1/x Let me tell you about one of the moatiest businesses you've never heard of. Pour yourself a cup of coffee and let's go..☕️

🇺🇸 Copart $CPRT

- Physical economies of scale

- Digital marketplace w/ trusted brand

- Unsexy but critical niche

- Reinvestment moat, 20-30% RoIC

🇺🇸 Copart $CPRT

- Physical economies of scale

- Digital marketplace w/ trusted brand

- Unsexy but critical niche

- Reinvestment moat, 20-30% RoIC

2/x Copart was founded in the early 80s by Willis Johnson (left), the now 73 y/o Chairman & 2nd largest shareholder, after a 10+ year career in the salvage industry. It was "bootstrapped" until the early 90s, when Willis heard that their biggest competitor $IAA should go public.

3/x Wall Street had never really entered Johnson's mind before that point, but when people told him he could expand even faster with outside funding, he figured that might be a good idea after all. The market opportunity was massive, and expansion would be expensive.

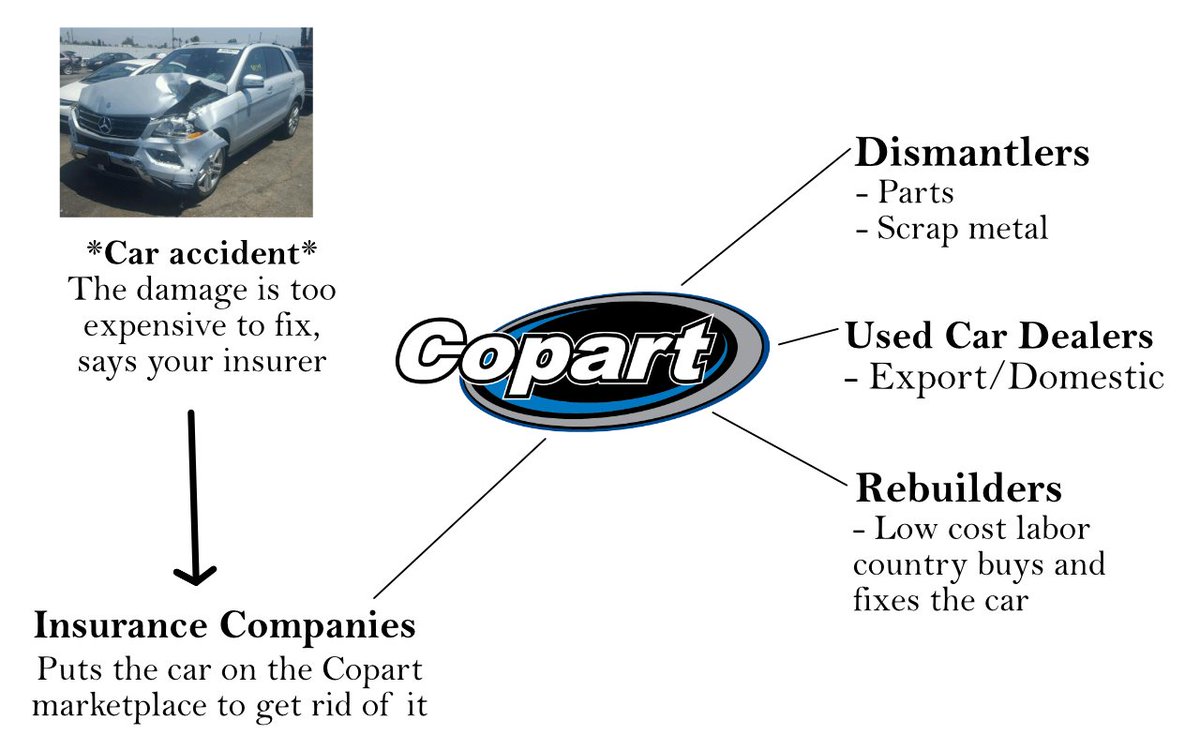

4/x So.. what does Copart do? Their niche is actually dinged up cars. As this illustration shows you, for every car accident the car owner's insurance company has to take some kind of action, and basically if the expense of fixing it is too high they auction it away on Copart.

5/x So, it's a marketplace? Yes, exactly. In the early days they tried the IAA model, to buy totalled cars from insurance companies and then auction them out themselves for profit, but soon realized that wasn't the way to go. They instead became a one-stop-shop middleman.

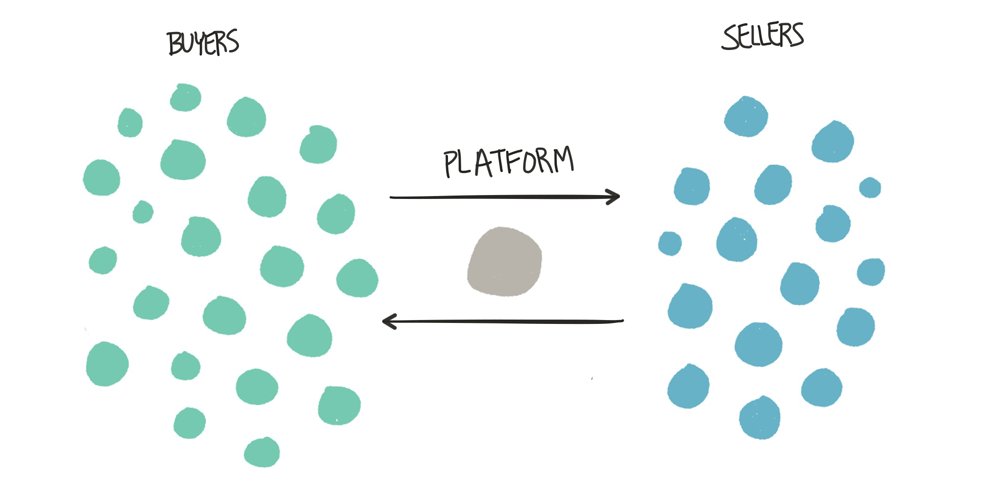

6/x What is needed for a marketplace business to succeed? Both huge supply and huge demand. That is hard, and that's exactly why it's such a powerful business once a dominant market position is established. Copart is by far the largest marketplace of it's kind today.

7/x The switch from buying the cars themselves to instead offer a marketplace, now with global scale because of the internet, gave both Copart and the insurance companies better unit economics. Win-win. That of course created a huge supply, which in turn increased demand.

8/x One of the key reasons behind Coparts success in my opinion is their early understanding of the internet. The spent thousands of dollar on computers when competition still used pen and paper for their car records, and was also the first car auction site with pictures online.

9/x Another key reason obviously is their *huge* investments in physical infrastructure. Copart don't just offer a digital marketplace, they offer to take care of everything surrounding the transaction (except transport in some markets, depending on where in the world you live).

10/x Just like with $AMZN, the physical part of the business just strengthens their digital offering. For Amazon, logistics and fulfillment centers created a huge advantage. $CPRT now has 200+ massive salvage yards around the world, and handle +175K auctions daily.

11/x The complexity and capital intensity of making this physical + digital network work seamlessly together is a huge barrier for competitors. It's obviously impossible to verify, but I definitely think Buffett's classic quote on $KO would be applicable on $CPRT as well.

12/x I really liked the Disneyland framework that Willis wrote about in Junk to Gold, which basically explains what all fantastic companies do over time; create a bunch of different revenue streams on top of their core business. Makes me think of names like $BABA, $AMZN & $GOOG.

13/x And much like $COST, Copart started out in the US (and still have the majority of their sales domestically >80%, although this includes exports) but are now leveraging their volume/cost advantage by taking on the world. To date, they have 8500+ acres of land in 11 countries.

14/x I'll keep this thread a little light on details, but studying the underlying market trends for Copart one can see a clear upward trend in stuff like 1) vehicle complexity, which means more expensive repairs, 2) miles driven and 3) overall total loss frequency.

15/x The trend towards more semi-self driving cars will probably also increase collisions as well during the learning period (next 10+ years?), and it's obviously a *long* time (most likely decades) before a zero collision environment with Level 5 autonomy is a global reality.

16/x So, what do we have here? A dominant digital marketplace business in a complex niche where volume (i.e. revenue) is driven by both underlying talwinds and customer satisfaction, who've spent more on physical infrastructure the last 5 years, than the previous 21.

17/x $CPRT has been running a conservative shop all it's business life, with Willis in the driver's seat and his son-in-law Jay Adair by his side since 1989, when he was 19. Jay himself became CEO in 2010 and has maintained the same philosophy, despite investing aggressively.

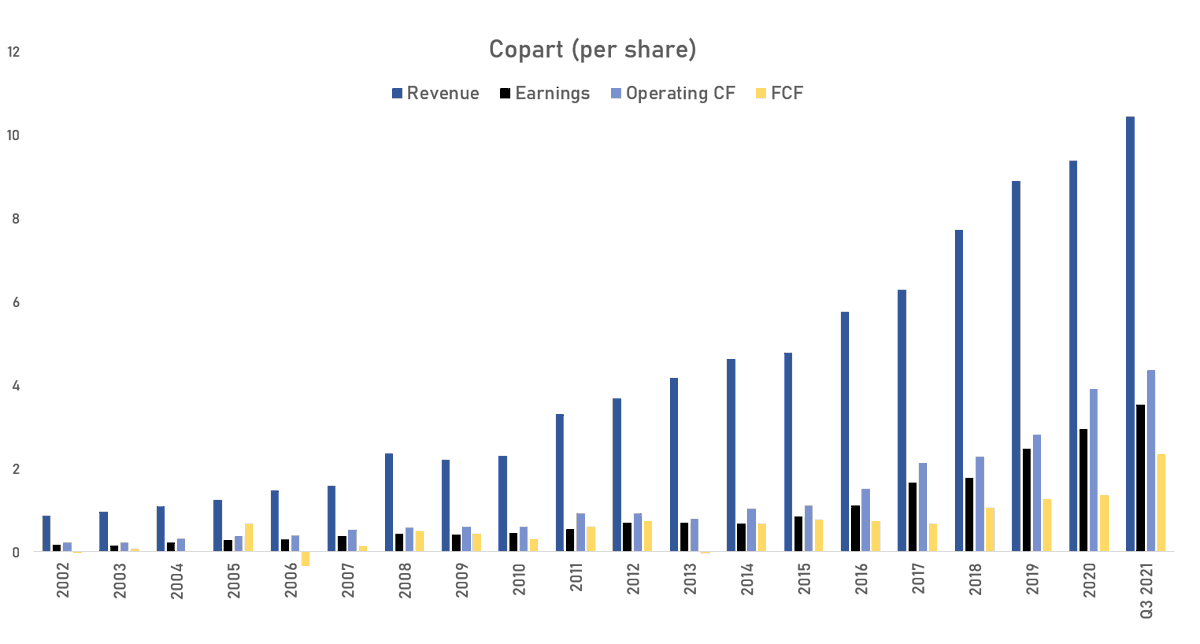

18/x The conservative yet long-term oriented capital allocation has led to a fantastic per share performance, with revenues growing 12x and earnings 22.5x the last 20 years. The number of shares has decreased -36% during the same period because of buybacks.

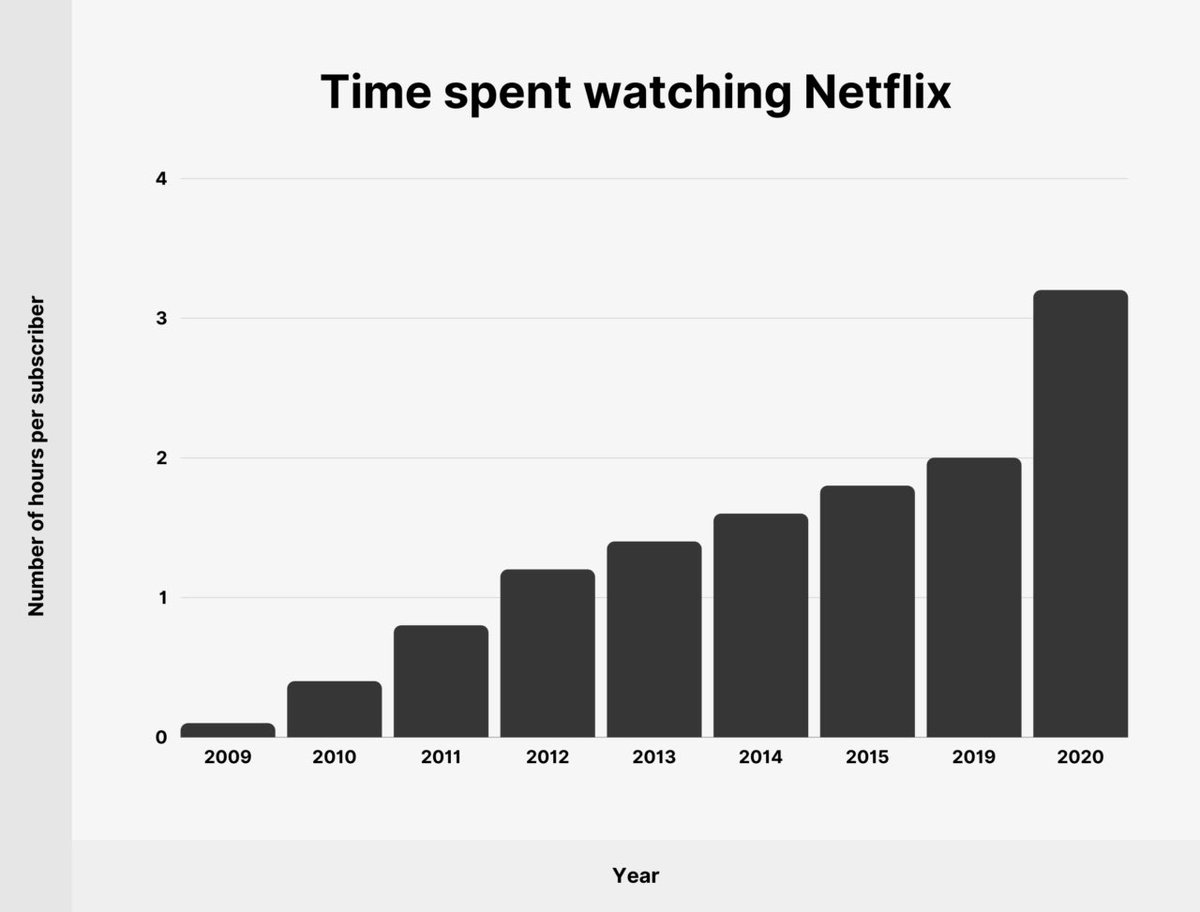

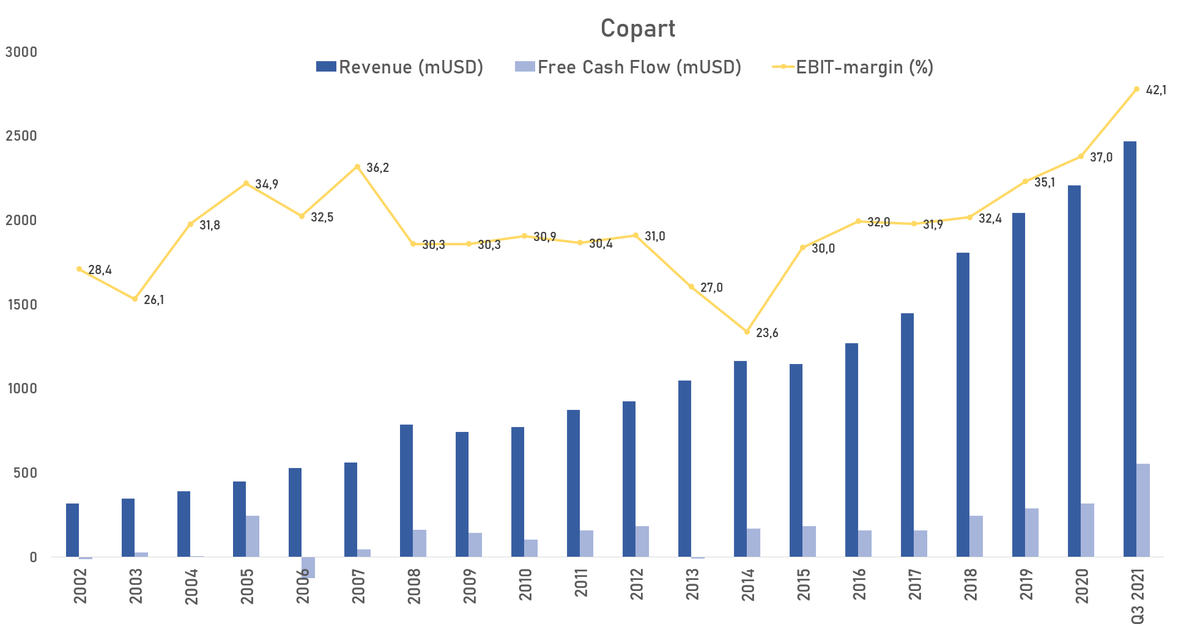

19/x The last year and a half has been exceptional margin wise, and that is basically because $CPRT haven't been able to put enough capital to work. Just like with $NFLX, the pandemic gave us a glimpse of how profitable a "steady state" might be without constant reinvestments.

20/x As a long-term shareholder it's hard to argue against constant reinvestments when the returns on capital look like this👇🏼 Perhaps the buybacks might be arguable, I haven't put much thought into that tbh. Either way, this is a world class business by any metric.

21/x Another quality stamp is that Willis and Jay still own a fairly large chunk of the company together, despite $CPRT market cap of >$30B. From what I know there's also lots of board members, C levels and lower ranked executives in the org. that own sizeable personal chunks.

22/x So.. what about valuation? Looking at NTM, consensus says 65x Free Cash Flow. Sounds frothy? FCF is expected to drop 25-30% y/y because of Copart putting lots of capital to work again. So that might not be a great multiple to look at. Instead, looking at EV/EBIT, it's 25x.

23/x Let's assume $CPRT stopped reinvesting their cash flows right now & optimized for profitability, I imagine they could do an easy >35% FCF. And with the 10-15% expected growth rate we are fairly soon down to a single digit FCF multiple. The same applies to GAAP EV/EBIT..

24/x i think the competitive characteristics of $CPRT demands a much higher multiple. I mean they are basically impossible to stop, and the increase in volume will just keep pushing up margins over time. I feel the moat here is misunderstood and/or underestimated.

25/x Despite being a >200-bagger since IPO, I think $CPRT has lots of multibagger potential over the next decade aswell. What made me look closer was the fact that both @SvnCapital & @chriswmayer own shares, who I respect a lot. All three of us also have $EVO as a large position.

• • •

Missing some Tweet in this thread? You can try to

force a refresh