what better way to start sunday than a #kilpest thread: a classic peter lynch pick & shovel investment for the diagnostics sector. If you like the thread, please retweet this tweet to help educate max investors. 🙏🙏

https://twitter.com/sahil_vi/status/1404417802929274881

Before I dive into Kilpest, some words on microcap investing. Everyone **needs** to be aware of what they are signing up for.

Two interviews from @varinder_bansal sir’s Omkara capital with very successful microcap investors (one with @iancassel sir: ...

@varinder_bansal @iancassel & one with @hiddengemsindia sir: ) do a wonderful job explaining all the landmines & things to keep in mind. Do watch these, please before you buy any #microcap

@varinder_bansal @iancassel @hiddengemsindia My own take is that one has to create a diversified PF of uncorrelated microcaps (if you'd typically invest in 5, make it 10 and so forth). Understand that liquidity risks will always remain.

@varinder_bansal @iancassel @hiddengemsindia In a market downturn, it wont be surprising if 2000 people want to sell a microcap and there are 0 buyers. Only invest in microcaps as a basket, and if you are comfortable sitting on 80% losses for many years. Otherwise dont. Risk wrt scale becomes larger in microcaps.

@varinder_bansal @iancassel @hiddengemsindia Higher probability of business disruptions, down quarters. Lack of Concalls or investor presentations. Maybe some facets of the co which certain investors might consider as red flags (promoter pay, RPT etc). valuepickr.com has been invaluable to my journey as an investor

@varinder_bansal @iancassel @hiddengemsindia Quality of collaborative research there (specially for microcaps which dont have much info) is remarkable. Its not a forum, its a community :-). Worth joining or at least reading specially if you want to dabble in microcaps.

@varinder_bansal @iancassel @hiddengemsindia Enough of general gyaan. Back to Kilpest. Kilpest has 2 businesses. An agrochem business and a diagnostics ancillary business (they make testing kits for a plethora of diagnostic tests).

@varinder_bansal @iancassel @hiddengemsindia The agrochem business is the gruesome business, and the diagnostics business is the real cash cow. The agchem was their older business, done under the Kilpest main company. Diagnostics is under the subsidiary 3B Black Bio.

@varinder_bansal @iancassel @hiddengemsindia Company is undergoing some serious transformation. Management plans to hive off and sell off the agrochem business, and amalgamate the subsidiary with the main company and rename it to 3B Black bio because that is the focus of the management, promoters and the company

@varinder_bansal @iancassel @hiddengemsindia This is why the rest of the analysis will focus on 3B Black bio: the diagnostics business. One of the key mental models popularized by @soicfinance is Variant perception. In case someone didnt notice, the Covid pandemic happened. Kilpest makes diagnostic testing kits.

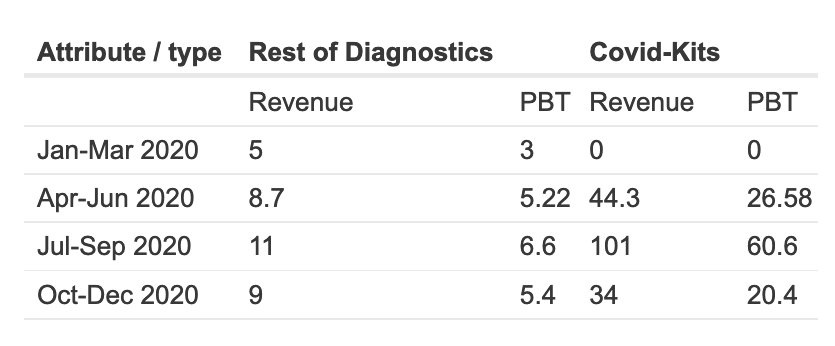

@varinder_bansal @iancassel @hiddengemsindia @soicfinance And so they were remarkably positively impacted by it. Look at the ginormous growth in PBTs in the previous pic I’d shared. Of course a lot of these are short term profits (hopefully the pandemic will end soon). This is why co appears to be optically cheap at a P/E of 3.4.

@varinder_bansal @iancassel @hiddengemsindia @soicfinance If we take out the one-off Covid earnings of course the P/E is much higher (though still cheap imo).

The variant perception here is to separate the wheat from the chaff, focus on the non-covid diagnostics business and value that.

The variant perception here is to separate the wheat from the chaff, focus on the non-covid diagnostics business and value that.

@varinder_bansal @iancassel @hiddengemsindia @soicfinance That biz is getting lost in the covid noise and is valued at throw away valuations. And the business is good quality. We will see that.

