30% probability $CAKE flips $UNI

Would have placed it at under 5% a month ago

- Massive momentum/uptrend

- Stronger marketing/virality/memetic engineering

- Vertical growth in TVL/Volume/Users

- Largely retail holderbase

- Orderbook/flow dynamics

- @PancakeBunnyFin staking yields creating long market bias $ further TVL/Farm reflexivity

- Stronger marketing/virality/memetic engineering

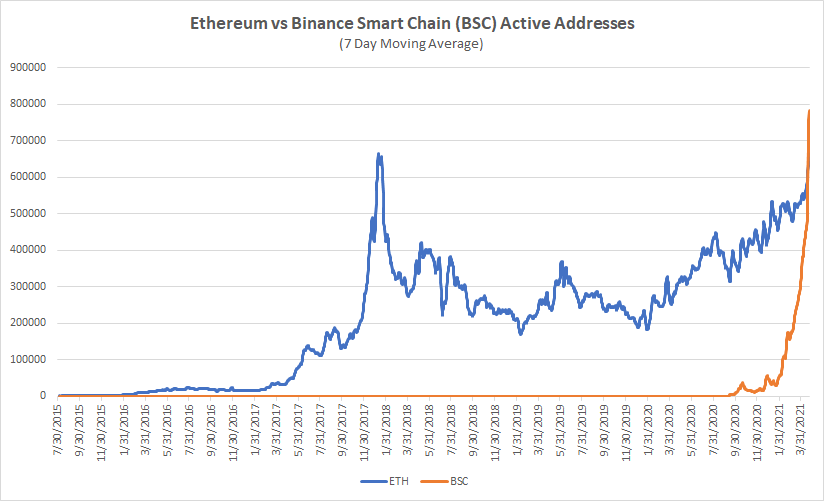

- Vertical growth in TVL/Volume/Users

- Largely retail holderbase

- Orderbook/flow dynamics

- @PancakeBunnyFin staking yields creating long market bias $ further TVL/Farm reflexivity

Most people write off @PancakeSwap as simple Uni fork not realizing they've built a full product stack. Nothing really compares to it

- Syrup Pool/Farm Program

- IFOs

- Trading Battles

- NFT/Collectibles

- Predictions (Binary options)

- Lottery

- Syrup Pool/Farm Program

- IFOs

- Trading Battles

- NFT/Collectibles

- Predictions (Binary options)

- Lottery

• • •

Missing some Tweet in this thread? You can try to

force a refresh