#WatfordFC 2019/20 financial results covered a season that the club described as “unique and challenging”, as it ended in relegation after they finished 19th in the Premier League and they had 3 managers: Javi Gracia, Quique Sanchez Flores and Nigel Pearson. Some thoughts follow.

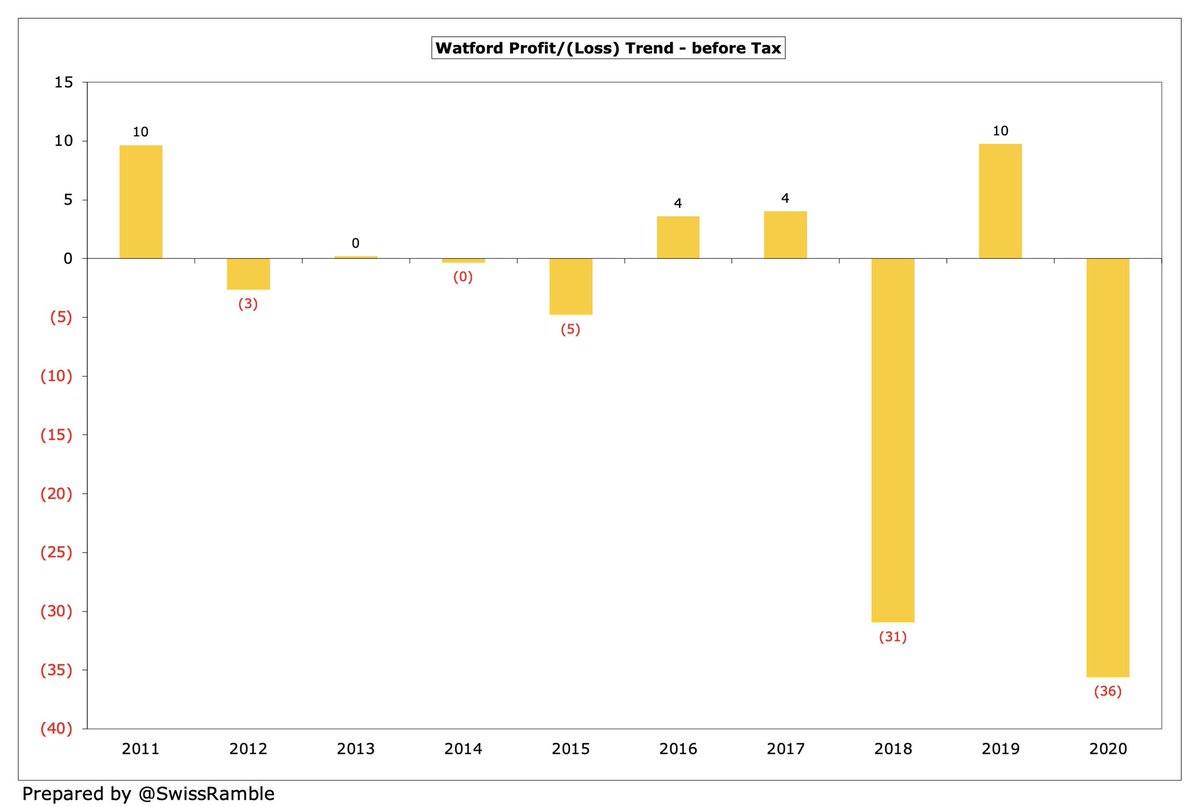

#WatfordFC swung from £10m pre-tax profit to £36m loss, as revenue decreased £28m (19%) from club record £148m to £120m and profit on player sales fell £4m to £18m, while expenses increased £9m (6%). Prior year boosted by £4.5m Marco Silva compensation. Loss after tax was £32m.

The main driver of #WatfordFC revenue reduction was broadcasting, which fell £24m (20%) from £119m to £95m, while match day dropped £2.0m (21%) to £7.3m, commercial decreased £1.2m (6%) to £17.4m and player loans were down £0.9m to £84k.

Despite relegation, #WatfordFC staff costs rose: the wage bill increased £13m (15%) to £96m, while player amortisation and impairment climbed £4m (10%) to £40m. On the other hand, other expenses were cut £8m (22%) to £27m and net interest payable fell slightly to £6.3m.

