0/ Beware the Ides of March: A roman history lesson or a historical lookback at $BTC price?

Normally a volatile time of year for #Bitcoin and thus far 2021 has been no exception. Here's what to expect going forward. 👇

delphidigital.io/reports/beware…

Normally a volatile time of year for #Bitcoin and thus far 2021 has been no exception. Here's what to expect going forward. 👇

delphidigital.io/reports/beware…

1/ #Bitcoin started off 2021 with its best performance since 2013, nearly doubling over the first seven weeks of the calendar year (+98%).

Even after the end of February sell off, $BTC recorded its 5th consecutive month of gains.

Even after the end of February sell off, $BTC recorded its 5th consecutive month of gains.

2/ As we have covered before, $BTC price tends to struggle between mid February and late March. #Bitcoin price corrected ~21% over last week of February.

Thus far, BTC seems to be following a similar playbook in 2021.

Thus far, BTC seems to be following a similar playbook in 2021.

3/ BTC volatility tends to pick up in March, albeit from above average levels when compared to traditional assets.

Bitcoin is not alone in this instance, $ETH has also struggled during this time period over the past couple years.

Bitcoin is not alone in this instance, $ETH has also struggled during this time period over the past couple years.

4/ >20% price drawdowns are commonplace in crypto markets and do not change the current long term bull trends. We have no reason to believe that the peak for BTC is behind us this cycle.

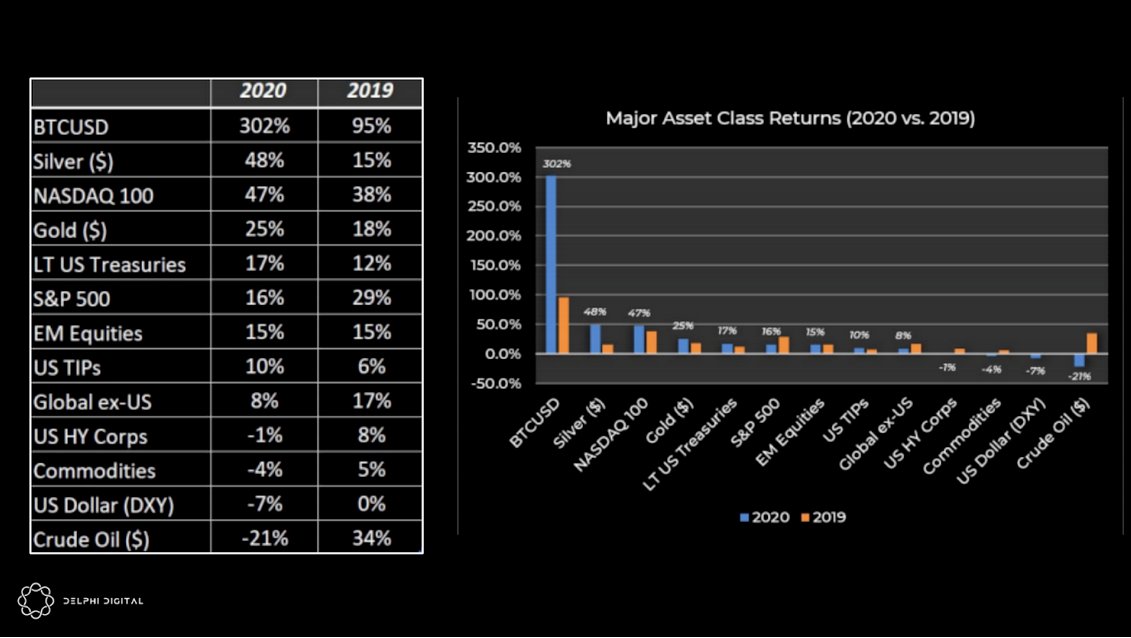

Bitcoin is still outperforming every major asset class by 40-50 points YTD.

Bitcoin is still outperforming every major asset class by 40-50 points YTD.

5/ Despite the increased March volatility, the $BTC end of year breakout was a strong confirmation for its uptrend.

When you zoom out on the BTCUSD long term chart, things look very promising.

When you zoom out on the BTCUSD long term chart, things look very promising.

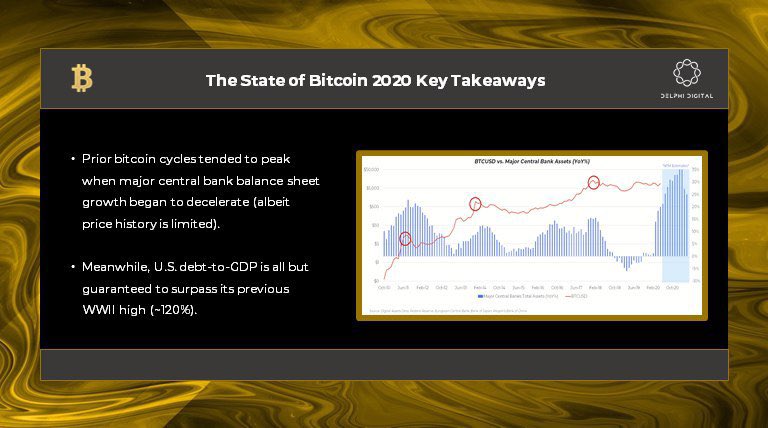

6/ Over the past 6 months, #Bitcoin has been transitioning from taboo to accepted amongst institutions. This gives BTC a stronger floor in case of another violent selloff.

Another bullish point: Bitcoin fund AUM continues to soar month over month.

Another bullish point: Bitcoin fund AUM continues to soar month over month.

7/ On the other hand, Gold and precious metals are down ~9.8% YTD, their worst start in over 30 years.

$BTC is starting to get more attention as we are seeing a greater divergence in fund flows between #Bitcoin investment products and the worlds largest gold ETFs.

$BTC is starting to get more attention as we are seeing a greater divergence in fund flows between #Bitcoin investment products and the worlds largest gold ETFs.

8/ In conclusion, we view any extreme March volatility as transitory compared to crypto’s longer-term uptrends.

Delphi Insights members will soon receive a deeper dive into the current macro backdrop and whether recent inflationary concerns are warranted or transitory.

Delphi Insights members will soon receive a deeper dive into the current macro backdrop and whether recent inflationary concerns are warranted or transitory.

9/ If you aren’t a member already, subscribe below: delphidigital.io/subscription-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh