Kusama and Polkadot are soon launching their parachain auctions. Cross-chain composability and scalability have never been so important.

How does an auction work for users? What does it mean for $DOT, $KSM price & circulating supply?

Thread 👇🏻👇🏻👇🏻

How does an auction work for users? What does it mean for $DOT, $KSM price & circulating supply?

Thread 👇🏻👇🏻👇🏻

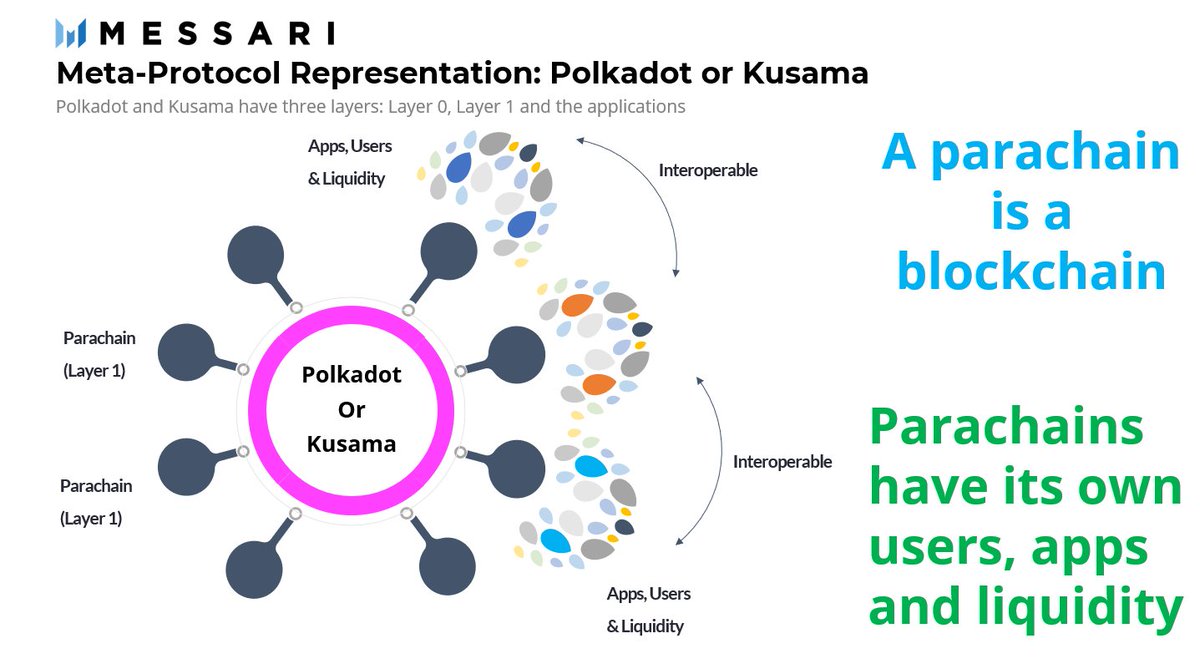

Why do developers want to do this?

The benefits of connecting to the @Polkadot or @kusamanetwork network includes full control over your environment -- but with a cheap & secure way for blockchains and apps to launch.

2/

Full report here-->

messari.io/article/the-po…

The benefits of connecting to the @Polkadot or @kusamanetwork network includes full control over your environment -- but with a cheap & secure way for blockchains and apps to launch.

2/

Full report here-->

messari.io/article/the-po…

Kusama is a low-value version of Polkadot, but important as a testbed. Getting a @kusamanetwork parachain is a stepping stone to the big leagues.

The community will lock $DOT & $KSM to participate. We could see circulating supply drop by half.

3/

The community will lock $DOT & $KSM to participate. We could see circulating supply drop by half.

3/

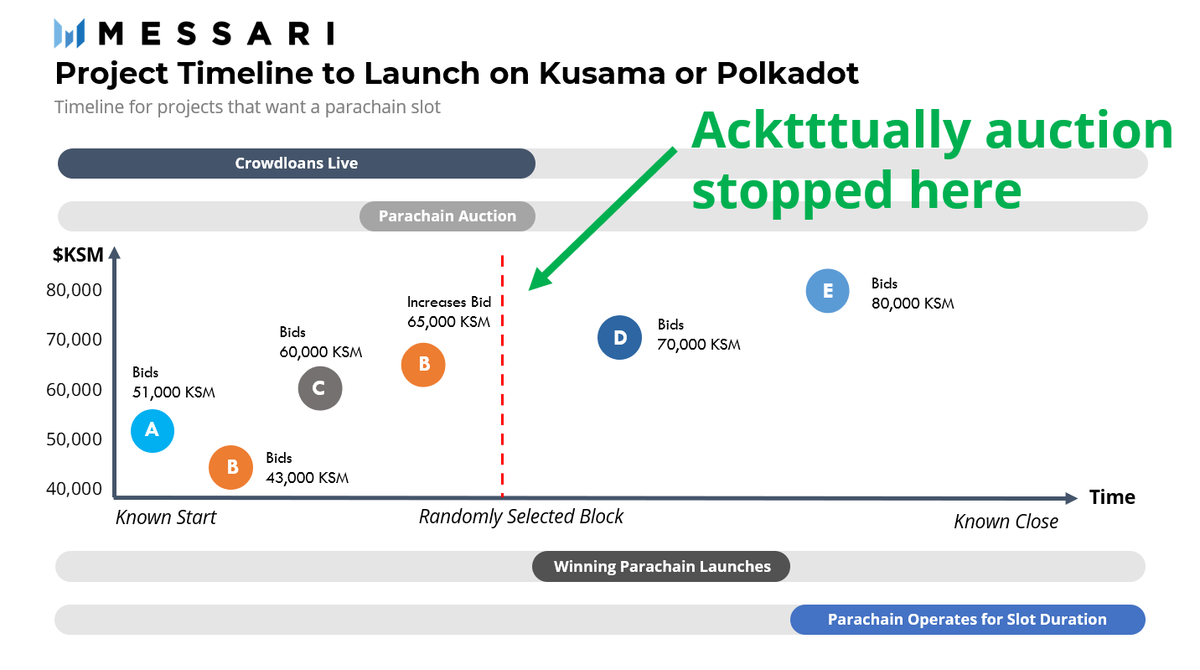

From the user's perspective, how does the auction work?

1️⃣ Crowdloans go live --> the project raises $KSM or $DOT from the community, say in return for the native token

2️⃣ Parachain auctions happen

3️⃣ The winning parachain launches

4️⃣ Unwinding at the end of the period

4/9

1️⃣ Crowdloans go live --> the project raises $KSM or $DOT from the community, say in return for the native token

2️⃣ Parachain auctions happen

3️⃣ The winning parachain launches

4️⃣ Unwinding at the end of the period

4/9

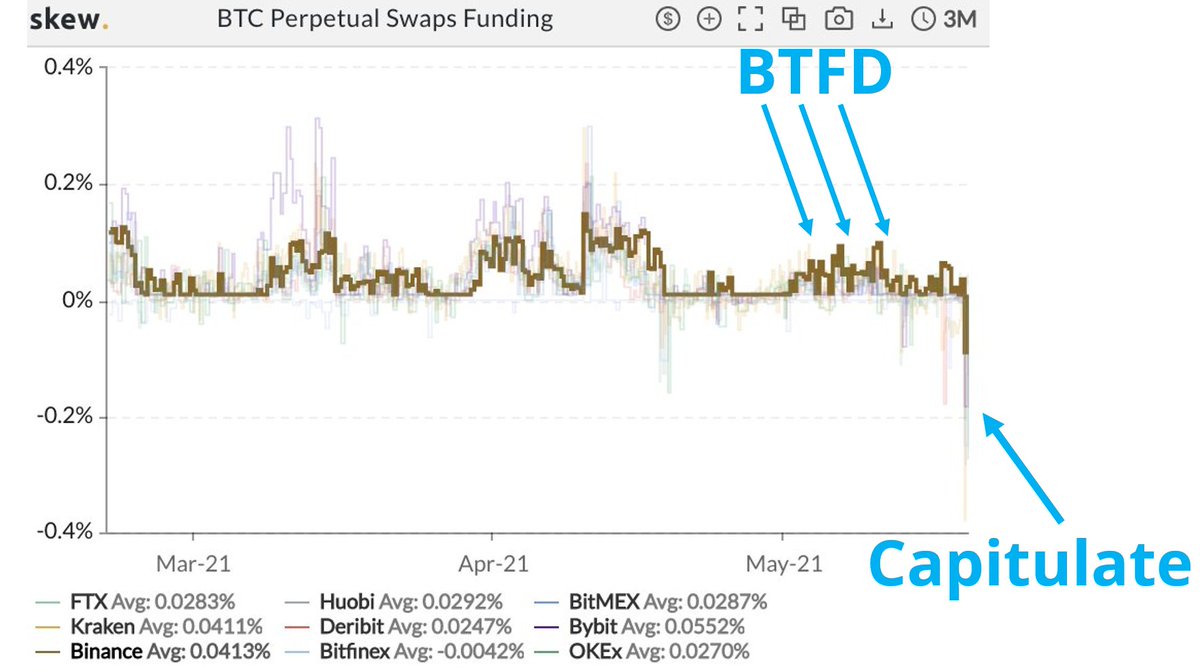

In the 2️⃣ Auction, a start and end time is announced. But a *retrospectively* randomly selected block cuts-off the live bidding process. The highest bidder at that time, regardless of subsequent bids, wins.

So best for projects and users to put all their chips in early

5/9

So best for projects and users to put all their chips in early

5/9

The winner automatically earns the slot and launches. Unlike ICOs, the $KSM or $DOT that users locked never go to the team. The tokens are locked until the parachain lease period ends (6-24 months), then the principal is returned.

6/9

6/9

We expect a parachain winning bid could be $30-50 million. In the table, we assume:

+ Bear market multiplier of 2-5x (each $1 inflow means a $2-5 increase in market cap),

+ Bull market multiplier of 10-20x

All things equal, we get a +21% to +206% price impact

7/9

+ Bear market multiplier of 2-5x (each $1 inflow means a $2-5 increase in market cap),

+ Bull market multiplier of 10-20x

All things equal, we get a +21% to +206% price impact

7/9

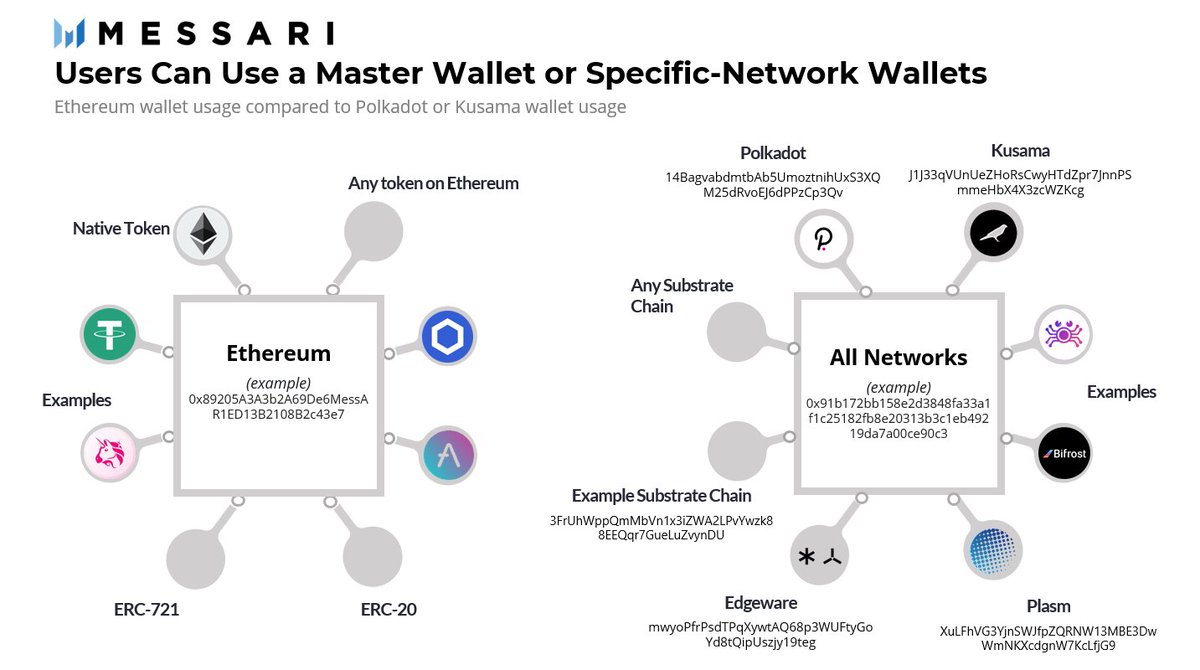

How do you use a @Polkadot wallet?

Unlike @ethereum, you can have a master wallet (accepts all tokens on all networks) or a seperate wallet for each. The latter is less convenient but more secure.

@PolkadotJs and @polkawallet are the most popular

8/9

Unlike @ethereum, you can have a master wallet (accepts all tokens on all networks) or a seperate wallet for each. The latter is less convenient but more secure.

@PolkadotJs and @polkawallet are the most popular

8/9

For a deeper dive in how the auction works, how the wallet works, the price impact on $DOT or $KSM, and the implications on circulating supply, please see our report.

9/9

messari.io/article/the-po…

9/9

messari.io/article/the-po…

• • •

Missing some Tweet in this thread? You can try to

force a refresh