Proof of Work Mining vs. Proof of Reserve Bonding

Similar inputs, different outputs

A thread 👇👇👇👇👇👇👇👇👇

Similar inputs, different outputs

A thread 👇👇👇👇👇👇👇👇👇

Proof of work mining is pretty well understood at this point

Miners use computers that solve math problems to earn block rewards: new tokens minted by the protocol

Mining is how networks like Bitcoin and Ethereum remain secure against attackers

Miners use computers that solve math problems to earn block rewards: new tokens minted by the protocol

Mining is how networks like Bitcoin and Ethereum remain secure against attackers

Generally, mining is talked about from the point of view of the protocol (at least from what I see). People will say the purpose of mining is to secure the network, and it is: for the protocol.

For the miner, the point is not to secure the network. The point is to make money.

For the miner, the point is not to secure the network. The point is to make money.

Miners are profit motivated actors, just like everyone else. They only do the work of securing the network because they get paid to do it.

It is important to note that miners are incentivized with new dilutionary tokens. Their profits are colloquially referred to as "seigniorage."

Seigniorage is the difference in the face value of money, such as a $0.25 quarter coin, and the cost to produce it.

Seigniorage is the difference in the face value of money, such as a $0.25 quarter coin, and the cost to produce it.

Miners receive dilutionary shares of the network at the cost of production.

They pay no one for them and they mark no one else up in acquiring them.

For an accumulator, these are the best kind of shares.

They pay no one for them and they mark no one else up in acquiring them.

For an accumulator, these are the best kind of shares.

Just because they don't pay anyone, doesn't mean they don't pay.

There are input costs associated with mining.

You need to buy rigs, pay for electricity, set up a data center with adequate cooling, etc. Block rewards certainly aren't free.

There are input costs associated with mining.

You need to buy rigs, pay for electricity, set up a data center with adequate cooling, etc. Block rewards certainly aren't free.

Mining costs are perpetual. Electricity is gone once it's used, equipment depreciates and needs to be replaced, etc.

The benefit of mining is also transient; the utility is only at a specific point in time.

The benefit of mining is also transient; the utility is only at a specific point in time.

For example, as a thought experiment, imagine every ethereum miner decides to turn off their machines tomorrow. What would happen?

The security of the network would drop to zero is what would happen. It wouldn't matter that it WAS secure, it needs to BE secure.

The security of the network would drop to zero is what would happen. It wouldn't matter that it WAS secure, it needs to BE secure.

To review, before we go further:

- Mining secures PoW networks

- Miners mine for seigniorage profits

- Mining has perpetual costs

- The benefit of mining is ephemeral and impermanent

- Mining secures PoW networks

- Miners mine for seigniorage profits

- Mining has perpetual costs

- The benefit of mining is ephemeral and impermanent

Just to get this out of the way, a Proof of Reserve system like @OlympusDAO has the benefit of living on top of an already-secured network (Ethereum).

We don't need to pay actual miners because we build on the application layer, not the infrastructural layer.

We don't need to pay actual miners because we build on the application layer, not the infrastructural layer.

So, what is Proof of Reserve and how is it different?

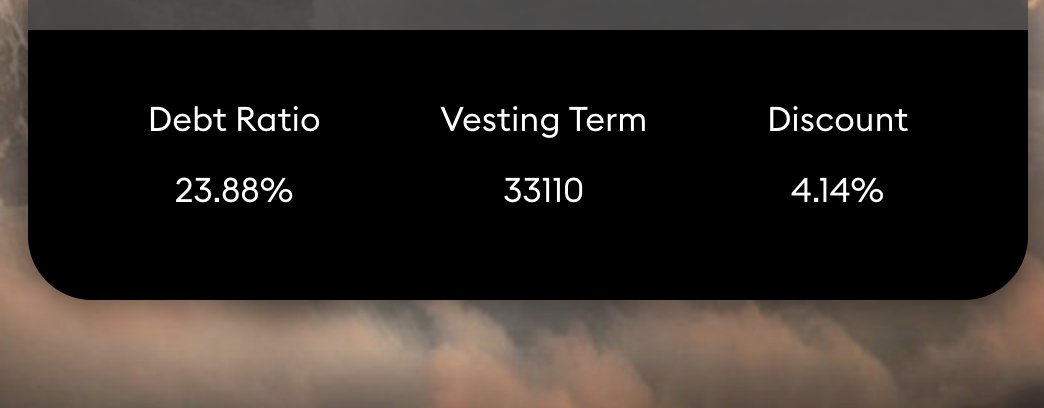

A Proof of Reserve network is one that derives value from protocol owned reserves. The security of the network is in the capitalization of the treasury, and its ability to influence and support its tokens' market.

A Proof of Reserve network is one that derives value from protocol owned reserves. The security of the network is in the capitalization of the treasury, and its ability to influence and support its tokens' market.

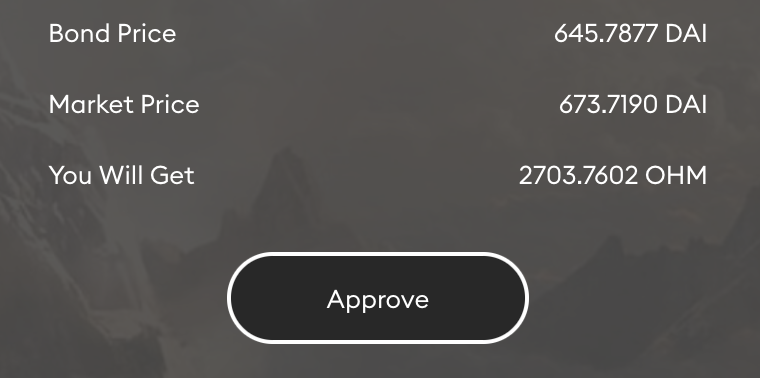

A PoR network accrues value through bonds, like PoW networks accrue value through mining.

Bonds allow participants to share in seigniorage profits by providing new assets to the treasury.

Bonds allow participants to share in seigniorage profits by providing new assets to the treasury.

Unlike Proof of Work mining, where capital is spent on equipment and other costs with transient benefit, with Proof of Reserve that capital is given directly to the protocol.

This means that it looks remarkably similar for the participant (spend $__ to receive __ coins), but it looks completely different for the protocol.

Unlike PoW, where benefit exists at only one point in time, the benefits of PoR are persistent and can only grow.

Once capital is in the treasury, it is in the treasury. Even if everyone stopped bonding, it would still be in the treasury.

Once capital is in the treasury, it is in the treasury. Even if everyone stopped bonding, it would still be in the treasury.

This creates a whole new element. Not only is the basic game the same, the players also get to work together to build something long lasting.

Miners are like Sisyphus pushing the boulder up a hill.

Bonders are like Ictinus building the Parthenon.

Miners are like Sisyphus pushing the boulder up a hill.

Bonders are like Ictinus building the Parthenon.

Like mining, bonds are competitive. There is not room for everyone.

If 2x the hashrate come online in PoW, the cost of production per coin doubles. If 2x the capital come online in PoR, the cost of bonds doubles.

If 2x the hashrate come online in PoW, the cost of production per coin doubles. If 2x the capital come online in PoR, the cost of bonds doubles.

This means that, like mining, bonds will scale to the underlying market.

$OHM price moving up means more room for bonds and, as a result, a larger treasury, just like $BTC price moving up means more room for miners and, as a result, a more secure network.

$OHM price moving up means more room for bonds and, as a result, a larger treasury, just like $BTC price moving up means more room for miners and, as a result, a more secure network.

The overall goal of bonds is to build the strength (capitalization) of the network. Just like $BTC and $ETH derive value from their security, $OHM derives value from its reserves.

As of today, 3 months in, that capitalization sits at $5.5m realized and $17.5m net assets.

As of today, 3 months in, that capitalization sits at $5.5m realized and $17.5m net assets.

I look forward to seeing the accumulation game develop as more players learn the rules and start playing.

Few understand how mining underpins PoW systems, and fewer understand how bonding underpins PoR systems.

Few understand how mining underpins PoW systems, and fewer understand how bonding underpins PoR systems.

For those interested in playing, today @OlympusDAO will offer FRAX-OHM bonds for the first time as part of a partnership with @fraxfinance.

This will be our third bond type, and it will add an additional layer that I am excited to see the effects of.

This will be our third bond type, and it will add an additional layer that I am excited to see the effects of.

• • •

Missing some Tweet in this thread? You can try to

force a refresh