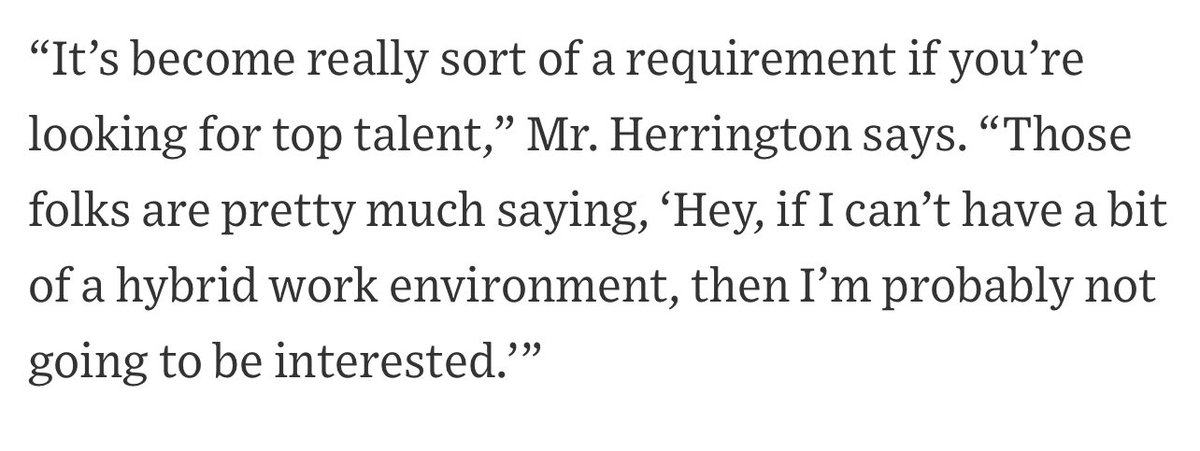

This dynamic of top talent viewing flexible hybrid work environments as a *requirement* is going to really test some top performing, but old school investment firms. wsj.com/articles/if-yo…

If an analyst is looking for a job, an investment firm that views remote work as a “perk,” requires permission, or has an arbitrary limit, will likely be seen as a firm that is out of touch, doesn’t trust their staff, or is at minimum a slow to adapt organization. Major red flag.

Our guess is there will be a couple year window where top talent incrementally shifts from older established firms to younger, more digitally native, adaptable investment organizations. Then the older firms will capitulate.

Standard asset allocator question in the year 2025: “Do you hire the top talent you can find, or do you limit yourself to the pool of people who happen to live within commute distance of an address someone in your organization selected many years ago?”

• • •

Missing some Tweet in this thread? You can try to

force a refresh