0/ [RESEARCH RECAP PUBLIC RELEASE]

First, a huge thank you to everyone who's supported the Delphi team this past year!

As a small token of appreciation, we’re releasing a special edition report covering some of our best work recently!

TLDR thread below:

delphidigital.io/reports/happy-…

First, a huge thank you to everyone who's supported the Delphi team this past year!

As a small token of appreciation, we’re releasing a special edition report covering some of our best work recently!

TLDR thread below:

delphidigital.io/reports/happy-…

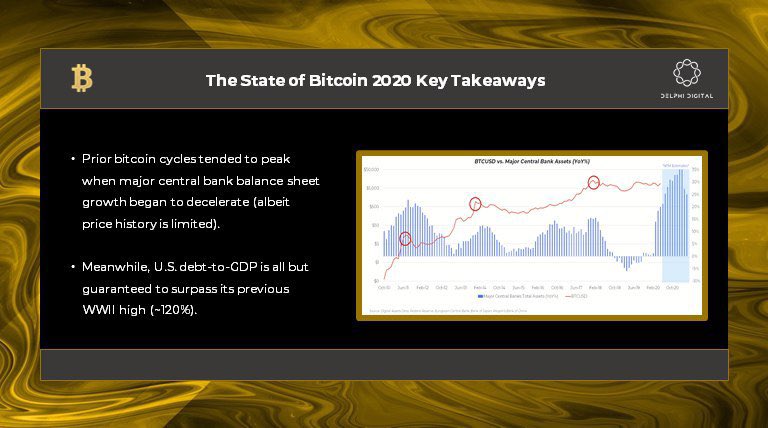

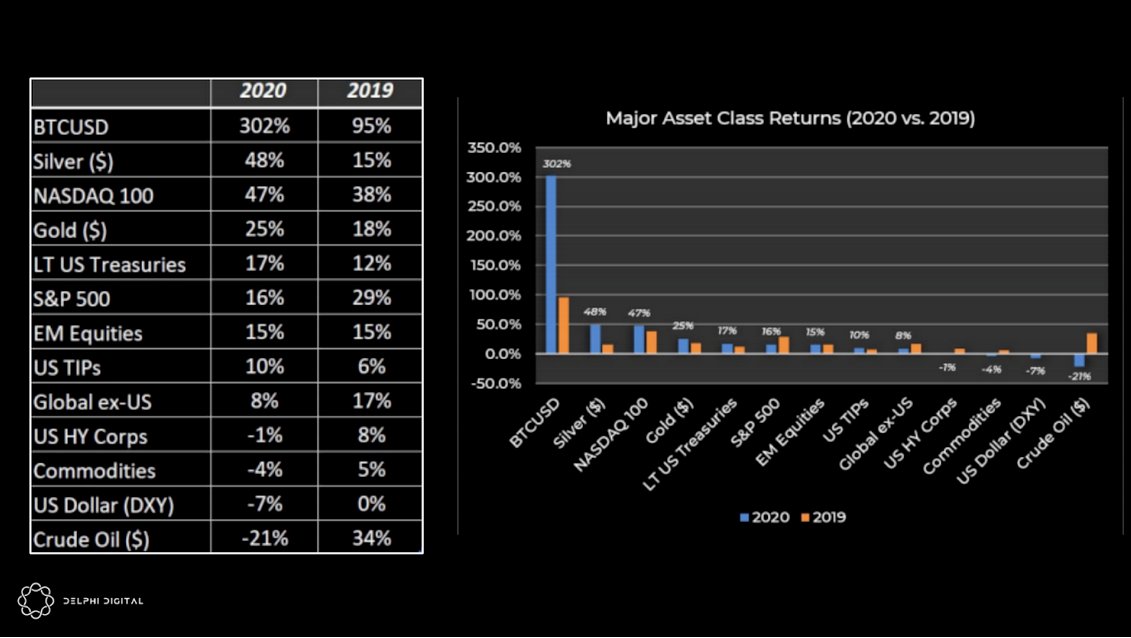

1/ Bitcoin is King of the Hill…Again

@Kevin_Kelly_II illustrates why #bitcoin can no longer be ignored by investment managers on the back of its 2nd consecutive year outperforming just about every major asset class.

delphidigital.io/reports/bitcoi…

@Kevin_Kelly_II illustrates why #bitcoin can no longer be ignored by investment managers on the back of its 2nd consecutive year outperforming just about every major asset class.

delphidigital.io/reports/bitcoi…

2/ The Bitcoin Bull Case: 2021 & Beyond

@mediodelphi's rigorous on-chain analysis paints the ideal setup for BTC while @Kevin_Kelly_II reaffirms several technical & macro tailwinds heading into 2021.

