.@SDullien & @KatjaRietzler have a paper out showing the scope for expansionary fiscal policy in Germany if the debt brake - which, stupidly, has constitutional status - were relaxed in various ways.

As this is relevant for the 🇪🇺 debate, a few key takeaways in EN.

1/7

As this is relevant for the 🇪🇺 debate, a few key takeaways in EN.

1/7

https://twitter.com/SDullien/status/1412019976958062592

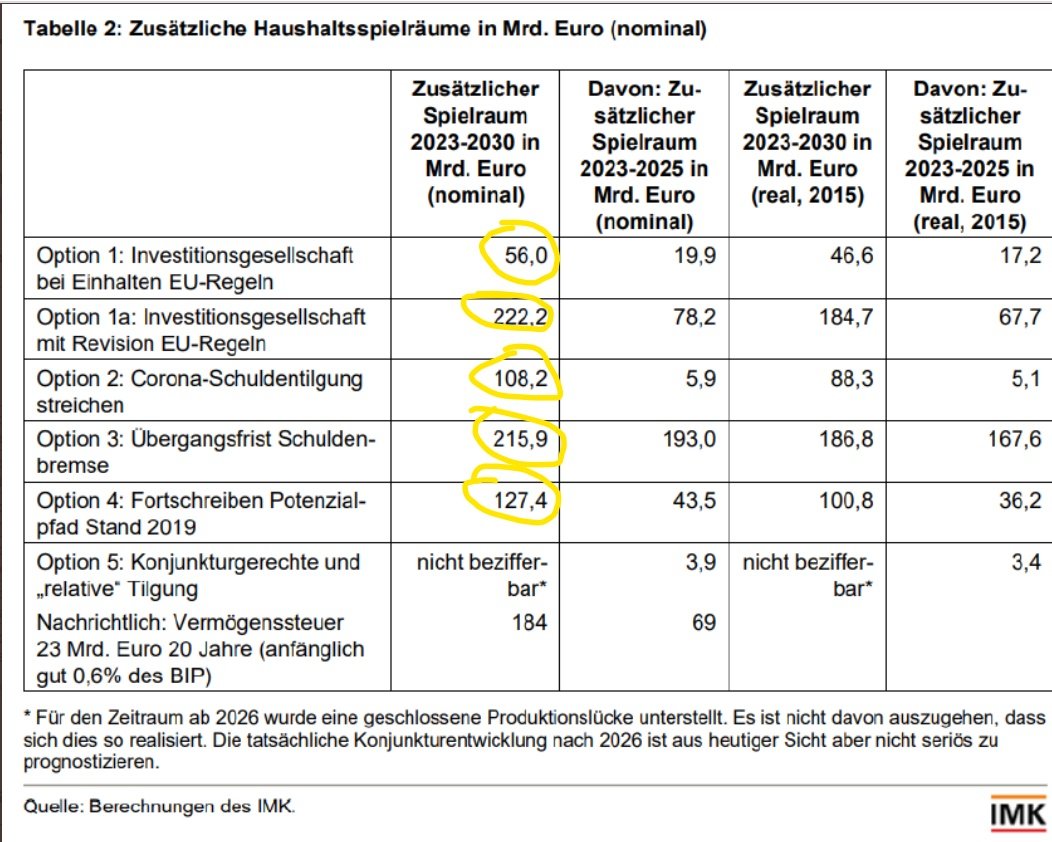

Keeping it simple, we'll just look at the total additional nominal fiscal marge de manouvre for the period 2023-30 (without feedback effects) opened up by 5 options.

2/7

2/7

Setting up a state-owned entity to borrow 1% of GDP for public investment a year would not need a change in the 🇩🇪 constitution. It creates fiscal space of €56bn with unchanged EU fiscal rules. If these are relaxed in the direction of a golden rule, that space quadruples.

3/7

3/7

If the requirement to repay principal on govt borrowing incurred to cope with the corona crisis were suspended or a 2nd transitional period (5 years) were introduced before the debt brake bites, just over €100/200bn wd be available

These options wd need a 2/3 parl. majority

4/7

These options wd need a 2/3 parl. majority

4/7

And if the hit to potential output resulting from the corona crisis were put aside and the estimate from 2019 used instead, €127bn wd be freed up. This wd likely require only a simple legislative vote; however, the EU rules on structural deficits would still apply

5/7

5/7

Overall, there are reforms in 🇩🇪 that would make a material difference to the country's medium-run fiscal space. This would have beneficial effects on 🇪🇺 partners. Some require a 2/3 majority tho - underlining the folly of giving operational rules constitutional status.

6/7

6/7

Others are less demanding domestically but require EU rule changes to be fully effective. This emphasises the importance of the current EU economic governance reform debate, where at least some move towards greater scope for public investment seems likely.

7/7

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh