🪞How Hedge Funds Do Post-Mortems🪞

"Pain+Reflection=Progress" ~Ray Dalio

The post-mortem is the hedge fund PM's leg day: can't skip.

Done right, it's a systematic exercise that mega boosts performance. Yet ppl never explain how to do one.

So @SeifelCapital(CS) & I teamed up

👇

"Pain+Reflection=Progress" ~Ray Dalio

The post-mortem is the hedge fund PM's leg day: can't skip.

Done right, it's a systematic exercise that mega boosts performance. Yet ppl never explain how to do one.

So @SeifelCapital(CS) & I teamed up

👇

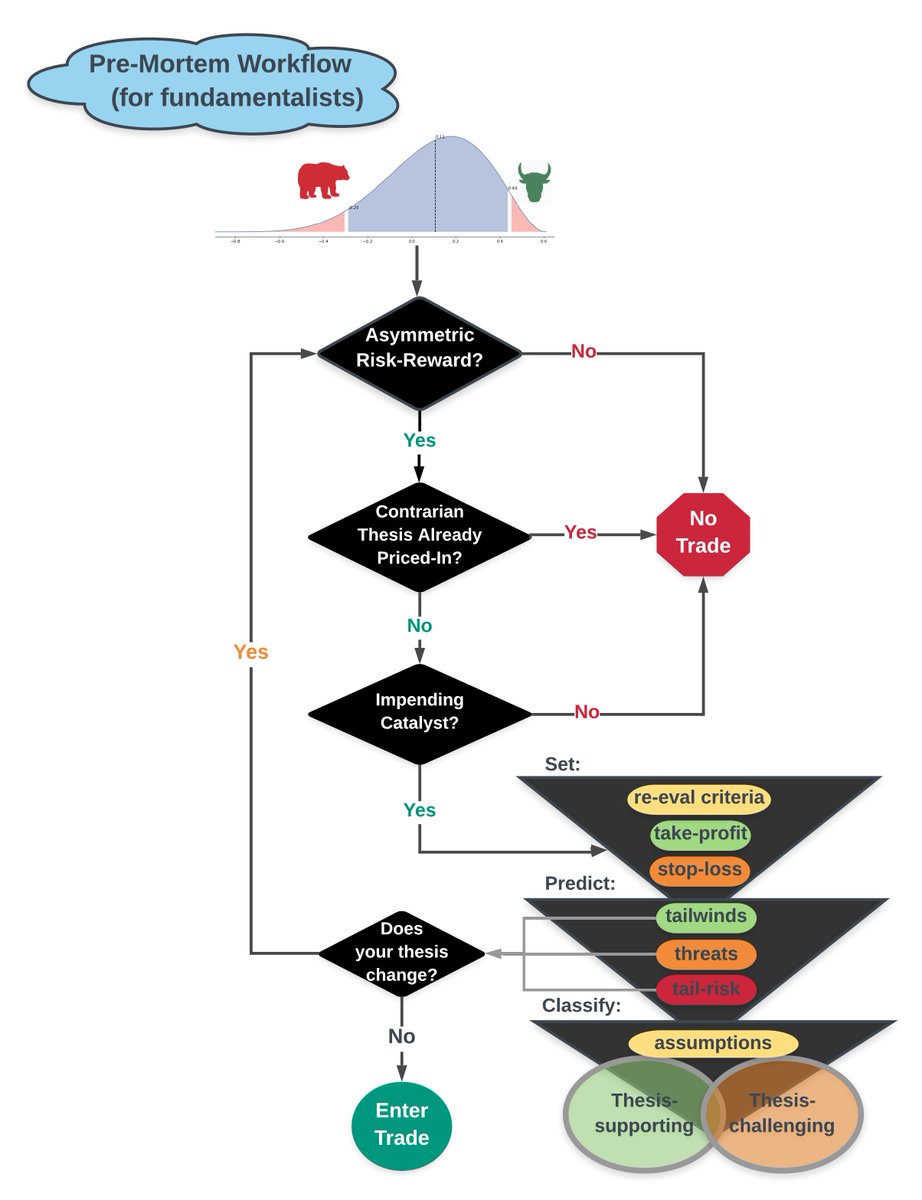

0/ Start with "pre-mortem"

Think back to when u entered the trade.

1. What asymmetric risk-reward opportunity did you see? 2. What catalysts would drive results in ur favor?

3. What risks were u wary of?

We'll do a 2nd follow-up🧵to focus on pre-mortem but here's a sneak peak:

Think back to when u entered the trade.

1. What asymmetric risk-reward opportunity did you see? 2. What catalysts would drive results in ur favor?

3. What risks were u wary of?

We'll do a 2nd follow-up🧵to focus on pre-mortem but here's a sneak peak:

1/ PnL Results

Fast-forward back to today. The catalyst you'd been playing for just happened (e.g. earnings, demo day, FOMC)

Your brokerage acct says +8%.

"So my thesis was correct!" you think.

Not quite.

CS explains "Look at both absolute return & risk adjusted return."

Fast-forward back to today. The catalyst you'd been playing for just happened (e.g. earnings, demo day, FOMC)

Your brokerage acct says +8%.

