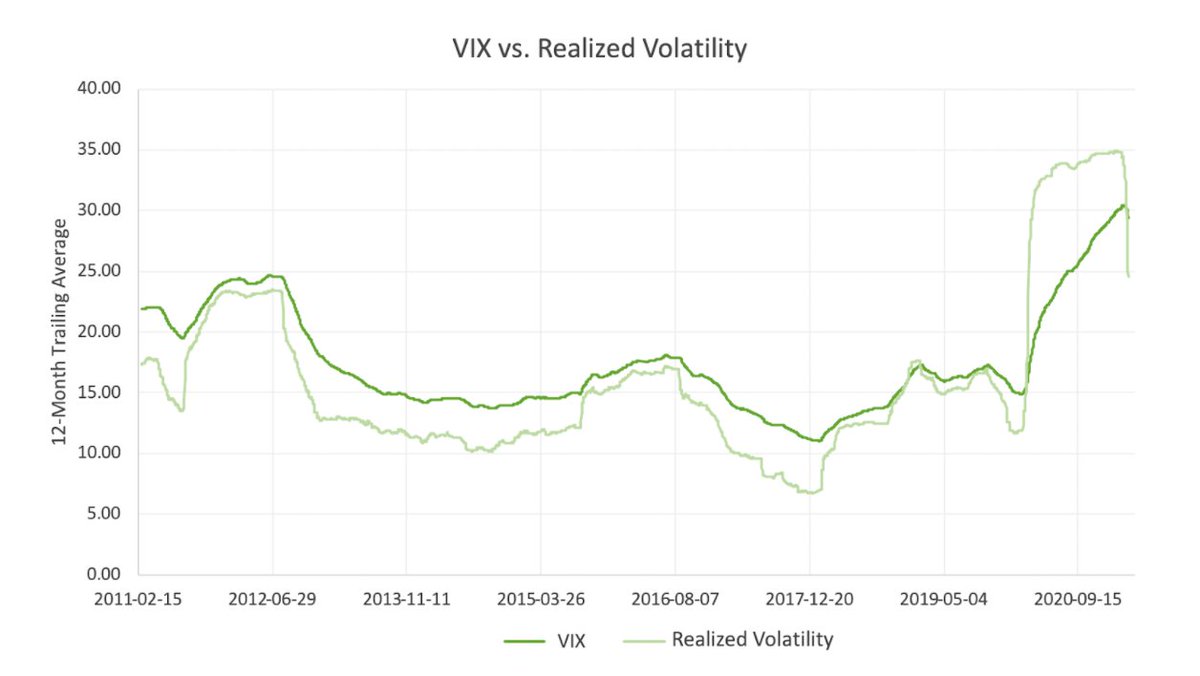

It’s important to note that the VIX can’t guarantee the future.

In fact, for most of its history, the VIX has been above the realized volatility of the market. This trend was recently broken with the high degree of fear caused by the COVID-19 pandemic.

It’s important to note that the VIX can’t guarantee the future.

In fact, for most of its history, the VIX has been above the realized volatility of the market. This trend was recently broken with the high degree of fear caused by the COVID-19 pandemic.

6/ How can I use volatility?

“Successful investing is anticipating the anticipations of others.” - John Maynard Keynes

Use the VIX to predict where investors' emotions may go next.

“Successful investing is anticipating the anticipations of others.” - John Maynard Keynes

Use the VIX to predict where investors' emotions may go next.

For example:

If the VIX gets too HIGH it could mean a period of LOWER volatility is coming and INCREASING RISK in your portfolio might be a good idea.

If the VIX gets too HIGH it could mean a period of LOWER volatility is coming and INCREASING RISK in your portfolio might be a good idea.

If the VIX gets too LOW it could mean a period of HIGHER volatility is coming and LOWERING RISK in your portfolio might be a good idea.

Grit always tries to think like a contrarian!

Grit always tries to think like a contrarian!

7/ NEWSLETTER

If you want MORE educational content like this, SUBSCRIBE to my newsletter! 👇

gritcapital.substack.com/welcome

If you want MORE educational content like this, SUBSCRIBE to my newsletter! 👇

gritcapital.substack.com/welcome

• • •

Missing some Tweet in this thread? You can try to

force a refresh