#idfcfirstbank is my largest and oldest investment. Thought of creating a thread to explain the business. If you like the thread, please spread the knowledge, retweet. Buckle up, because this is going to be a long one. :D

Quick summary of what a bank does. This enables me to establish a framework under which the analysis of the bank will become very structured.

Money is its raw material.

Money is its raw material.

Bank takes customer deposits, raises money via borrowings (can issue its own bonds, takes loans from other banks etc). This is the input for the bank. Since the bank is liable to pay interest on it, it is also known as liabilities.

The output is a loan which the bank gives. These are broadly of 2 types: loans given to customers (Retail and Corporate) and subscription to bonds issued by other entities (Government of India, corporates like Vodafone Idea etc).

This is the output of a bank. Since these generate income for the bank, they are called assets. Not all the liabilities can be utilised as loans or used to purchase bonds, because banks need to have enough liquidity to service redemptions of their deposits.

RBI makes rules around this, that banks must follow. RBI is the regulator for this sector.

Let’s understand how a bank makes profits.

Let’s understand how a bank makes profits.

Suppose total deposits and borrowings for a bank is 10,000 cr. Total loans + subscription to bonds is 8,000 cr. Suppose that the rate of interest the bank pays on liabilities is 5%. Then, the interest outgo is 200cr.

Suppose that the rate of interest the bank charges on assets is 10%. Interest earned is 800 cr. The net interest margin (NIM) is a term you’ll commonly see. NIM is the interest earned minus interest outgo as a proportion of interest earning assets. (800-200)/8000 = 7.5%.

The “spread” for the bank is the difference between interest rate for assets and interest rate for liabilities: 10% - 5% = 5%. The bank has other costs as well. Costs of running the branches, and money paid to employees, sales and marketing campaigns etc.

Key unit economics metrics to track for a bank are RoA and RoE. The first tells us how profitable the bank is as a proportion of its total assets (which includes the debt it takes). The second tells us the profitability as a proportion of its equity only.

You go from one to the other by leveraging (pun intended) the bank’s D/E ratio: which captures how much liabilities/debt the bank has as a proportion of its equity capital. The higher the D/E, the riskier it is. investopedia.com/ask/answers/07….

There are 2 key drags on a bank’s profitability. The first tracks its operating efficiency. It is the Cost-to-income ratio (CIR). It is calculated by dividing the operating expenses by the operating income generated: net interest income plus the other income.

The second tracks its lending efficiency. It is the Gross NPA (Non Paying Asset) of the bank. Remember the 8,000cr our bank gave out as loans + subscriptions to bonds? Well, not everyone will pay back the money.

There are RBI rules (rbi.org.in/scripts/BS_Vie…) around how to track non-payment but tl;dr is if you don’t pay for 90 days to a bank, a due EMI, then you become an NPA . This leaves a hole in the bank’s balance sheet.

The way to fill the hole is to set aside a part of your Profits to fill that hole. These are known as provisions. What is left of the metaphorical hole after the bank partially fills it with provisions is known as NNPA: Net NPA.

To Recap, there is the asset side, the liability side, profitability (NIM, RoA, RoE) and drag on profitability (CIR, GNPA, Provisions). Are we done? Nope.

The bank can do what is known as cross-selling and juice up its profitability by boosting its non-lending income. Many avenues: Banks can sell credit cards, create insurance or Mutual fund (MF) arms and manage assets, distribute others’ insurance or MF.

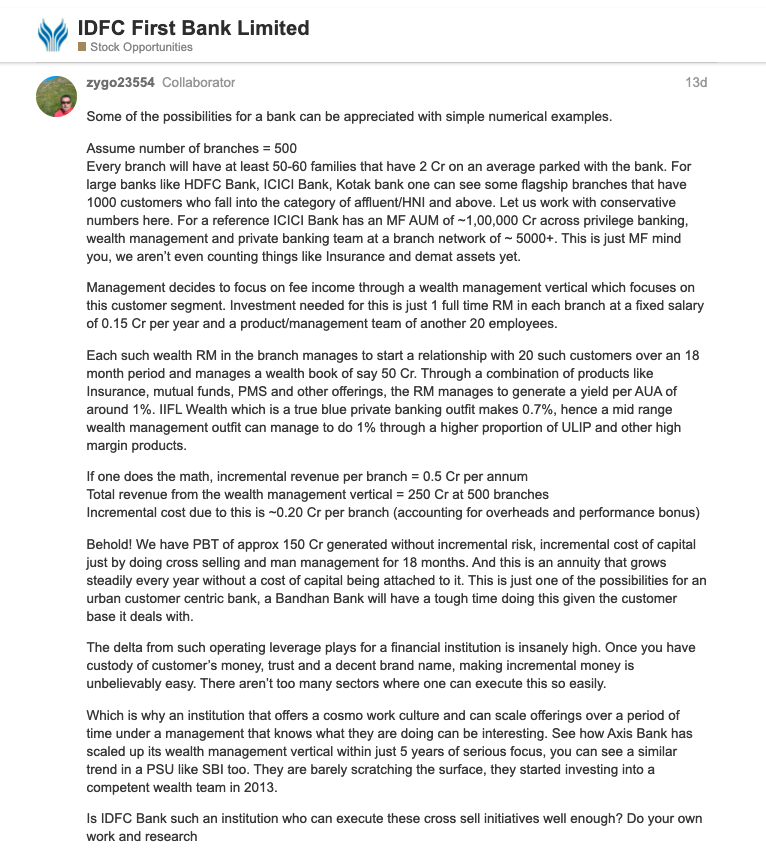

Here is a brilliant VP post on estimating just the tip of the iceberg that is cross-selling which IDFCF bank can do: forum.valuepickr.com/t/idfc-first-b… All credit to Kedar.

Let us now analyze the bank from the prism of asset side, liability side, profitability, Cost to Income, Asset Quality (NPAs), Cross-selling.

Liability Side. This is very important for a bank. Why? Because this is cheap money. HDFC Bank offers a 3.5% savings account interest rate. And then there are current accounts (used by businesses) where interest rate offered is 0%!

These two sources of funds are so important that they have an acronym: CASA. Banks need to do advertising and brand building in order for customers to develop trust in a bank and bring there CASA. There is another thing banks can do. Attract customers with high SA interest rates.

Not all banks can do this though. It depends on the kind of customers they are giving loans to. If these loans are at high interest rate (Say 14%) then bank can give 7% interest rate on its SA and attack customers.

You bring them in with the money motif and keep them for the better services and the marginally higher SA interest rate. This is exactly what #IDFCF bank did! Started out with 7% interest about a year and half ago, brought in truckloads of CASA.

Bank is now able to retain it due to the better services (my subjective judgement) and marginally better Savings interest rates of 4-5% (than large banks). And Fixed deposit rates of 6% (marginally better than big banks)

Look at the growth in CASA and CASA Ratio (en.wikipedia.org/wiki/CASA_ratio)! Due to this, bank’s dependence on costly borrowing from large lendees (CoD) has also gone down.

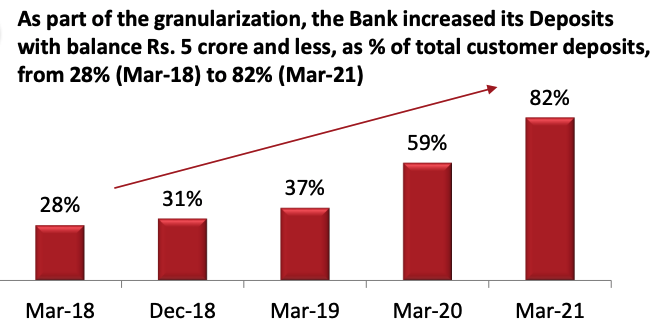

Not only does bank want to grow its customer deposits, bank wants to make the liability granular: chhota chhota deposits by many customers. Makes the liability side more sticky and less prone to large changes. Good progress has been made on that side.

Cost of funds (CoF, cleartax.in/g/terms/cost-o…) will go down even more as SA interest rates go down and high interest bonds are substituted by Retail CASA+TD. CoF was 6.8% for 9MFY21.

This is because SA rates were at 7% throughout. As SA rate is 4-5% now, higher cost bonds would be paid back early and CoF will go down. Meaning, lower interest outgo. Higher NIMs. Sweet.

Observe Interest bearing liabilities and trend in interest rates. Both will go lower. And quantum of borrowings will also go lower.

Summary of Liability side: Fast Growing CASA, Retailization of CASA, reducing interest rates on SA, CASA substituting higher interest borrowings.

Asset side.

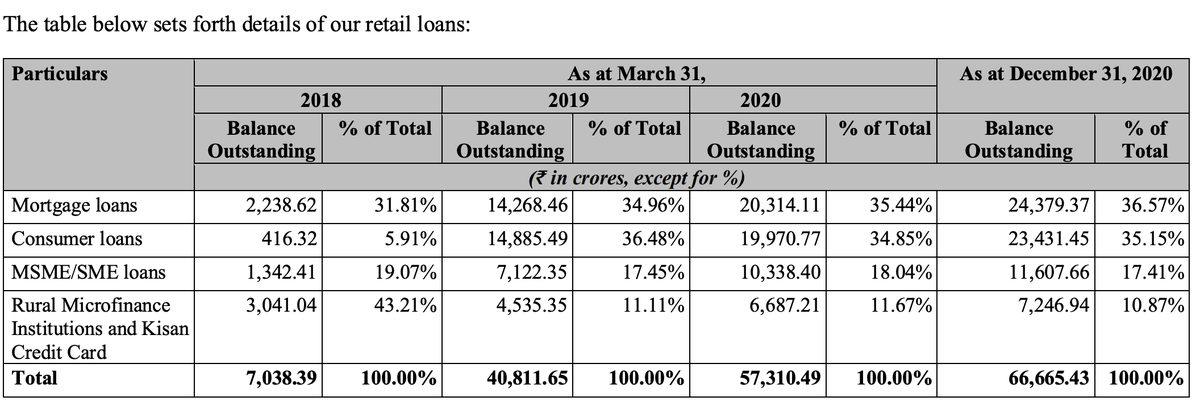

Here are the types of loans that the bank offers. Pay special attention to the very first tile. We will come back to this later.

Here are the types of loans that the bank offers. Pay special attention to the very first tile. We will come back to this later.

Similar transformation is playing out. Wholesale assets are corporate loans (large ticket size, some of them legacy & high risk like infra loans). Bank’s stated objective is to be a retail bank (on both sides). Wind down infra loans (risky, low NIM) to 0% of book.

Retail book has grown beautifully post merger (IDFC Bank + Capital First, haven't talked much about this coz dont find it that important to understand biz of the bank). Have consciously degrown wholesale book, and within that infra book aggressively.

Another perception about #IDFCFIRSTBank is that it lends to risky lenders. This has been somewhat true, historically speaking. But we are seeing a transformation here as well.

Look at how mortgage and consumer loans (low duration, low ticket size, given to high earning potential people like no cost EMIs) have gone up, SME has remained stable and Microfinance has gone down.

In the latest Q, bank has also started that reducing saving rate to 4% has enabled it to start a new segment. Prime home loan lending. Giving home loans to top corporate customers at low interest rates.

Bank also revealed other ways in which they are reducing risk of the assets:

Reduction in credit to first time borrowers, and increase in credit to customers with high credit scores.

Reduction in credit to first time borrowers, and increase in credit to customers with high credit scores.

Establishes a long-term (15-20 years) relationship with a high income high saving customer. Good cross-selling opportunity. Low NPAs. Lowers Balance sheet riskiness as well.

Let us establish why these trends are sustainable and will continue going forward. Bank has a lot of money in government securities. Some minimum amount they need to keep as per RBI guidelines, but above that, bank has simply parked excess liquidity here.

When this gets disbursed as retail loans, average yield would go up. Expanding interest income and NIMs. Sweet.

Summary of Asset side: Growing Retail loans, shrinking corporate loans, vanishing infra loans, increasing yields & interest incomes, expanding NIMs, reducing risk on balance sheet.

Drags on Profitability:Asset Quality

Pre-covid, bank’s GNPA was around 2.6%. Post covid, it has risen to ~4.1%. I personally think this is a great performance given that a large part of the book is lending to SME and Micro Finance.

Pre-covid, bank’s GNPA was around 2.6%. Post covid, it has risen to ~4.1%. I personally think this is a great performance given that a large part of the book is lending to SME and Micro Finance.

CEO has guided for long term stable GNPA of 2% financialexpress.com/industry/banki…

An interesting deep dive into the NPAs for the bank reveals some of the sectors which are most stressed. Infra contributes to half of all wholesale NPAs. (This is going to go away in steady state).

Drags on Profitability: Cost to Income Ratio

The Net Interest Income (NII, investopedia.com/terms/n/net-in…) for the bank was Rs 10,000 cr for FY21. But profits only Rs 450 cr. Why? Coz profits got eaten by up CIR and provisions.

The Net Interest Income (NII, investopedia.com/terms/n/net-in…) for the bank was Rs 10,000 cr for FY21. But profits only Rs 450 cr. Why? Coz profits got eaten by up CIR and provisions.

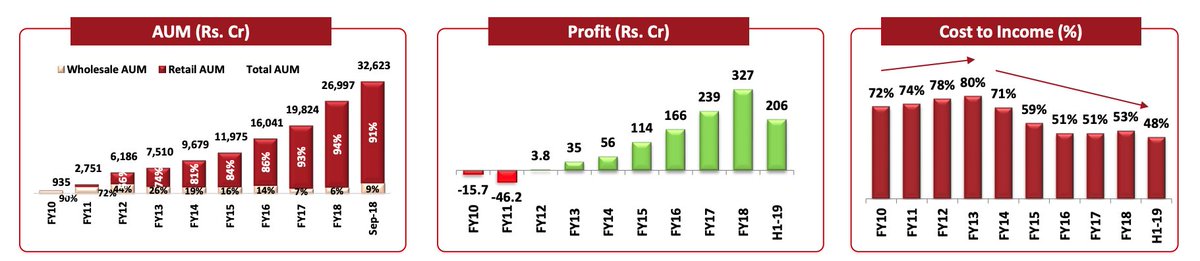

Bank is expanding fast. Needs to hire employees. Build/lease branches. The costs are front-loaded. Thus, the profitability is back-ended. As the OpEx and CapEx gets amortized over a larger AUM and CASA, CIR will come down. Has happened before for Capital First.

What will happen is that the OpEx will grow slower than AUM/CASA and that way, operating leverage will play out, resulting in increased Net Profits. This is also the reason why the retail segment shows constant losses right now.

Cross-selling. The icing on the cake. Bank has already launched a credit cards business. And it is an innovative one. Instead of giving constant high rate of interest on credit which all banks give, IDFCF bank will lower interest rate depending on one’s credit profile. Sweet

Bank wants to promote credit card as a means to get “credit”. 9-15% interest for a short duration is not something most customers that are ok with taking credit would mind. No interest on short term cash withdrawals. Sweet.

Even the reward points were better than my current HDFC bank credit card! Read more here:

idfcfirstbank.com/credit-card. The cross selling opportunity has only started.

idfcfirstbank.com/credit-card. The cross selling opportunity has only started.

There is a surprise in this thread. We already analyzed the bank from the prism of asset, liability, profitability, Cost to income, NPAs, cross selling. But we haven’t looked at the MOST important thing.

Why? Numbers are only as trustworthy as the management in a bank. There are hazaar ways for management to hide bad assets, or manipulate the P&L if they want to. Heck, even the NPAs only become NPAs when management recognizes them as such.

So let us analyze why I like the management of IDFCF bank

1. They give their own score-card every quarter. Management had set some 5 year goals when merger happened. Quarter after quarter they show progress on these. Almost never seen management make it so easy for investors to track “walk the talk”.

2. It’s the little things that matter. Bank recognized Vodafone Idea as stressed asset (and this was a large one at around 3% of book) and created a 50% provision when the SC AGR dues judgement came. Not many other banks did this aggressively.

economictimes.indiatimes.com/markets/stocks…

economictimes.indiatimes.com/markets/stocks…

3. When they state their profits or other metrics which companies maximize, they always try to focus on calling out the one-offs, state with and without the one-offs. Few examples from latest Investor presentation.

4. Bank proactively reveals the stressed book (non NPA but chances of it becoming NPA). Observe how stressed book has been degrowing but provisions for stressed book (these are not NPAs, so bank creating provisions for them is conservative, pro-active lending).

6. CEO has said in multiple interviews that they would never delay recognizing an asset as NPA. Won’t be afraid of doing so. I know many ppl would say: how can we trust him? Fair point. I do, others can choose to not. At least he says the right things.

Now the most important section, the risks.

1. If bank does not follow conservative underwriting processes, NPAs could blow up and eat into NIMs.

1. If bank does not follow conservative underwriting processes, NPAs could blow up and eat into NIMs.

2. There will be few years of low profitability as they expand branch network and OpEx grows without significant loan book growth (since infra loans are being wound down)

3. Any covid wave would cause short term pain to the bank’s lendees.

3. Any covid wave would cause short term pain to the bank’s lendees.

End of a 63 65 tweet long thread. If you liked it, please RT the first tweet. Many retail investors are invested in IDFC first. Deserve to understand the business well.

4. Prime lending would cause some downward pressure on NIMs.

Disclosure: invested since Dec 2019. Largest investment, so positively biased. This is not an investment advice, purely for educational purpose.

• • •

Missing some Tweet in this thread? You can try to

force a refresh