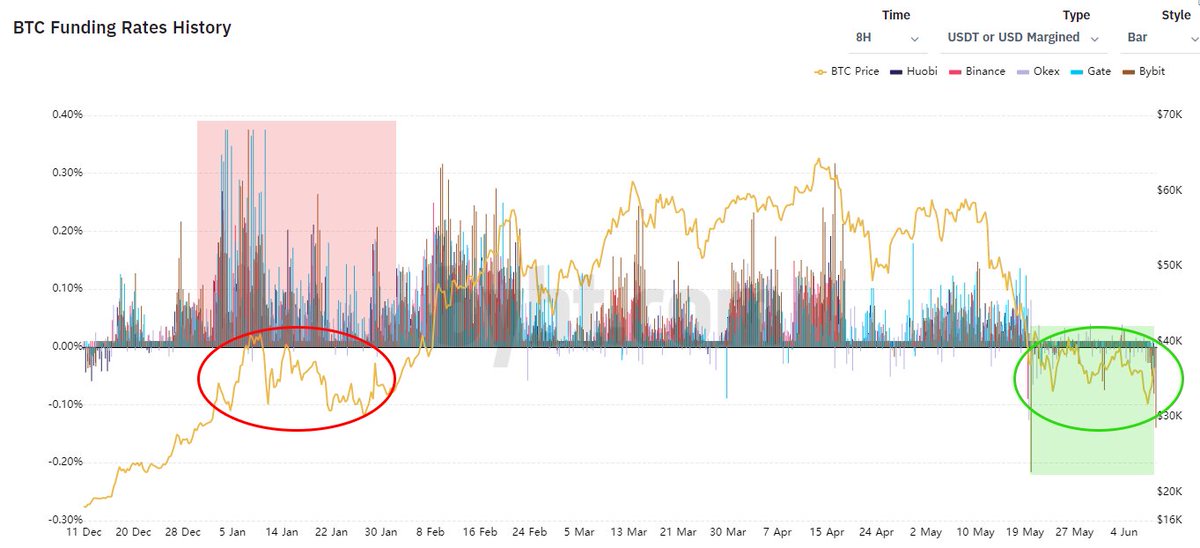

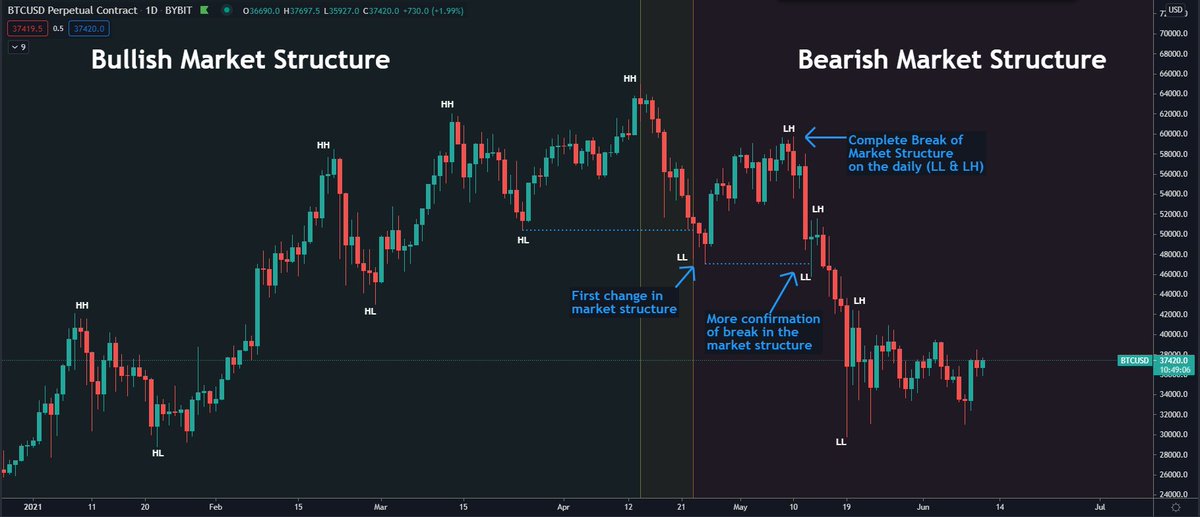

5 months time and a lot of previous price action can do a lot to a market.

Up to you to decide whether $BTC's fundamentals have meanwhile improved or not.

The general public seems to have a darker outlook on BTC compared to Jan 2021 when price first visited the $30-40K levels.

Up to you to decide whether $BTC's fundamentals have meanwhile improved or not.

The general public seems to have a darker outlook on BTC compared to Jan 2021 when price first visited the $30-40K levels.

If this Then vs Now concept is something people seem to like, I could start a little series for other periods of time or occurances. If I can get the data of course 🙂

For example: Then vs Now "Cycle tops".

For example: Then vs Now "Cycle tops".

• • •

Missing some Tweet in this thread? You can try to

force a refresh