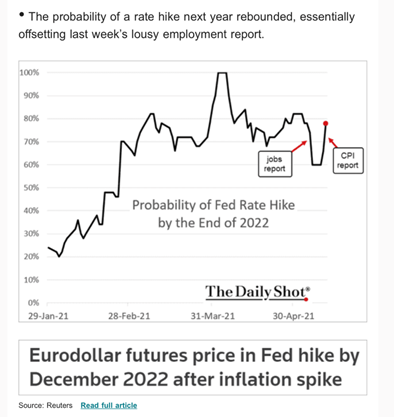

CBs must keep their nerve with no change in their stance or views on the economy. Despite all warnings about temporary supply glitches & one-off effects on inflation, media and markets are in a frenzy about inflation data for the US April inflation, 4.2% yoy and 3% for core.1/

The EA numbers are much lower, 1.6% and 0.8%. I expected 2% for the EA and more than 3% for the US (markets were expecting 3.6%). The oil price went negative for a few days in March 2020 and was still around $21 in April 2020, implying a huge base effect for March/April 2021.2/

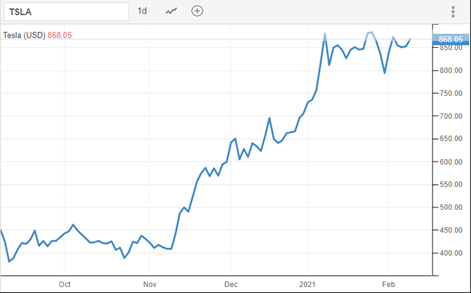

Markets reacted sharply. In 2 days, the US 10Y yield went up from 1.6 to 1.69 now. In the EA the average increase is now also 9 b.p. Stocks are going down (especially tech in the US). VIX, the “ fear index” had a spike but still fat from several previous peaks. 3/

CBs will have to wait for the beginning of 2022 to be vindicated in their views. In the end, inflation will hardly be above 2 in the US in this year and the next, whereas the ECB forecasts only 1.5% for this year and 1.2% and 1.4% for 2022 and 2023. Markets are pressing but…4/

A period of sustained high inflation is unlikely. To think differently, one would have to believe that wage increases would follow, generating a wage-price spiral or, even less likely, that a mere unanchoring of expectations would trigger upwards actual pricing decisions 5/

• • •

Missing some Tweet in this thread? You can try to

force a refresh