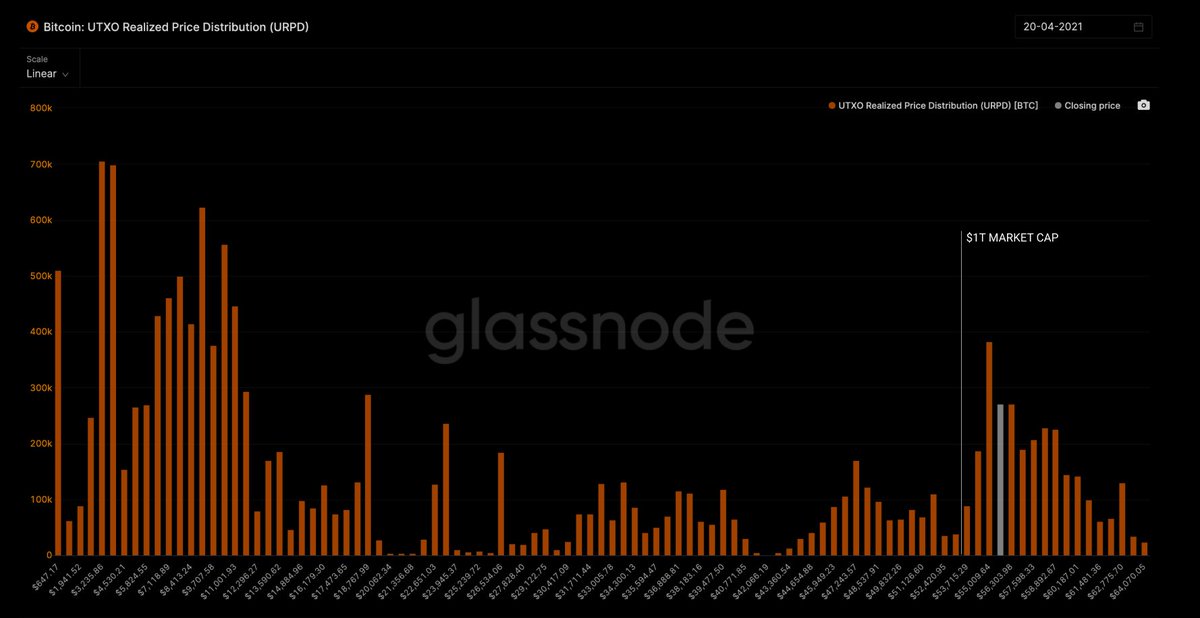

This cycle is different; the movement of coins to strong holders is unprecedented.

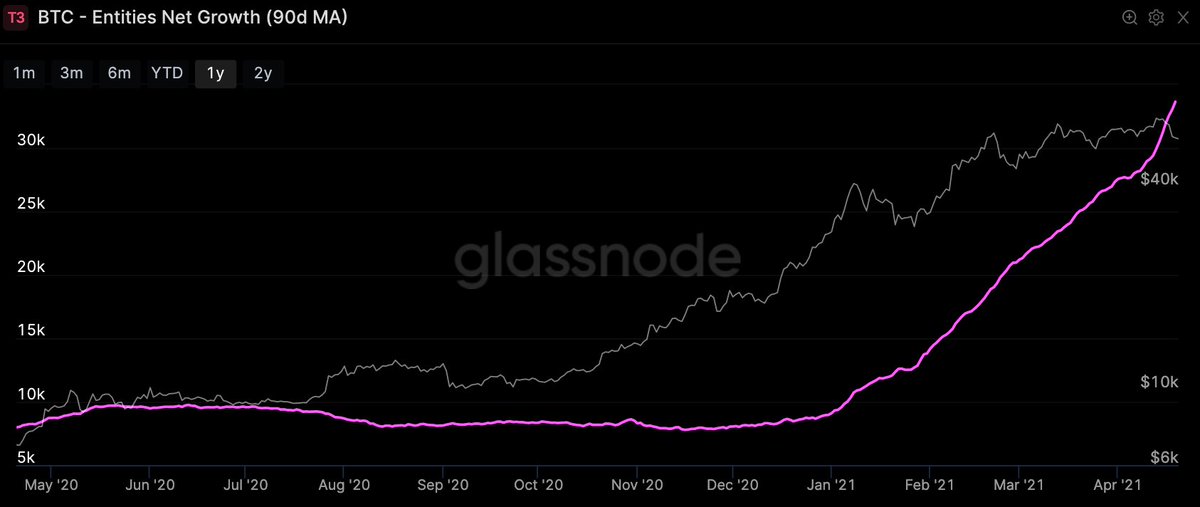

Chart: purple line tracks coins moving between weak and strong hands (running total over 128 days)

Raw data: @glassnode

Chart: purple line tracks coins moving between weak and strong hands (running total over 128 days)

Raw data: @glassnode

A few observations regarding the trend towards strong HODLing...

1) No way are we entering a bear market. That's obvious this week from price action, but not so obvious 2 weeks ago when the sky was falling.

1) No way are we entering a bear market. That's obvious this week from price action, but not so obvious 2 weeks ago when the sky was falling.

2) Coins moving to corporate treasuries likely making an impact.

3) Grayscale Investment Trust now accounting for 3.5% of the supply only allows for inflows of BTC into cold storage (paper is traded, no coins move).

4) Leverage markets that grew in size from 2017 may have had a part to play also. Lots of coins used moved in order to trade them, with leverage less coins need to move for the same amount of speculation.

5) In the early days of Bitcoin, it was used as a currency (Silkroad era) so makes sense coins moved between more liquid hands.

• • •

Missing some Tweet in this thread? You can try to

force a refresh