1/ The state of DeFi on Solana - @SBF_Alameda @aeyakovenko @RajGokal

TL; DR:

-DeFi on Solana is still at the early state

-Few projects have released products but every crucial niche already has projects developing.

TL; DR:

-DeFi on Solana is still at the early state

-Few projects have released products but every crucial niche already has projects developing.

2/ -High chance that when the time comes, many projects will release mainnet and make an explosion in the eco

When the market is unstable like this, it nice to calm ourselves down, stop chasing for yield and take a closer look at what’s actually happening

When the market is unstable like this, it nice to calm ourselves down, stop chasing for yield and take a closer look at what’s actually happening

3/ DeFi is product-market fit, before, Crypto only has one use case: currency. But being just a currency doesn’t do anything, Crypto needs a real use case and DeFi is perfect for that.

4/ To catch up with the exponential growth of DeFi and further come to mass adoption we will need an infrastructure that can handle that demand

5/ Scalability is one of the biggest problems of Ethereum, despite gas fees has declined significantly recently because of the market, but what will happen if the bull market comes back and the demand rises again?

6/ There are a lot of solutions to this problem (layer2, ETH2.0, layer1 blockchains), and one of the best is @solana, a blockchain with cutting-edge technology.

Next, we will talk about the state of DeFi on Solana to see how far it has come and what is still missing.

Next, we will talk about the state of DeFi on Solana to see how far it has come and what is still missing.

7/ Be a person that has followed the ecosystem for a long time, I’m amazed by the growth in the ecosystem. The number of new projects is skyrocketing and all crucial niches of DeFi have projects name on it

https://twitter.com/solanians_/status/1402843464841064451

8/ Especially with the hackathon season is conducting, I’m confident that the number of new projects will increase and continue to spread the ecosystem wider.

9/ But keep in mind that almost all of them haven’t released products. this is understandable because in Solana, Devs need to use a new language called RUST, not just simply “copy+paste” like at the chains that EVM compatible

Come to the part reviewing important niches on Solana

Come to the part reviewing important niches on Solana

10/ Stablecoin

Stablecoin is one of the most important parts of Crypto. Stablecoin is a tool to measure the value of assets and remove the volatile risk for keeping crypto assets. Looking at the growth in stablecoin helps us to identify the growth in the whole ecosystem.

Stablecoin is one of the most important parts of Crypto. Stablecoin is a tool to measure the value of assets and remove the volatile risk for keeping crypto assets. Looking at the growth in stablecoin helps us to identify the growth in the whole ecosystem.

11/ Right now Solana mainly supports $USDC & $USDT with the total stablecoins issued over $1.3 B

And the growth in stablecoin supply is relatively fast compared with a young blockchain.

And the growth in stablecoin supply is relatively fast compared with a young blockchain.

https://twitter.com/solanians_/status/1395321805758369800

12/ Dex

There are 2 main Dex models: Order-book and AMM.

First, we will compare some stats of AMMs between ecosystems

There are 2 main Dex models: Order-book and AMM.

First, we will compare some stats of AMMs between ecosystems

https://twitter.com/solanians_/status/1400425063212478474

13/ As you can see with the 3 months old project, @RaydiumProtocol TVL is quite impressive. This can achieve because of cheap txs fees from Solana, product like FusionPools have incentivized users to contribute assets to protocol.

14/ Next is volume, to understand why Raydium volume is relatively low, first, we need to understand the structure of Serum.

I already have a thread about Serum pools, you guys can read it here:

I already have a thread about Serum pools, you guys can read it here:

https://twitter.com/solanians_/status/1373134520363347973

15/ To summarize, Raydium is an on-chain order book AMM

Ex: User A swaps $10,000 USDC to $RAY, Raydium will pricing on both RAY and Serum order book. If your order on Raydium receives $9,800 worth of $RAY on Raydium and $9,900 on Serum >> Raydium will make a swap through Serum

Ex: User A swaps $10,000 USDC to $RAY, Raydium will pricing on both RAY and Serum order book. If your order on Raydium receives $9,800 worth of $RAY on Raydium and $9,900 on Serum >> Raydium will make a swap through Serum

16/ This helps users to have better pricing but it will shard the liquidity from protocols. We will need the right plan to solve this liquidity problem. @RaydiumProtocol x @SushiSwap to bring Sushi to Solana is one of that

https://twitter.com/messaricrypto/status/1369687748307738631

17/ For the order book, I also have a thread about the Serum model, and why Serum eco will flourish.

