Nearly 20% of all US Dollars that EXIST were printed last year.

Let that sink in…

Time for a thread 👇👇👇

Let that sink in…

Time for a thread 👇👇👇

The amount of money being pumped into the system has reached unprecedented levels as JPOW (the FED Chair) has let the money printer go BRRRRR.

When you have BOTH expansionary fiscal and monetary policy happening at the same time, AKA “Easy Money,” the grim reaper is sure to arrive….INFLATION!

But what does this all mean? How does this affect my portfolio?

But what does this all mean? How does this affect my portfolio?

Let’s break INFLATION down in 90 seconds and how to protect your hard-earned dough:

Inflation 👉 What is it?

Where are we now? 👉 Current Economy walkthrough

Let’s get started!

Inflation 👉 What is it?

Where are we now? 👉 Current Economy walkthrough

Let’s get started!

1.1/ Inflation 👉 What is it?

Inflation is the decline in purchasing power of a given currency over time. One dollar buys less of a certain good in the future.

Put another way - it is a rise in the general price level of goods and services.

Inflation is the decline in purchasing power of a given currency over time. One dollar buys less of a certain good in the future.

Put another way - it is a rise in the general price level of goods and services.

1.2/ Types of Inflation

There are 3 types of inflation: Demand-pull, Cost-push, or Built-in.

At the end of the day, inflation all comes down to WHAT forces are tugging at demand and supply. And there are MANY components.

There are 3 types of inflation: Demand-pull, Cost-push, or Built-in.

At the end of the day, inflation all comes down to WHAT forces are tugging at demand and supply. And there are MANY components.

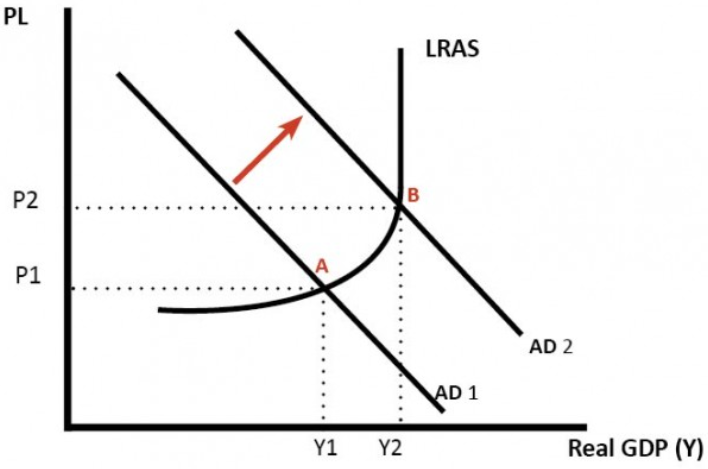

1.3/ Demand-pull inflation

This occurs when an increase in the supply of money drives demand for goods and services up. Increase in demand is faster than the increase in production (supply), driving prices up (shift from P1 to P2 as shown below).

This occurs when an increase in the supply of money drives demand for goods and services up. Increase in demand is faster than the increase in production (supply), driving prices up (shift from P1 to P2 as shown below).

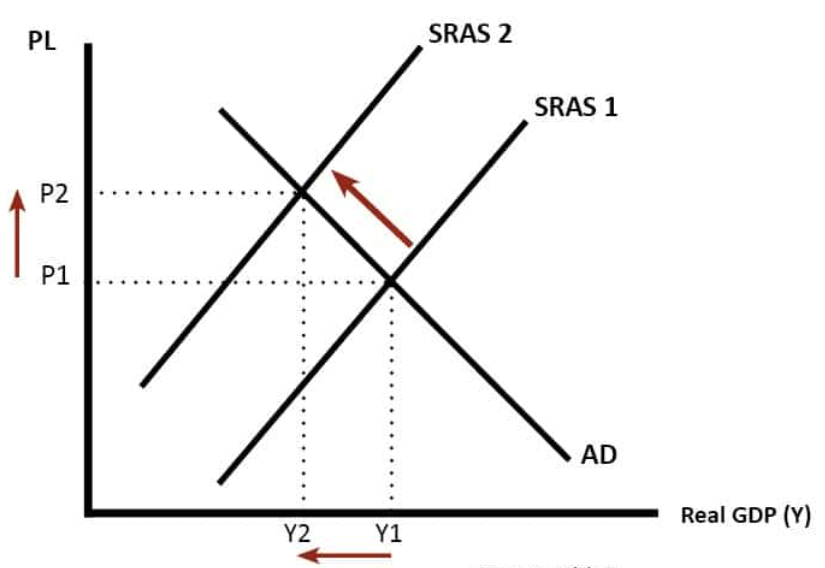

1.4/ Cost-push inflation

This is a result of the increase in prices that work through the entire supply chain system. For example, if the current shortage in semi-conductors persists (lower supply), the big semiconductor companies can charge more per graphics card.

This is a result of the increase in prices that work through the entire supply chain system. For example, if the current shortage in semi-conductors persists (lower supply), the big semiconductor companies can charge more per graphics card.

