0/ Tokenomic Design Explorations

Since the inception of crypto-assets, tokenomics have been a fresh attempt at designing asset ownership instruments from first principles.

However, we're just scratching the surface. A thread on how tokenomics can develop in a xchain world

👇

Since the inception of crypto-assets, tokenomics have been a fresh attempt at designing asset ownership instruments from first principles.

However, we're just scratching the surface. A thread on how tokenomics can develop in a xchain world

👇

1/ Recap

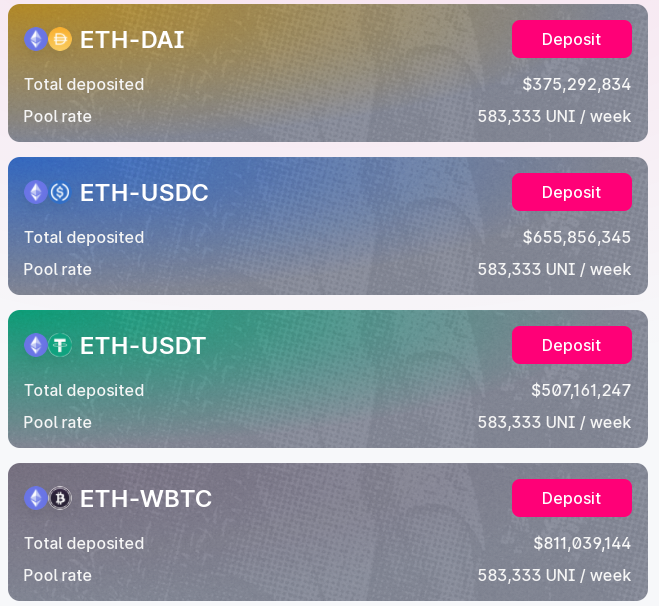

Currently, tokens are used primarily as a growth marketing tool. Via liquidity mining, protocols spend 'equity' in return for bootstrapping initial adoption.

This has been wildly successful, with Compound's LM event kickstarting the original DeFi Summer last year.

Currently, tokens are used primarily as a growth marketing tool. Via liquidity mining, protocols spend 'equity' in return for bootstrapping initial adoption.

This has been wildly successful, with Compound's LM event kickstarting the original DeFi Summer last year.

2/ Since then, LM programs have been the bread & butter growth hacking mechanism for new protocols.

However designing LM programs are extremely tricky.

Give away too much, and you'll have little left in the tank for the future. Too little, and competitors will overshadow you.

However designing LM programs are extremely tricky.

Give away too much, and you'll have little left in the tank for the future. Too little, and competitors will overshadow you.

3/ Cross chain world

When everyone was playing in the same pond (base layer ETH), things were simple.

Vampiric forks were deemed as direct competitors attempting to take away incumbents' market share.

But what happens when cross-chain / L2 ecosystems begin springing up?

When everyone was playing in the same pond (base layer ETH), things were simple.

Vampiric forks were deemed as direct competitors attempting to take away incumbents' market share.

But what happens when cross-chain / L2 ecosystems begin springing up?

4/ At this juncture, few protocols have the necessary resources to launch multiple versions of their product across different chains.

Not only does it cost an exorbitant amt of technical resources, but launching multiple LM programs at once is simply unsustainable.

Not only does it cost an exorbitant amt of technical resources, but launching multiple LM programs at once is simply unsustainable.

5/ Friendly forks

As such, cross-ecosystem collaborations between different dev teams are now feasible.

Why spend the time/effort/tokens on another chain if you could green stamp another team that forks your code and channels value to you?

As such, cross-ecosystem collaborations between different dev teams are now feasible.

Why spend the time/effort/tokens on another chain if you could green stamp another team that forks your code and channels value to you?

6/ Exhibit A: @CurveFinance / @Ellipsisfi

Ellipsis is an authorized fork of Curve on BSC that is publicly backed by Curve. This has allowed them to garner much stronger market traction, riding on the goodwill and brand recognition of Curve.

docs.ellipsis.finance

Ellipsis is an authorized fork of Curve on BSC that is publicly backed by Curve. This has allowed them to garner much stronger market traction, riding on the goodwill and brand recognition of Curve.

docs.ellipsis.finance

7/ In return, Ellipsis will offer veCRV holders a portion of all fees generated. Periodic airdrops of $EPS will also be given to these tokenholders.

By rubber stamping a friendly fork, Curve has increased the value proposition of $CRV, at the cost of minimal resources.

By rubber stamping a friendly fork, Curve has increased the value proposition of $CRV, at the cost of minimal resources.

8/ Exhibit B: @LiquityProtocol / @FluityF

Fluity is a similar friendly fork of Liquity on BSC. All $LQTY holders are rewarded with 25% of all the $FLTY tokens over the course of 2 years. However, Liquity currently has 'no oversight' over Fluity.

Fluity is a similar friendly fork of Liquity on BSC. All $LQTY holders are rewarded with 25% of all the $FLTY tokens over the course of 2 years. However, Liquity currently has 'no oversight' over Fluity.

https://twitter.com/LiquityProtocol/status/1390745131448471556?s=20

9/ These examples show how protocols are beginning to work together to form Parent - Subsidiary relationships.

Parent enjoys 'royalties' in the form of airdrops / fees generated by the sub.

Subsidiary enjoys brand recognition + advisory from Parent to accelerate early adoption

Parent enjoys 'royalties' in the form of airdrops / fees generated by the sub.

Subsidiary enjoys brand recognition + advisory from Parent to accelerate early adoption

10/ DeFi Conglomerates

Moving forward, this type of growth strategy will likely see increased adoption by ETH-based DeFi majors.

Most of them are simply swamped with meeting roadmap goals and have not designed LT strategies & LM programs to include multiple DeFi ecosystems

Moving forward, this type of growth strategy will likely see increased adoption by ETH-based DeFi majors.

Most of them are simply swamped with meeting roadmap goals and have not designed LT strategies & LM programs to include multiple DeFi ecosystems

11/ If DeFi bluechips are able to formulate partnerships with clear value accrual to their own token, I see no reason why they can't become the dominant Parent token across different ecosystems.

This may very well be how the first DeFi Conglomerates take shape.

This may very well be how the first DeFi Conglomerates take shape.

• • •

Missing some Tweet in this thread? You can try to

force a refresh