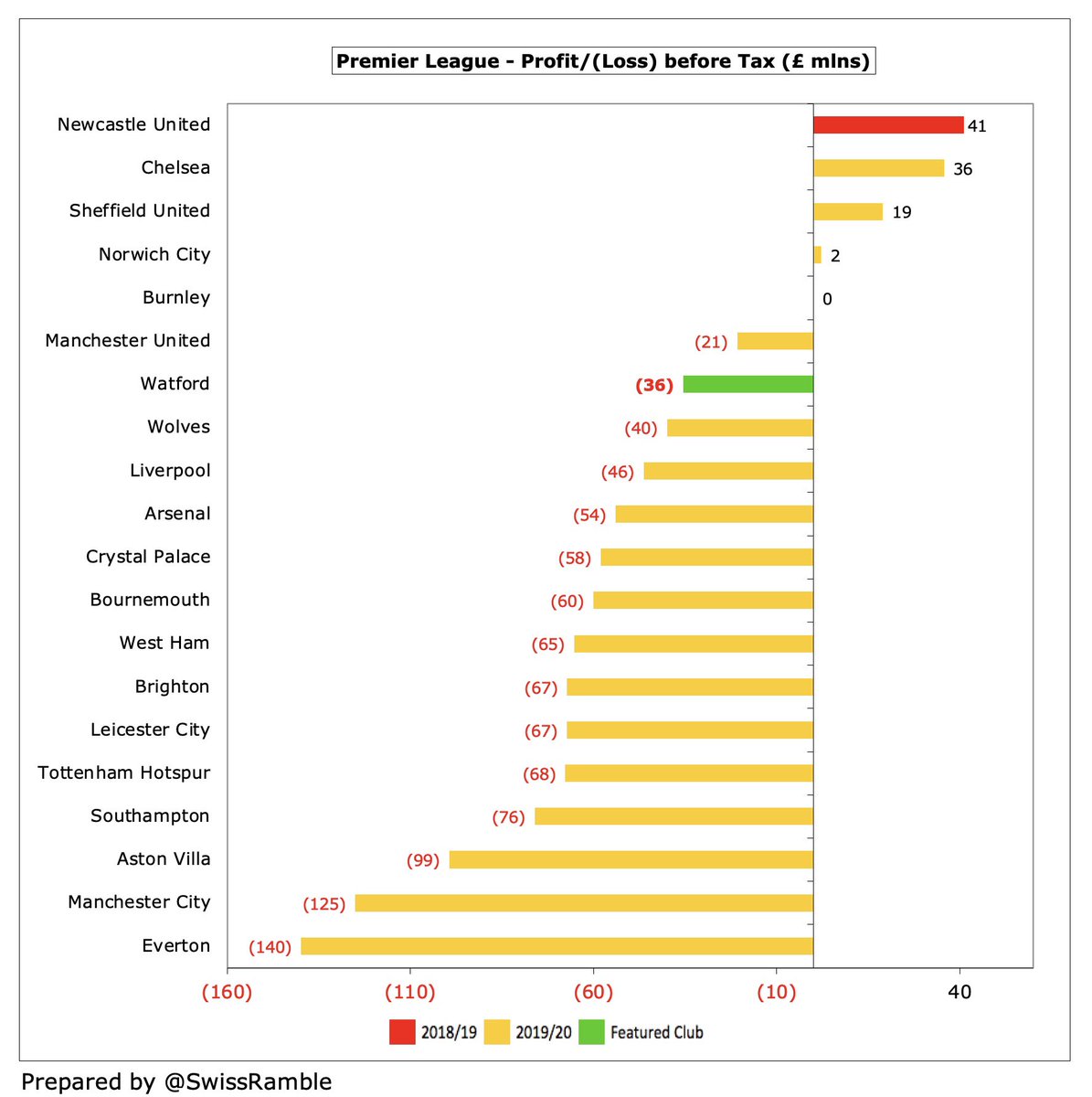

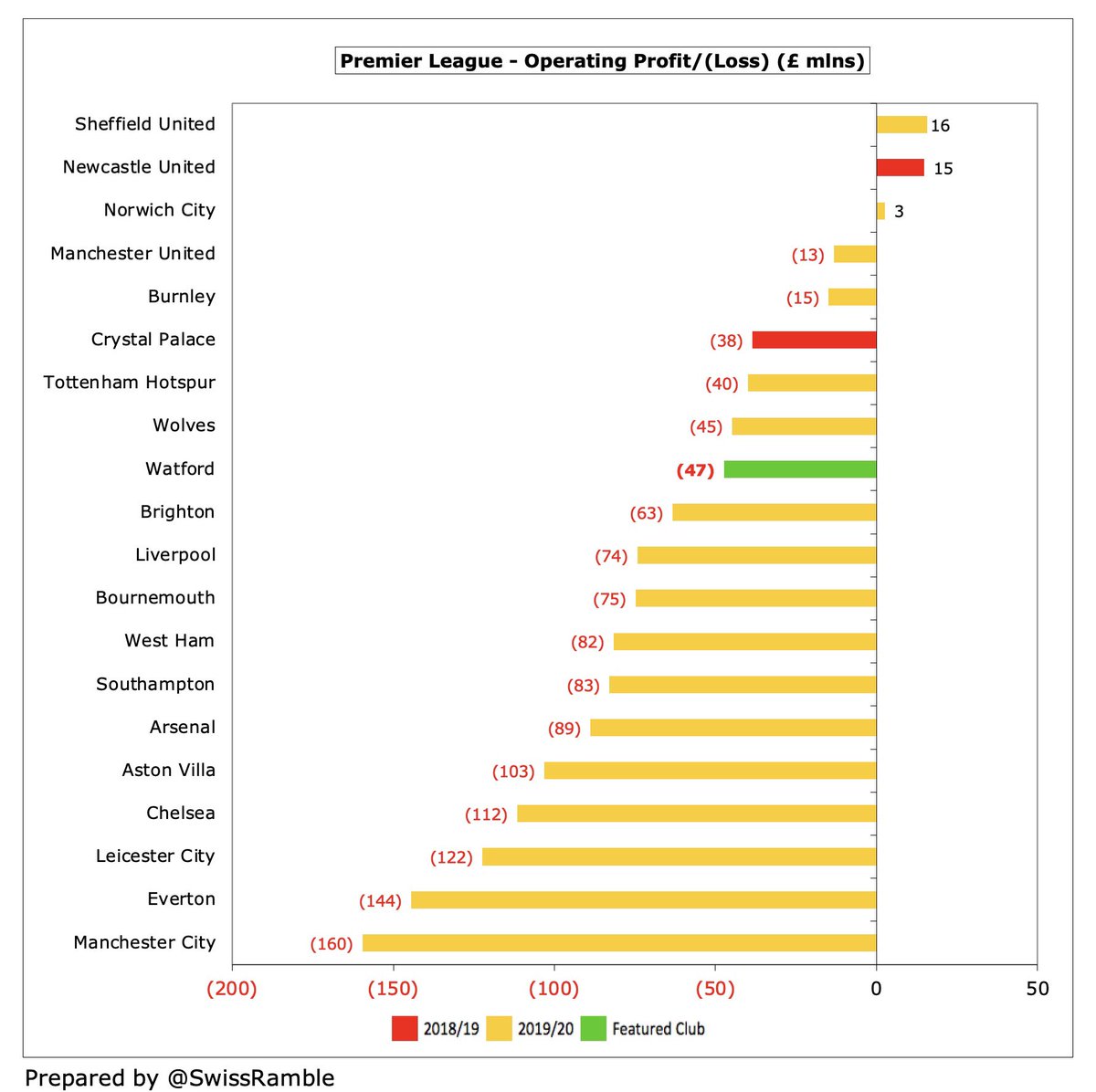

Although #WatfordFC £36m loss is obviously not great, it is actually pretty good compared to others, as all clubs have been adversely impacted by COVID with no fewer than 13 in the Premier League posting higher losses in 2019/20, including #EFC £140m, #MCFC £125m and #AVFC £99m.

Clearly #WatfordFC figures have been significantly hit by the pandemic, which has resulted in money lost from a rebate to broadcasters and games played behind closed doors, while revenue for games played after 30th June accounting close has been deferred to 2020/21 accounts.

#WatfordFC listed the COVID impact as £10m lost revenue (broadcasting rebate £7.2m, match day £2.4m and commercial £0.3m), while I estimate that £17m TV revenue has been deferred to 2020/21. Excluding £27m reduction, revenue would have been £147m with the club posting a £9m loss.

#WatfordFC bottom line benefited from £18m profit on player sales, down £4m on prior year, mainly from the sale of Lukebakio to Hertha Berlin, Foulquier to Granada and Oulare to Standard Liège. That’s not bad, but a fair way below #CFC £143m, #LCFC £63m and #AFC £60m.

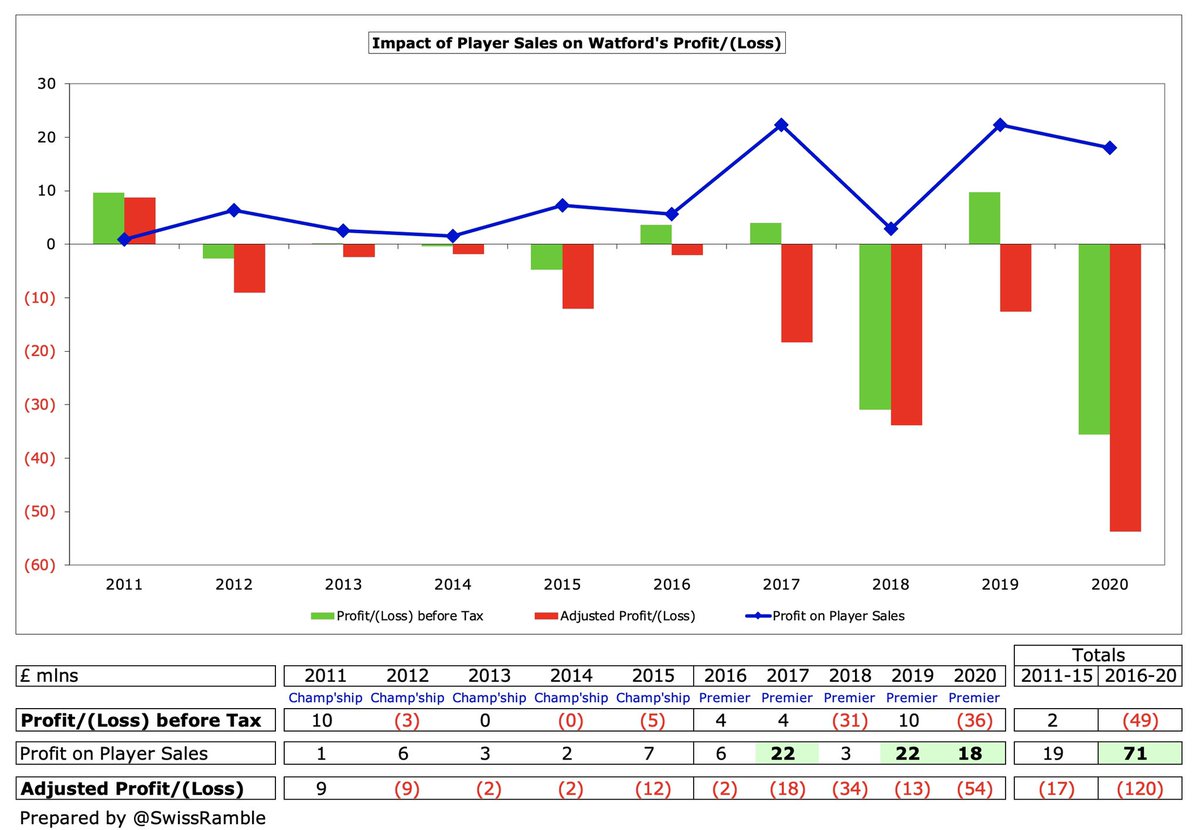

During their time in the Premier League #WatfordFC reported profits in 3 out of 5 seasons, though there is an overall deficit of £49m in this period, due to the hefty losses in 2018 and 2020. In the Championship, they tended to lose money, though the losses were quite small.

One reason for #WatfordFC swinging from profit to loss in 2020 is exceptional items. Prior year was boosted by £4.5m compensation for Marco Silva’s move to #EFC, while 2020 was adversely impacted by £6.7m termination payments, presumably for Javi Gracia and Quique Sanchez Flores.

#WatfordFC have grown their profits from player trading, making £71m in the last five years, compared to only £19m in the preceding 5-year period. Indeed, 2020/21 figures will include £51m, mainly from Doucouré to #EFC, Estupinan to Vilarreal and Suarez to Granada.

#WatfordFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales, dropped from £35m to £(3)m, the club’s worst in the Premier League. This is around mid-table in the top flight, though far below #MUFC £132m and #THFC £106m.

