@CurveFinance thread Pt.2 👇

While spoofing is possible through Curve, such activity can ultimately benefit LPs. Arbitrage on the Curve DEX is also lucrative for traders.

&

resources.curve.fi/base-features/…

While spoofing is possible through Curve, such activity can ultimately benefit LPs. Arbitrage on the Curve DEX is also lucrative for traders.

https://twitter.com/CurveFinance/status/1409621994014920714

&

resources.curve.fi/base-features/…

@CurveFinance's liquidity pools:

Total LPs: 42,801

duneanalytics.com/queries/4804/9…

Curve.fi's real-time interactive charts:

curve.fi/totaldeposits

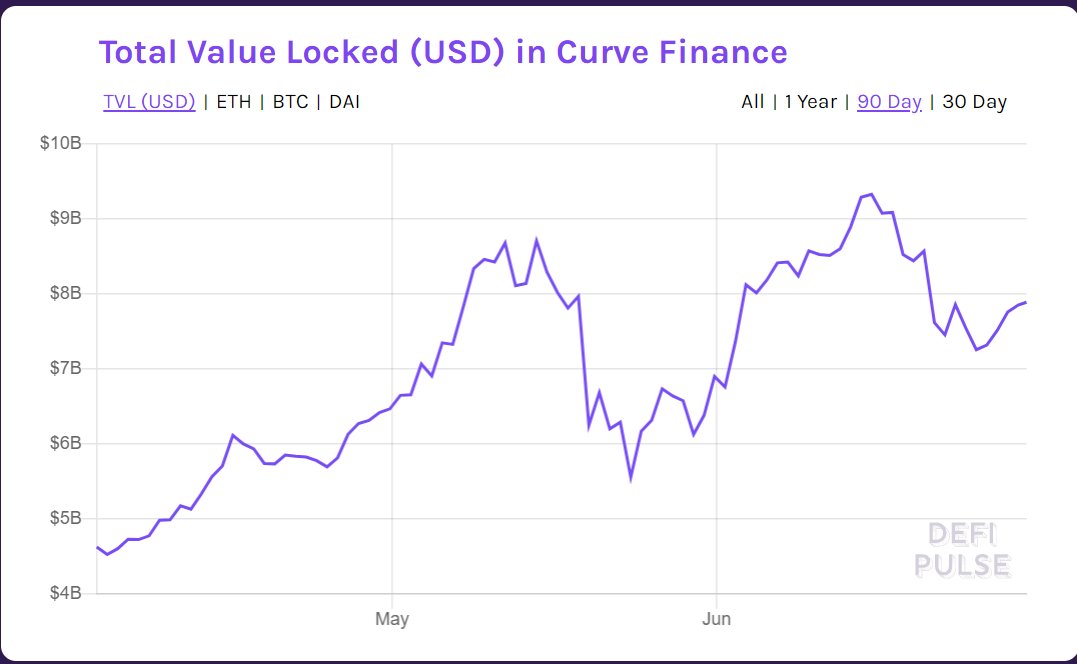

Curve's at the top of the leaderboards for DeFi-DEX TVL.

Total LPs: 42,801

duneanalytics.com/queries/4804/9…

Curve.fi's real-time interactive charts:

curve.fi/totaldeposits

Curve's at the top of the leaderboards for DeFi-DEX TVL.

https://twitter.com/WuBlockchain/status/1407931282634395655

Curve's new pool additions include @Chainlink, Ironbank, SAAVE, and ankrETH pools.

news.curve.fi/ahead-of-the-c…

Check all the pools here:

curve.fi/pools

news.curve.fi/ahead-of-the-c…

Check all the pools here:

curve.fi/pools

Curve's #TriCrypto Pool:

The wBTC-WETH-USDT TriCrypto pool — the first v2 liquidity pool on the Curve platform — is quite interesting.

curve.fi/tricrypto

Base annual percentage yield (APY) of over 7% that approaches more than 29% after adding all the rewards.

The wBTC-WETH-USDT TriCrypto pool — the first v2 liquidity pool on the Curve platform — is quite interesting.

curve.fi/tricrypto

Base annual percentage yield (APY) of over 7% that approaches more than 29% after adding all the rewards.