"So my thesis was correct!" you think.

Not quite.

CS explains "Look at both absolute return & risk adjusted return."

What goes into "risk adjusted"?

Doesn't matter whether Sharpe or Treynor.

The building blocks are the same.

A) normalize out beta

e.g. I went long $RBLX into Q1 '21; raw PnL is red. But green after subtracting % loss of equities selloff

B) correlation

C) std deviation of returns

Doesn't matter whether Sharpe or Treynor.

The building blocks are the same.

A) normalize out beta

e.g. I went long $RBLX into Q1 '21; raw PnL is red. But green after subtracting % loss of equities selloff

B) correlation

C) std deviation of returns

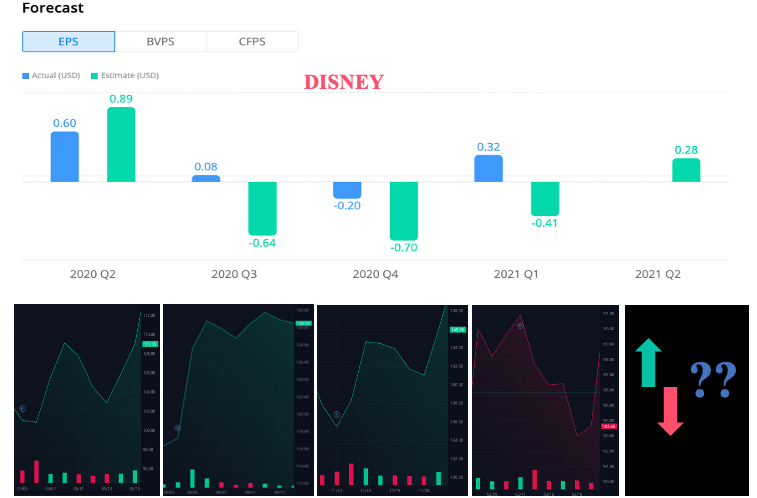

2/ Compare actual vs expected fundamental results

There's a difference btw making $ and being right.

Just b/c your PnL is up, doesn't mean your underlying thesis was right.

Winning over time means improving accuracy of fundamental theses. But how do u assess thesis accuracy?

There's a difference btw making $ and being right.

Just b/c your PnL is up, doesn't mean your underlying thesis was right.

Winning over time means improving accuracy of fundamental theses. But how do u assess thesis accuracy?

Start by calculating % surprise btw reported & expected KPIs. Assess if u were in the ballpark.

e.g. $RBLX revenue grew +140% YoY in Q1. Beat my base forecast +100% and was just shy of my bullish forecast +150%

Did the market react as expected?

Yes. But then CPI had to happen😢

e.g. $RBLX revenue grew +140% YoY in Q1. Beat my base forecast +100% and was just shy of my bullish forecast +150%

Did the market react as expected?

Yes. But then CPI had to happen😢

Revenue is the most common KPI driving stock prices, but not the only.

Others:

- EPS

- ROIC

- MAUs/DAUs (apps)

-GMV (exchanges, e-commerce)

CS: "If there's a material surprise, ask yourself:

a. What drove the discrepancies?

b. What was the resulting impact on value?"

Others:

- EPS

- ROIC

- MAUs/DAUs (apps)

-GMV (exchanges, e-commerce)

CS: "If there's a material surprise, ask yourself:

a. What drove the discrepancies?

b. What was the resulting impact on value?"

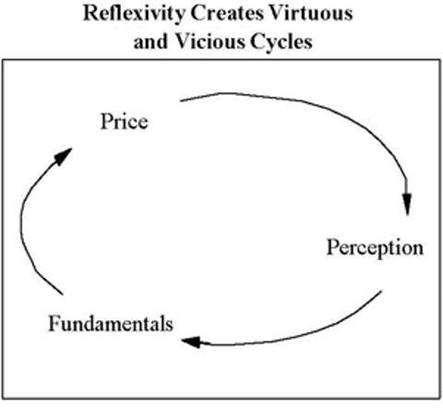

3/ Assessing Thesis Accuracy: Know thy opponent

When the market doesn't react as expected (e.g. $GME same store sales tank but the stock pops), ask yourself "Was I right abt the marginal buyer/seller?"

i.e. Who's trading against you? What metrics/trends does ur opponent track?

When the market doesn't react as expected (e.g. $GME same store sales tank but the stock pops), ask yourself "Was I right abt the marginal buyer/seller?"

i.e. Who's trading against you? What metrics/trends does ur opponent track?

Here's some advice for fundamentalists:

If your trade touches meme-stonk vicinity (data warehouses, exercise bikes, contains the word zoom), retail volume has flooded in. Go read r/wallstreetbets.

If you're trading against AQR, go read their whitepapers on factor analysis.

If your trade touches meme-stonk vicinity (data warehouses, exercise bikes, contains the word zoom), retail volume has flooded in. Go read r/wallstreetbets.

If you're trading against AQR, go read their whitepapers on factor analysis.

4/ Assessing Thesis Accuracy: Correct Catalyst

Top catalyst examples:

- earnings

- product launch (tech)

- crude inventories (for energy)

- FDA approval (for biotech)

There's 2 ways to get the catalyst "wrong"

1. Nobody cared

2. A stronger catalyst knocked yours out of da park

Top catalyst examples:

- earnings

- product launch (tech)

- crude inventories (for energy)

- FDA approval (for biotech)

There's 2 ways to get the catalyst "wrong"

1. Nobody cared

2. A stronger catalyst knocked yours out of da park

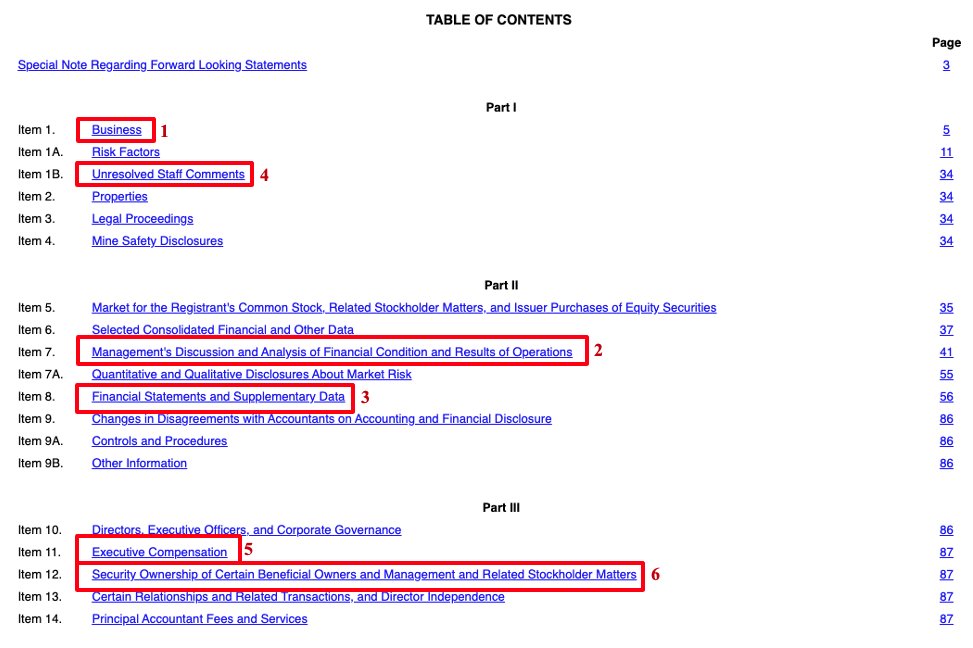

5/ Assessing Thesis Accuracy: Assumptions

When investors say "think back to first principals" they mean "question your ex-ante assumptions."

So far, we've reflected on the who, what, and when, but not why. Maybe you mis-predicted EPS. Why? What assumptions drove you off?

When investors say "think back to first principals" they mean "question your ex-ante assumptions."

So far, we've reflected on the who, what, and when, but not why. Maybe you mis-predicted EPS. Why? What assumptions drove you off?

There are 3 types of assumptions:

1. accurate assumptions (e.g. cooping kids @ home means growth spurt for RBLX)

2. false assumptions (e.g. GME trades on fundamentals)

3. omitted assumptions (e.g. SPAC frenzy means D&O insurance 🚀🚀... too bad i didn't think of this earlier)

1. accurate assumptions (e.g. cooping kids @ home means growth spurt for RBLX)

2. false assumptions (e.g. GME trades on fundamentals)

3. omitted assumptions (e.g. SPAC frenzy means D&O insurance 🚀🚀... too bad i didn't think of this earlier)

6/ Blind-Spots

Speaking of omitted...

There are 3 types of blind-spots:

1. known unknowns (e.g. probability Biden's tax absurdity passes)

2. unknown knowns (e.g. literally u were myopic & forgot about some key factor)

3. unknown unknowns (totally left-field 6σ shit like COVID)

Speaking of omitted...

There are 3 types of blind-spots:

1. known unknowns (e.g. probability Biden's tax absurdity passes)

2. unknown knowns (e.g. literally u were myopic & forgot about some key factor)

3. unknown unknowns (totally left-field 6σ shit like COVID)

7/ Meta-reflection

Your investment process itself-- ideation framework, due diligence, post-mortem framework--needs periodic fine-tuning.

CS says, "Ask yourself:

How can i improve visibility on risks?

What fundamental/technical factors did I miss that I can add to my framework?"

Your investment process itself-- ideation framework, due diligence, post-mortem framework--needs periodic fine-tuning.

CS says, "Ask yourself:

How can i improve visibility on risks?

What fundamental/technical factors did I miss that I can add to my framework?"

8/ Time to grab a beer.

Post-mortems are a hard workout on the brain.

Reward yourself when done so as to give the lizard brain some Pavlovian incentivization for next time!

Post-mortems are a hard workout on the brain.

Reward yourself when done so as to give the lizard brain some Pavlovian incentivization for next time!

• • •

Missing some Tweet in this thread? You can try to

force a refresh