$BTC is up ~70% since the report was first published.

delphidigital.io/reports/the-bi…

@mediodelphi's rigorous on-chain analysis paints the ideal setup for BTC while @Kevin_Kelly_II reaffirms several technical & macro tailwinds heading into 2021.

$BTC is up ~70% since the report was first published.

delphidigital.io/reports/the-bi…

3/ 'Tis the Season

@mediodelphi examines seasonality and foreshadows $ETH outperformance heading into early 2021.

Return since publish (12/23):

🔸ETH = 79%

🔸BTC = 38%

delphidigital.io/reports/tis-th…

@mediodelphi examines seasonality and foreshadows $ETH outperformance heading into early 2021.

Return since publish (12/23):

🔸ETH = 79%

🔸BTC = 38%

delphidigital.io/reports/tis-th…

4/ #Ethereum Ecosystem Analysis & ETH 2.0

@Alex_Ged's marquee monthly deep dive into all things ETH.

$ETH began heating up in late Nov. as holders refused to sell & the amount held by centralized exchanges fell ~15%.

A staple report for us internally.

delphidigital.io/reports/eth-2-…

@Alex_Ged's marquee monthly deep dive into all things ETH.

$ETH began heating up in late Nov. as holders refused to sell & the amount held by centralized exchanges fell ~15%.

A staple report for us internally.

delphidigital.io/reports/eth-2-…

5/ As this market matures, institutions & traditional investors will begin to wade into DeFi.

Pros: strong project teams will attract more capital, harnessing the potential of DeFi.

Cons: greater congestion = higher gas prices.

The savior from this new norm? L2 solutions.

Pros: strong project teams will attract more capital, harnessing the potential of DeFi.

Cons: greater congestion = higher gas prices.

The savior from this new norm? L2 solutions.

6/ Layer 2: Rollups

@Alex_Ged takes a 28-page deep dive into L2 solutions and provides a comparative analysis for each.

While L2 adoption is far from mainstream, it's important to understand the best potential solutions for various projects.

delphidigital.io/reports/layer-…

@Alex_Ged takes a 28-page deep dive into L2 solutions and provides a comparative analysis for each.

While L2 adoption is far from mainstream, it's important to understand the best potential solutions for various projects.

delphidigital.io/reports/layer-…

7/ Polkadot’s DeFi Stack

@ashwath_22 examines @Polkadot's focus on scalability & connectivity as a layer 0 protocol and the network’s attempt to recreate similar functionality to Ethereum’s DeFi ecosystem.

This was one of our most read reports of Q4.

delphidigital.io/reports/polkad…

@ashwath_22 examines @Polkadot's focus on scalability & connectivity as a layer 0 protocol and the network’s attempt to recreate similar functionality to Ethereum’s DeFi ecosystem.

This was one of our most read reports of Q4.

delphidigital.io/reports/polkad…

8/ If you’re a fan of @AaveAave then you’ll enjoy @ZeMariaMacedo's back-to-back reports on $AAVE token economic structure and proposed enhancements.

The first reviews Aave's current model and how it can be further optimized (11/10/20).

delphidigital.io/reports/toward…

The first reviews Aave's current model and how it can be further optimized (11/10/20).

delphidigital.io/reports/toward…

9/ Aave Token Architecture v2

Capital protection is paramount & the core focus of the 2nd report.

Aided by @JonathanErlichL, our team breaks down the strengths & drawbacks of Aave’s Safety Module, which underwrites all risks for protocol participants.

delphidigital.io/reports/aave-t…

Capital protection is paramount & the core focus of the 2nd report.

Aided by @JonathanErlichL, our team breaks down the strengths & drawbacks of Aave’s Safety Module, which underwrites all risks for protocol participants.

delphidigital.io/reports/aave-t…

10/ A Look Into Public DeFi Treasuries

When researching any token, it’s important to fully understand the project’s issuance schedule and treasury management

@ashwath_22 explores the treasury models of major projects & their potential impact on price.

delphidigital.io/reports/a-look…

When researching any token, it’s important to fully understand the project’s issuance schedule and treasury management

@ashwath_22 explores the treasury models of major projects & their potential impact on price.

delphidigital.io/reports/a-look…

11/ @iearnfinance didn’t have the luxury of pre-funding a treasury and because the token is fully issued, $YFI adopted a new fee structure with the hopes of using the protocol’s cash flow to attract skilled strategy creators.

12/ On the other hand, @synthetix_io is not fully diluted and is benefiting from the recent $SNX price run up.

With close to 20% of the total $SNX supply, the DAO can generate passive income via trading fees on the protocol paid to stakers, on top of SNX staking rewards.

With close to 20% of the total $SNX supply, the DAO can generate passive income via trading fees on the protocol paid to stakers, on top of SNX staking rewards.

13/ Meanwhile, @thorchain_org / $RUNE is using its treasury for the sole purpose of funding of its ongoing development.

The model is straightforward and the team doesn’t intend on having a long-lasting treasury, with plans to become obsolete in mid-2022.

The model is straightforward and the team doesn’t intend on having a long-lasting treasury, with plans to become obsolete in mid-2022.

14/ Now for DeFi’s golden child: @UniswapProtocol.

As of now, 43% of $UNI supply is vested to its treasury over 4 years. With both $UNI vesting and the free cash flow levels, this protocol may be the best funded treasury around.

Our recap includes 3 possible scenarios:

As of now, 43% of $UNI supply is vested to its treasury over 4 years. With both $UNI vesting and the free cash flow levels, this protocol may be the best funded treasury around.

Our recap includes 3 possible scenarios:

15/ @iearnfinance was the first major protocol to merge with not one but two DeFi protocols.

Read @ashwath_22's take on the $Pickle acquisition in late November, a relevant topic for those expecting more protocol M&A.

delphidigital.io/reports/the-im…

Read @ashwath_22's take on the $Pickle acquisition in late November, a relevant topic for those expecting more protocol M&A.

delphidigital.io/reports/the-im…

16/ The Great yBundling (YFI)

@Shaughnessy119 dissects The Great Unbundling (s/o @benthompson) and the implications for $YFI's moat & value proposition.

One of our most popular Delphi Daily's.

delphidigital.io/reports/the-gr…

@Shaughnessy119 dissects The Great Unbundling (s/o @benthompson) and the implications for $YFI's moat & value proposition.

One of our most popular Delphi Daily's.

delphidigital.io/reports/the-gr…

18/ Public Goods Problem

There are things we all agree we want but remain underfunded. In “Coordination, Public Goods and Crypto (Parts 1 & 2)” @ZeMariaMacedo explores how crypto may be able to solve this problem.

delphidigital.io/reports/coordi…

There are things we all agree we want but remain underfunded. In “Coordination, Public Goods and Crypto (Parts 1 & 2)” @ZeMariaMacedo explores how crypto may be able to solve this problem.

delphidigital.io/reports/coordi…

19/ Jose also provided a great framework for thinking about the broader picture of crypto investing alongside some of the key considerations unique to this market.

Through his exploration, he highlights why insurance might still be undervalued.

delphidigital.io/reports/crypto…

Through his exploration, he highlights why insurance might still be undervalued.

delphidigital.io/reports/crypto…

20/ The Graph: Our Experience Creating a Subgraph for $ESD

@lukedelphi walks through the subgraph he and our team built for @emptysetdollar using @graphprotocol.

Also includes a step-by-step guide for those more technically inclined!

delphidigital.io/reports/the-gr…

@lukedelphi walks through the subgraph he and our team built for @emptysetdollar using @graphprotocol.

Also includes a step-by-step guide for those more technically inclined!

delphidigital.io/reports/the-gr…

21/ We round out the research recap with a selection of @PodcastDelphi highlights & complimentary access to several FULL length Delphi Daily’s!

To receive our free weekly Delphi Debrief, sign up at → delphidigital.io/research/

To receive our free weekly Delphi Debrief, sign up at → delphidigital.io/research/

• • •

Missing some Tweet in this thread? You can try to

force a refresh