1/ With the launch of Uniswap V3, I'm seeing questions regarding the differences between DEX-based TWAP oracles and Chainlink Price Feeds

There are four primary differences

1. Freshness/accuracy

2. Market coverage

3. Security scalability

4. Feed diversity

$LINK $UNI

There are four primary differences

1. Freshness/accuracy

2. Market coverage

3. Security scalability

4. Feed diversity

$LINK $UNI

2/ For context, the naive way to use Uniswap (or any DEX) as a price oracle is to take the spot (aka current) price

This method is extremely vulnerable to flash loan attacks and millions have been lost this way

Even Uniswap doesn't recommend you use their protocol in this way

This method is extremely vulnerable to flash loan attacks and millions have been lost this way

Even Uniswap doesn't recommend you use their protocol in this way

3/ To prevent this (specific) issue of flash loans, Uniswap v2 and v3 offers Time Weighted Average Price (TWAP) oracles

TWAP is a way to calculate the mean price of an asset during a period of time

e.g. "1 hr TWAP" is the average price of an asset over a specific hour of time

TWAP is a way to calculate the mean price of an asset during a period of time

e.g. "1 hr TWAP" is the average price of an asset over a specific hour of time

4/ There are some minor technical differences between TWAP oracles on V2 compared to V3, but what I describe below applys to both just as equally

Let's start with the first, freshness and accuracy

Let's start with the first, freshness and accuracy

5/ TWAP is a lagging indicator (by design)

While this is fine during times of low volatility, a TWAP can become highly out of sync with the market wide price during high volatility

Why does this happen?

While this is fine during times of low volatility, a TWAP can become highly out of sync with the market wide price during high volatility

Why does this happen?

6/ With TWAP oracles, tamper resistance (security) is inversely correlated with freshness (accuracy)

Longer TWAPs provide higher tamper-resistance at the trade-off of less accuracy during volatility

Shorter TWAPs provide more fresh up-to-date data, but is cheaper to manipulate

Longer TWAPs provide higher tamper-resistance at the trade-off of less accuracy during volatility

Shorter TWAPs provide more fresh up-to-date data, but is cheaper to manipulate

7/ With Uniswap TWAP oracles, you're forced to choose between a stale but tamper-resistant price point or a fresh but manipulable price point

Let's look at a theoretical but plausible situation, a money market using Uniswap V3 TWAP with 1 hour samples as its oracle solution

Let's look at a theoretical but plausible situation, a money market using Uniswap V3 TWAP with 1 hour samples as its oracle solution

8/ Again, during times of low volatility it appears things are working

However, volatility increases and the market-wide price of a token being used as collateral drops 50% in ten minutes (this is crypto, it happens)

Normally the protocol would liquidate this position just fine

However, volatility increases and the market-wide price of a token being used as collateral drops 50% in ten minutes (this is crypto, it happens)

Normally the protocol would liquidate this position just fine

9/ However because a TWAP of 1 hour was used, it hasn't had time to catch up yet and reports a drop of only 5%

As a result of stale pricing data, liquidations do not occur in time and now the debt is now worth more than the underlying collateral

Undercollateralization occurs

As a result of stale pricing data, liquidations do not occur in time and now the debt is now worth more than the underlying collateral

Undercollateralization occurs

10/ Even once the TWAP feed finally catches up and reports the correct price after the 50% drop, it'll be too late because the position cannot be fully liquidated

The lenders end up eating the loss, which would have never happened if a proper price feed solution was used

The lenders end up eating the loss, which would have never happened if a proper price feed solution was used

11/ This is just an example but it's the exact issue I'm talking about

DeFi needs oracles to deliver the market-wide price to protect user funds, lagging indicator price oracles simply don't cut it when there's billions and eventually trillions at stake here

DeFi needs oracles to deliver the market-wide price to protect user funds, lagging indicator price oracles simply don't cut it when there's billions and eventually trillions at stake here

12/ Chainlink avoid these issues by not using a TWAP but instead fetching the real time market-wide price from professional data aggregators like BraveNewCoin, Kaiko, and more who track all exchanges and weigh each by real volume while avoiding outliers and fake volume

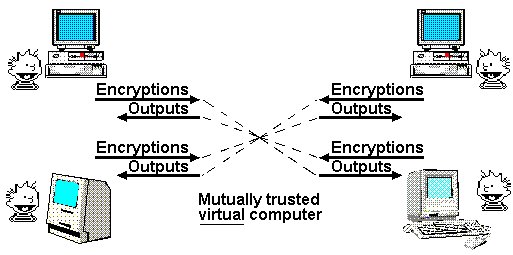

13/ Each Chainlink node fetches from multiple data aggregators and takes a median value

Each price feed aggregates from multiple independent nodes by taking a median value again

This provides pricing data that reflects the true market wide price without compromising on security

Each price feed aggregates from multiple independent nodes by taking a median value again

This provides pricing data that reflects the true market wide price without compromising on security

14/ Chainlink Price Feeds update on a deviation threshold basis (e.g. 0.5%) and the oracle reports are sourced from off-chain asynchronously, so flash loans inherently have zero effect (as flash loans only exist atomically within a single block)

15/ In comparison, fetching price data from only a single DEX means you're only looking at a small sliver of the total trading market

This lowers the cost of attack as you need less capital to manipulate a single market, rather than hundreds of CEXs and DEXs at the same time

This lowers the cost of attack as you need less capital to manipulate a single market, rather than hundreds of CEXs and DEXs at the same time

16/ While the DEX used as a TWAP oracle may be sufficiently liquid when first intregrated, there's no garuentee that liquidity/volume won't shift to a different exchange and unexpectedly lower the cost of manipulation

This is an issue for all single source oracles

This is an issue for all single source oracles

17/ We need to also consider liquidity fragmentation, not only between competing DEXs (vampire attack), but also between two verisons of the same DEX (Uniswap V2/V3), and between the same DEX on multiple chains (Uniswap V3 on Ethereum and Optimism)

18/ This means the market coverage is therefore reduced even further, dropping the cost of attack

This is something that cannot be predicted ahead of time and if a dev is not paying attention, their protocol can get rekt when the liquidity and volume on the single DEX runs thin

This is something that cannot be predicted ahead of time and if a dev is not paying attention, their protocol can get rekt when the liquidity and volume on the single DEX runs thin

19/ One way you can increase security to a TWAP feed is by adding more liquidity

However this is not capital efficient and is a double edged sword because that liquidity can be removed at any point in time just as easily

Liquidity rug pulls on a single DEX will wreck your TWAP

However this is not capital efficient and is a double edged sword because that liquidity can be removed at any point in time just as easily

Liquidity rug pulls on a single DEX will wreck your TWAP

20/ Lastly (because this thread is already too long), there is feed diversity

Uniswap TWAP can only provide pricing data for ERC20s relative to other ERC20s tokens

A Uniswap pool with WBTC and ETH can provide the WBTC/ETH and ETH/WBTC exchange rates *from the Uniswap market*

Uniswap TWAP can only provide pricing data for ERC20s relative to other ERC20s tokens

A Uniswap pool with WBTC and ETH can provide the WBTC/ETH and ETH/WBTC exchange rates *from the Uniswap market*

21/ What it cannot do is provide the provide the price of oil, stocks, forex, commodities, real estate, or any other price data beyond tokens

Synths like $sTSLA and $mTSLA already use external price oracles so using Uniswap pools as the oracle is just adding a unnecessary step

Synths like $sTSLA and $mTSLA already use external price oracles so using Uniswap pools as the oracle is just adding a unnecessary step

