1/ @VenusProtocol, a decentralized money market and synthetic stablecoin protocol built on #BinanceSmartChain with $11B+ in user deposits, has just created a proposal to fully upgrade their oracle solution to #Chainlink Price Feeds

$XVS $LINK

blog.venus.io/venus-deploys-…

$XVS $LINK

blog.venus.io/venus-deploys-…

2/ Venus is the largest #DeFi protocol in terms of total value locked across the entire #BSC network

defistation.io/venus

It's an algorithmic money market that allows users to not only lend and borrow tokens, but also mint decentralized synthetic stablecoins and earn yield

defistation.io/venus

It's an algorithmic money market that allows users to not only lend and borrow tokens, but also mint decentralized synthetic stablecoins and earn yield

3/ With 18 supported assets and yields up to 30% APY, Venus has become the defacto money market on the #BSC network

However, to ensure the protocol is fully collateralized and user funds protected, Venus requires price oracles to determine the value of all collateral and debt

However, to ensure the protocol is fully collateralized and user funds protected, Venus requires price oracles to determine the value of all collateral and debt

4/ In this latest governance proposal, VIP-23, it is proposed that the @VenusProtocol upgrade its oracle solution to using @chainlink Price Feeds to ensure the highest level of tamper-resistance, market coverage, and protection against flash loan attacks

app.venus.io/vote/proposal/…

app.venus.io/vote/proposal/…

5/ An integration with #Chainlink Price Feeds would enable the @VenusProtocol ecosystem to enter into the next phase of growth in TVL and users

I commend the leadership of @JLSwipe and the work of the entire Venus team for prioritizing the security of user funds on the platform

I commend the leadership of @JLSwipe and the work of the entire Venus team for prioritizing the security of user funds on the platform

6/ This integration not only increases the security of the protocol, but creates a synergistic relationship between the Venus and Chainlink communities

Linkies fully embrace Chainlinked protocols, as seen with the over $1.4B $LINK deposits on Aave

VIP-23 is a win-win for all

Linkies fully embrace Chainlinked protocols, as seen with the over $1.4B $LINK deposits on Aave

VIP-23 is a win-win for all

7/ To provide context as to why Venus is upgrading their oracle solution to Chainlink, let's look at the oracle solution that is currently being used, Band Protocol

While there are many reasons why Band is a subpar oracle solution (imo), here are the main issues I see

While there are many reasons why Band is a subpar oracle solution (imo), here are the main issues I see

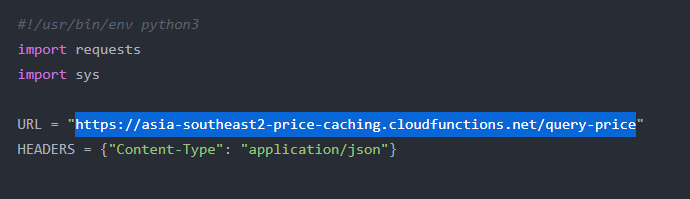

8/ A single centralized cloud function is used by all Band nodes to fetch data from all authenticated APIs, creating a single point of failure for all of Band's price feeds

This centralization is exactly the opposite of what you want in an oracle network

docs.bandchain.org/technical-spec…

This centralization is exactly the opposite of what you want in an oracle network

docs.bandchain.org/technical-spec…

9/ Because Band nodes can only deliver data to Bandchain, a single centralized relayer (lite-client) is used to bridge data from Bandchain to BSC

In theory, anyone can run a relayer, but in practice there is zero financial incentive to do so, therefore only the Band team does

In theory, anyone can run a relayer, but in practice there is zero financial incentive to do so, therefore only the Band team does

10/ Substantial lack of market coverage due to mixing refined data from aggregators and raw data from exchanges

This means Band's data is not volume-weighted, but instead a bizarre mixture of sources where some exchanges are overweighted regardless of volume/liquidity

This means Band's data is not volume-weighted, but instead a bizarre mixture of sources where some exchanges are overweighted regardless of volume/liquidity

11/ Bandchain is hardcapped at a max of 100 nodes and only supports up to 16 nodes per price feed update

But ultimately, it really doesn't really matter how many nodes there are, because all data from authenticated APIs is routed through a single centralized cloud function!

But ultimately, it really doesn't really matter how many nodes there are, because all data from authenticated APIs is routed through a single centralized cloud function!

12/ There are many more reasons as to why Band is a subpar oracle solution

If you're interested, I suggest diving into this article below as none of these issues presented have been fixed (new ones have been introduced like the centralized cloud function)

smartcontentpublication.medium.com/a-comparative-…

If you're interested, I suggest diving into this article below as none of these issues presented have been fixed (new ones have been introduced like the centralized cloud function)

smartcontentpublication.medium.com/a-comparative-…

13/ But enough about Band, why is #Chainlink the superior price oracle solution for Venus? I'll explain in the context of how Chainlink solves the issues that Band inherently suffers from

14/ Chainlink nodes have native support for credentials management using external adapters that each node runs themselves in order to access authenticated APIs in a decentralized manner, all without relying any centralized cloud function like Band does

blog.chain.link/build-and-use-…

blog.chain.link/build-and-use-…

15/ Chainlink nodes can directly deliver data to any blockchain network, like BSC, without the use of centralized, unpaid relayers

70+ Chainlink Price Feeds are already operating live on the #BSC mainnet without any cross-dependencies on any other chain

binance.com/en/blog/421499…

70+ Chainlink Price Feeds are already operating live on the #BSC mainnet without any cross-dependencies on any other chain

binance.com/en/blog/421499…

16/ Chainlink achieves full market coverage using multiple layers of aggregation and by fetching data from multiple premium data aggregators who generate volume-weighted, market-wide pricing, thereby preventing data manipulation attacks

blog.chain.link/levels-of-data…

blog.chain.link/levels-of-data…

17/ Chainlink is a heterogenous framework for building decentralized oracle networks, there is no limit to how many networks can be launched nor how decentralized these networks can become

Chainlink OCR feeds now have up to 31 nodes and growing

blog.chain.link/how-chainlink-…

Chainlink OCR feeds now have up to 31 nodes and growing

blog.chain.link/how-chainlink-…

18/ From the VIP-23 governance proposal, created by an address funded by the Venus Deployer, it is made clear that an integration of Chainlink would dramatically increase protocol security

"Why should we use an inferior solution while we can use the market leader Chainlink?"

"Why should we use an inferior solution while we can use the market leader Chainlink?"

19/ By upgrading their oracle solution to Chainlink, @VenusProtocol can leverage all of these benefits to continue scaling the TVL of the protocol and ensure user funds are protected at all times

Shout out to @JLSwipe for proactively upgrading the security of the Venus protocol

Shout out to @JLSwipe for proactively upgrading the security of the Venus protocol

• • •

Missing some Tweet in this thread? You can try to

force a refresh