So, here's where I am on the #JobsReport right now:

First, we should never read too much into any one report, *especially* in moments like now when so much is changing. Revisions can be big enough to shift our overall interpretation. And even "real" changes can prove short-lived.

First, we should never read too much into any one report, *especially* in moments like now when so much is changing. Revisions can be big enough to shift our overall interpretation. And even "real" changes can prove short-lived.

https://twitter.com/bencasselman/status/1390647659921387520

But if your prior coming into today was "labor supply isn't a real problem right now," I think this report has to shift that somewhat.

Here's why:

Here's why:

The two strongest pieces of evidence against the "labor supply" story were:

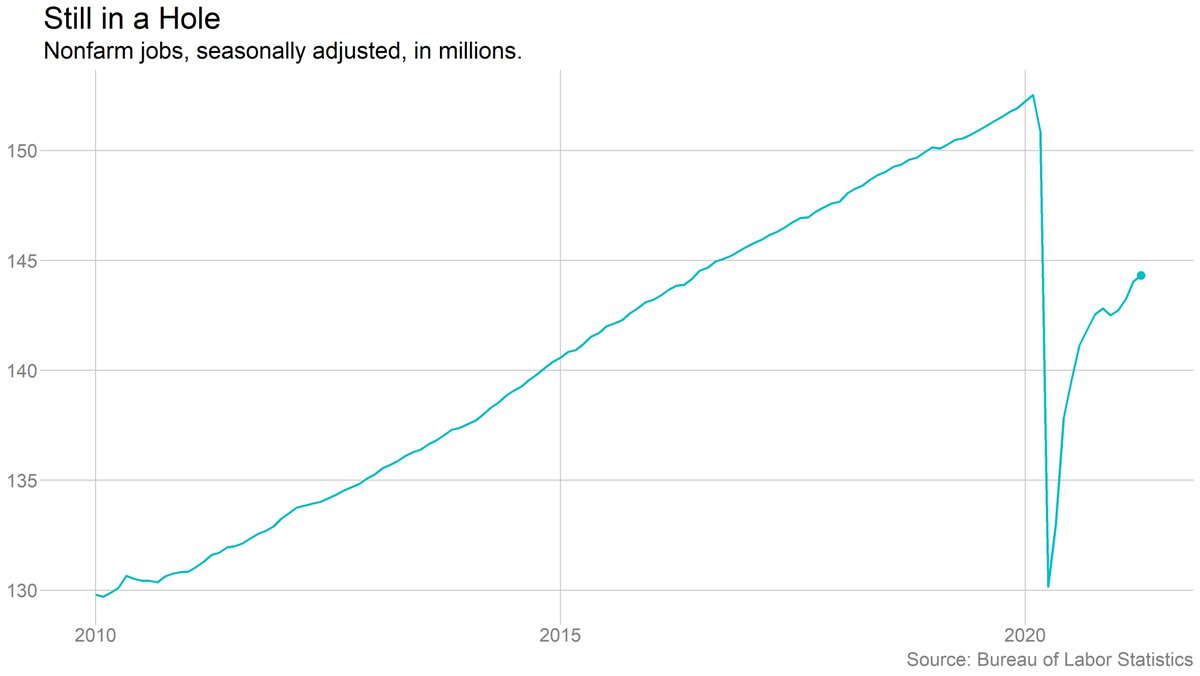

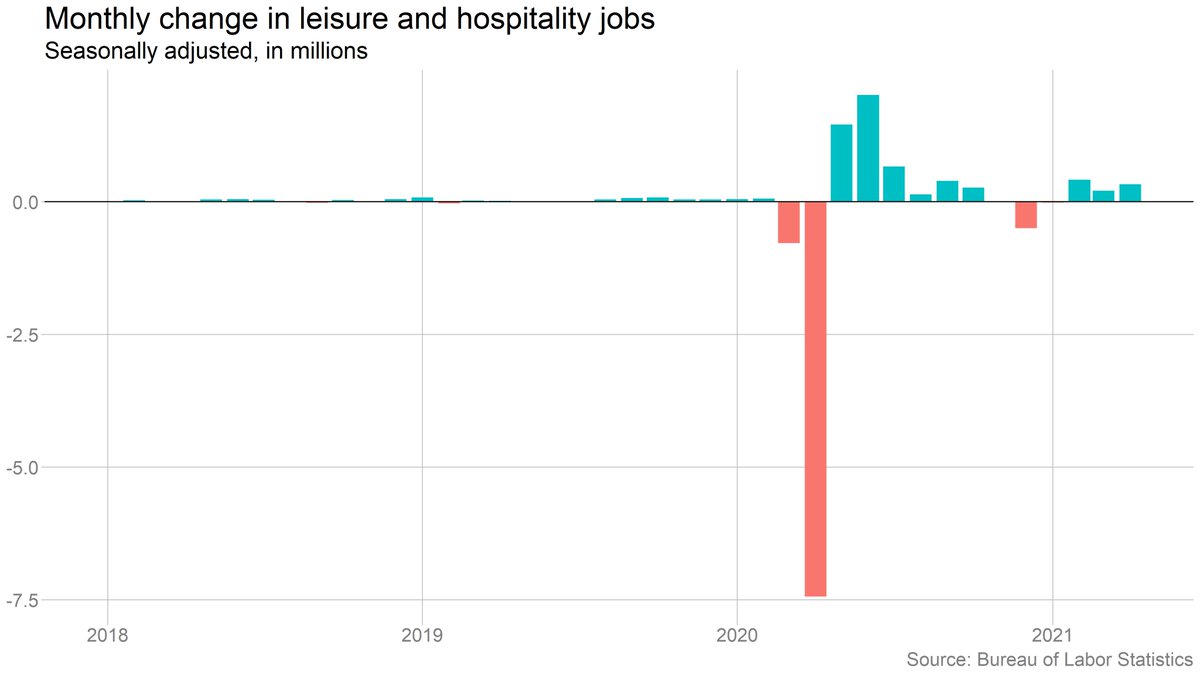

1. Job growth was really strong (hard to say there's a shortage when companies can hire 1m people per month!);

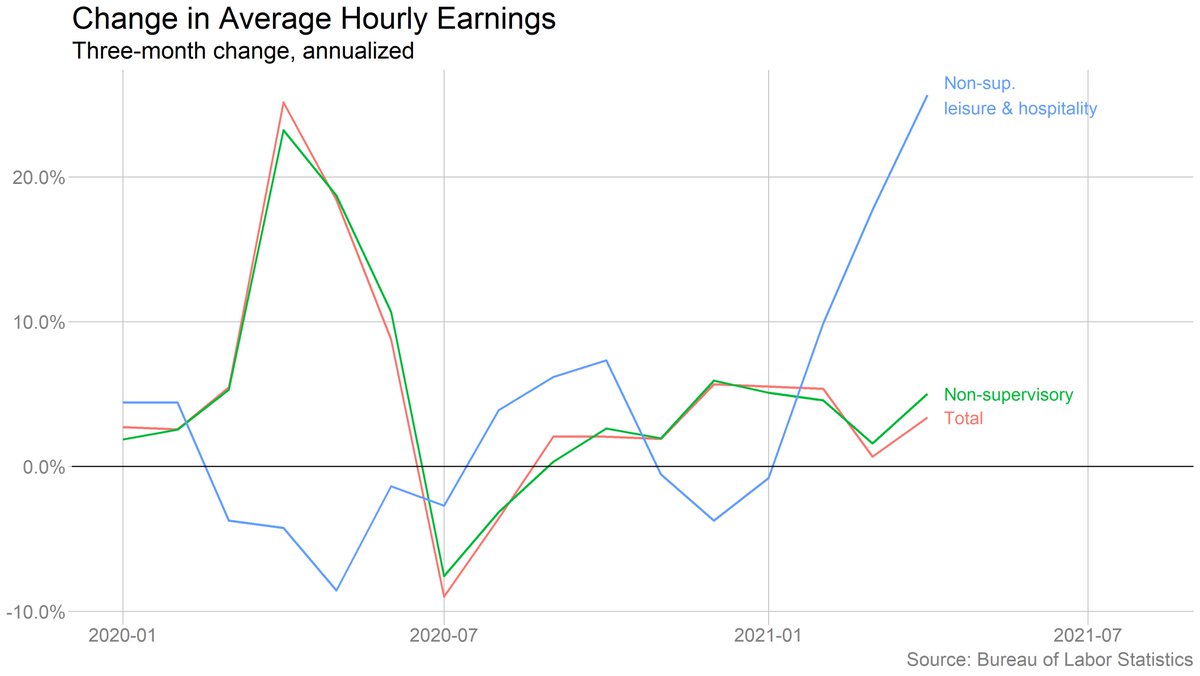

2. Wage growth was modest, even in the most affected industries.

1. Job growth was really strong (hard to say there's a shortage when companies can hire 1m people per month!);

2. Wage growth was modest, even in the most affected industries.

Well, job growth wasn't really strong last month. And wages? Well, average hourly earnings shot up in leisure and hospitality.

If you're worried about composition, ECI (less timely, but better data) also showed pretty robust wage growth, esp. in that sector.

