1/x One of the great things about blogging is you assemble a record of real time thoughts during periods of stress. This allows for reviews of what went as expected and what didn't. Our 2020 posts focused mostly on how we were assessing unprecedented levels of change. Links below

https://twitter.com/IntrinsicInv/status/1338534176522321920

2/x Prior to COVID, we wrote about how forecasts are a necessary part of investing. Your only choice is whether to make explicit forecasts or implicit ones. intrinsicinvesting.com/2020/01/10/pic…

3/x We discussed the key difference between a company's products being "relevant" vs "recognizable" and discussed how highly recognizable products may be losing relevance, which lays a trap for investors. intrinsicinvesting.com/2020/02/21/rel…

4/x As the market crashed in March, we faced questions from clients asking if the "game had changed". Our answer was that the game was the same, it had just gotten more fierce. intrinsicinvesting.com/2020/03/16/has…

5/x On March 20, the day before the bottom, we laid out how we planned to manage our strategy through the pandemic. We called on investors to stick with those companies that could survive the crisis, because they would thrive on the other side. ensemblecapital.com/wp-content/upl…

6/x 2020 was the most consequential test of corporate management in a very, very long time. We highlighted the role executives needed to play in carrying all of their stakeholders through the crisis. intrinsicinvesting.com/2020/04/09/cor…

7/x We highlighted the many ways that our portfolio companies recognized their responsibilities to all stakeholders and took steps to make sure the ecosystem in which they create profits remained healthy and robust. intrinsicinvesting.com/2020/06/16/no-…

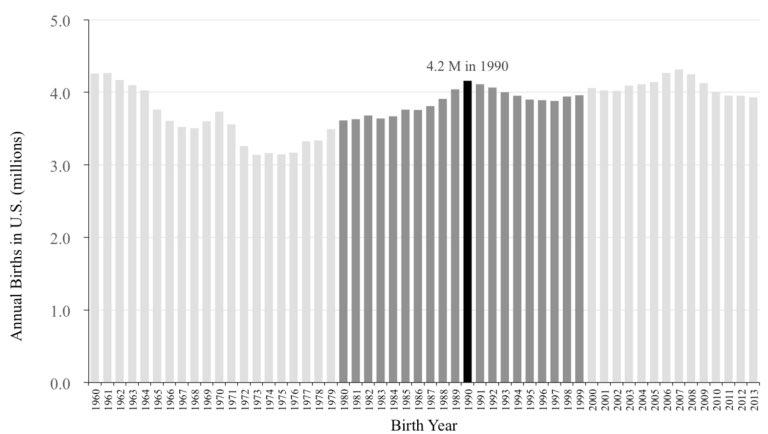

8/x We wrote up our long thesis on Nintendo, a company we had spent much of 2019 researching, and why the short term stay at home boost to video games would accelerate a long term trend towards the mainstreaming of family gaming. intrinsicinvesting.com/2020/07/14/nin…

9/x For the first time we shared our framework for assessing stakeholder value creation and the role it plays in generating sustainable long term profits. intrinsicinvesting.com/2020/09/03/und…

10/x We only own 20-25 stocks. To spend so much time on a company, we need to find it "interesting". In this post we explained why focusing on interesting companies is a key to alpha generation. intrinsicinvesting.com/2020/10/01/why…

11/x We shared our long thesis on Intuitive Surgical. It isn't so much that they sell surgery "robots" as it is that they empower "bionic surgeons." Certainly one of the more "interesting" companies in our portfolio! intrinsicinvesting.com/2020/10/27/int…

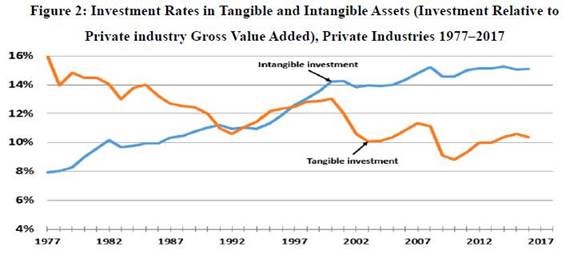

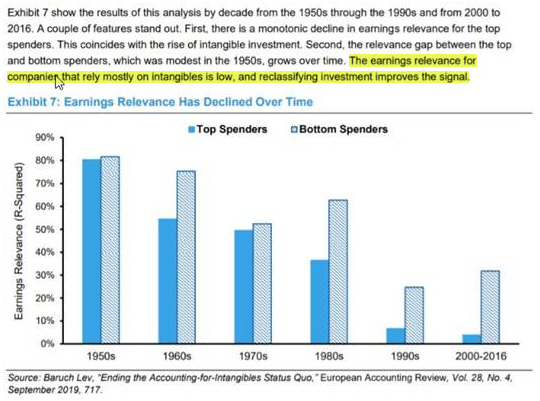

12/x To wrap up a year of huge change, we laid out why the conditions were now set for a much, much higher rate of change to broad economy/society-wide systems. We think the next few years ahead will be interesting and unprecedented in their own ways. intrinsicinvesting.com/2020/11/11/the…

• • •

Missing some Tweet in this thread? You can try to

force a refresh