1/5

Bushveld Energy 2021 position if listed separately,

A. $8m profit on #IES investment.

B. 25.25% ownership in Enerox who's 2020 contract wins were c. 65% of what IES achieved and will hold $30m for expansion to production twice the size of IES.

#BMN

Bushveld Energy 2021 position if listed separately,

A. $8m profit on #IES investment.

B. 25.25% ownership in Enerox who's 2020 contract wins were c. 65% of what IES achieved and will hold $30m for expansion to production twice the size of IES.

#BMN

https://twitter.com/MylesMcNulty/status/1395621925083299840?s=20

2/

C. 55% ownership of a 200MWh electrolyte plant under construction with the IDC of S.A.

D. Mini-grid project under construction at Vametco in partnership with the IDC with potential to open up localised VRFB production and industrial opportunity.

C. 55% ownership of a 200MWh electrolyte plant under construction with the IDC of S.A.

D. Mini-grid project under construction at Vametco in partnership with the IDC with potential to open up localised VRFB production and industrial opportunity.

3/

E. Actively tendering for Eskom BESS projects totalling c. 1,440MWh with the battery tender element valued by the World Bank at $468m.

F. First active vanadium rental product in play with a UK client.

E. Actively tendering for Eskom BESS projects totalling c. 1,440MWh with the battery tender element valued by the World Bank at $468m.

F. First active vanadium rental product in play with a UK client.

4/

G. A guaranteed vanadium supply from one of the largest producers of vanadium in the world. Gaining them vital stable input costs and allowing them to actively chase work within a hugely expanded energy storage market.

G. A guaranteed vanadium supply from one of the largest producers of vanadium in the world. Gaining them vital stable input costs and allowing them to actively chase work within a hugely expanded energy storage market.

5/

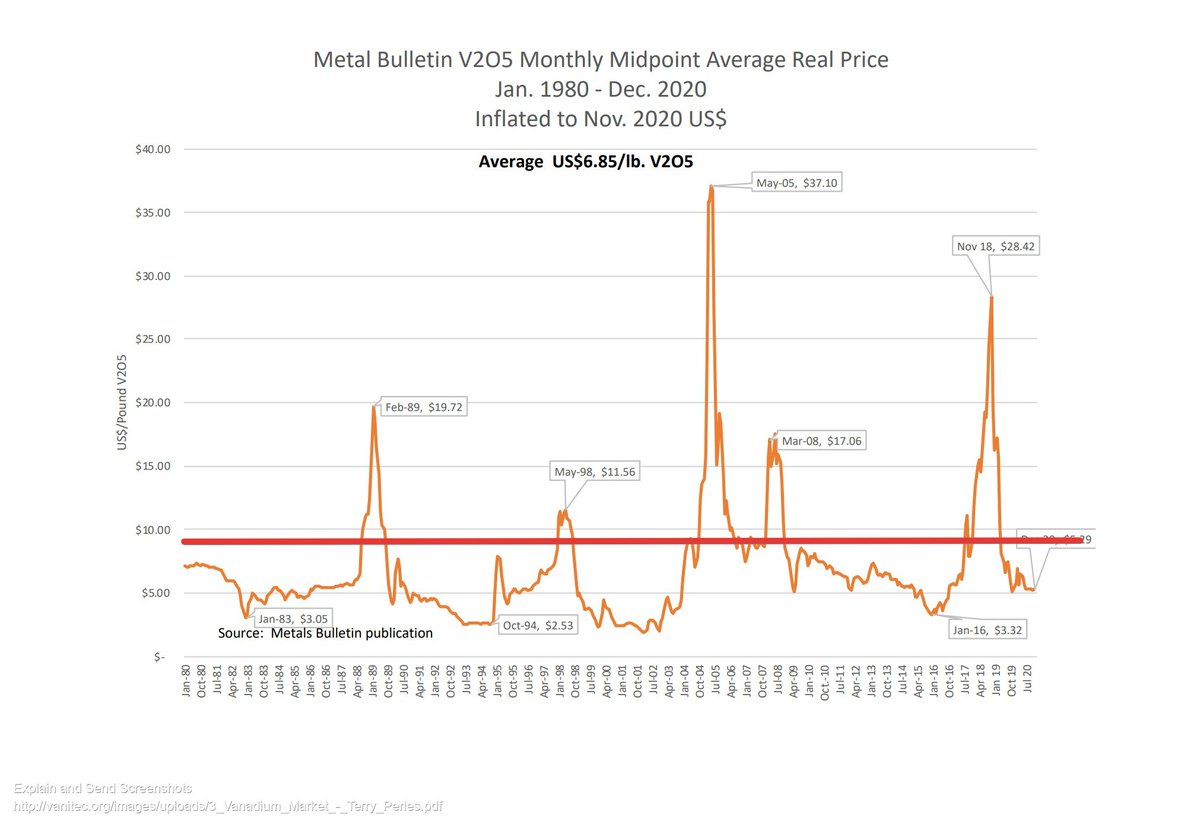

That company + a profitable and very large vanadium miner (which is itself on a steep expansion curve in order to feed the needs stated above), operating in a rising vanadium price market are combined currently valued at just £186m.

The word 'undervalued' comes to mind.

That company + a profitable and very large vanadium miner (which is itself on a steep expansion curve in order to feed the needs stated above), operating in a rising vanadium price market are combined currently valued at just £186m.

The word 'undervalued' comes to mind.

• • •

Missing some Tweet in this thread? You can try to

force a refresh