@varinder_bansal @iancassel @hiddengemsindia @soicfinance Let us start by teasing apart last year's earnings of 3BBB into covid-kit and the rest of diagnostics business. One of the great thing this microcap company did (ever since may 2020) was to separately tell the revenues from covid kits for each month and sometimes quarter.

@varinder_bansal @iancassel @hiddengemsindia @soicfinance Company shares # of test kits sold and average realization. Gives us covid kit revenue. PBT margins were same and roughly 60% before and after covid-kits were being sold (were actually higher), so conservatively I have modelled for 60%.

@varinder_bansal @iancassel @hiddengemsindia @soicfinance 20cr PBT in TTM for rest of diagnostics. Results in 15cr PAT. Company has ~100cr cash (80cr till Q3 + 20cr [conservatively] in Q4+Q1) already. This implies an ex-cash normalized P/E of 15. Much higher, but also not that expensive (we will cover why in rest of the tweet storm).

@varinder_bansal @iancassel @hiddengemsindia @soicfinance I will analyze the biz in terms of Growth, Quality & Durable competitive advantages, Unit economics & margins, Management Quality, Valuations, Competitor Analysis & risks.

@varinder_bansal @iancassel @hiddengemsindia @soicfinance Growth

Pre-covid, 3BBB was growing at 30-40% CAGR topline. Higher growth rates have continued in 2020 (ex-covid as well) due to larger & growing customer base (see last line; will come to this later).

Pre-covid, 3BBB was growing at 30-40% CAGR topline. Higher growth rates have continued in 2020 (ex-covid as well) due to larger & growing customer base (see last line; will come to this later).

@varinder_bansal @iancassel @hiddengemsindia @soicfinance Key future growth triggers/drivers for 3BBB:

1. Acceleration of Molecular diagnostics penetration: Number of ICMR approved molecular diagnostics labs has gone up from 400 pre-covid to 2600 now. There are decades where nothing happens, and then there are years where decades happen

1. Acceleration of Molecular diagnostics penetration: Number of ICMR approved molecular diagnostics labs has gone up from 400 pre-covid to 2600 now. There are decades where nothing happens, and then there are years where decades happen

@varinder_bansal @iancassel @hiddengemsindia @soicfinance The Pandemic has caused an extreme acceleration in the penetration of molecular diagnostics among diagnostics centers in India. This accelerated molecular diagnostics penetration & cross-selling to these newly created molecular diagnosis labs would be one key growth driver.

@varinder_bansal @iancassel @hiddengemsindia @soicfinance 2. Industry growth: Pre-pandemic molecular diagnostics industry itself was growing at ~8.5% (pre-covid) at global level (making it one of fastest growing industry). APAC region was growing at 11.5%.

@varinder_bansal @iancassel @hiddengemsindia @soicfinance In India, Diagnostics is a fast growing industry, which we can tell from Dr lal path’s pre pandemic growth rate of ~15% for topline. In fact Lal path’s post pandemic non-covid tests are also growing much faster now (even accounting for low base effect).

@varinder_bansal @iancassel @hiddengemsindia @soicfinance 3. New products leading to higher cross selling: Company is constantly developing new products. This will allow higher cross selling to existing clients and ability to capture larger share of client wallet.

@varinder_bansal @iancassel @hiddengemsindia @soicfinance We already see this in the numbers. In Feb-20 company used to get Rs 45M from long-term contractors (7 such contracts existed). In Feb-21 this has increased to Rs 70M (7 contracts now as well). This is a growth of 55%. Company is able to capture a larger share of customer wallet

4. Growing exports: Due to pandemic certain restrictions, company’s exports have been hard to scale. One such restriction is that government only provides 3 month export licences at a time. This creates uncertainty in client’s mind about the supply chain.

In FY20 company was able to do exports of Rs 6.5M. In FY22 Company aims to do exports of Rs 60-70M modulo government license restrictions. The sustainability of exports will become clearer when we look at the quality section.

5. One of the key products being developed by Co is NGS: Next Generation Sequencing. This will enable millions of sequencing reactions to be analyzed in parallel.

Company is expecting to commercialize its NGS kits in next few quarters. See pic for which tests would this consist of.

6. Inorganic growth opportunities: Company is already sitting on 100cr cash. Will generate more from the last and next few quarters of Covid tests. My estimate is that if we see no new covid waves (hopefully), company will end up with 120cr of cash due to covid tests.

This 125cr of cash would enable co to pursue inorganic growth. Multiple options exist. For me personally, best capital allocation would be R&D investment to improve quality of R&D even more (more on that later). Next best would be forward integration …

...by buying a small but high quality diagnostics front end. Would reduce the growth rate and unit economics in short term, but would enable sustainable growth. The probability of terminal value increasing would be high. Next best would be a buyback.

Next best would be an acquisition in molecular diagnostics space. This is because they already have a very good organic growth opportunity in their niche. Won’t make much sense to acquire anyone IMO since this is a very capex light business (more on that later), easily scalable.

Summary of growth: industry grew very fast, is growing fast. New product development, exports and inorganic expansion will power next few years of growth.

Quality & Durable Competitive Advantages

1. 3B’s covid kit is the **first and only** (as per my limited knowledge, full verification would require going through 245 companies which I havent done) indian covid RT-PCR kit to be approved by USFDA under EUA.

1. 3B’s covid kit is the **first and only** (as per my limited knowledge, full verification would require going through 245 companies which I havent done) indian covid RT-PCR kit to be approved by USFDA under EUA.

To understand how difficult this is, I quote 2 examples: One of their American competitors (who make their kits in US and in India) called Co-diagnostics have this on their website for their covid-kit:

Even American molecular diagnostics company was unable to get their RT-CPR kits approved. Also, from discussions with other investors, it appears that MyLab was also trying to apply for USFDA approval, but I can verify that they have not received it.

2. 3BBB’s TruePCR covid test was one of the first 5 to be approved in India.

https://twitter.com/ANI/status/1245782603350839296?s=09At that point in time, the accuracy required for approval was 100%. Subsequently due to the covid waves…

...ICMR reduced the concordance with TP/TN required to be 75% and subsequently removed the requirement altogether since we needed more kits. This has definitely reduced the quality of the testing, due to influx of low quality kit manufacturers and chinese kits in Indian market.

3. While 3BBB is selling its kits at Rs 70-80, Indian government is procuring kits at Rs 26/27. 3BBB’s refusal to sell at that price point itself points to superior quality of their kits. Also, out of 180 odd kits available in India, only 40 are indigenous.

This gives us some sense of how many sub-par quality kits we have and that the competitive intensity (ex low-quality kits) might be a little overestimated.

4. In a recent Video that I was watching, 3B’s head of commercial operations called out that NIV pune used their kits in conducting Covaxin trial. They have also provided kits to ICMR. This is a fairly sizable endorsement of their quality.

5. Their pedigree of employees is fairly great. Just look at the experience which one of their senior scientists comes with. Their head of R&D has been with them for 8 years. Shows their ability to retain senior key management.

6. One of only 5 global companies to have their RT-PCR kit approved for saliva testing by US-FDA under EUA.

7. They already have tie-ups with UK importer: HS Biolabs. Were unable to supply due to government restrictions. These export relationships can be mined for cross-selling once covid restrictions are lifted.

8. I think the key strength of this company is its employees. And their combined R&D experience rearching, developing, validating and quality controlling the kits. This is core biotechnology.

See this youtube video on quality of diagnostics in India: They QC every batch. They test on client specific machine and model to ensure they are able to guarantee the quality.

Summary of quality: R&D focussed co embedded in supply chains of high quality clients. Second co to manufacture RT-PCR in India. Early USFDA EUA approval for the test kit.

Unit Economics & Margins

1. We can see that co has very high fixed asset turnover of 10-100x depending on which period of time you look at. This might create a doubt in the minds of reader, how co is able to get such high fixed asset turnover.

1. We can see that co has very high fixed asset turnover of 10-100x depending on which period of time you look at. This might create a doubt in the minds of reader, how co is able to get such high fixed asset turnover.

We can observe the US listed similar business “co diagnostics”. They have similar fixed asset turns & margins: Clarifies the industry structure: Requires More of Scipex (science & scientist expenditure) rather than Capex (Capital expenditure)

The high asset turns are because enzymes required are at microgram level. In essence, reason they were able to scale from 5000 tests/day to 100000 tests/day is coz their capacity utilization was hardly 5% or lesser pre-covid.

This info comes from RTPCR’s USFDA EUA filing:

fda.gov/media/139296/d…. Most reagents are in small quantities. Highest quantity required is 2mL for 100 tests. 20 microL for 1 test. 20L for 1,00,000 tests.

fda.gov/media/139296/d…. Most reagents are in small quantities. Highest quantity required is 2mL for 100 tests. 20 microL for 1 test. 20L for 1,00,000 tests.

2. Margins are high because of the very high value add and quality added. They buy simple raw materials, import the DNA/RNA/genetic material of the disease or markers they want to identify.

Impart their knowledge into this set of materials so that together it becomes a testing kit. As demand for covid tests went up, the supply of raw materials had increased, this is why they are able to maintain margins while selling kits at Rs 70 now, versus Rs 750 a year ago

3. Working capital is fairly good for the subsidiary 3BBB. Kilpest has high WC due to the agri business. Just need to subtract the balance sheet for standalone from consolidated to work out the numbers.

4. Due to the decent WC, very low fixed assets required and high margins, unit economics are wonderful to say the least. ROCE of 117% in December 2021 quarter.

Summary of Unit Economics and Margins: High Fixed asset turnover, low WC, high margins.

Management Quality

Very focussed on value unlocking: amalgamation of 3BBB into kilpest and renaming. Increasing focus on highest value add business. Communicate biz updates very regularly. Explain reasons for failure. Detailed Investor presentations.

Very focussed on value unlocking: amalgamation of 3BBB into kilpest and renaming. Increasing focus on highest value add business. Communicate biz updates very regularly. Explain reasons for failure. Detailed Investor presentations.

Valuations

120cr of cash, a core business growing topline at 30-40% powered by research and development of new products and cutting edge of diagnostics biotech. Non covid kit business of 35cr with PAT margins of 45%, ROCE>50%, you do the math

120cr of cash, a core business growing topline at 30-40% powered by research and development of new products and cutting edge of diagnostics biotech. Non covid kit business of 35cr with PAT margins of 45%, ROCE>50%, you do the math

High quality Competitor Analysis

Will analyze the 4 competitors who were approved alongside 3BBB in 1st tranch of covid tests. Also Co-diagnostics since they come up a lot.

Will analyze the 4 competitors who were approved alongside 3BBB in 1st tranch of covid tests. Also Co-diagnostics since they come up a lot.

1. Altona: They do not detect the RDRP gene. As per the doctor mentions that RDRP gene has highest specificity for detecting Covid among all genes.

The altona test does have USFDA EUA so in that sense is as good as TruePCR. Note that Altona is based out of germany, not an Indian manufacturer.

2. My Lab: While TruePCR (3BBB) has moved to a 1-tube assay, MyLab still has only a 3-tube assay. This is actually higher impact than we realize & is also beautifully covered in the video i linked before.

A lab using MyLab RTPCR can only do 30 tests at a time since each test requires 3 tubes. This means 3x lower throughput/revenue than TruePCR. Mylab take 2.5 hours compared to TruePCR’s 1.5 hours. MyLab also does not have USFDA EUA approval.

3. Seegene: A korean listed co. Very high margins, high fixed asset turns. Verifies our hypothesis about industry structure. Co was making decent profits and has decent growth pre-covid as well (this was not the case for co diagnostics). Was valued at 25x TTM earnings pre-covid

This throws some light on what a reasonable valuation for 3BBB might look like in steady state with decent growth (15% top line growth over 5 years). Single tube test. Test takes 1.844 hours. Seems to match TruPCR on almost all parameters.

4. SD BioSensor: Korean private company. Also USFDA EUA Approved. Looks for RDRP and E gene but not the N gene. In this way, slightly inferior to TrurPCR and Seegene.

5. Co-diagnostics/Ambalal Sarabhai: Ambalal does not own the tech or the product. I concluded this because ambalal website redirects to Co-diagnostics whenever there is a link about products or technology.

The real brain is Co-diagnostics. As I stated before, their test is not yet USFDA EUA approved. Apart from that, could not figure out how many tubes it uses. Only looks for RDRP and E gene not the N gene and in that way is similar to SD Biosensor test. Takes 1.5 hours.

Summary of Competitor Analysis: 3BBB seems to be at same level as korean diagnosis kit makers, ahead of indian competitors and certain american ones too.

Risks/Open questions

1. Are they able to sell to large labs and hospital chains like Apollo, Manipal, Dr lal, Thyrocare. Are these backward integrated?

1. Are they able to sell to large labs and hospital chains like Apollo, Manipal, Dr lal, Thyrocare. Are these backward integrated?

Similarly, when their current clients grow big, they can decide to backward integrate into testing kits (metropolis already did this by acquiring Hi tech labs).

2. Their high-quality indian competitors like MyLab flush with cash could decide to provide larger discounts for existing segments, increasing competitive intensity, worsening the margins and unit economics.

3. Microcap so all associated risks. I personally protect against downside by keeping position size small and pyramiding up with consistent business performance and management execution on guidance.

Thanks to everyone on VP who helped me understand this business so well. Full VP thread of 416 posts for those who might want to dive deeper:

forum.valuepickr.com/t/kilpest-indi…

forum.valuepickr.com/t/kilpest-indi…

@threadreaderapp unroll

Disc: I am invested, imho position sizing is paramount for microcaps. Regardless of conviction or quality, I personally would never put more than 5% in a microcap. This thread is only for educational purpose. Do your own due diligence before investing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh