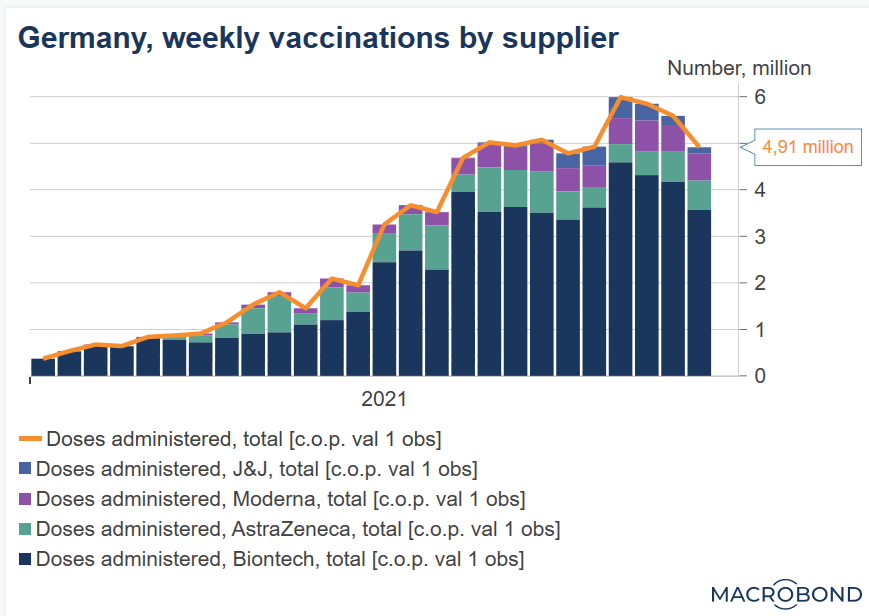

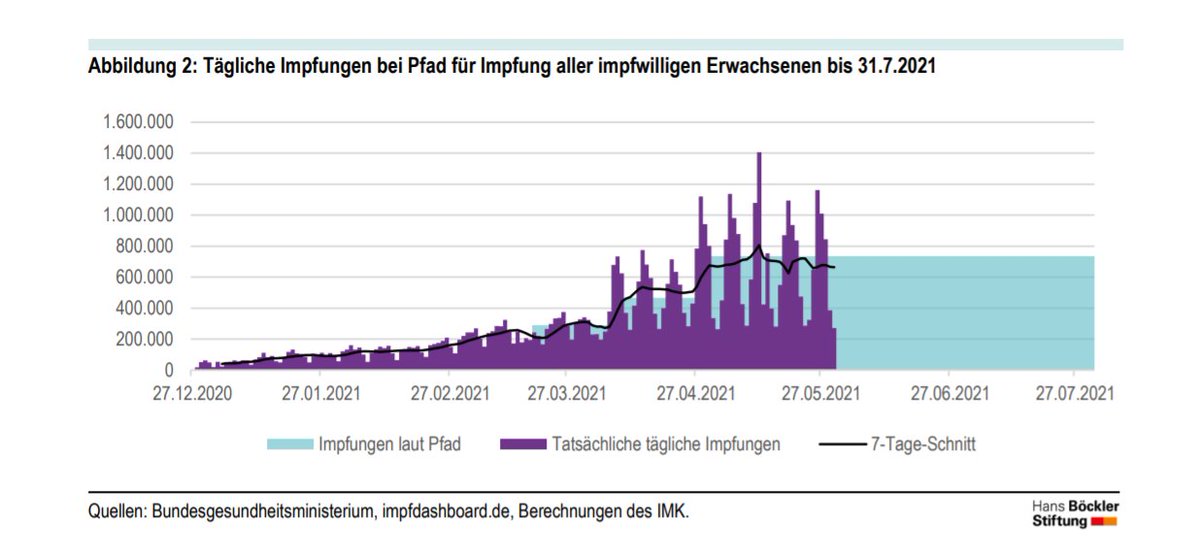

As 🇩🇪💉campaign loses some momentum, an anxious question arises: is this due to greater than expected resistence to getting a jab? And will vax rates that could realistically be achieved be enough to limit the public health risks?

@rki_de looks at both Qs & ... is confident

1/

@rki_de looks at both Qs & ... is confident

1/

https://twitter.com/rki_de/status/1412048168255168512

There is a lot of detail in the report, but the key message on needed vax rates - in most cases: 2 shots - is:

90% coverage of the <60's is needed.

For 12-59 year-olds there is a huge difference btwn 65 & 75% coverage. Above that the effect is smaller.

(>12 assumed = 0).

2/

90% coverage of the <60's is needed.

For 12-59 year-olds there is a huge difference btwn 65 & 75% coverage. Above that the effect is smaller.

(>12 assumed = 0).

2/

For a baseline scenario (a set of plausible assumptions including seasonality, role of delta etc.) the fig. shows the modelled incidence (cases /100.000pop, 7 days). Above 85% the additional protective effect is marginal. The figure for hospitalsiations has the same form.

3/

3/

On vax willingness the study refers to surveys suggesting Germans will accept vaccination at levels that imply a high level of community protection. The intention to get vaccinated amongst those so far unvaccinated is reported at around 2/3s for both >60 and 12-59.

4/

4/

Adding those shares already vaccinated leads to hi estimates of almost 95%/85% for over/under 60s. Initial vaccinations of the elderly are already very hi at over 84%.

There are grounds for scepticism here, however.

5/

There are grounds for scepticism here, however.

5/

Firstly, @rki_de assumes that all those with a 1st shot will also get fully vaccinated. While it cites survey evidence in support of this, it has been widely reported that substantial numbers are missing their 2nd appointments. Some may have got a 2nd jab elsewhere.

6/

6/

Others may subsequently get fully vaccinated. Still, a substantial number may never bother.

Secondly, the acceptance figure includes those who defitely and those say they probably will get vaccinated.

The road to hell is paved with good intentions!

7/

Secondly, the acceptance figure includes those who defitely and those say they probably will get vaccinated.

The road to hell is paved with good intentions!

7/

Even if the acceptance estimates are likely too high, the study does suggest that the cooling off of the vax pace in Germany is *not* a sign of the country having hit a wall. Vax rates are also susceptible to policy changes: an obvious screw to turn would be to end free tests.

8/

8/

Erratum.

Sorry in tweet 2 it should be OVER 60s and UNDER 12s - the signs need to be swapped 😳

(thanks @BarkowConsult)

Sorry in tweet 2 it should be OVER 60s and UNDER 12s - the signs need to be swapped 😳

(thanks @BarkowConsult)

• • •

Missing some Tweet in this thread? You can try to

force a refresh