There are three key ways to get rich:

1. Start a Business

2. Be Born Into a Wealthy Family

3. Extreme Patience

Everyone likes the stories about #1 and #2.

Nobody likes to hear about #3.

Too bad.

Today, I'm going to tell you a story about a guy who made billions with #3...

1. Start a Business

2. Be Born Into a Wealthy Family

3. Extreme Patience

Everyone likes the stories about #1 and #2.

Nobody likes to hear about #3.

Too bad.

Today, I'm going to tell you a story about a guy who made billions with #3...

“__________ has the best operating and capital deployment record in American business.”

–Warren Buffett

“His results are a mile higher than anyone else …utterly ridiculous.”

–Charlie Munger

Who is this mystery man?

I'd wager money you've never heard of him...

–Warren Buffett

“His results are a mile higher than anyone else …utterly ridiculous.”

–Charlie Munger

Who is this mystery man?

I'd wager money you've never heard of him...

Everyone knows about Buffett and Munger.

But almost nobody knows about Henry Singleton.

The man who quietly bootstrapped $450k into $1.15 BILLION.

But almost nobody knows about Henry Singleton.

The man who quietly bootstrapped $450k into $1.15 BILLION.

Over his tenure, Teledyne owned more than 150 companies with interests as varied as insurance, dental appliances, specialty metals, and aerospace electronics.

He focused on profitable niches, often owning high tech businesses in specialized areas.

He focused on profitable niches, often owning high tech businesses in specialized areas.

Singleton had a dead simple approach to investing:

He bought back Teledyne shares when they were selling cheaply.

Then he issued Teledyne shares when they were highly valued, using the proceeds to buy great businesses.

For the long gaps in between: he did very little.

He bought back Teledyne shares when they were selling cheaply.

Then he issued Teledyne shares when they were highly valued, using the proceeds to buy great businesses.

For the long gaps in between: he did very little.

It worked out astonishingly well:

Whens Singleton got started in 1960, Teledyne made $50,000 in annual profit.

When Singleton retired in 1989, Teledyne made $392 million in annual profit.

Whens Singleton got started in 1960, Teledyne made $50,000 in annual profit.

When Singleton retired in 1989, Teledyne made $392 million in annual profit.

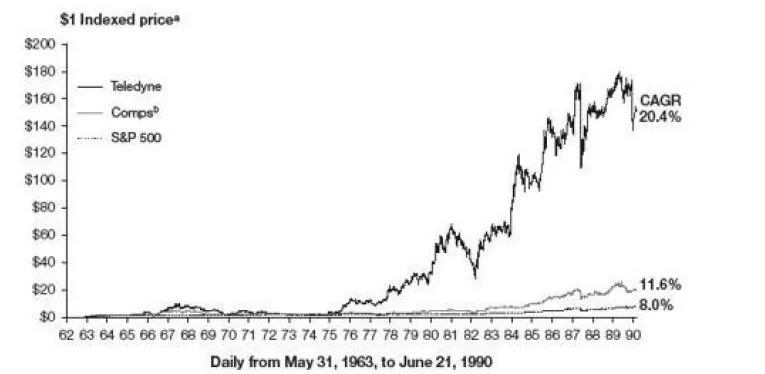

Between 1963 and 1990 Teledyne quietly compounded at an eye-popping 20.4%, more than double the market.

In part, he achieved this by buying back 90% of Teledyne’s outstanding shares whenever the market undervalued them.

In part, he achieved this by buying back 90% of Teledyne’s outstanding shares whenever the market undervalued them.

This is what we investing nerds call "capital allocation".

Which really just means:

Investing a dollar to the place within your company that returns the highest amount.

This is not the sort of strategy that gets most CEOs out of bed...

Which really just means:

Investing a dollar to the place within your company that returns the highest amount.

This is not the sort of strategy that gets most CEOs out of bed...

When left with excess profits, a CEO has 4 choices:

1. Let the cash pile up.

2. Issue the excess cash as a dividend.

3. Use the cash to invest in growth within the company (R&D, expansion, marketing, etc).

4. Acquire/invest in more companies.

1. Let the cash pile up.

2. Issue the excess cash as a dividend.

3. Use the cash to invest in growth within the company (R&D, expansion, marketing, etc).

4. Acquire/invest in more companies.

Give most CEOs two options:

1. Buy a sexy new business and make 10% per year

2. Buy back undervalued stock and make 25% per year

And I'd wager most CEOs would probably pick #1, even though it's illogical.

Let's be honest:

It's a lot more exciting than buying back stock.

1. Buy a sexy new business and make 10% per year

2. Buy back undervalued stock and make 25% per year

And I'd wager most CEOs would probably pick #1, even though it's illogical.

Let's be honest:

It's a lot more exciting than buying back stock.

Unfortunately being a great capital allocator isn't sexy.

It's boring. Beautifully boring, for us nerds.

It requires extreme discipline and patience.

It's boring. Beautifully boring, for us nerds.

It requires extreme discipline and patience.

Fortunately, Singleton had this in spades.

He was quite content to sit on his hands for long periods, waiting for the next boring but logical opportunity.

It's not an exciting way to get rich, but if you have the personality for it, it's extremely satisfying.

He was quite content to sit on his hands for long periods, waiting for the next boring but logical opportunity.

It's not an exciting way to get rich, but if you have the personality for it, it's extremely satisfying.

Most people think that in order to get rich, they have to be open door #1 and start a company like Bezos or Musk.

That's insanely hard and not for the faint of heart.

That's insanely hard and not for the faint of heart.

But people forget about boring old door #3:

Logic, patience and discipline. Like Singleton.

It doesn't have to be complicated. Or your life's work.

It can be a weekend hobby investing in a 401k.

But patience and discipline pays off big time in the long run.

Logic, patience and discipline. Like Singleton.

It doesn't have to be complicated. Or your life's work.

It can be a weekend hobby investing in a 401k.

But patience and discipline pays off big time in the long run.

Munger puts it best:

“The big money is not in the buying and selling, but in the waiting.” 💘

“The big money is not in the buying and selling, but in the waiting.” 💘

• • •

Missing some Tweet in this thread? You can try to

force a refresh