As the #tricrypto pool grows, so does its capital efficiency and thus its ability to resist front-running (according to Curve).

&

https://twitter.com/CurveFinance/status/1408509337228779528

&

https://twitter.com/CurveFinance/status/1409291474156625925?s=20

Liquidity pooling explained:

Small pool = high slippage (transactions swing prices significantly)

Big pool = low slippage (transactions do not make the price vary by much)

reddit.com/r/CryptoCurren…

Small pool = high slippage (transactions swing prices significantly)

Big pool = low slippage (transactions do not make the price vary by much)

reddit.com/r/CryptoCurren…

TriCrypto's performance reveals #Bitcoin's use in #DeFi is increasing, contrary to what many may believe (that Bitcoin and DeFi are somehow at odds and not interoperative).

https://twitter.com/CurveFinance/status/1408934195368505346?s=20

More than 1% of $BTC circulating supply is wrapped & largely used to collateralize liquidity pools. That's a positive development for #DeFi & AMMs

&

&

coindesk.com/wrapped-btc-bi…

https://twitter.com/iearnfinance/status/1408068987221536775?s=20

&

https://twitter.com/iearnfinance/status/1408068987221536775?s=20

&

coindesk.com/wrapped-btc-bi…

The Curve Governance Token $CRV:

Total token holders: 36,975

duneanalytics.com/datanut/Curve-…

Curve's ERC-20 governance token allows holders to participate in the @CurveFinance DAO.

Total token holders: 36,975

duneanalytics.com/datanut/Curve-…

Curve's ERC-20 governance token allows holders to participate in the @CurveFinance DAO.

Users can lock their $CRV (converted to veCRV) to vote for new pools, changes to fee structures, & propose $CRV token burns.

resources.curve.fi/base-features/…

&

dao.curve.fi

The longer you hold $CRV, the greater your voting power.

resources.curve.fi/base-features/…

&

dao.curve.fi

The longer you hold $CRV, the greater your voting power.

@CurveFinance

Current max holding period: 4yrs w/ 2.5x voting power

At least 2500 veCRV is required to initiate a DAO proposal (via the governance forum),

& at least 33% of veCRV must participate for the proposal to be considered.

Current max holding period: 4yrs w/ 2.5x voting power

At least 2500 veCRV is required to initiate a DAO proposal (via the governance forum),

& at least 33% of veCRV must participate for the proposal to be considered.

The Curve DAO requires a 50% voting quorum (more than 50% of veCRV voting in favor) for a proposal to pass.

All changes to the DEX must be initiated by the @CurveFinance team.

gov.curve.fi

All changes to the DEX must be initiated by the @CurveFinance team.

gov.curve.fi

An Unofficial, slightly dated image of how the @CurveFinance DAO functions

Kudos to @coinbureau & @defiprime

Kudos to @coinbureau & @defiprime

$CRV didn't have an #ICO

Instead, a user suddenly deployed the 1st $CRV smart contract & released it to the public via Twitter.

How?

Publicly available code from the project's Github, &

The team later approved the launch after evaluating the code.

Instead, a user suddenly deployed the 1st $CRV smart contract & released it to the public via Twitter.

How?

Publicly available code from the project's Github, &

The team later approved the launch after evaluating the code.

https://twitter.com/0xc4ad/status/1293977012550467584

Twitter user @0xc4ad pre-mined more than 80,000 $CRV, w/ ridiculously high price on @Uniswap due to the low ratio of $CRV to other pooled tokens.

$CRV's market cap briefly surpassed $BTC ($3.8T)

Prices have since fallen as the ratios stabilized & the crypto market declined.

$CRV's market cap briefly surpassed $BTC ($3.8T)

Prices have since fallen as the ratios stabilized & the crypto market declined.

$CRV Release Schedule:

Circulating supply: 388,557,627.38

Total CRV Locked: 235,191,886.05 (37.71% of all circulating CRV)

Average lock time: 3.68 years

Total supply: 3.03B CRV

dao.curve.fi/inflation

Circulating supply: 388,557,627.38

Total CRV Locked: 235,191,886.05 (37.71% of all circulating CRV)

Average lock time: 3.68 years

Total supply: 3.03B CRV

dao.curve.fi/inflation

5% of the $CRV total supply is issued to addresses according to the liquidity provided before the official token launch, unlocked gradually daily for a year (365 days).

An additional 5% goes to DAO reserves,

3% to employees with the same unlock schedule as LPs,

An additional 5% goes to DAO reserves,

3% to employees with the same unlock schedule as LPs,

30% to shareholders (Egorov & 2 angel investors) w/a 4y & 2y release schedule.

62% of $CRV goes to current & future LPs, distributed daily w/ a 2.25% decrease in daily amts after ea/yr

62% of $CRV goes to current & future LPs, distributed daily w/ a 2.25% decrease in daily amts after ea/yr

As more #stablecoins become popular & find real-world use, Curve.fi will become a competitive hub for moving from one stablecoin to another.

@CurveFinance's DEX utilization has stabilized, though the overall crypto market has cooled off in recent weeks.

@CurveFinance's DEX utilization has stabilized, though the overall crypto market has cooled off in recent weeks.

$BTC & other assets are rapidly tokenizing, further broadening the addressable market for @CurveFinance.

Compared to #CeFi, the low fees & low slippage, along with LP perks, are difficult to downplay.

Curve's competes for the 1st spot on @defipulse's leaderboard for TVL.

Compared to #CeFi, the low fees & low slippage, along with LP perks, are difficult to downplay.

Curve's competes for the 1st spot on @defipulse's leaderboard for TVL.

The team has announced several developments for the ecosystem, including bringing @CurveFinance to @Polkadot

https://twitter.com/EquilibriumDeFi/status/1359457987841191936

@CurveFinance aims to bring more incentives for DAO & liquidity pool participation to further #decentralization.

Ex: "provably fair lottery" to incentivize governance participation

&

Deployment on @0xPolygon:

Ex: "provably fair lottery" to incentivize governance participation

https://twitter.com/sasha35625/status/1361651719176912899

&

Deployment on @0xPolygon:

https://twitter.com/renprotocol/status/1404844419203928065?s=20

3rd parties are improving @CurveFinance's incentives for LPs.

@ConvexFinance is a new DEX that's already captured over $4.08B in TVL & may significantly improve Curve's existing incentives.

They've already locked 50B $CRV, earning a *filthy* APR.

@ConvexFinance is a new DEX that's already captured over $4.08B in TVL & may significantly improve Curve's existing incentives.

They've already locked 50B $CRV, earning a *filthy* APR.

https://twitter.com/ConvexFinance/status/1409484292497952776?s=20

@ConvexFinance's value prop:

By tokenizing $CRV through their platform, boost APR to delicious rates w/o having to time-lock $CRV on Curve.fi

docs.convexfinance.com/convexfinance/…

&

docs.convexfinance.com/convexfinance/…

By tokenizing $CRV through their platform, boost APR to delicious rates w/o having to time-lock $CRV on Curve.fi

docs.convexfinance.com/convexfinance/…

&

docs.convexfinance.com/convexfinance/…

Pt 3. 👇

Convex's proposition is a big deal since converting $CRV cannot be reversed, & $veCRV is non-transferrable, thus locking you in for a multi-year slog.

Convex's proposition is a big deal since converting $CRV cannot be reversed, & $veCRV is non-transferrable, thus locking you in for a multi-year slog.

Combine Convex's influence w/ @iearnfinance, which has actively been buying up a large portion of $CRV & locking the tokens as $veCRV

That comes w/ some big perks for Yearn's vaults

That comes w/ some big perks for Yearn's vaults

https://twitter.com/iearnfinance/status/1406938849440305154?s=20

Yearn's veCRV holdings give them disproportionate voting power, though it's less an issue w/ Curve, as stated earlier

"Curve War" = less $CRV on the market as incentives drive demand higher.

40%+ of the supply is already taken out of circulation

duneanalytics.com/banteg/misc

"Curve War" = less $CRV on the market as incentives drive demand higher.

40%+ of the supply is already taken out of circulation

duneanalytics.com/banteg/misc

Curve's v2 brings volatile assets to the DEX with a dynamic peg, allowing for deeper liquidity similar to @Uniswap,

But w/o the need for active management (lost in Uniswap v3) & a bonus of liquidity mining.

coindesk.com/defis-curve-ey…

But w/o the need for active management (lost in Uniswap v3) & a bonus of liquidity mining.

coindesk.com/defis-curve-ey…

The best way to get $CRV is through farming as an LP.

A full breakdown of $CRV yield farming & how to use the @CurveFinance platform, by @BanklessHQ & @DeFi_Dad

A full breakdown of $CRV yield farming & how to use the @CurveFinance platform, by @BanklessHQ & @DeFi_Dad

$CRV is an ERC-20 token, storable on any wallet that supports Ethereum-based assets.

A Web 3.0 browser wallet such as @MetaMask also works & is useful if you plan to use your governance tokens to vote.

A Web 3.0 browser wallet such as @MetaMask also works & is useful if you plan to use your governance tokens to vote.

Curve believes it's crucial to constantly review code & offer bug bounties regularly.

curve.fi/bugbounty

Ex: "permanently locked" bounty to offset significant fees incurred after a recent #DeFi exploit.

gov.curve.fi/t/february-mar…

&

coindesk.com/yearn-finance-…

curve.fi/bugbounty

Ex: "permanently locked" bounty to offset significant fees incurred after a recent #DeFi exploit.

gov.curve.fi/t/february-mar…

&

coindesk.com/yearn-finance-…

The Curve Emergency DAO:

- 9 members

- ~60% support,

- The Curve DAO can add or remove members & reenable contracts.

dao.curve.fi/emergencymembe…

- Has the ability to disable Curve pool contracts & all functionality beyond withdrawals & enable them again.

- 9 members

- ~60% support,

- The Curve DAO can add or remove members & reenable contracts.

dao.curve.fi/emergencymembe…

- Has the ability to disable Curve pool contracts & all functionality beyond withdrawals & enable them again.

Smart contracts on @CurveFinance cannot be upgraded, prioritizing user control over their assets.

LPs must accept staking risks where multiple smart contract products all pose a potential point of failure.

LPs must accept staking risks where multiple smart contract products all pose a potential point of failure.

Another risk is the potential permanent loss of a stablecoin peg, which can effectively devalue an LP's funds in the affected pools to 0.

@CurveFinance's detailed guide on navigating risk:

resources.curve.fi/guides/choosin…

@CurveFinance's detailed guide on navigating risk:

resources.curve.fi/guides/choosin…

With a growing community of traders & a swelling base of LPs (including Yearn) providing significant capital to the liquidity pools,

Along w/ big incentives for traders & LPs to balance the long lock-in periods,

@CurveFinance deserves its place as one of the top DEXs.

Along w/ big incentives for traders & LPs to balance the long lock-in periods,

@CurveFinance deserves its place as one of the top DEXs.

Combining the DAO formation & several 3rd-party improvements & opportunities, & v2's introduction of volatile assets,

@CurveFinance may be one of the most interesting projects to get involved with for the long run & during the next bear market.

@CurveFinance may be one of the most interesting projects to get involved with for the long run & during the next bear market.

I see @CurveFinance as a mid-term technical buy as long as #Ethereum & the broader market consolidates or builds bullish momentum,

While a bear market scenario will be an excellent time to explore $CRV yield farming.

While a bear market scenario will be an excellent time to explore $CRV yield farming.

Keep in mind that the lock-in times are lengthy, & the 3rd-party workarounds may have incredible APRs, but there is significant risk involved.

After all, the DEX & AMM space & #DeFi as a whole are in their infancy.

After all, the DEX & AMM space & #DeFi as a whole are in their infancy.

The #DeFi terrain is rife with hacks, points of failure, & trickery.

Always do your own research before diving head-first into something as complex as @CurveFinance.

Read the full article & disclaimer here:

alphatrades.medium.com/curve-finance-…

Please share this w/ your network 🙏✌

Always do your own research before diving head-first into something as complex as @CurveFinance.

Read the full article & disclaimer here:

alphatrades.medium.com/curve-finance-…

Please share this w/ your network 🙏✌

• • •

Missing some Tweet in this thread? You can try to

force a refresh