22/ Additionally, Uniswap TWAP cannot provide you the USD price of tokens

Sure ETH/USDT is a proxy for ETH/USD but you need to trust the stablecoin peg to always hold (which it doesn't always), so that's a large assumption

Sure ETH/USDT is a proxy for ETH/USD but you need to trust the stablecoin peg to always hold (which it doesn't always), so that's a large assumption

23/ A side note, I am actually a fan of Uniswap, the V1 was the first dApps I used (besides EthLend) and imo the UX/UI is second to none in the DeFi space

However, the trade-offs of TWAP price feeds is little discussed do this thread aims to provide you some conext

However, the trade-offs of TWAP price feeds is little discussed do this thread aims to provide you some conext

24/ So in summary the Uniswap TWAP (and any other DEX TWAP) is not an adequate oracle solution for smart contracts securing real value because of stale pricing data during volatility, lack of market coverage, unscalable security, and no support for price feeds beyond tokens

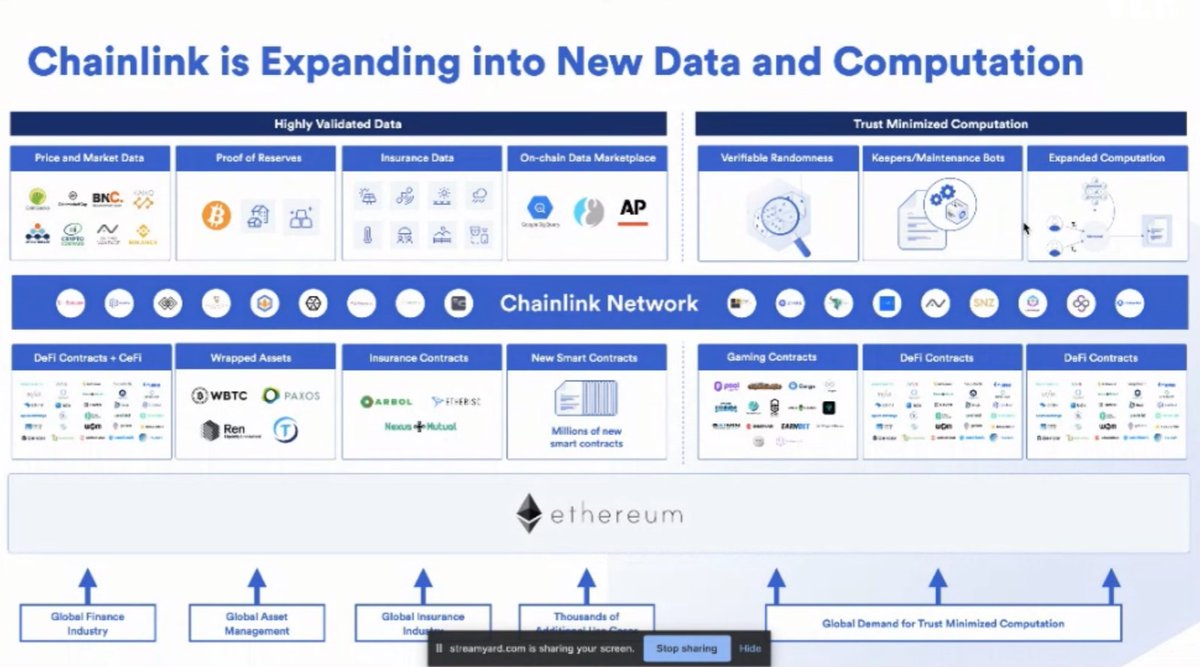

25/ Of note, Chainlink Oracles do indeed provide far more than just price feeds, and I've covered this extensively in the past

However, Chainlink price feeds are the gold standard of DeFi and should not be dismissed given it secures billions for Aave, Synthetix, etc

However, Chainlink price feeds are the gold standard of DeFi and should not be dismissed given it secures billions for Aave, Synthetix, etc

• • •

Missing some Tweet in this thread? You can try to

force a refresh