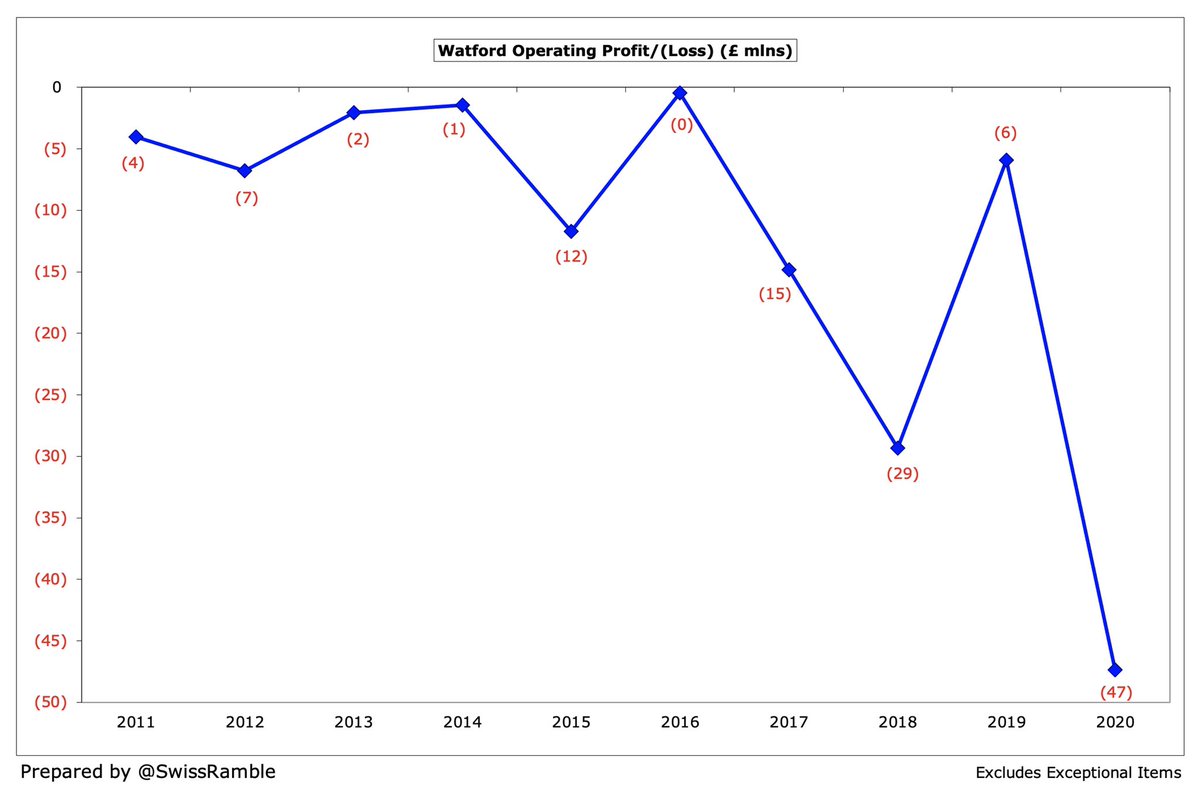

At an operating level (i.e. excluding player sales and interest), #WatfordFC loss widened from £6m to £47m. This is the club’s worst ever performance, but is still in the top half of the Premier League with no fewer than 5 clubs having operating losses above £100m.

Despite the decline in 2020, #WatfordFC revenue has still grown by £26m (27%) from £94m to £120m since 2016, their first season following promotion to the Premier League. However, it will fall again after relegation, despite parachute payments and TV money deferred from 2019/20.

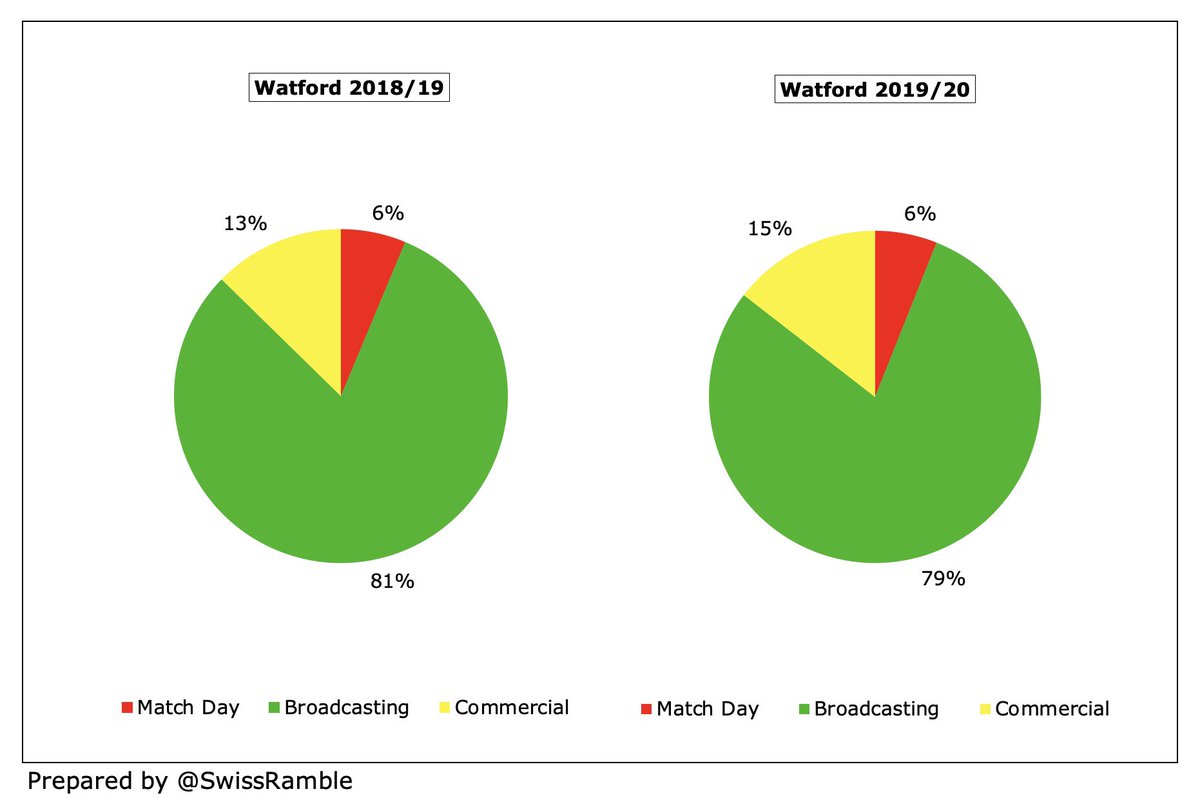

Even after the steep decrease in broadcasting income, this was still by far #WatfordFC most important revenue stream, accounting for 79% of total revenue, followed by commercial 15% and match day 6%.

Following the decrease in 2020, #WatfordFC £120m revenue was 17th highest in the Premier League, only ahead of #NCFC, #AVFC and #AFCB. To place this into perspective, it was less than a quarter of #MUFC £509m, highlighting the Hornets’ challenge in the top tier.

#WatfordFC £28m revenue decrease is one of the better performances in COVID-impacted 2019/20 Premier League, though in percentage terms their 19%, is towards the upper end. Partly driven by accounting date, as this influences the amount of revenue deferred to 2020/21

#WatfordFC broadcasting income fell £24m (20%) from £119m to £95m, due to lower merit payment for finishing 19th, revenue from 6 games slipping to 2020/21 accounts (played after 30th June accounting close) and broadcasters’ rebate. Other clubs have seen similar falls in 2019/20.

Following relegation from the Premier League, #WatfordFC TV income will fall significantly in 2020/21, albeit cushioned by £42m parachute payment, giving them much higher revenue than most other Championship clubs. Parachutes then fall to £34m (year 2) and £15m (year 3).

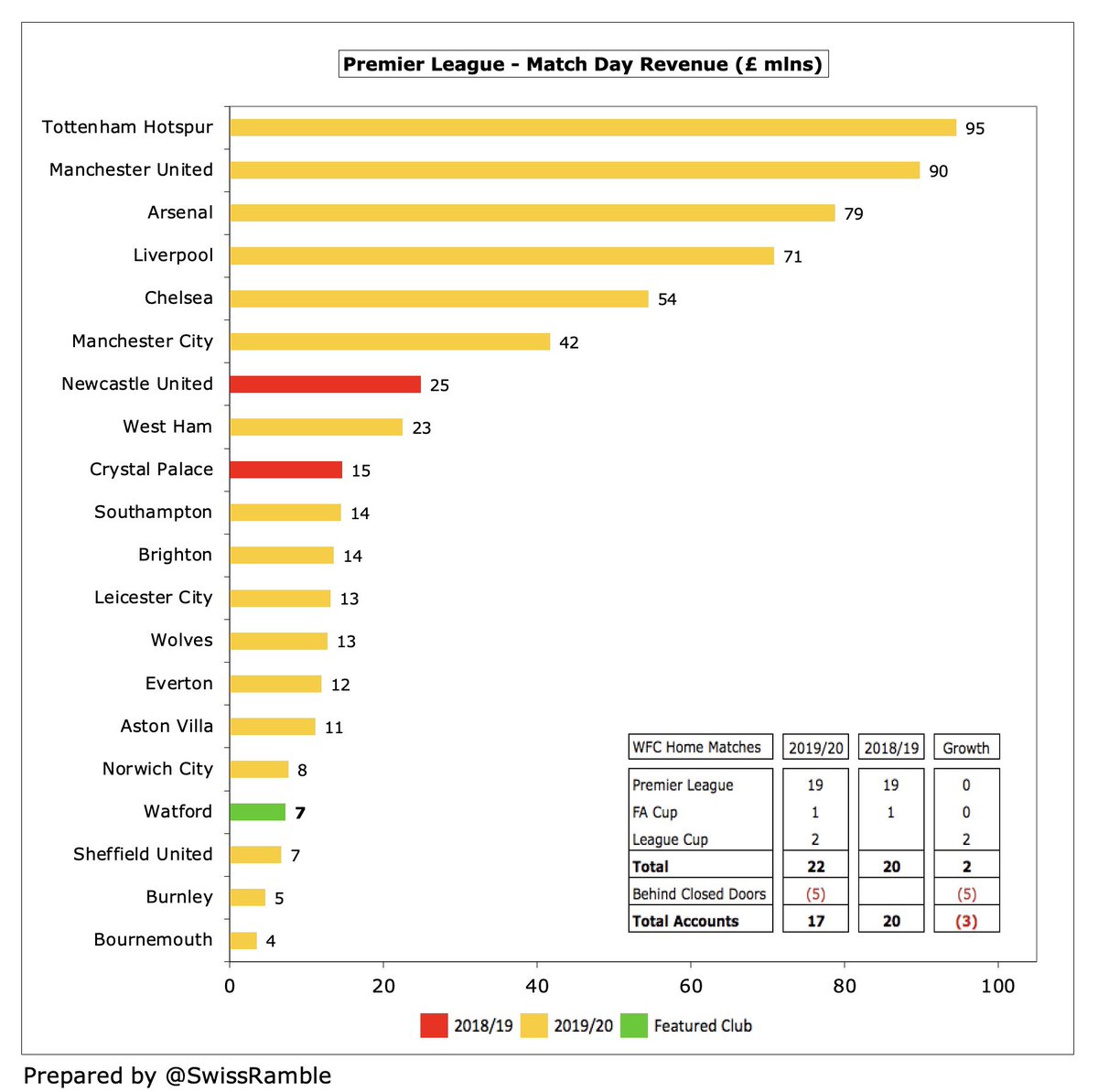

#WatfordFC match day income fell £1.9m (21%) from £9.2m to £7.3m, as they played 5 home games behind closed doors due to COVID. One of the lowest in the Premier League, only ahead of #SUFC, Burnley and #AFCB. For some context, less than 8% of #THFC £95m after their stadium move.

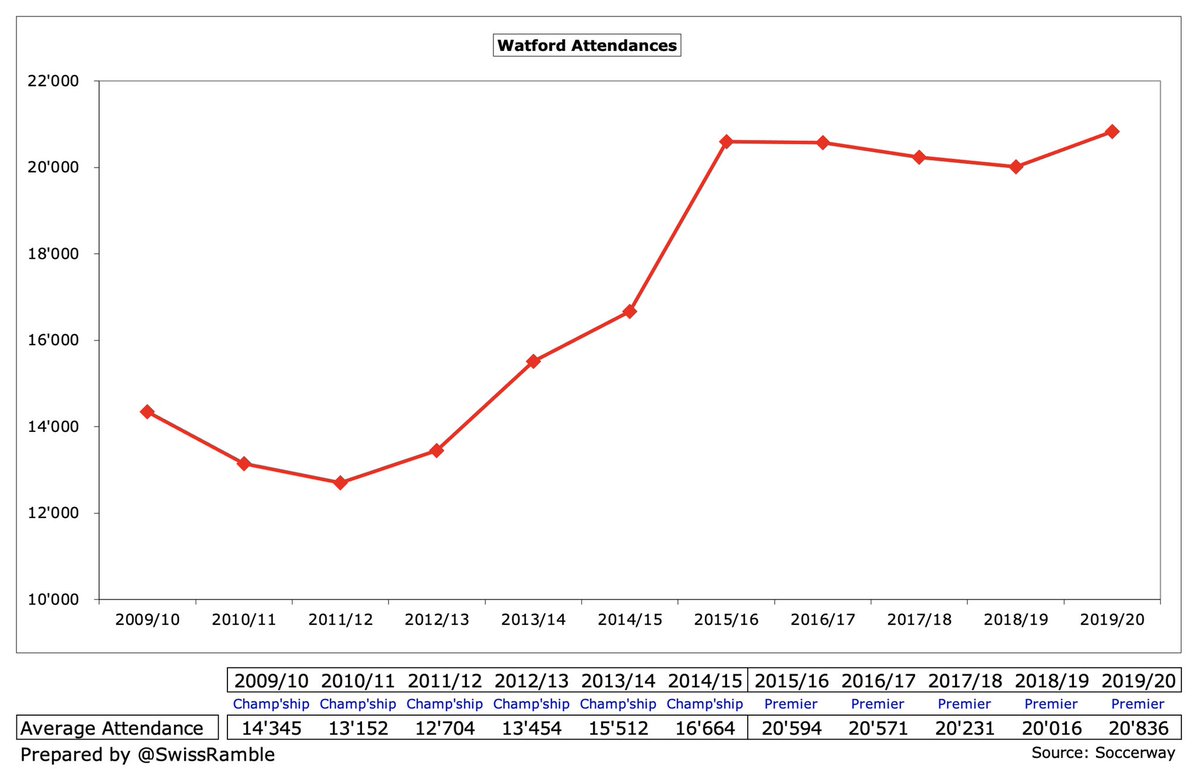

#WatfordFC average attendance rose from 20,016 to 20,836 (for games played with fans), though this was 3rd lowest in the Premier League. Ticket prices were raised in 2019/20, but frozen since then. Club looking to develop stadium to expand capacity to 30,000 following promotion.

#WatfordFC commercial revenue fell £1.2m (6%) from £18.6m to £17.4m (prior year restated). This revenue stream was again one of the lowest in the Premier League, just behind Southampton. For perspective, over a quarter of a billion below #MUFC £279m.

In 2019/20 Sportsbet.io replaced FXPro as #WatfordFC shirt sponsor, increasing annual payment from £3m to £6.5m., including sleeve sponsorship (Bitcoin logo). In 2002/21 Kelme replaced Adidas as kit supplier in a 4-year deal with reported increase from £750k to £2.5m.

#WatfordFC wage bill rose £12m (15%) from £84m to £96m, a club record, with playing staff increasing from 65 to 74. This means that wages have grown by two-thirds since first season in the Premier League (£58m). Includes £6.7m termination payments to former coaches.

Despite this growth, #WatfordFC £96m wage bill was the 4th lowest in the Premier League, only higher than #WWFC, #NCFC and #SUFC. It will fall in the Championship, due to player departures and relegation clauses (though media reports suggest that some players did not have these).

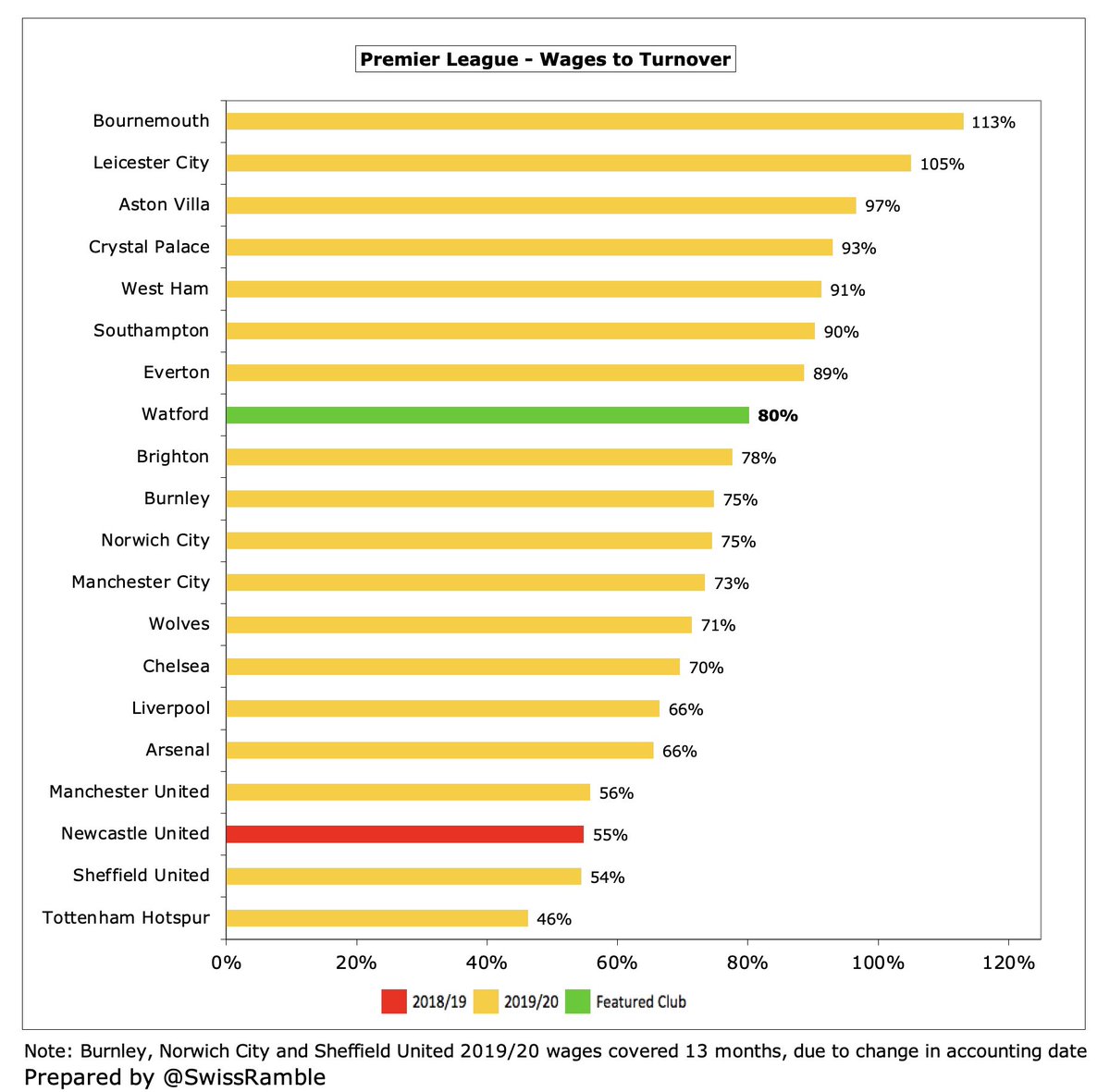

As a result of the revenue fall, #WatfordFC wages to turnover ratio increased (worsened) from 57% to 80%, the 8th highest in the Premier League. In fairness, without the COVID revenue loss I estimate that this ratio would have been only 66%.

Remuneration for #WatfordFC highest paid director, presumably chairman and CEO Scott Duxbury, increased by 26% from £752k to £948k. That might seem a little steep after relegation, but is much less than the likes of #MUFC Ed Woodward and #THFC Daniel Levy (both around £3m).

#WatfordFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £6m (16%) from £34m to £40m, up from £1m in the Championship though still firmly in the bottom half of the Premier League, over £100m below big-spending #MCFC £146m.

#WatfordFC other expenses were cut £7m (22%) from £34m to £27m. However, these have still surged from £8m in the Championship, due to “the costs associated with running a successful business within the premier League.”