“All rivers flow into the sea just like the value occurred will flow into Serum”

“All rivers flow into the sea just like the value occurred will flow into Serum”

https://twitter.com/solanians_/status/1387998507856920576

18/ Before the heavy market crash, the daily volume of Serum Dex is from $50M to $100M. An impressive number with a Dex order book

19/ Lending & Borrowing

Besides @Oxygen_protocol that actually has working products, other projects still at the development stage, Oxygen itself is lending p2p and not money market like Aave, Compound.

Besides @Oxygen_protocol that actually has working products, other projects still at the development stage, Oxygen itself is lending p2p and not money market like Aave, Compound.

20/ This is one niche that we should pay close attention to because lending & borrowing have existed for centuries and is the fundamental reason for every bubble. If the ecosystem wants to grow, this niche is inevitable.

21/ Derivative

Derivative is received a lot of attention when every category: Options, Margin trading, Prediction, Index,.. have projects name on it.

Derivative is received a lot of attention when every category: Options, Margin trading, Prediction, Index,.. have projects name on it.

22/ But just like lending, nearly all of them haven’t released products. The only protocol with the working product is @mangomarkets with $17M+ TVL

https://twitter.com/mangomarkets/status/1405199852674457607

23/ Others

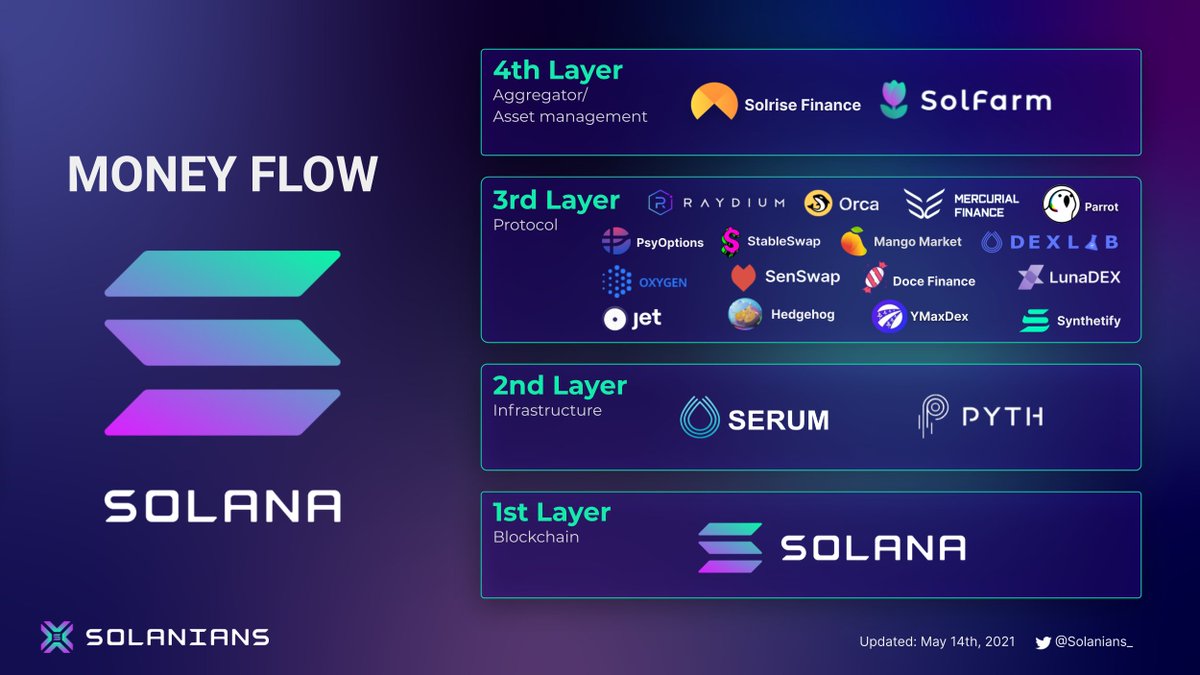

With other legos, I divide projects into 2 categories:

Fundamental: Oracle, Vaults,...

Higher: Aggregator, asset management,...

Me myself see the higher potential at the fundamental layer. Only when the fundamental has stable we can gain real value from a higher layer

With other legos, I divide projects into 2 categories:

Fundamental: Oracle, Vaults,...

Higher: Aggregator, asset management,...

Me myself see the higher potential at the fundamental layer. Only when the fundamental has stable we can gain real value from a higher layer

24/ Right now only a few projects have shown their product (@switchboardxyz released mainnet, @MercurialFi released Devnet2) and it still a bit tricky to make a decision at the moment

DeFi on Solana still at an early stage and the potential growth is huge. Despite the difference in the design language slows down the speed compares to EVM compatible chains. But from an investors perspective, this is the golden time for us to research and find gems for ourselves

• • •

Missing some Tweet in this thread? You can try to

force a refresh