If you're worried about composition, ECI (less timely, but better data) also showed pretty robust wage growth, esp. in that sector.

To be clear, not all the evidence pointed in the same direction. The labor force grew. Leisure & hosp added 331k jobs. I don't think this report proves that labor supply is the primary constraint. But it is more consistent with that story than a consensus report would have been.

Note also that saying "labor supply is a constraint" is not the same as saying that unemployment benefits, specifically, are the issue. There are other factors that could be limiting supply, notably health concerns and child care issues.

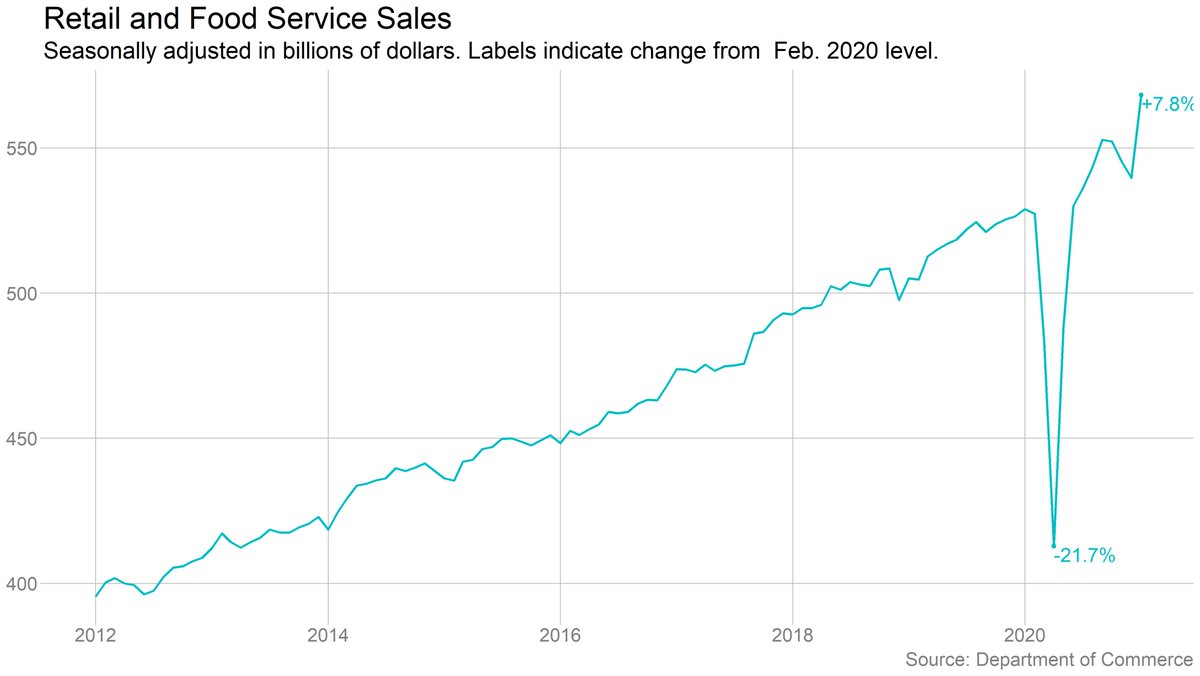

(There's also evidence of supply constraints beyond labor, notably the chip shortage in manufacturing. Doubt that's a major piece of the puzzle here, but could be some of it.)

It could also be the case that rehiring this many workers takes time, especially when there's a lot of reallocation needed between sectors. Though that doesn't really explain why hiring slowed so much from March to April -- maybe March represented the "low-hanging fruit"?

If your prior coming into this was "labor supply is a constraint right now, but it will resolve quickly in the next few months," I don't really see anything here that should shift that prior.

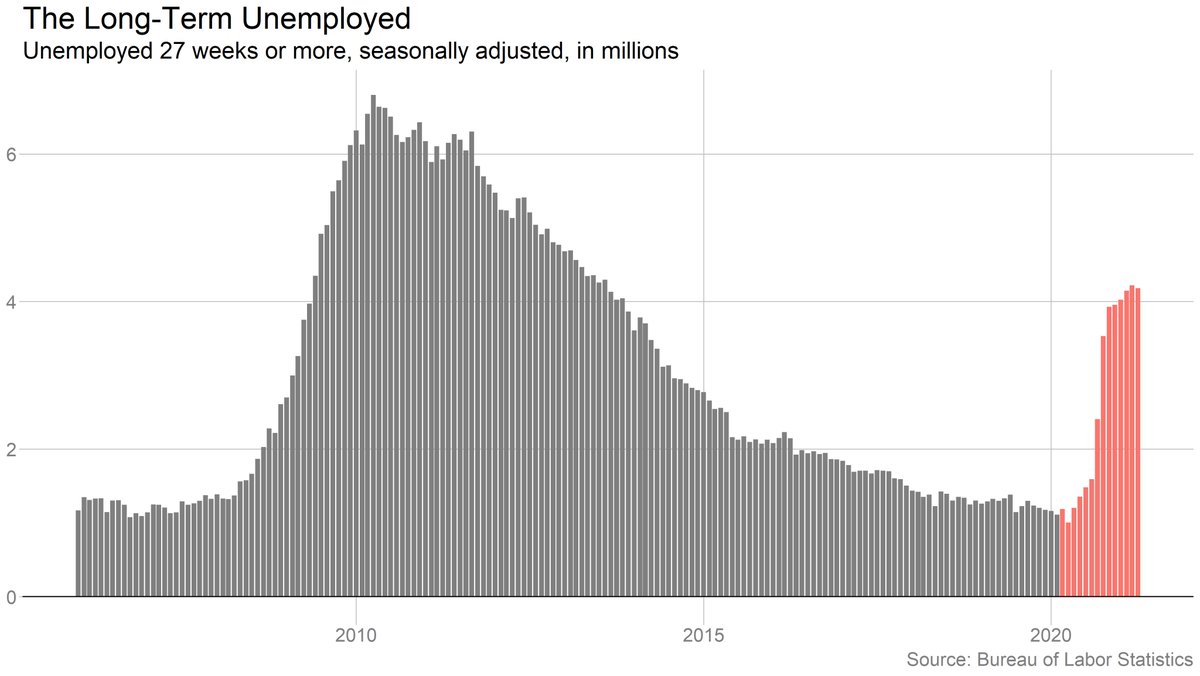

There's no evidence here of a long-term structural shift in labor supply. The labor force grew. Long-term unemployment actually fell slightly. (For goodness sake, don't tell me the problem is a "skills mismatch"!)

Long story short: We need more data to know for sure what's going on here. We *certainly* don't know how long the current dynamics will persist. But I find the labor supply story more credible today than I did yesterday.

Addendum: "UI is reducing labor supply, but that's a good thing until people get vaccinated/cases fall further/schools reopen" is a perfectly valid position, but it is a distinct argument from "UI is not reducing labor supply."

(I am not endorsing either position, to be clear.)

(I am not endorsing either position, to be clear.)

• • •

Missing some Tweet in this thread? You can try to

force a refresh