0/ In today’s Delphi Daily, we break down $BTC exchange inflows, @DeribitExchange futures trading at -75% basis, and gas hitting 1700 gwei.

Check out the full analysis! 👇

delphidigital.io/reports/delphi…

Check out the full analysis! 👇

delphidigital.io/reports/delphi…

1/ May 2021 hasn’t been kind to BTC bulls, but today was by far the worst day for the market since March 2020.

Over $2 billion in BTC positions —longs and shorts — were liquidated in today’s choppy market. Over $10 billion were liquidated across crypto perps and futures.

Over $2 billion in BTC positions —longs and shorts — were liquidated in today’s choppy market. Over $10 billion were liquidated across crypto perps and futures.

2/ As demand dried across BTC markets, the annualized basis for one month futures briefly traded at a big discount. @DeribitExchange had the worst reaction, with basis reaching -75%.

This was a result of heavy selling across futures market causing them to go into backwardation.

This was a result of heavy selling across futures market causing them to go into backwardation.

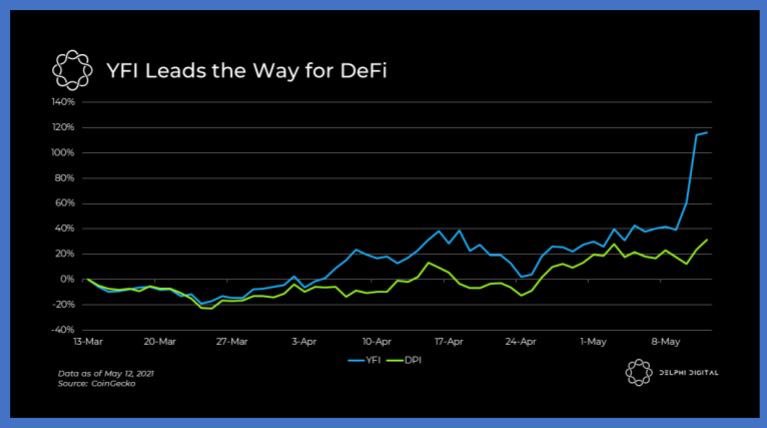

3/ Gas eclipsed 2000 gwei briefly and was between 1500 and 1700 gwei for about an hour.

As markets crashed, DeFi liquidation opportunities popped up in every corner, giving way to gas wars amongst liquidators and arbitrageurs.

As markets crashed, DeFi liquidation opportunities popped up in every corner, giving way to gas wars amongst liquidators and arbitrageurs.

4/ BTC inflow to exchanges exceeded 20,000 coins in just an hour today. This is the highest daily and hourly inflow since Black Thursday.

While this isn’t a certain signal of a bottom, it’s a sign of capitulation and shaking out “weak hands.”

While this isn’t a certain signal of a bottom, it’s a sign of capitulation and shaking out “weak hands.”

5/ Next up, our tweets of the day!

@Zapper_fi raises $15 million in Series A funding.

@Zapper_fi raises $15 million in Series A funding.

https://twitter.com/zapper_fi/status/1394290253230493699

6/ The bright side of high collateralization ratios.

https://twitter.com/kaiynne/status/1394999172583989249

8/ When there are crazy days like today, don’t miss a beat and stay up to date!

Subscribe below: delphidigital.io/subscription-p…

Subscribe below: delphidigital.io/subscription-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh