1/ Today at 9.30 am, the German Constitutional Court announces its decision whether the ECB is sufficiently complying with its #PSPP ruling from May 2020.

In the following thread I want to briefly discuss two important aspects of this ruling: Proportionality and Accountability.

In the following thread I want to briefly discuss two important aspects of this ruling: Proportionality and Accountability.

2/ Proportionality: In last year’s decision the GCC made clear that it sees the PSPP as overstepping the boundaries of monetary policy into the realms of economic policy which is supposed to be in the hands of national governments.

3/ However, GCC acknowledges that extraordinary circumstances might justify unconventional measures that might have unintended economic policy like effects. The question was whether PSPP was a proportionate measure to ensure price stability despite its unintended (side) effects.

4/ While the ECB is primarily accountable to the European Parliament, the GCC effectively asked the German Parliament and the government to also demand accountability at least from the Bundesbank (maybe even the ECB).

5/ So, what has happened since the ruling? The most prominent measure was probably that the ECB sent minutes of ECB meetings and other documents that were supposed to prove the proportionality assessment of PSPP by the ECB to the Bundestag and the German government.

6/ Bundestag and the German government had a look at the documents and have signaled that they are satisfied with the ECB’s assessment. So far, so good!

bundestag.de/dokumente/text…

bundestag.de/dokumente/text…

7/ Moreover, Bundesbank president Jens Weidmann is now reporting to the Bundestag every quarter about the ECB’s monetary policy, similar to the hearings of the EP’s Committee on Economic and Monetary Affairs where the ECB president has to participate.

handelsblatt.com/finanzen/geldp…

handelsblatt.com/finanzen/geldp…

8/ This institutionalization of another level of accountability for the Eurosystem in the form of the Bundesbank is potentially very important to the GCC and especially to Peter M. Huber who seems to be a fan of proceduralisation of European law.

9/ I am not an expert but I’ll try to explain: proceduralisation promises to generate adequate procedures and standards that can secure the legitimacy of the law even under the conditions of mult-level law-making. “Procedural obligations relate to proceedings (courses of action)

10/ ... and prescribe measures which constitute, shape, and channel these proceedings. Examples in the field of international law are obligations to lay down something in writing, to give information to specific actors or the public, …, and the like.” mpil.de/en/pub/researc…

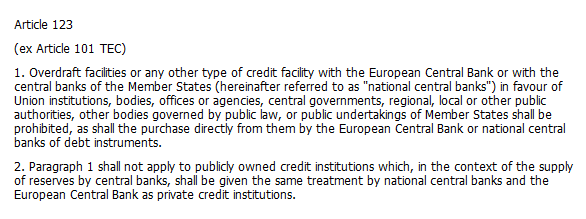

11/ As I understand it, the reporting judge Peter M. Huber tries to establish clearer boundaries for the imprecise formulations of the Treaty of Maastricht. For example, at what point is buying government bonds illegal monetary financing?

12/ Here the GCC has already tried to define rules for what the ECB is allowed to do in past rulings. Remember the debate on issuer limits and PEPPs flexibility? journals.sagepub.com/doi/abs/10.117…

13/ In the case of PSPP that would have meant a clearer set of criteria of when government bond purchases are justified and proportional. Of course, the ECB did not provide such a thing and will most likely never do so to preserve some flexibility in a changing econ. environment.

14/ Last point is improved communication. Lagarde promised better communication but I am not sure how much has already changed (yes, the website is new) and how much is yet to come.

15/ For what it’s worth, the mentioning of the words proportionate and proportionality in ECB speeches has doubled over the last year compared to the year before the ruling.

16/ To conclude: Since last years ruling has not been clear on what the 🇩🇪 government, the Bundesbank, or the ECB were supposed to do it seems unlikely that the GCC will demand the Bundesbank to stop participating in the PSPP despite some judges feeling uncomfortable about it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh