🇩🇪💉 update 5 July & review calendar week 26

Slowdown continues - but ?-mark over corporate doctors

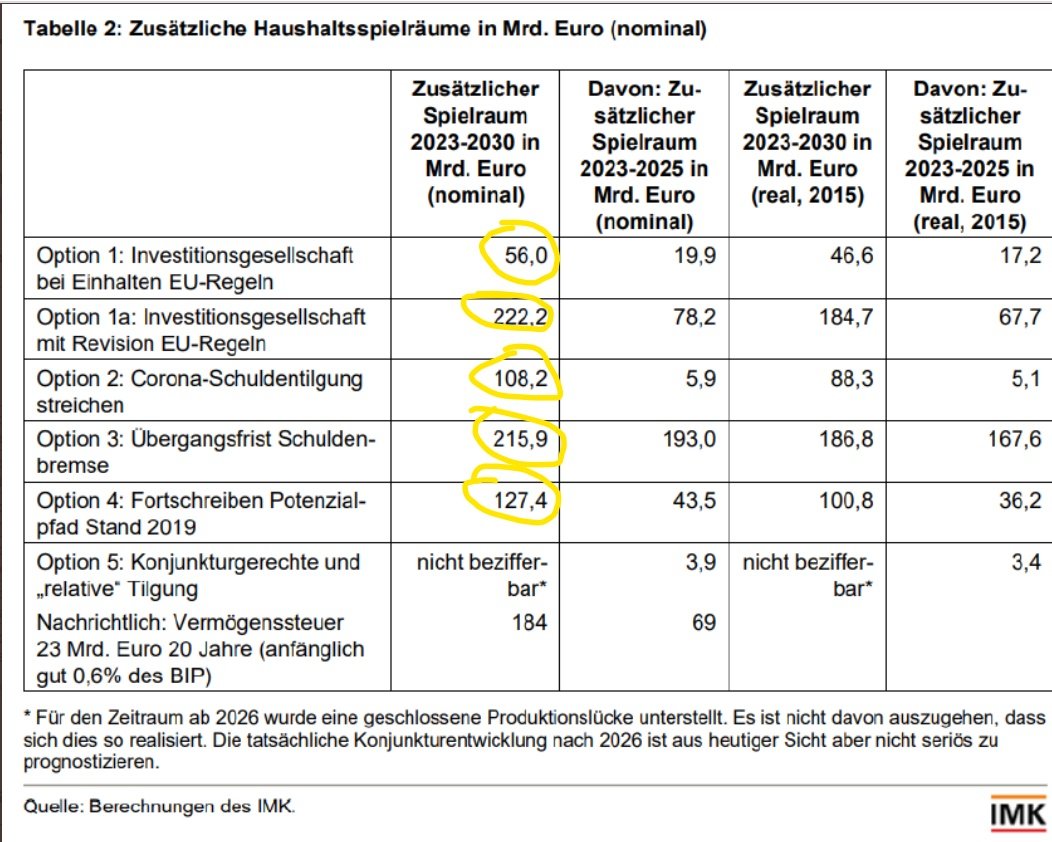

With the figures reported for Friday & the weekend once again down on the previous week (b4 revisions), the 7-day ave continues to slide, and is now only a touch above 700k.

1/5

Slowdown continues - but ?-mark over corporate doctors

With the figures reported for Friday & the weekend once again down on the previous week (b4 revisions), the 7-day ave continues to slide, and is now only a touch above 700k.

1/5

The sharp fall-off in 2nd 💉is barely offset by a renewed increase in 1st doses.

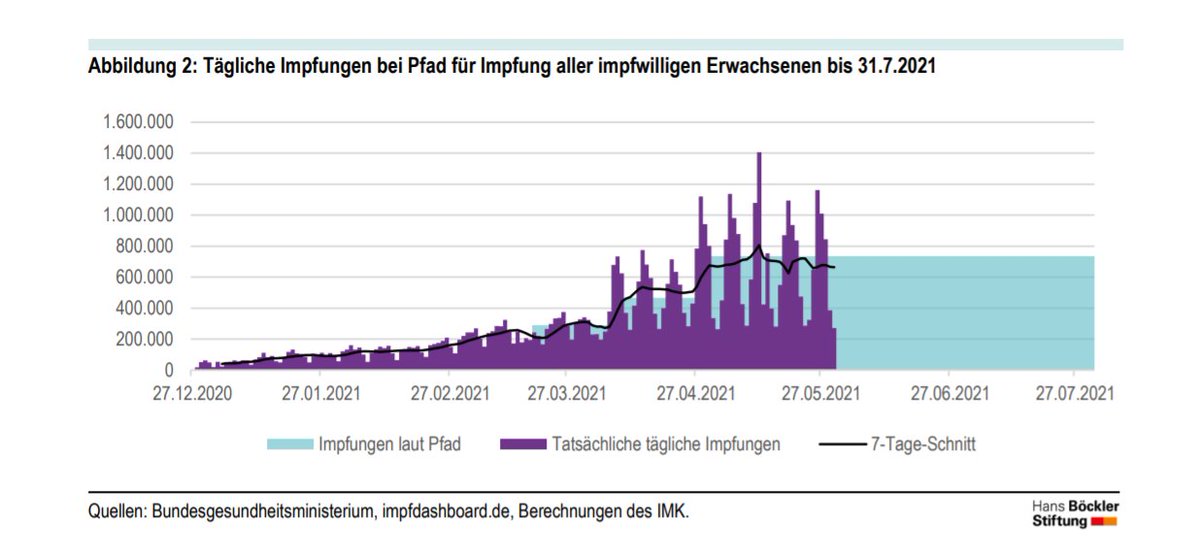

Last week saw the first decline under 5m doses for 4 weeks. (Revisions might be enough to change this, & see 4&5/5.)

On the face of it, 🇩🇪 campaign is returning to May vax rates.

2/5

Last week saw the first decline under 5m doses for 4 weeks. (Revisions might be enough to change this, & see 4&5/5.)

On the face of it, 🇩🇪 campaign is returning to May vax rates.

2/5

With vaccine supply still buoyant, the share of delivered doses that have been injected in upper arms falls substantially (by 1%point) to 87.3%.

This means 11 1/4 million doses are unused - or, perhaps better, unaccounted for.

3/5

This means 11 1/4 million doses are unused - or, perhaps better, unaccounted for.

3/5

For, as previous posts have noted, 🇩🇪 vax data reporting leaves questions unanswered. In particular the coverage of corporate doctors is patchy.

Last Wednesday @rki_de reported rki.de/DE/Content/Inf… 564k shots by corporate doctors. But they have received around 2 million.

4/5

Last Wednesday @rki_de reported rki.de/DE/Content/Inf… 564k shots by corporate doctors. But they have received around 2 million.

4/5

Almost certainly they've administered many more, maybe 1 million more. What is not clear is whether the additional shots have been reported elsewhere (& so are in the totals). If not, there could be substantial upward revisions.

Hopefully @rki_de will clarify by Wednesday.

5/5

Hopefully @rki_de will clarify by Wednesday.

5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh