ReconAfrica – No Oil? Pump Stock. Viceroy's latest report is now live

@viceroyresearch is short Reconnaissance Energy, a oil junior specializing in stock promotion & insider enrichment. $RECO is a bad operator, on the ground & in the markets.

viceroyresearch.org/2021/06/24/rec…

#thread 1/

@viceroyresearch is short Reconnaissance Energy, a oil junior specializing in stock promotion & insider enrichment. $RECO is a bad operator, on the ground & in the markets.

viceroyresearch.org/2021/06/24/rec…

#thread 1/

RECO’s mining assets are not highly speculative: they are borderline imaginary. Once it’s promotional veil has been pulled back, we believe $RECO will revert to trading as a speculative, but highly unimpressive, penny-stock. $RECAF $0XD:FRA 2/

$RECO consistently markets its exploration allotment as a potential shale (unconventional) play, highlights the drilling campaign is to confirm “organic rich shales”, showcases a scenario valuation based on shale, and commissions engineering reports on unconventional basis. 3/

Unconventional exploration is banned by the Namibian Government. Namibia’s Petroleum Commissioner, Maggy Shino, confirms “there is no way we will license $RECO or any other company to carry out fracking or unconventional hydrocarbon exploration in Namibia”. 4/

$RECO commissioned Sproule to prepare a prospective resources report on license areas in Namibia and Botswana. Sproule point out that there is no real data supporting their report. It is a purely conceptual model based on analogues in other countries, even other continents. 5/

Once again, Sproule’s engineering report represents only unconventional assets, which is not extractable in Namibia or Botswana. Without corrections, this information $RECO has been pay-promoting down the throats of unsophisticated investors. 6/

Having an invalid engineering study, facing immense public scrutiny for unconventional promotion, and no geographic analysis: $RECO backflipped, stating they had “clear evidence of a working conventional petroleum system” . This means nothing. 7/

Sproule’s assignation of commercial success to $RECO 's operations is just 3.3%, inflated by their assumption of (illegal) unconventional exploration. Penny stock junior explorers in Canada report 30% chances of commercial success and contingent resources. 8/

RECO’s “Kavango Basin” appears to be a work of geo-fantasy by $RECO management using legacy data. We find it more likely that the license area is over the Owambo basin: a thoroughly explored and disappointingly dry basin in Northern Namibia. 9/

$RECO hinge promotional updates on “high-resolution aeromagnetic data”. Industry standard is to confirm aeromagnetic data with 2D or 3D seismic data before drilling. 10/

Even if this basin did contain commercial conventional resources, $RECO is years and tens-of-millions of dollars away from drilling an exploratory well with any chance of discovering commercial oil or gas. 11/

$RECO promotional cross-sections of license areas are implied to be independently, but independent contractors appear to be employees of $RECO’s technical team. “Facts” from this data are rife with ridiculous caveats: 12/

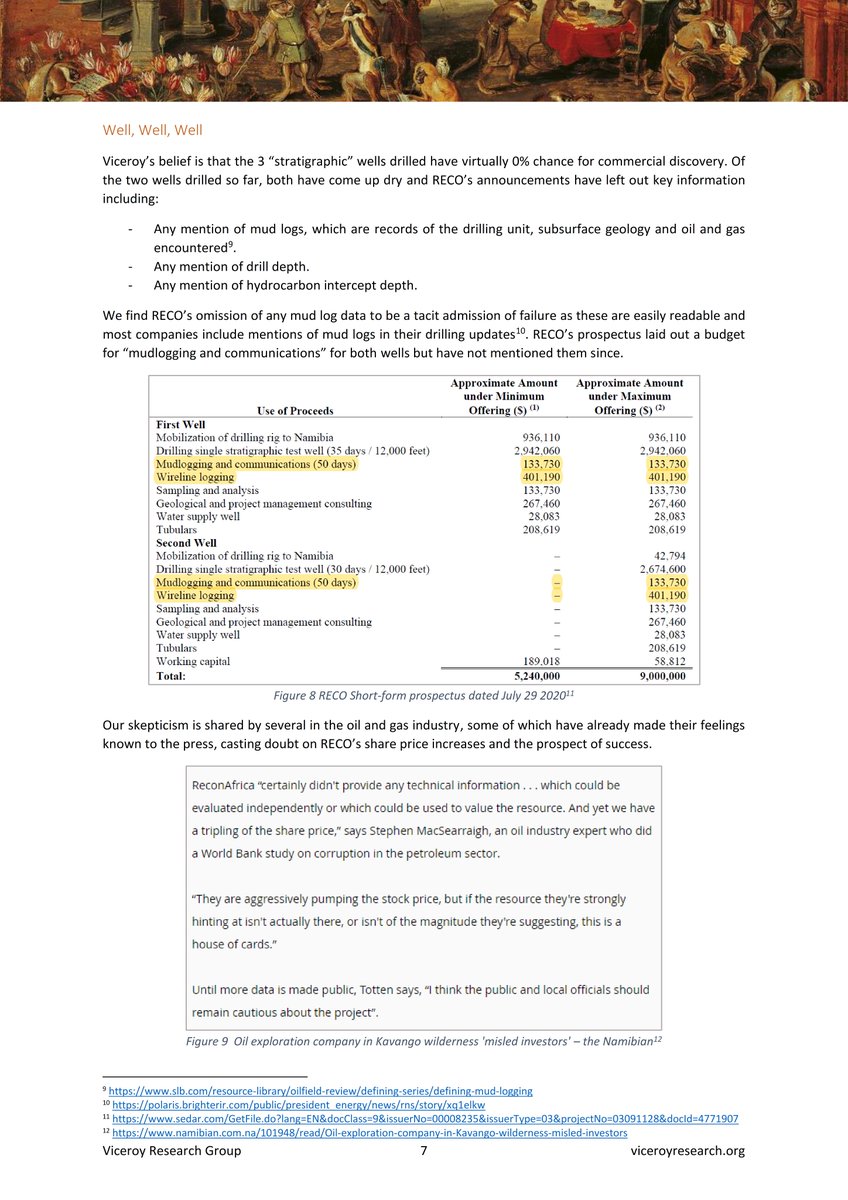

RECO’s drilling of 3 stratigraphic wells is to swindle investors & fulfil immediate commitments to NAMGOV to retain their leases. $RECO appear to have no intention on releasing any meaningful well data because they were likely colossal failures. 13/

Viceroy Research confirm $RECO mudlog data was made available to NAMGOV. We challenge $RECO to release this data to the public (as any other transparent junior minor with alleged world-class assets would do). 14/

RECO’s cheerleading includes the ridiculous proposition that big oil is lining up to partner with them. Industry partners will want to review well data. Given that $RECO are not releasing this information (because the wells were failures), a partner proposition is ludicrous. 15/

As for $RECO ’s JOA with NAMCOR: Namibia’ Petroleum Commissioner Maggy Shino Confirms this is a standard document, and requirement for EVERY EXPLORATION LICENSE ISSUED IN NAMIBIA. To be abundantly clear: every oil explorer in Namibia has a JOA with NAMCOR. 16/

RECO’s sprawling ESG concerns are captured by the great investigative journalism from @JeffreyBarbee & @LaurelNeme. 17/

nationalgeographic.com/animals/articl…

nationalgeographic.com/animals/articl…

By Namibian law, $RECO was required to manage drill cuttings, which are the runoff waste from test drilling, so that they do not seep back into the ground via lined pits. NatGeo investigations show this was not the case. 18/

The major implication of RECO’s obsession with promoting water resources is that water resources are only really significant to unconventional mining, which $RECO cannot conduct! 19/

The rise in RECO’s share price has been accompanied by several shill pieces commissioned by $RECO. These campaigns are clearly aimed at unsophisticated investors unfamiliar with oil and gas exploration. 20/

$RECO has spent, at least, in the high 6-digit figures promoting their stock through YouTubers and other unlicensed stock promoters. These include a FINRA-sanctioned broker who proclaims to engineer a short squeezes. 21/

One such promoter was paid CAD 120k to promote $RECO, and hilariously (in a pathetic way) claimed that Namibia’s oil prospects are favorable based on how many dinosaurs once roamed the area. 22/

Until called out by the press: $RECO retained controversial Namibian businessman Knowledge Katti, who privately brags about using political connections to “do the magic” with government officials. 23/

Knowledge Katti’s antics in the oil and gas industry were exposed by The Namibian in 2017, and perfectly state that Mr Katti has “previously profited from the perception that Namibia has oil deposits”. We have flagged this relationship with regulators globally. $RECO 24/

Viceroy was entirely unsurprised to find checkered histories and a slew of failed oil ventures in the wake of $RECO management. This is a summary of our findings. We will make the entirety of our findings available to regulators. 25/

Chairman & Former CEO Jay Park was implicated in Griffiths Energy bribery scandal: the bribe was transferred through Griffiths’ law firm, of which Park was the Senior Partner, to the Chad officials. Griffiths’ oil fields was similarly an uncommercial disaster. $RECO 26/

UN Sanctions experts also questioned Park’s conflict of interest acting as an advisor to the Somali government, while being concurrently paid by British company Soma Oil and Gas, which was actively negotiating an oil and gas contract with Somalia. $RECO 27/

Craig Steinke is the founder and largest shareholder of RECO. Viceroy’s investigations suggest Mr. Steinke is a $RECO shadow director. 28/

Steinke is also the largest shareholder, founder, CEO & director of Renaissance Oil, acquired by $RECO in May 2021. Through this relationship, he has shamelessly pushed large uncommercial (poorly disclosed) related party RECO transactions to enrich himself. 29/

Steinke’s Biography on Renaissance Oil Corp’s website notes experience with the Marcellus Shale projects, which continue to face environmental scrutiny since operators were put under the spotlight in the 2010 documentary Gasland. $RECO 30/

The only relevant experience we can find for Steinke anywhere near Marcellus is a brief Chairman position in Storm Cat Energy. Storm Cat filed for bankruptcy when the price of natural gas collapsed and left over 2,000 methane wells unrehabilitated in Wyoming. $RECO 31/

Steinke was the CEO of R2 Energy Limited, who procured fracking projects in Spain to no avail due to anti-fracking opposition. Had this project commenced, they would bankrupt after the collapse of natural gas prices. The rehabilitation would be left to the Spanish taxpayer. 32/

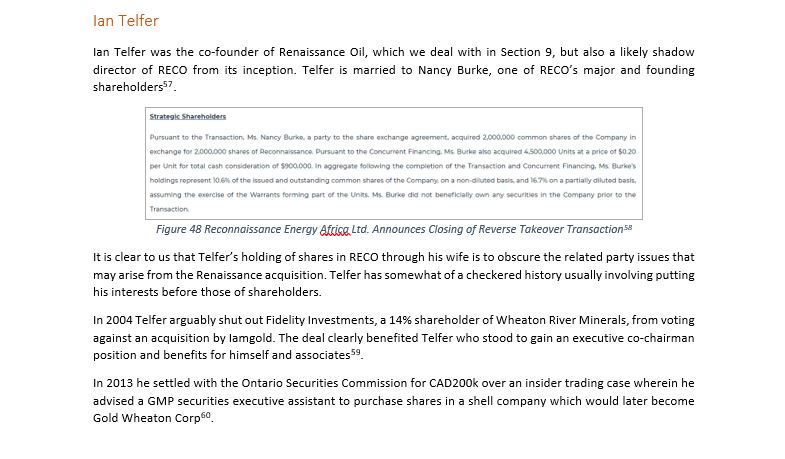

Ian Telfer was the co-founder of Renaissance Oil, but also a likely shadow director of RECO from its inception. Telfer is married to Nancy Burke, one of $RECO ’s major shareholders & co-founder. Again, this was not disclosed as a related party transaction with. 33/

In 2013 Telfer settled with the Ontario Securities Commission for CAD200k over an insider trading case wherein he advised a GMP securities executive assistant to purchase shares in a shell company which would later become Gold Wheaton Corp. $RECO 34/

Renaissance Oil and $RECO also shared the same CFO at the time of the acquisition. Go figure. This does not make an arm’s length transaction possible. 35/

US-Sanctioned Russian oil company, Lukoil, was a major Renaissance Oil shareholder. It has failed at every step to capitalize onshore assets in Mexico, and is a constant going-concern risk. Mexico banned fracking in June 2020: Renaissance assets largely unconventional. $RECO 36/

A convoluted transaction engineered by insiders saw Telfer & Steinke capitalize on millions of RECO stock at the expense of $RECO shareholders for a largely worthless asset. 37/

Management brazenly promote company stock while concurrently selling stock on the open market and issuing fat bonuses with opaque benchmarks. $RECO 38/

Viceroy believe $RECO will revert to trading as a speculative, but unimpressive, penny stock. 39/39 #endthread

• • •

Missing some Tweet in this thread? You can try to

force a refresh