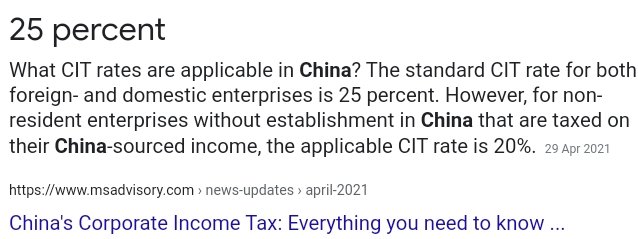

#YELLEN WANTS THE #G7 TO FOLLOW #CHINA'S STEPS

Levying the Corp Tax on foreign Cos operating at home (🇨🇳has a 20% rate)or abroad, is illegal.

It deprives those foreign companies of the export revenues of their multinationals that would be taxed by the countries they are based on.

Levying the Corp Tax on foreign Cos operating at home (🇨🇳has a 20% rate)or abroad, is illegal.

It deprives those foreign companies of the export revenues of their multinationals that would be taxed by the countries they are based on.

https://twitter.com/CarlosVignote/status/1402099896753147915

Yellen's proposal could be a 15% rate on foreign Cos subsidiaries of 🇺🇸Cos w/ a 15% min Corp Tax & a credit of 100% of the foreign rate.

🇨🇮example: 2.5% effective rate on the 🇨🇮subsidiaries of🇺🇸Cos vs 0.5% today.

The tax rate is an issue within a region(🇪🇺,🇺🇸,etc),not among them.

🇨🇮example: 2.5% effective rate on the 🇨🇮subsidiaries of🇺🇸Cos vs 0.5% today.

The tax rate is an issue within a region(🇪🇺,🇺🇸,etc),not among them.

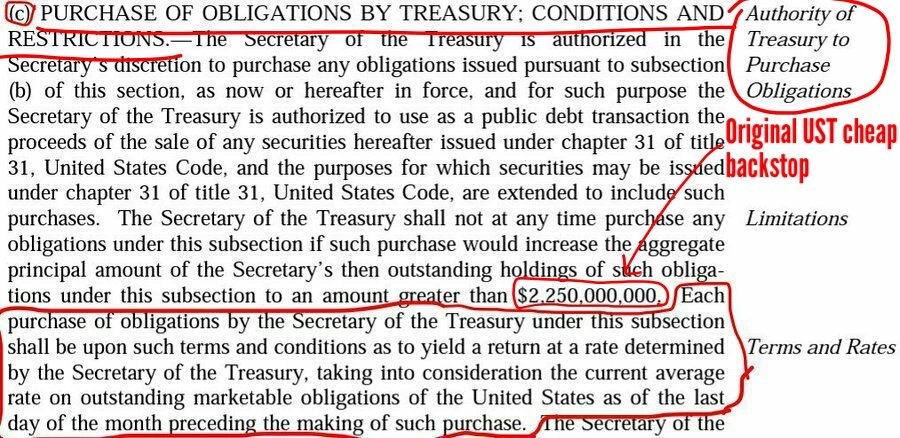

NO CORP TAX ON FOREIGN COMPANIES

Either operating at home or on the foreign subsidiaries of local Cos operating abroad(services Cos)

If they are manufacturers,they must ship their products from home,be taxed at home.🚨The country accumulates forex reserves.@USTreasury @WhiteHouse

Either operating at home or on the foreign subsidiaries of local Cos operating abroad(services Cos)

If they are manufacturers,they must ship their products from home,be taxed at home.🚨The country accumulates forex reserves.@USTreasury @WhiteHouse

So,what🇨🇳has is a 20% Import Tariff.Later,the #G7 follows suit as part of joining all🇨🇳's initiatives:Belt & Road initiative,#coronavirus hoax to create 1,000s of Municipal/First Responders/Health Care-related jobs(#Biden:"the guy that holds the arm while being vaxxed"),masks,etc

• • •

Missing some Tweet in this thread? You can try to

force a refresh