On popular demand and @LuckyInvest_AK sir’s guidance, here is the thread to understand the business of #mastek

If you find it useful, please retweet _/\_ so that other investors can also benefit.

If you find it useful, please retweet _/\_ so that other investors can also benefit.

https://twitter.com/sahil_vi/status/1408361399424671751

@LuckyInvest_AK Before mastek, let us understand the industry it operates in. Broadly speaking, the IT industry is an enabler for all businesses, automating those business tasks for them which are somewhat incidental to the core business. As an example, consider #ITC & their ITC store.

@LuckyInvest_AK ITC has its own ecommerce store from which products are ordered. Building out this IT product: the backend & the app, are incidental to the core business (FMCG brands) of ITC. Some companies choose to build and maintain in-house IT teams. Others, outsource it to IT companies.

@LuckyInvest_AK Traditionally, IT services consisted of bespoke applications and services being developed by the IT companies for their clients. Lets take an example of ITC. While the IT company would develop the backend for the ecommerce portal, the code would have to run on ITC’s servers.

@LuckyInvest_AK This was obviously an overhead for ITC, and all such companies.

Enter Cloud Computing. The core premise of cloud computing is that organizations can rent computers running in cloud provider’s datacenters and run their applications on these cloud computers.

Enter Cloud Computing. The core premise of cloud computing is that organizations can rent computers running in cloud provider’s datacenters and run their applications on these cloud computers.

@LuckyInvest_AK Big players here are AWS (Amazon web services), Google Computing Platform (GCP), Microsoft Azure. Fast growing players here are GCP, Oracle Cloud, Microsoft Azure:

cloudwars.co/google-cloud/t…

cloudwars.co/google-cloud/t…

@LuckyInvest_AK This brings us to the specific sub-industry of IT that everyone and their mom wants to operate in. Digital Transformation.

@LuckyInvest_AK Digital transformation is the process of using digital technologies to create new — or modify existing — business processes, culture, and customer experiences to meet changing business and market requirements.

@LuckyInvest_AK Old Age Business: Physically sell goods to customers, chitter chatter and listen to their feedback with your biased mental filters. Dismiss some of it incorrectly, act on some of it.

@LuckyInvest_AK New Age Business: Let customers order goods on platforms like Amazon, Dunzo or your own customer ecommerce platforms. Mine customer tweets to understand their pain points.

@LuckyInvest_AK Run sentiment analysis to understand overall brand perception transformation and see it improve as a result of remedial actions taken.

@LuckyInvest_AK So what kind of services does a new age business require in its digital transformation journey?

1. Custom application development: Each business is unique and thus each business’ needs are unique.

1. Custom application development: Each business is unique and thus each business’ needs are unique.

@LuckyInvest_AK 2. Application Maintenance & Support: Once these applications have been developed, they need to be maintained as well. Think of Apps and code as a network of nodes, interdependent on each other. The app is the final node of the network visible to the customer.

@LuckyInvest_AK Dependencies often span across open source code which itself evolves over time. This is what creates a need for maintenance and support.

@LuckyInvest_AK 3. On-prem to cloud migration: Most traditional businesses have some on premise computing device and data. That needs to be migrated to a cloud solution. A major part of this for most organizations is ERP: Enterprise resource planning

@LuckyInvest_AK 4. Assurance and Testing: Making sure all the codes exactly as intended. Giving “formal” proofs of correctness (mathematically) when required.

@LuckyInvest_AK 5. Data & business intelligence : Did you know, that each second, 1.7MB of data is created per human in 2020. The amount of data created globally roughly doubles every 3 years. But where does all this data come from?

@LuckyInvest_AK Well, as the number of digital devices (phones, tablets, smart fridge, smart TV) grows; as the number of applications (whats app, Twitter, YouTube) grow and as more and more people come online, all these nodes (humans, apps, devices) communicate with each other.

@LuckyInvest_AK Embedded somewhere in all this mountain of data are insights which can transform businesses. Help them understand their customers better. Help them understand their own supply chain better.

@LuckyInvest_AK All this *BIG DATA* (yes, it is big) needs to be processed at source (the device where it is generated), warehoused (stored in client cloud servers), processed again for insights. This huge ballooning of data is why AI, ML, analytics have become buzz words.

@LuckyInvest_AK Everybody and their mom want to become a data scientist/analyst.

@LuckyInvest_AK 6. Consulting: Often times, clients dont even know what they need. In such cases

Digital transformation companies need to leverage their past experience, look at the business in front of them and propose the correct digital transformation journey, then execute it.

Digital transformation companies need to leverage their past experience, look at the business in front of them and propose the correct digital transformation journey, then execute it.

@LuckyInvest_AK 7. Digital Commerce: Especially with the advent of the pandemic, there is a need for offline stores to complement their offline presence with an online presence. It cos help them build the full commerce stack online.

@LuckyInvest_AK All of these are exactly the business verticals of #Mastek of today. It used to be a traditional offshore IT company. In FY16, 48% of revenues of mastek used to come from digital solution providing. That number today stands close to 75-80%.

@LuckyInvest_AK Another interesting thing about mastek is their sharp fall in revenues from FY15 to FY16. This happened due to their divestment of Majesco (insurance service provider). This is what started mastek on its journey to become a digital transformation solution provider.

@LuckyInvest_AK One thing we have to understand about IT business is that primary costs are computers and employees. Both scale sub-linearly with revenues which leads to significant operating leverage and very attractive unit economics.

@LuckyInvest_AK When the company is very large and cant grow very fast (TCS), they prefer to return the cash back to shareholders via buyback or dividend. Midcap and Small IT cos which can grow much faster try to grow fast organically.

@LuckyInvest_AK But as one can imagine, beyond a certain healthy clip, one cannot grow that fast organically because processes (like hiring and company culture) do not scale that well.

@LuckyInvest_AK Another observation to be made is that each co at any point in time has a specific set of advantages or historic strongholds. But technology keeps evolving.

@LuckyInvest_AK Blockchain, Internet of Things, Smart devices, Reinforcement Learning & many more technologies make it difficult for a co to develop all tech capabilities in house. This is why all IT companies but specially small and mid sized ones with larger aspirations indulge in acquisitions

@LuckyInvest_AK One such acquisition done by Mastek is EvoSys. While #mastek ’s traditional strongpoint has been digital application and commerce development, evosys brings with it Oracle Cloud expertise.

@LuckyInvest_AK Evosys is Oracle’s largest partner for SAP Compete program. It even features in Garner’s Magic quadrant for Oracle cloud services as a top 10 player.

@LuckyInvest_AK This has proved to be one great bolt on acquisition. 1+1 = 3. Multiple cross and co sell opportunities. Ability to grab a larger share of the customer wallet goes up significantly. Evosys helps customers come on Cloud, Erstwhile mastek enables digital transformation of their biz.

