0/ Today we looked at YFI’s current run to ATH, @Uniswap’s highest single day of volume, and the amount of $ETH in smart contracts continues to rise. 👇

delphidigital.io/reports/delphi…

delphidigital.io/reports/delphi…

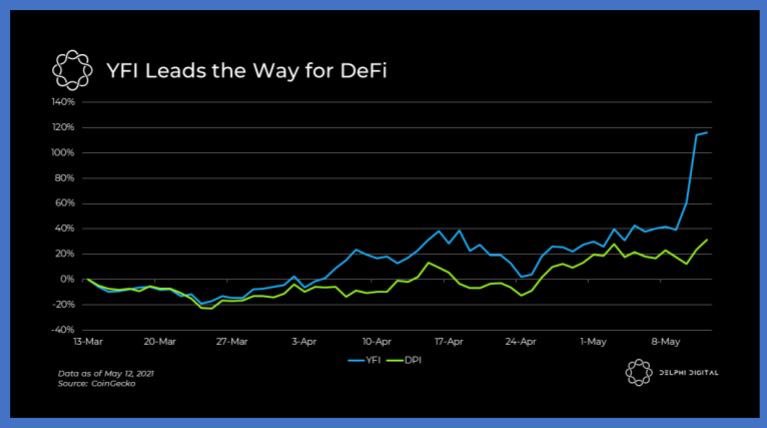

1/ Following months of choppy price action, YFI hit an all-time high, surpassing $90,000 at one point.

$YFI is now leading the current DeFi Rally.

This rally was further propelled by @iearnfinance embracing the dog coin phase.

$YFI is now leading the current DeFi Rally.

This rally was further propelled by @iearnfinance embracing the dog coin phase.

2/ A week after Uniswap v3 launch, Uniswap v2 recorded $3.6 billion in daily volume. This marks the highest volume in any single day.

Dog coins are the primary catalyst for higher Uniswap volumes.

Dog coins are the primary catalyst for higher Uniswap volumes.

3/ The top 3 lending platforms ( $AAVE $COMP $MKR ) collectively hit $20 billion in outstanding loans.

Maker has significantly increased its market share on the back of recent protocol changes.

In the meantime, Aave loans jumped in light of their deployment on Polygon.

Maker has significantly increased its market share on the back of recent protocol changes.

In the meantime, Aave loans jumped in light of their deployment on Polygon.

4/ The amount of ETH held in smart contracts is consistently growing, a rough indicator of ETH flowing into DeFi.

This means $ETH is exiting centralized exchanges and moving into smart contracts.

This is one of the main catalysts for the ongoing ETH rally.

This means $ETH is exiting centralized exchanges and moving into smart contracts.

This is one of the main catalysts for the ongoing ETH rally.

5/ Now it's time for some tweets of the day.

The S&P 500 gapped down today as consumer inflation comes in significantly higher than analysts’ expectation.

The S&P 500 gapped down today as consumer inflation comes in significantly higher than analysts’ expectation.

https://twitter.com/thestalwart/status/1392457512251805700?s=21

6/ @AxieInfinity @YieldGuild and our team announce a documentary on play-to-earn and its effect in developing countries (releases tomorrow).

https://twitter.com/yieldguild/status/1392248910412869634?s=21

7/ The Fed is working on an open source CBDC.

https://twitter.com/deitaone/status/1392466109786431490?s=21

8/ This has been an example of the new format of our Delphi Daily.

To ensure you never miss our latest reports, subscribe below: delphidigital.io/subscription-p…

To ensure you never miss our latest reports, subscribe below: delphidigital.io/subscription-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh