This thread updates Indian vaccine order data as of June 8 2021.

First an overview of all orders by the central government paid for or advance made. Current cumulative total is 1055.5 million doses ordered.

1/

First an overview of all orders by the central government paid for or advance made. Current cumulative total is 1055.5 million doses ordered.

1/

General observation: Mar/Apr/May orders are approx 6 weeks apart. This offers insight into production rate.

SII: 100m doses at 6 week cadence, translates to 67m/month rate in March (100/6*4)

Next order is 110m order 6 weeks later, implying 73m/month production rate April.

2/

SII: 100m doses at 6 week cadence, translates to 67m/month rate in March (100/6*4)

Next order is 110m order 6 weeks later, implying 73m/month production rate April.

2/

The June order of 250m doses is harder to parse, but if production rate is 100m/month, it means next SII order will be ~10 weeks from now.

So the order cadence here aligns closely with stated SII production rate estimates for the same months.

3/

So the order cadence here aligns closely with stated SII production rate estimates for the same months.

3/

Using the same approach, Covaxin March order 20m implies monthly rate of 17m doses. April order was 50m translating to production rate 33m.

Both these are close to stated rates - Krishna Ella mentioned 30m/month in April.

The 190m order in June is harder to interpret.

4/

Both these are close to stated rates - Krishna Ella mentioned 30m/month in April.

The 190m order in June is harder to interpret.

4/

However, the history of orders to date has a very visible pattern - they align roughly to know production rates in those months.

The June order volume is abnormally large. This may reflect optimism regarding supply volume, or the need for front loaded Capex, or both.

5/

The June order volume is abnormally large. This may reflect optimism regarding supply volume, or the need for front loaded Capex, or both.

5/

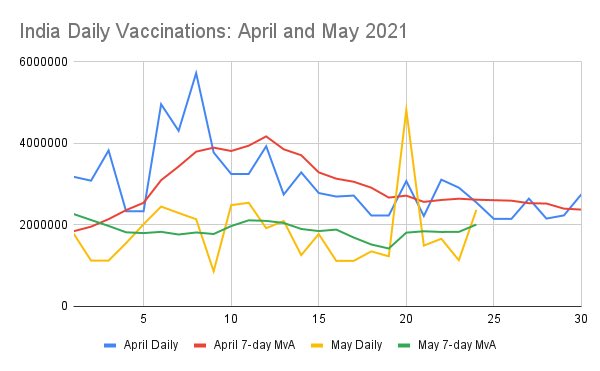

Now looking at another chart. How do cumulative orders each month translate to rate of consumption ? Here’s data comparing central orders vs cumulative consumption:

6/

6/

To date, cumulative order total 1055.5m and consumption 239m doses as of today.

Each month, cumulative orders to then exceed consumption by 90-150m doses.

May data is a little misleading - only central orders listed, but consumption is from central+state+private orders.

7/

Each month, cumulative orders to then exceed consumption by 90-150m doses.

May data is a little misleading - only central orders listed, but consumption is from central+state+private orders.

7/

These datapoints show two things:

1. The companies and Govt communicate about production level for next ~2 months, and Govt places orders tailored to that rate and need for further Capex.

2. Any given month, pending order volume is ~10 crore more than usage to then.

8/

1. The companies and Govt communicate about production level for next ~2 months, and Govt places orders tailored to that rate and need for further Capex.

2. Any given month, pending order volume is ~10 crore more than usage to then.

8/

How about state orders ? These were very hard to find details for various reasons. A collection of all news items indicates a cumulative over volume of at least 240 million doses by all state combined.

However, they received only a fraction of that in May - approx 10%.

9/

However, they received only a fraction of that in May - approx 10%.

9/

This mechanism is ending on June 21, so order data going forward will be easier to track since it is just central + some private orders.

Given the quantum of pending orders, there’s no real concern of lack of orders, and data shows there’s never really been.

10/

Given the quantum of pending orders, there’s no real concern of lack of orders, and data shows there’s never really been.

10/

Final observations:

1. Govt appears to prefer to keep powder dry by not overspending on huge EU-style bulk orders that won’t be satisfied for 6-12 months. What if there’s a crisis needing immediate funds to buy other things ? Wave 2 needed Oxygen, remdisivir and more.

11/

1. Govt appears to prefer to keep powder dry by not overspending on huge EU-style bulk orders that won’t be satisfied for 6-12 months. What if there’s a crisis needing immediate funds to buy other things ? Wave 2 needed Oxygen, remdisivir and more.

11/

2. It supports domestic initiatives. It supported Covaxin, and now gave Biological-E a huge upfront payment. A Zycov-D order can be expected in near future, and potentially a Sputnik one.

June dose rate is closing in on April peak, and should exceed it by month end.

12/12

June dose rate is closing in on April peak, and should exceed it by month end.

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh