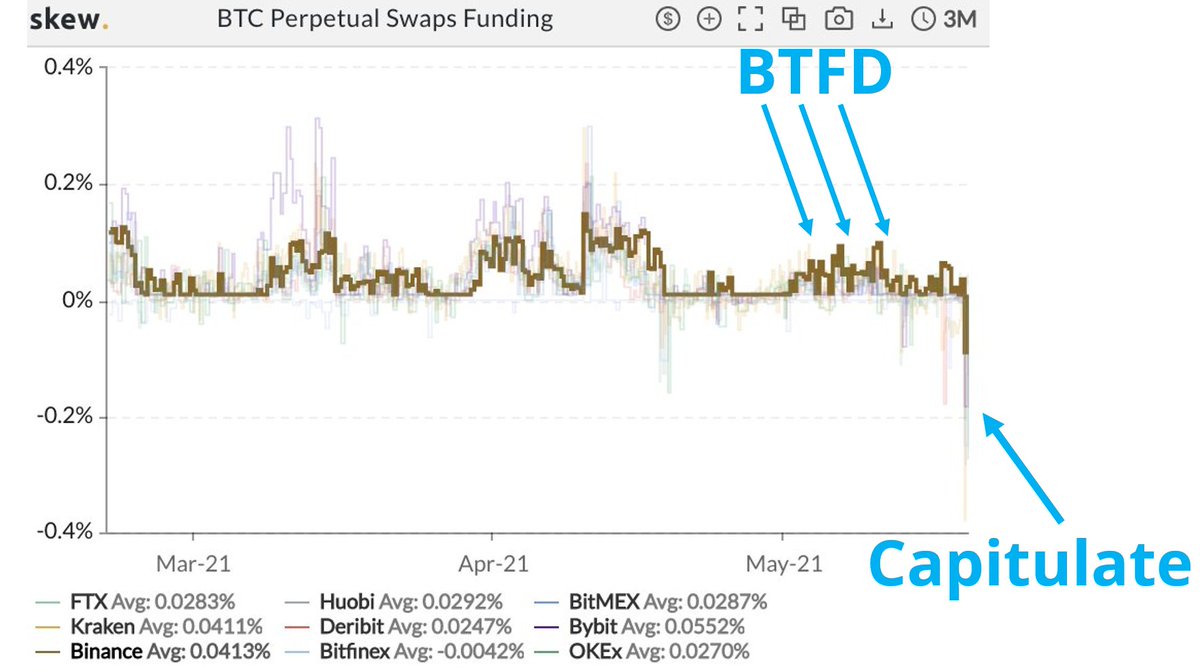

Macro Update: The crypto selldown of the past couple weeks has seen the most amount of value wiped out. Crypto investors underrated the Fed's statements because we've largely been dancing to our own tune the past 10 years. This formula doesn't work anymore

1/

1/

But with institutional adoption, we now need to pay attention to cross-asset flows. #Bitcoin is viewed as a risk-on, growth asset, at the extreme end of the risk spectrum.

What happens when inflation prints much higher than expected?

2/

messari.io/article/macro-…

What happens when inflation prints much higher than expected?

2/

messari.io/article/macro-…

The Fed said that it was only thinking-about, thinking-about tapering. #Bitcoin and risk-assets love quantitative easing and egregious money printing. It hates quant tapering and tightening belts.

3/

3/

As with all asset prices, it’s less about absolute numbers and more about the rate-of-change. On an absolute basis, liquidity conditions are loose.

But will this change?

4/

But will this change?

4/

Not so fast. The Fed said that it's only "thinking about maybe" tapering because jobs numbers were terrible. Non-farm payrolls increased only 250k in April vs +1 million expected.

Full breakdown of jobs & retail data in the report --> messari.io/article/macro-…

5/

Full breakdown of jobs & retail data in the report --> messari.io/article/macro-…

5/

Meanwhile, we all know the macro backdrop: COVID. That means low base effects. (Full breakdown of commodities prices, supply-side disruptions in report)

Plus, there's a ton of pent up demand and excess savings generated over the pandemic:

6/

Plus, there's a ton of pent up demand and excess savings generated over the pandemic:

6/

So the Fed may not taper until 2022. The next meeting is June 16th, and we'll find out more then.

But even if tapering is on the table, will it matter to #Bitcoin? In the past, Treasury Bond Yields have been uncorrletaed to $BTC

7/14

But even if tapering is on the table, will it matter to #Bitcoin? In the past, Treasury Bond Yields have been uncorrletaed to $BTC

7/14

Let's assume it's going to be correlated this time though. Politically, policymakers are unlikely to steer off course. It would be politicaly suicide to cool the markets before the recovery is 100% underway.

Plus, QE is so much more politically popular.

8/14

Plus, QE is so much more politically popular.

8/14

Economically, can the Fed taper? The deficit is ~$2.3 trillion 2021E, excluding Biden's Build Back Better campaign.

This is the 2nd deepest deficit since 1945.

9/14

This is the 2nd deepest deficit since 1945.

9/14

Plus, the US Treasury needs to issue $1.8 trillion of debt. Who's going to buy that and at what price?

10/14

messari.io/article/macro-…

10/14

messari.io/article/macro-…

Not the foreigners. They're already balking. But when there's a bad debt auction, this spooks the markets and puts the Fed and US Treasury in the limelight. Politically that's very bad.

Still, if the US wants to spend, someone needs to pick up the tab.

11/14

Still, if the US wants to spend, someone needs to pick up the tab.

11/14

So even if the Fed wants to taper... they will have to do so very gradually.

The base case is that they start Q1'2022. Inflation should ease by then, commodity pressures and logistics disruptions moderate.

12/14

The base case is that they start Q1'2022. Inflation should ease by then, commodity pressures and logistics disruptions moderate.

12/14

Taper tantrums are here to stay. Crypto investors need to watch this data point due to institutional investors participating in the market now. Capital is mercenary and $BTC, considered extremely risky, will be the first to react during a taper tantrum.

13/14

13/14

See our full report for economic data, the same-day reaction by equities and credit markets and a more robust breakdown of macro factors --> messari.io/article/macro-…

14/14

14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh