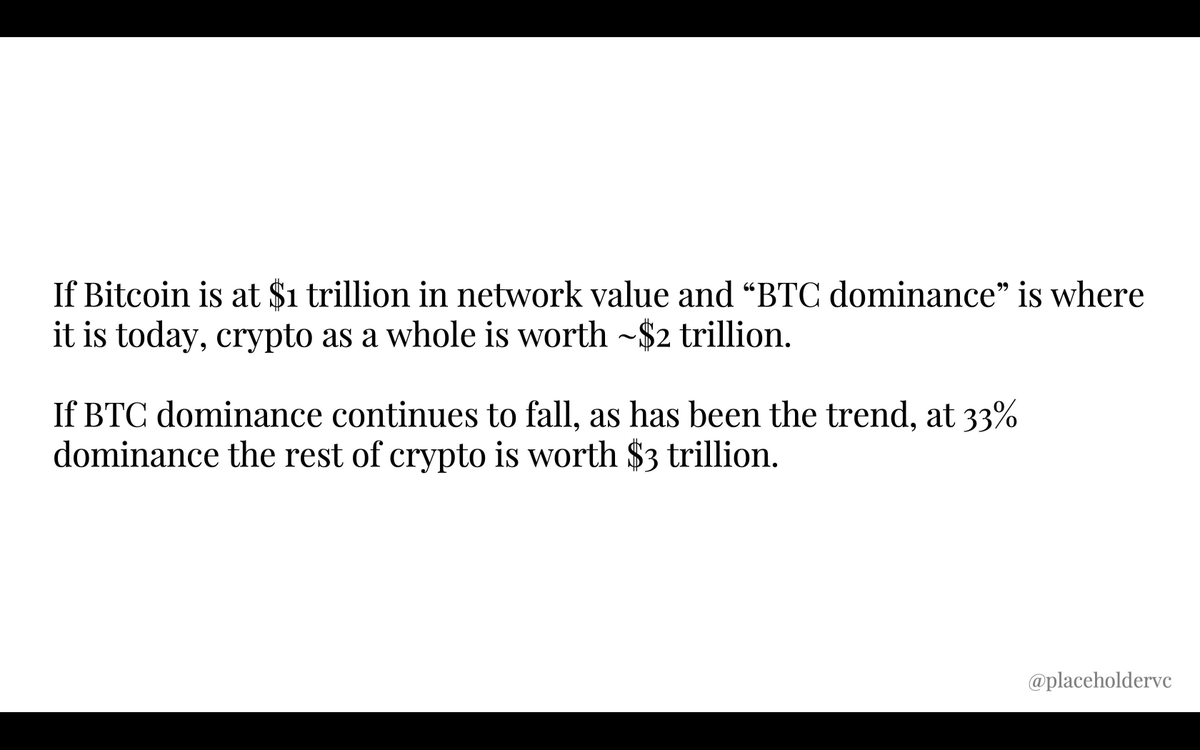

In the turbulence of 2019, @placeholdervc would run optimistic exercises to stay grounded. This was one:

https://twitter.com/eliasimos/status/1391450345637924868

We now run a combination of optimistic and pessimistic exercises from #crypto's current perch.

People naturally asking, when's the top?

The truth: no one knows, exactly.

People naturally asking, when's the top?

The truth: no one knows, exactly.

While we're in one predicted range at $2.5T in total #crypto value, the vibe from 2021 is supply inflation, speculation, and innovation. People saying, Up Only.

It would seem $BTC has further to rise in $USD & further to fall in dominance, $ETH is on 🔥🔥🔥, and so the final $T's could stun us.

For perspective, tech & telecom public names peaked at ~$3T in 2000, which when adjusted for inflation is $4.6T today (another @placeholdervc exercise, @jmonegro led)

https://twitter.com/cburniske/status/1126580075548303360?s=20

All that said, be mindful of excess hopium.

It's hard to get high off hopium in a bear.

It's easy to get too high off hopium in a bull.

Markets run hopium cycles on greed and fear.

It's hard to get high off hopium in a bear.

It's easy to get too high off hopium in a bull.

Markets run hopium cycles on greed and fear.

.@albertwenger nails it here:

"You get swept up in it, are surrounded by others who are as well, and a powerful internal logic takes hold, where everything is evaluated only in relation to other parts of the bubble and not the world at large."

continuations.com/post/161091248…

"You get swept up in it, are surrounded by others who are as well, and a powerful internal logic takes hold, where everything is evaluated only in relation to other parts of the bubble and not the world at large."

continuations.com/post/161091248…

Everything will happen, it just takes time (and metaverses).

Full prezo that @eliasimos mentioned, and instigated this thread, here:

https://twitter.com/cburniske/status/1126576282668552192?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh