#Neuland (FY-21 Annual Report) :

- Focused on growing CMS business ; 4-5 late stage projects to get commercialised in next 12-24 Months.

- GDS business can grow with addition of specialised, high value APIs in Speciality segment. (Semaglutide)

- Focused on growing CMS business ; 4-5 late stage projects to get commercialised in next 12-24 Months.

- GDS business can grow with addition of specialised, high value APIs in Speciality segment. (Semaglutide)

GDS Business :

- Plans to launch 18 new products in phases during this decade.

- 3 Peptides at various stages of development for GDS business.

- The specialty segment is expected to drive profits and prime segment is expected to strengthen the vertical in the coming future.

- Plans to launch 18 new products in phases during this decade.

- 3 Peptides at various stages of development for GDS business.

- The specialty segment is expected to drive profits and prime segment is expected to strengthen the vertical in the coming future.

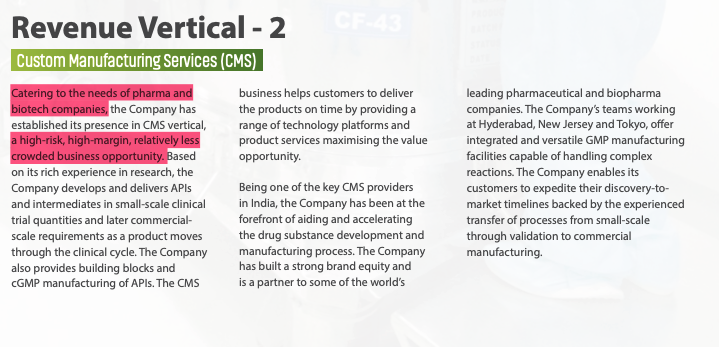

CMS Business :

- High Risk High Margin business with less competition

- Inflow of late-stage projects, having potential to boost revenue in the next fiscal.

- Peptides : Some molecules are at an advanced stage of development & show considerable promise for commercialisation.

- High Risk High Margin business with less competition

- Inflow of late-stage projects, having potential to boost revenue in the next fiscal.

- Peptides : Some molecules are at an advanced stage of development & show considerable promise for commercialisation.

Research & Development :

- 300-member strong team of research scientists.

- Filed 2 USDMF during FY-21 ; Ready to file 5 more DMFs.

- Added a new peptide lab and non-GMP Kilo lab for Unit-III

- Committed to develop high value molecules.

- 300-member strong team of research scientists.

- Filed 2 USDMF during FY-21 ; Ready to file 5 more DMFs.

- Added a new peptide lab and non-GMP Kilo lab for Unit-III

- Committed to develop high value molecules.

Supply Chain Risk :

- Earlier ~ 60% of raw materials were coming from China, whereas from June 2021 less than 10% of raw materials will be imported from China.

- Focus on in-house manufacture of some of the intermediates at Unit-III.

- Earlier ~ 60% of raw materials were coming from China, whereas from June 2021 less than 10% of raw materials will be imported from China.

- Focus on in-house manufacture of some of the intermediates at Unit-III.

• • •

Missing some Tweet in this thread? You can try to

force a refresh