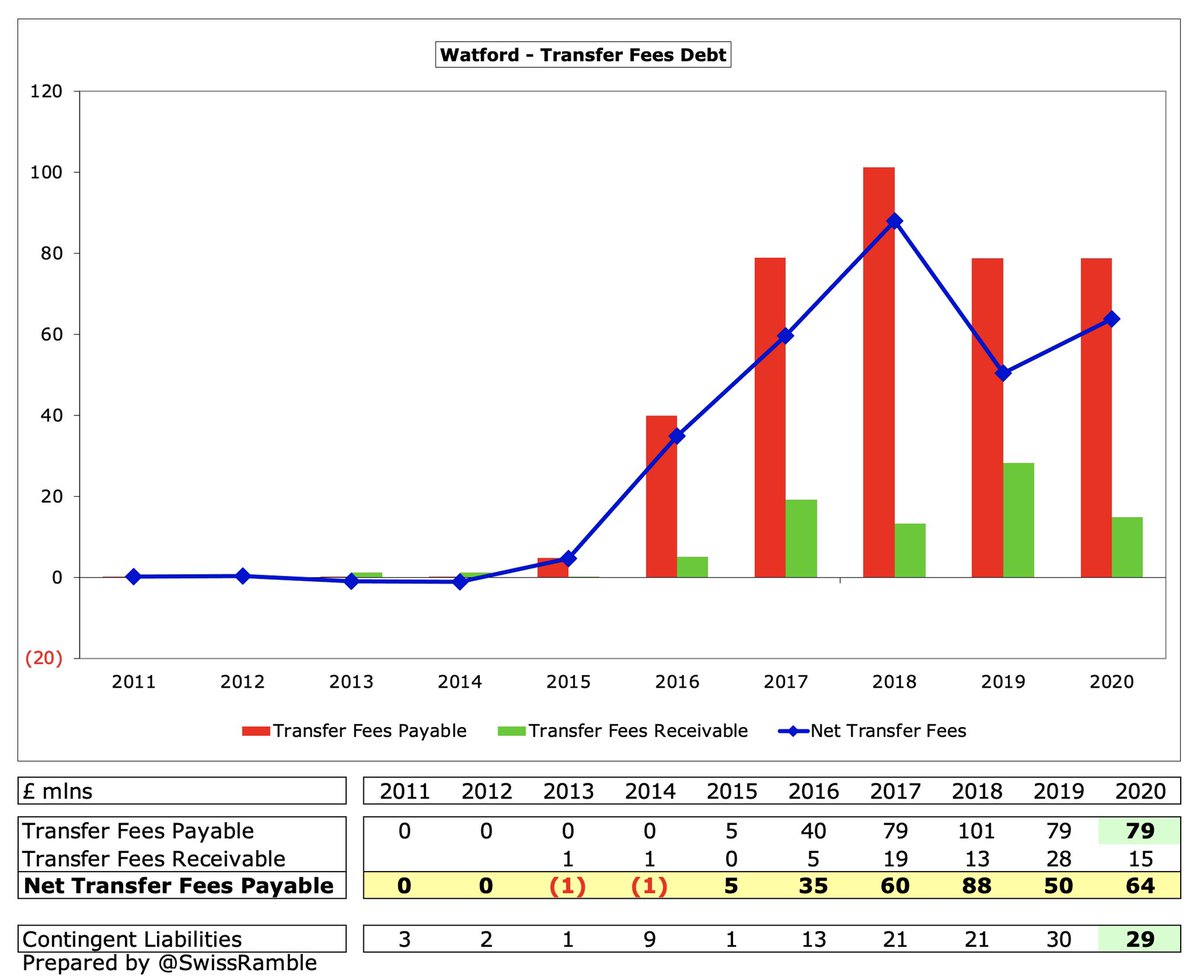

#WatfordFC spent £66m on player purchases in 2019/20, including Ismaela Sarr, Ignacio Pussetto (from the Pozzo family’s Udinese), Craig Dawson and Joao Pedro. This was in the bottom half of the Premier League, around the same level as #SUFC.

This means that #WatfordFC had £303m gross spend in the transfer market in their 5 years in the Premier League (net spend £195m), significantly higher than the £8m they spent in the preceding 5-year period. Per the accounts, expenditure is less than £1m following relegation.

#WatfordFC gross debt rose £5m from £88m to £93m, including bank overdraft increasing from £1m to £15m, loans from group undertakings £76m, directors’ loans £1m, finance leases £0.7m and other loans £0.4m. Debt has shot up from just £13m since promotion to the Premier League.

Interestingly, #WatfordFC accounts state there are £76m loans from group undertakings, though they also note that club consolidated loans of £55m and £25m with Hornets Investments Ltd into a £70m loan, where the senior creditor is XXIII Capital with “no connection to the group”.

Despite the increase, #WatfordFC £93m gross debt was only 12th largest in the Premier League, far below the likes of THFC £831m (new stadium), #MUFC £526m, #EFC £409m and #BHAFC £306m. Since year-end, there have been reports of additional loans with Macquarie Bank.

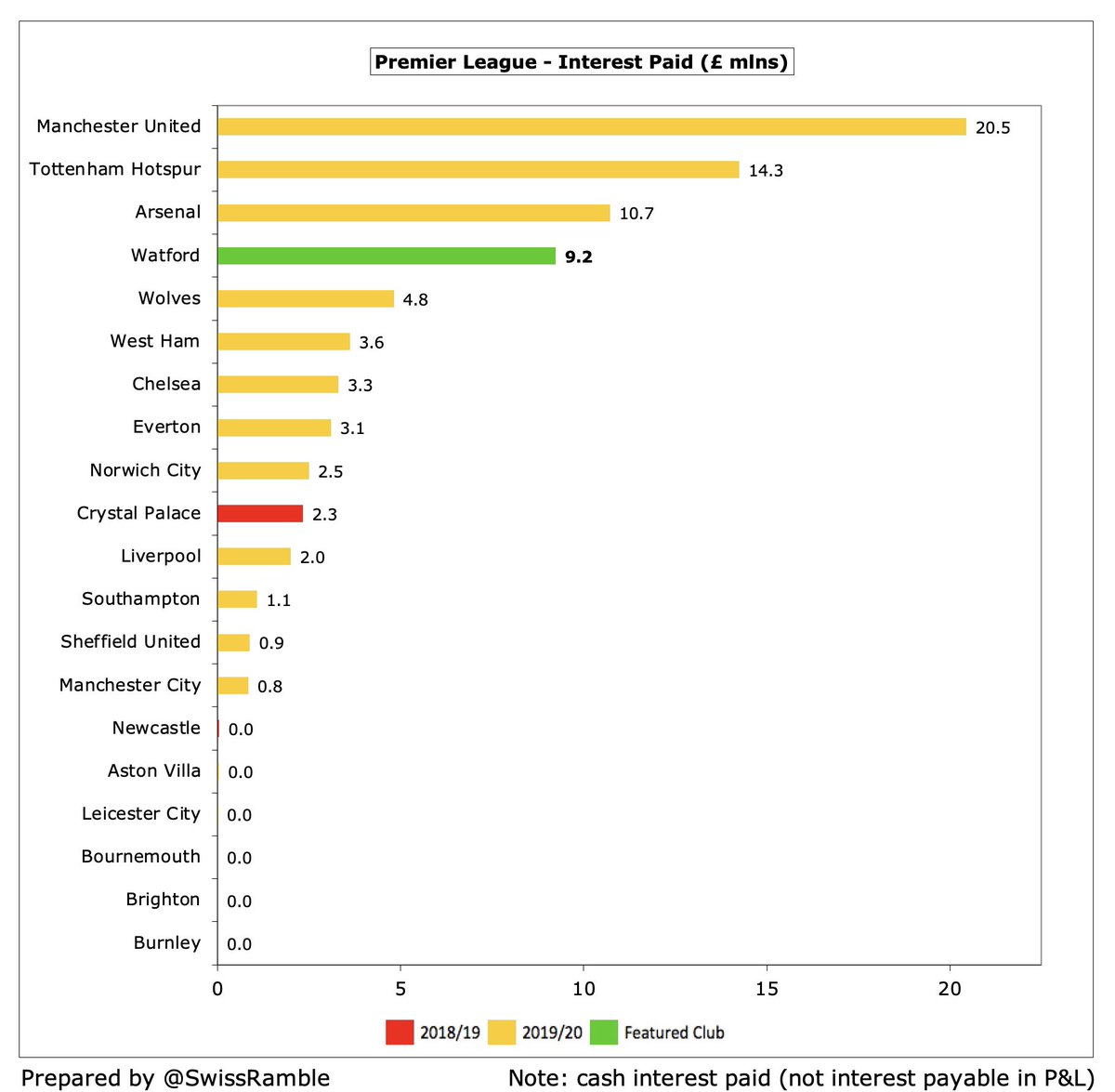

#WatfordFC £70m refinanced loan is at LIBOR + 5.35%, which is better than the previous loans (£55m at LIBOR + 6.28% and £25m at 10%). That said, the club still paid £9.2m interest in 2019/20, the 4th highest in the Premier League, only behind #MUFC £20m, #THFC £14m and #AFC £11m.

#WatfordFC also have £79m transfer debt, the 8th highest in the Premier League. They are in turn owed £15m by other clubs, leaving a net payable of £64m. In addition, there are £29m contingent liabilities dependent on player appearances, sell-on clauses, etc.

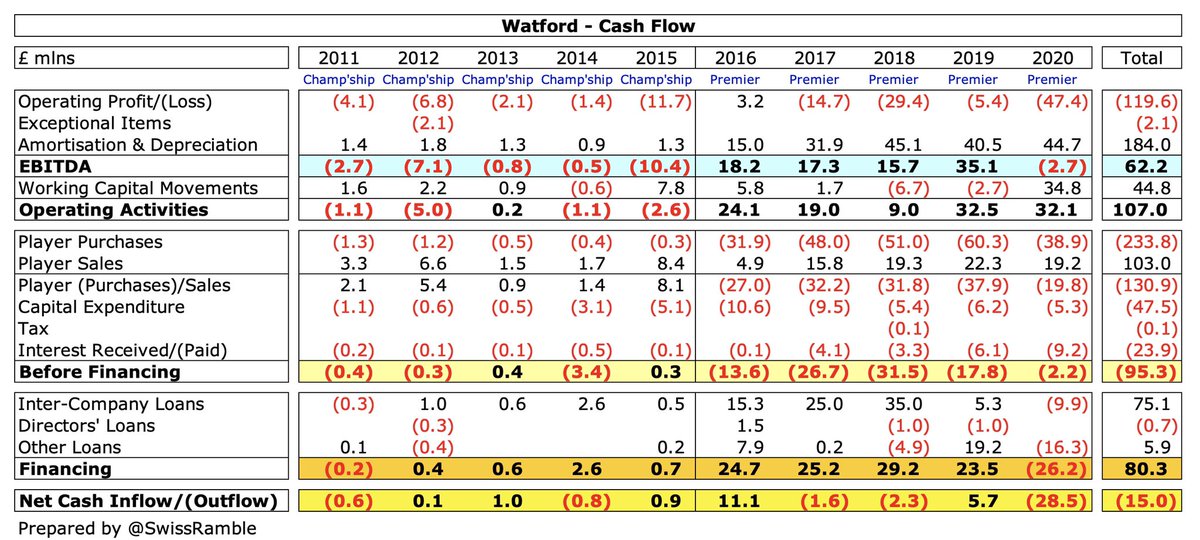

#WatfordFC £47m operating loss resulted in £32m cash flow after adding back £45m amortisation/depreciation and £35m working capital movements. Spent £20m on players (purchases £39m, sales £19m), £9m interest and £5m capex. Plus £26m loan repayments (owner £10m, external £16m).

As a result, #WatfordFC cash balance dropped £14m to just £18k and the club took out a £15m overdraft. Unsurprisingly, this was the lowest cash in the Premier League, underlining the importance of the Pozzo family’s financial support (commitment given for new investment).

In the last decade #WatfordFC had £202m available cash: £107m from operations, £74m owners’ loans, £6m other loans and £15m decrease in cash balance. They spent £131m on new players (net), £47m on infrastructure with a further £24m going on interest payments.

Like other clubs, #WatfordFC 2019/20 finances were badly hit by the pandemic. Relegation will obviously have had a further impact in 2020/21, though they ultimately enjoyed a successful campaign in the Championship. The immediate return to the top flight will help going forward.

• • •

Missing some Tweet in this thread? You can try to

force a refresh