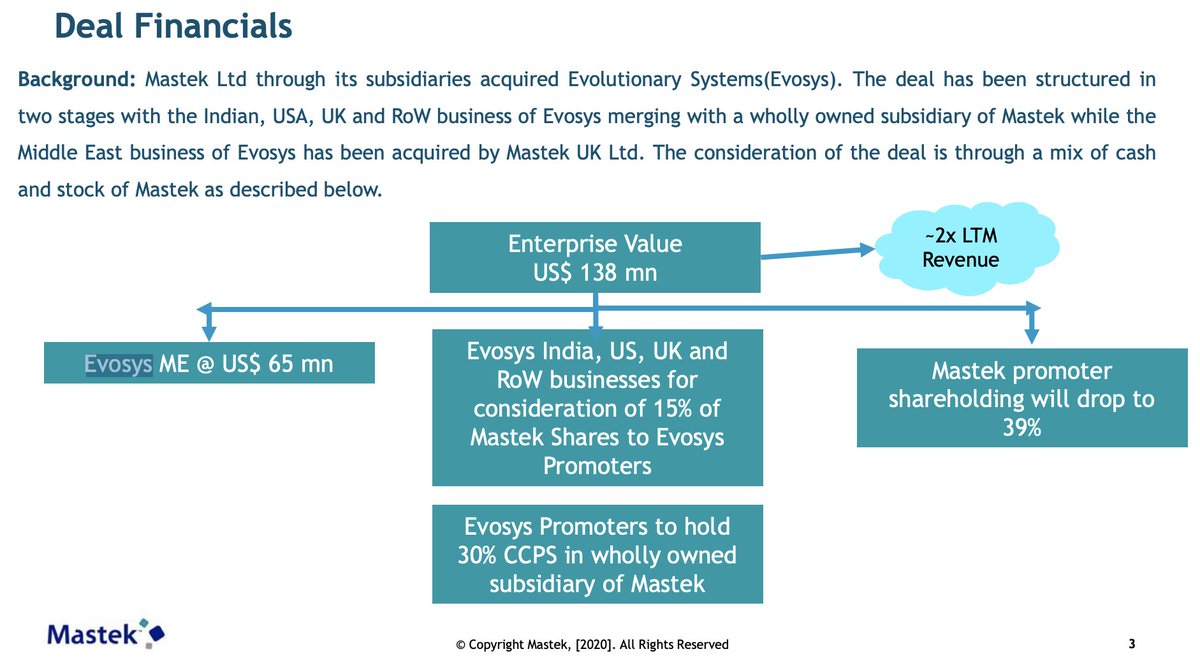

@LuckyInvest_AK This has also proved to be great capital allocation. EvoSys was acquired for EV of ~140M$ at ~2x TTM Sales. EvoSys is one of the foremost oracle cloud partners, and was growing topline at CAGR of 40%+ pre-merger.

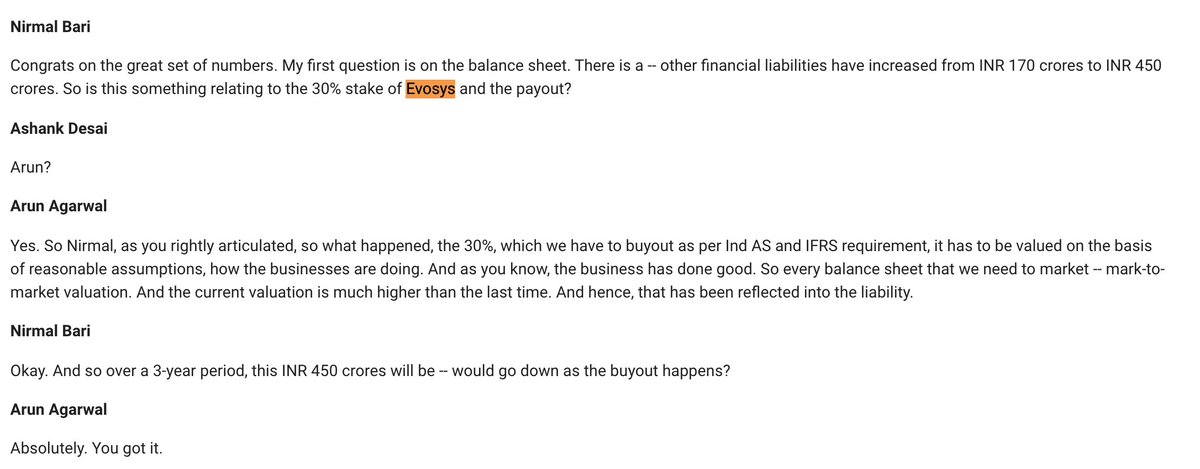

@LuckyInvest_AK You might see some contingent liability numbers on balance sheet. These are largely to do with the remaining part of evosys acquisition deal which will happen over next 3 years.

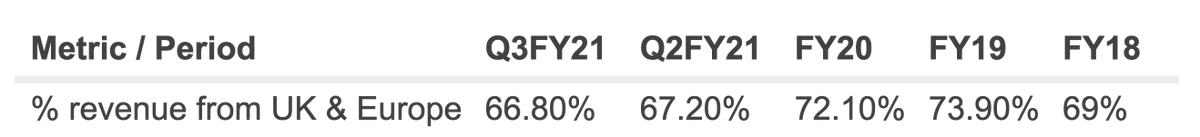

@LuckyInvest_AK Traditionally, Mastek has been a co which has derived a lot of its revenue from UK. Mastek is in fact one of the key partners in UK governments’ healthcare digitization plan. It also implemented the London congestion charge collection project in 2000s.

@LuckyInvest_AK This has been one key source of strengths as well as risk for Mastek (over-reliance on UK geography and also on UK government orders). Management is fully awake and is working overtime to conduct acquisitions in order to diversify the revenue pool.

@LuckyInvest_AK In fact it is suspected that the reason why ex-ceo Mr Owen left is because management really wants to focus on US geography and Mr Owen did not wish to relocate to US (He is from UK).

@LuckyInvest_AK One of the key questions in investors mind is generally how much mastek can grow. We have a few different signals to indicate that 25% topline CAGR might be achievable in the medium term.

@LuckyInvest_AK 1. Ex Ceo John Owen openly talks about increasing the velocity the growth in the FY20 annual report.

@LuckyInvest_AK 2. Digital Transformation industry itself is growing at about 22% CAGR. And the CMD Mr Ashant desai often mentions in interviews that they will grow faster than the industry.

@LuckyInvest_AK 3. IT cos track the backlog of orders in the form of order book. The order book has grown 42% from FY20 to FY21.

@LuckyInvest_AK There are enough and more reasons to believe that co can grow topline at 25%+ in medium term. Has good track record of capital deployment. They are sitting on 850cr cash and cash equivalent which is a good 15% of mcap.

@LuckyInvest_AK Co is looking to acquire and expand capabilities and also diversify geographical revenue sources. The co has strategic clarify on what capabilities to build in-house and what capabilities to acquire. They dont disclose this (for competitive reasons)

@LuckyInvest_AK when I read the concalls, it looks like management knows what they are doing wrt acquisitions. They are actually evaluating for synergies and culture match and 1 level down management quality, not going purely by numbers.

@LuckyInvest_AK Here is a quick summary of some key monitorables. Pay special attention to the increase in scale of the company in terms of # of clients.

@LuckyInvest_AK One of the metrics to understand the size of the co is the size of the deals it is gunning for and able to win.

@LuckyInvest_AK As the co has scaled up, the free cash generation and unit economics has only improved.

@LuckyInvest_AK In terms of the end user industry, mastek clients are quite diversified.

@LuckyInvest_AK Valuations

I started buying the Company at 15-16 TTM p/e multiple in Jan 2021 and so have a good margin of safety. Will continue to average up as management executes. Everyone must do their own valuation exercise based on their understanding.

I started buying the Company at 15-16 TTM p/e multiple in Jan 2021 and so have a good margin of safety. Will continue to average up as management executes. Everyone must do their own valuation exercise based on their understanding.

@LuckyInvest_AK Key risks

1. High concentration of revenues in UK. Co is very aware and working overtime to fix this.

1. High concentration of revenues in UK. Co is very aware and working overtime to fix this.

@LuckyInvest_AK 2. Base rate for success of acquisitions is low. Evosys has succeeded which we can see in joint to market deal wins and co sell and cross sell. Not necessary that next acquisition would succeed too.

3. Who will the next CEO be? Will they be competent?

3. Who will the next CEO be? Will they be competent?

@LuckyInvest_AK If you please the thread, please retweet the 1st tweet so all investors can read and benefit.

@LuckyInvest_AK @AnyBodyCanFly FYI since you're interested in mastek :)

@LuckyInvest_AK Disc: I am invested and positively biased. This is not a buy or sell reco. Purely for sharing knowledge. Do your own analysis or consult financial advisor before any buy or sell decision.

• • •

Missing some Tweet in this thread? You can try to

force a refresh