In turn, the Xbox head honchos want to keep their profit margin the same so they pass this cost onto little Justin who is just trying to catch a W in Fortnite. The end result is a higher retail price at Walmart for Mr. Justin Sr to buy that Xbox. No more V-bucks for you Justin!

1.5/ Built-in inflation

People expect inflation rates to continue in the future, so workers demand HIGHER WAGES to keep their purchasing power.

But, if wages increase more than the price levels, workers will buy more things which then further pushes the price of goods up.

People expect inflation rates to continue in the future, so workers demand HIGHER WAGES to keep their purchasing power.

But, if wages increase more than the price levels, workers will buy more things which then further pushes the price of goods up.

1.6/ So how do we measure inflation?

A common method is the Consumer Price Index (CPI) which simply pools together a basket of goods and looks at the overall increase of these goods over time. The CPI is a pretty good measurement...

A common method is the Consumer Price Index (CPI) which simply pools together a basket of goods and looks at the overall increase of these goods over time. The CPI is a pretty good measurement...

1.7/ BUT...

One thing the CPI doesn’t do a great job of capturing is regional differences in inflation because it uses averages.

Another thing it doesn’t capture is the rising cost of housing which is hitting record highs in the U.S. Instead it measures the cost of renting.

One thing the CPI doesn’t do a great job of capturing is regional differences in inflation because it uses averages.

Another thing it doesn’t capture is the rising cost of housing which is hitting record highs in the U.S. Instead it measures the cost of renting.

2.1/ Where are we now 👉 Current situation + Corona

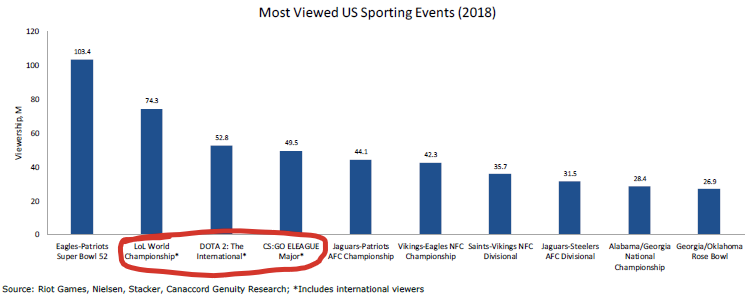

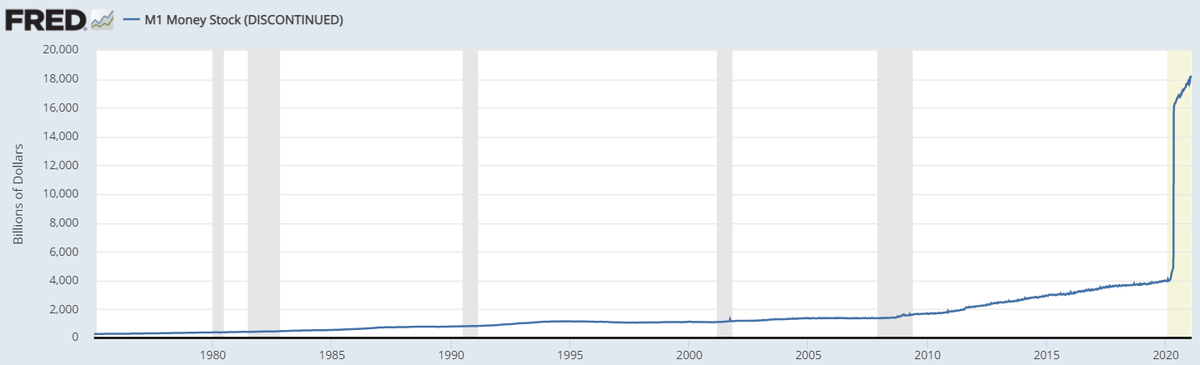

The most prominent charts are of the historic amount of money into the system versus now:

The most prominent charts are of the historic amount of money into the system versus now:

2.2/ TEMPORARY?

Are the price jumps temporary as we bring the economy back to a post-pandemic world? Or have some supply chains been altered for the longer term, leading to a long-term shift in prices?

A lot of this has to do with dynamic demand patterns around COVID-19.

Are the price jumps temporary as we bring the economy back to a post-pandemic world? Or have some supply chains been altered for the longer term, leading to a long-term shift in prices?

A lot of this has to do with dynamic demand patterns around COVID-19.

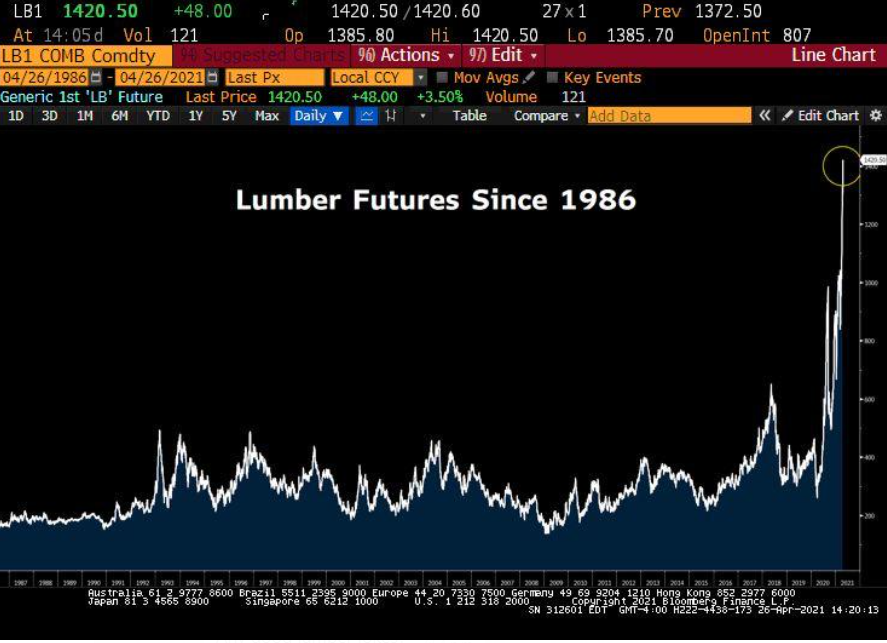

2.3/ LUMBER!

We’re feeling the increases across a lot of consumer goods. I see it in cars, copper, semiconductors, wheat, corn, gasoline, and ESPECIALLY houses (shoutout to $1M shacks in Toronto).

The most recent poster child for this has been LUMBER!

We’re feeling the increases across a lot of consumer goods. I see it in cars, copper, semiconductors, wheat, corn, gasoline, and ESPECIALLY houses (shoutout to $1M shacks in Toronto).

The most recent poster child for this has been LUMBER!

2.4/ Why lumber?

During COVID, more people are staying home, wanting more space, leading to more renovations.

Interest rates are also at historic lows, making financing these purchases very cheap (increasing demand even further!).

During COVID, more people are staying home, wanting more space, leading to more renovations.

Interest rates are also at historic lows, making financing these purchases very cheap (increasing demand even further!).

2.5/ HISTORY LESSON

If you were in the lumber industry back in the 08/09 housing crisis, and you didn’t get wiped out, you were very hesitant about building inventory.

This led a lot of the builders to keep only 45 days of inventory on hand while making 90 days of commitments.

If you were in the lumber industry back in the 08/09 housing crisis, and you didn’t get wiped out, you were very hesitant about building inventory.

This led a lot of the builders to keep only 45 days of inventory on hand while making 90 days of commitments.

2.6/ FAST FORWARD...

So when COVID hit in March 2020, people thought:

“no one will be building anything, this is like 08 all over again, and the sky is falling”

So they sold down their inventory, causing the prices to drop.

So when COVID hit in March 2020, people thought:

“no one will be building anything, this is like 08 all over again, and the sky is falling”

So they sold down their inventory, causing the prices to drop.

2.7/ RECOVERY

But then recovery started to take hold. As prices climbed in September 2020, up to $900, no one thought this was sustainable and the price pulled back again.

However, if you were looking to buy lumber in the spot market, no inventory could be found.

But then recovery started to take hold. As prices climbed in September 2020, up to $900, no one thought this was sustainable and the price pulled back again.

However, if you were looking to buy lumber in the spot market, no inventory could be found.

2.8/ FUTURES

In order to fund the 45 day gap that I mentioned, you then had to turn to the FUTURES market.

This is the setup that you need to grasp when extrapolating longer term price metrics and hints on persistent inflation. This was an inventory cycle issue.

In order to fund the 45 day gap that I mentioned, you then had to turn to the FUTURES market.

This is the setup that you need to grasp when extrapolating longer term price metrics and hints on persistent inflation. This was an inventory cycle issue.

2.9/

I walked through this lumber example in such detail to highlight how much emotions can influence pricing fluctuations.

What economists generally try to do is look at economic factors to try to gauge the overall picture… what they are trying to do is read the tea leaves.

I walked through this lumber example in such detail to highlight how much emotions can influence pricing fluctuations.

What economists generally try to do is look at economic factors to try to gauge the overall picture… what they are trying to do is read the tea leaves.

2.10/ WANT MORE?

Housing prices, CPI, etc…

All the tea leaves that we try to read to form the overall bigger picture.

For a couple of other tea leaves that are relevant in the inflation debate, and to SEE WHAT I OWN to protect my portfolio… check out my newsletter! 👇

Housing prices, CPI, etc…

All the tea leaves that we try to read to form the overall bigger picture.

For a couple of other tea leaves that are relevant in the inflation debate, and to SEE WHAT I OWN to protect my portfolio… check out my newsletter! 👇

3/ GRIT NEWSLETTER

Every week I write a newsletter to +25k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to see how we’re playing this! 👇

gritcapital.substack.com/welcome

Every week I write a newsletter to +25k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to see how we’re playing this! 👇

gritcapital.substack.com/welcome

• • •

Missing some Tweet in this thread? You can try to

force a refresh