The 21 Weekly Exponential Moving Average tends to be a vital reference point for #BTC

Keeping the 21 WEMA as support means $BTC will continue its Bull Market

Losing the 21 WEMA often means BTC will be entering a Bear Market

Here's a thread with my thoughts about the 21 WEMA:

Keeping the 21 WEMA as support means $BTC will continue its Bull Market

Losing the 21 WEMA often means BTC will be entering a Bear Market

Here's a thread with my thoughts about the 21 WEMA:

1.

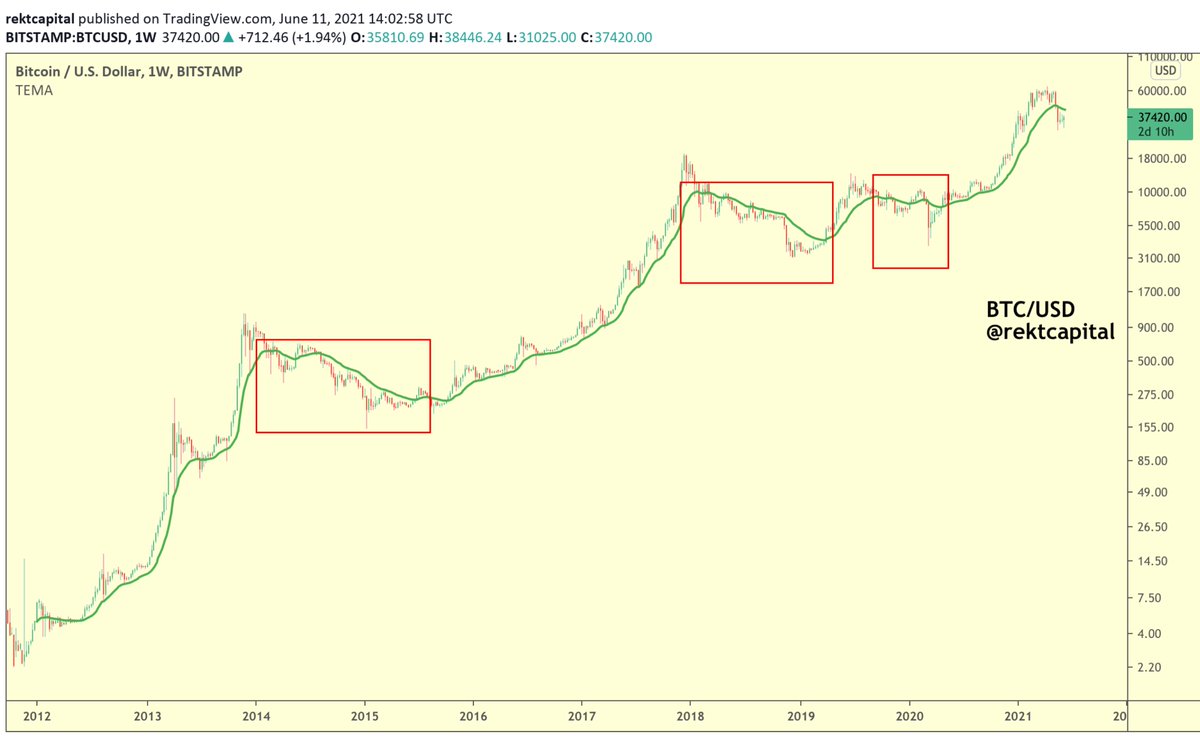

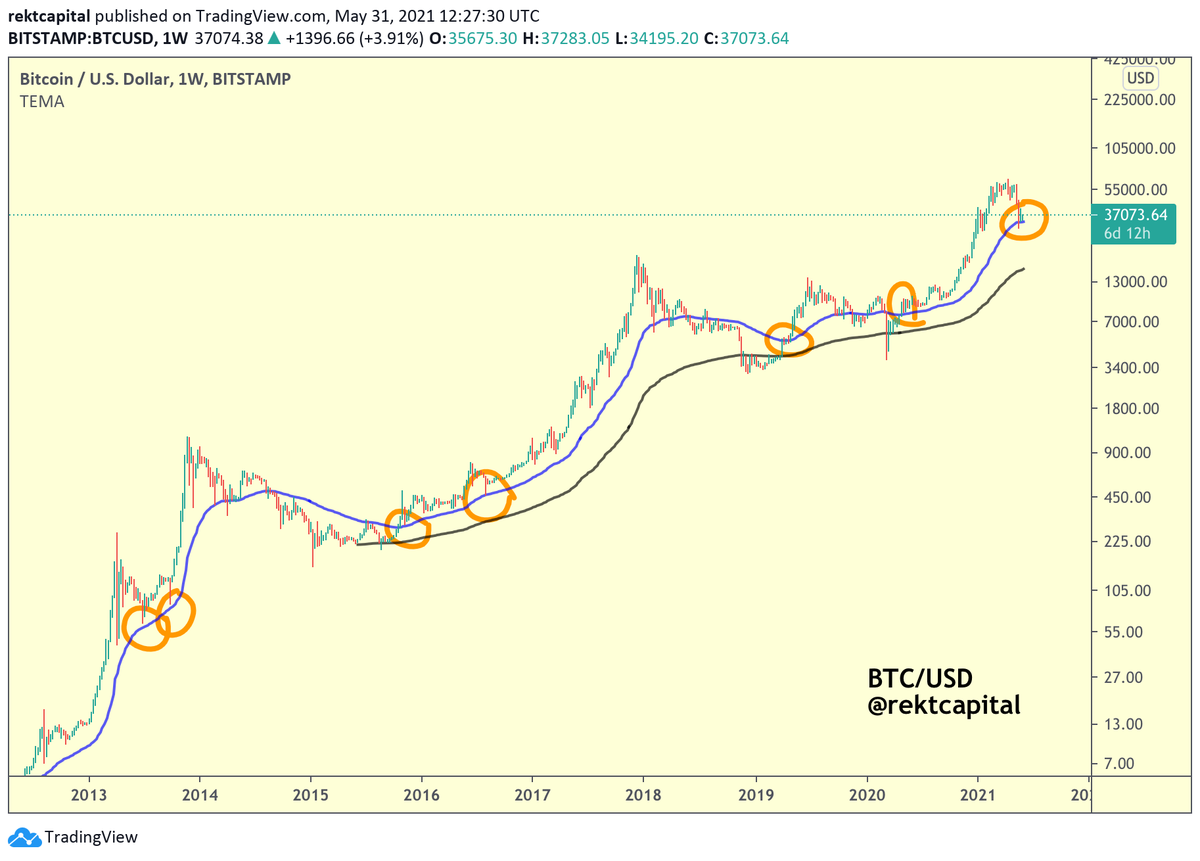

Historically, the 21 WEMA (green) supports a Bull Market uptrend for #BTC

Keeping this EMA as support on pullbacks has been vital to sustaining bullish momentum for $BTC

But there have been periods where the 21 WEMA has been briefly lost as support before being recovered:

Historically, the 21 WEMA (green) supports a Bull Market uptrend for #BTC

Keeping this EMA as support on pullbacks has been vital to sustaining bullish momentum for $BTC

But there have been periods where the 21 WEMA has been briefly lost as support before being recovered:

2.

For example, #BTC lost the 21 WEMA as support in the 2012 & mid-2013 (red) Bull Markets

But $BTC quickly reclaimed the 21 WEMA as support to continue the Bull Trend (orange)

#Crypto #Bitcoin

For example, #BTC lost the 21 WEMA as support in the 2012 & mid-2013 (red) Bull Markets

But $BTC quickly reclaimed the 21 WEMA as support to continue the Bull Trend (orange)

#Crypto #Bitcoin

3.

Of course, losing the 21 WEMA as support and then failing to reclaim it as support or confirming it as new resistance has preceded new #BTC Bear Markets (red)

#Crypto #Bitcoin

Of course, losing the 21 WEMA as support and then failing to reclaim it as support or confirming it as new resistance has preceded new #BTC Bear Markets (red)

#Crypto #Bitcoin

4.

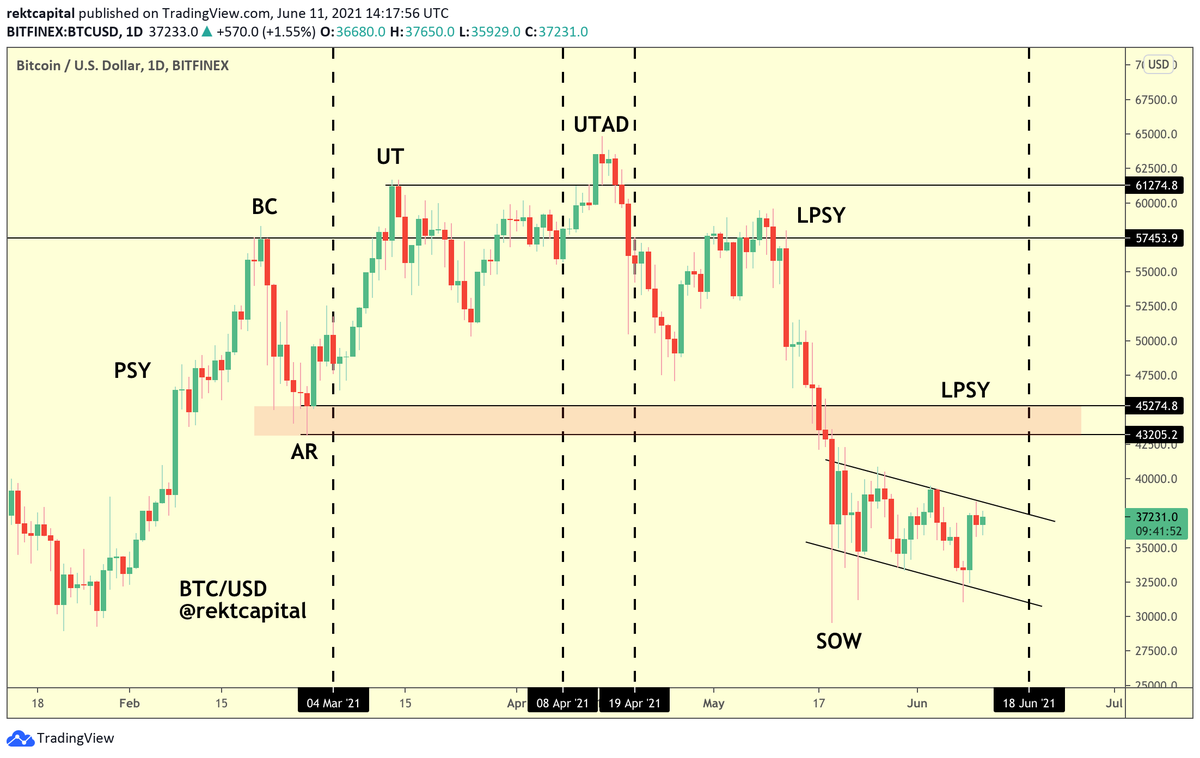

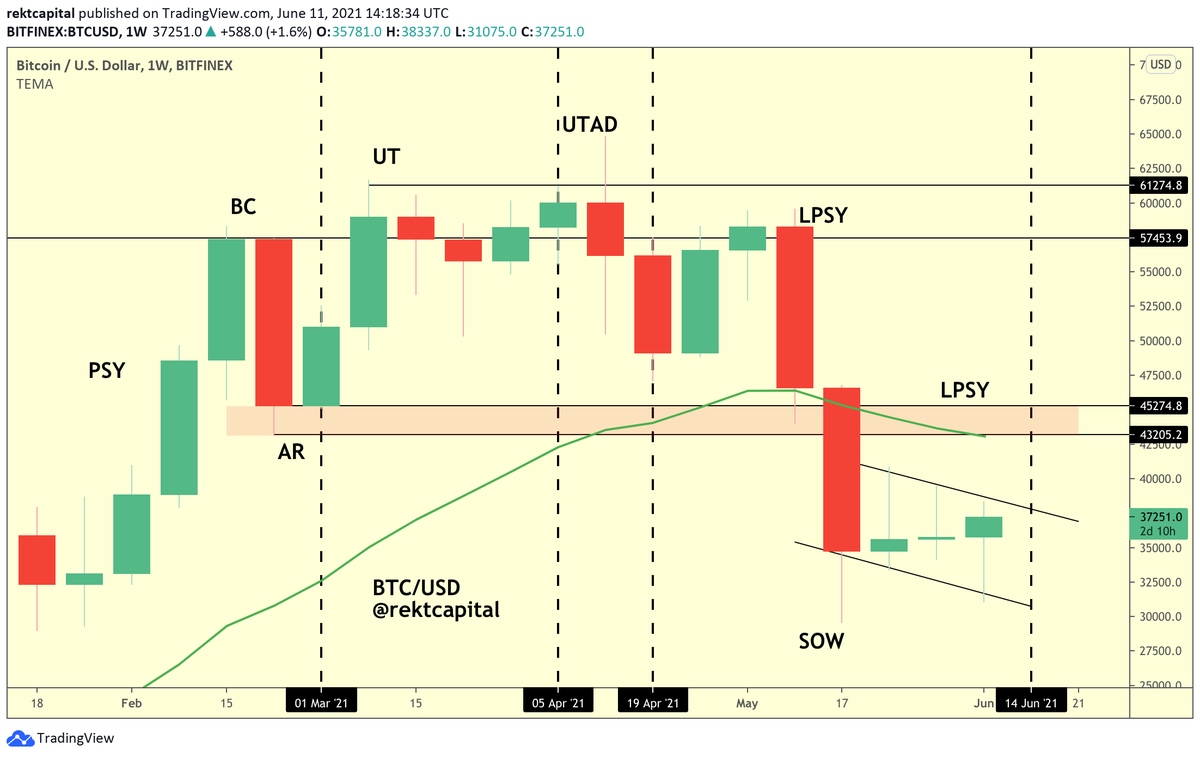

Which is why #BTC needs to soon reclaim the 21 WEMA as support

It's really important that the 21 WEMA doesn't turn into resistance upon a $BTC recovery towards the low $40,000s (i.e. the price level where the 21 WEMA now resides)

#Crypto #Bitcoin

Which is why #BTC needs to soon reclaim the 21 WEMA as support

It's really important that the 21 WEMA doesn't turn into resistance upon a $BTC recovery towards the low $40,000s (i.e. the price level where the 21 WEMA now resides)

#Crypto #Bitcoin

5.

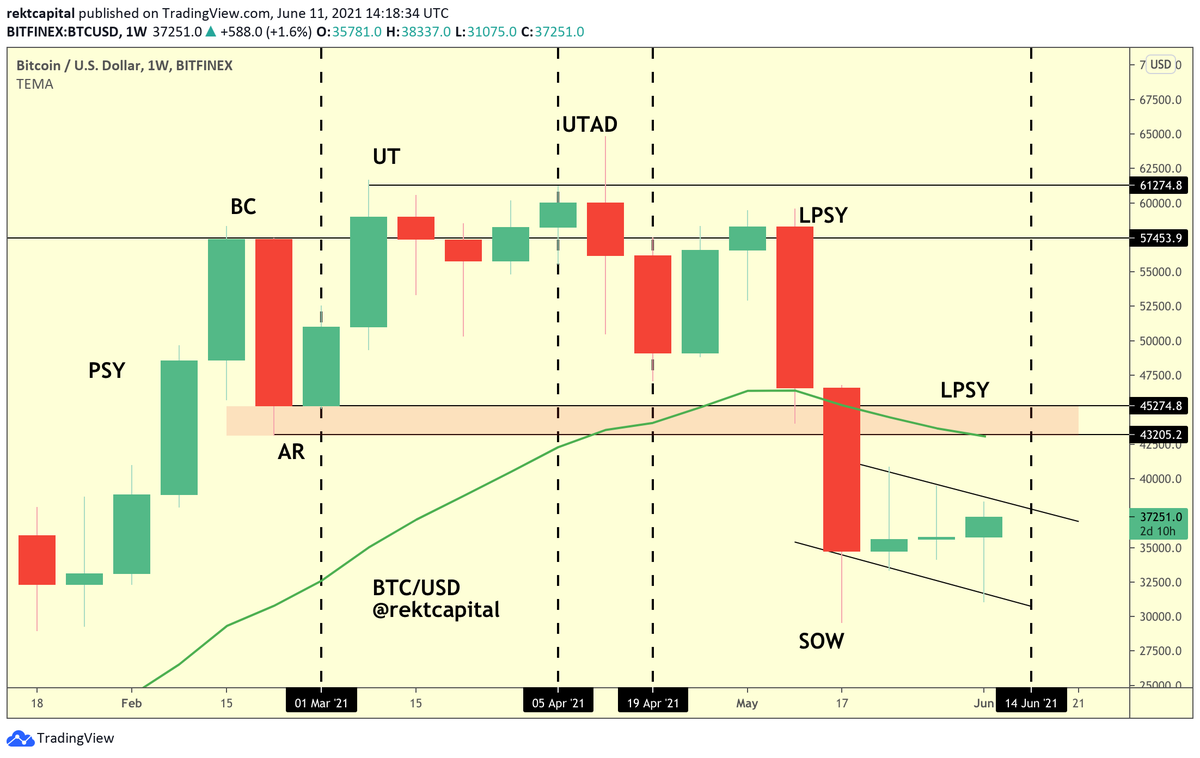

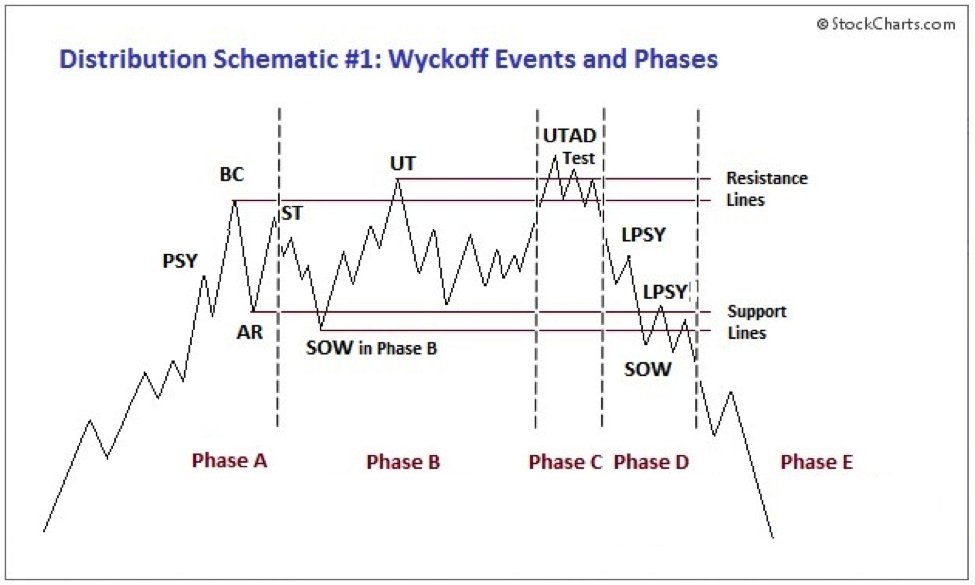

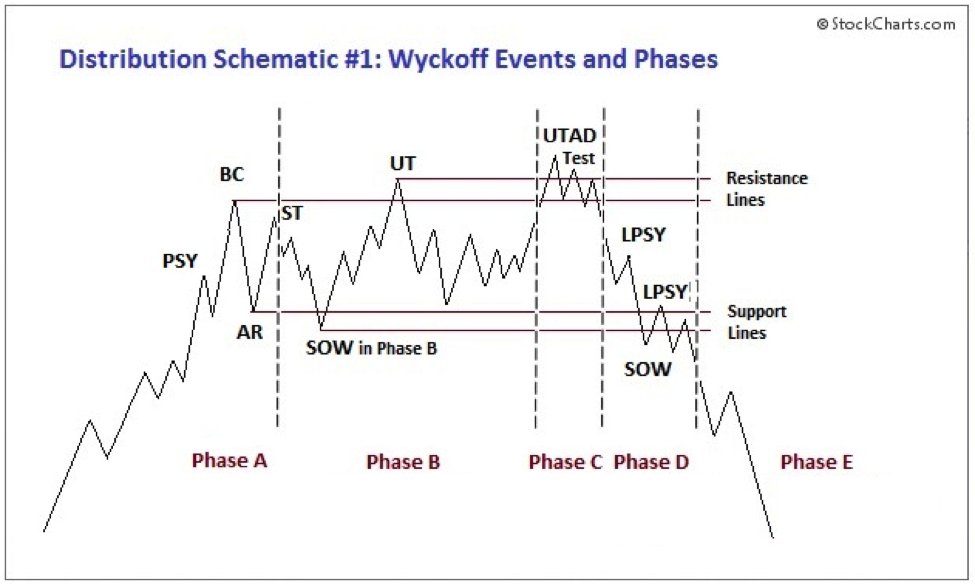

What's interesting about the 21 WEMA is that is aligns perfectly with the bottom of the #BTC Wyckoff Distribution Range

That is, the 21 WEMA is a confluent resistance with the Wyckoff range

#Crypto #Bitcoin

What's interesting about the 21 WEMA is that is aligns perfectly with the bottom of the #BTC Wyckoff Distribution Range

That is, the 21 WEMA is a confluent resistance with the Wyckoff range

#Crypto #Bitcoin

6.

At the moment, the #BTC breakdown from the Wyckoff Distribution range is an unconfirmed breakdown

For $BTC to confirm the breakdown, it would need to breakout from this wedging structure (black) only to harshly reject from the bottom of the range to decline into Phase E

At the moment, the #BTC breakdown from the Wyckoff Distribution range is an unconfirmed breakdown

For $BTC to confirm the breakdown, it would need to breakout from this wedging structure (black) only to harshly reject from the bottom of the range to decline into Phase E

7.

A #BTC rejection from Wyckoff range bottom would not only validate the Wyckoff Schematic...

But it would also validate a historical tendency regarding the 21 WEMA

That is, whenever the 21 WEMA is lost as support & then turned into resistance - a new $BTC downtrend begins

A #BTC rejection from Wyckoff range bottom would not only validate the Wyckoff Schematic...

But it would also validate a historical tendency regarding the 21 WEMA

That is, whenever the 21 WEMA is lost as support & then turned into resistance - a new $BTC downtrend begins

8.

After all, the 21 WEMA is a confluent resistance with the Wyckoff range bottom

#BTC needs to break above the 21 WEMA & turn it back into a support to invalidate the Wyckoff Distribution range

Wyckoff Distribution Ranges have been invalidated before

After all, the 21 WEMA is a confluent resistance with the Wyckoff range bottom

#BTC needs to break above the 21 WEMA & turn it back into a support to invalidate the Wyckoff Distribution range

Wyckoff Distribution Ranges have been invalidated before

https://twitter.com/rektcapital/status/1398272497347346436?s=20

9.

Now let's briefly turn our attention to the 50 Weekly Exponential Moving Average (50 WEMA, blue)

This EMA has figured as a vital source of support in #BTC Bull Markets as well

See my previous thread about why the 50 WEMA is worth keeping in mind:

Now let's briefly turn our attention to the 50 Weekly Exponential Moving Average (50 WEMA, blue)

This EMA has figured as a vital source of support in #BTC Bull Markets as well

See my previous thread about why the 50 WEMA is worth keeping in mind:

https://twitter.com/rektcapital/status/1399696440927133698?s=20

10.

In short, the #BTC 21 WEMA was lost as support

But the $BTC 50 WEMA continues to hold as support...

#Crypto #Bitcoin

In short, the #BTC 21 WEMA was lost as support

But the $BTC 50 WEMA continues to hold as support...

#Crypto #Bitcoin

11.

This means that #BTC will likely see price compression as a result of these two converging EMAs

The 21 WEMA could act as resistance and the 50 WEMA will act as support to form a triangular market structure

This triangle will probably be $BTC's home for the coming weeks

This means that #BTC will likely see price compression as a result of these two converging EMAs

The 21 WEMA could act as resistance and the 50 WEMA will act as support to form a triangular market structure

This triangle will probably be $BTC's home for the coming weeks

12.

Price compression precedes immense volatility

So while continued consolidation inside this triangular market structure formed by the two EMAs lies in #BTC's future...

The consolidation won't go on for too long

$BTC will coil into the apex of this triangle

Price compression precedes immense volatility

So while continued consolidation inside this triangular market structure formed by the two EMAs lies in #BTC's future...

The consolidation won't go on for too long

$BTC will coil into the apex of this triangle

13.

How long #BTC will consolidate in the $33,000 - $42,000 area that is encapsulated by the two EMAs?

I doubt the consolidation will last until August

The more likely scenario for #Bitcoin leaving this triangle could be sometime in July

Price compression precedes volatility

How long #BTC will consolidate in the $33,000 - $42,000 area that is encapsulated by the two EMAs?

I doubt the consolidation will last until August

The more likely scenario for #Bitcoin leaving this triangle could be sometime in July

Price compression precedes volatility

14.

If you liked this thread - you'll love the Rekt Capital newsletter

Feel free to sign up for regular cutting-edge insights on #BTC and Altcoins:

rektcapital.substack.com

#Crypto #Bitcoin

If you liked this thread - you'll love the Rekt Capital newsletter

Feel free to sign up for regular cutting-edge insights on #BTC and Altcoins:

rektcapital.substack.com

#Crypto #Bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh