Last thread on @HoneHealth.

@Saad_Hone reached out and we’re going to talk, and I appreciate him being willing to engage with someone publicly questioning his company like this.

This thread is about how we can all work together to make this better.

@Saad_Hone reached out and we’re going to talk, and I appreciate him being willing to engage with someone publicly questioning his company like this.

This thread is about how we can all work together to make this better.

My DMs have been crazy the last few days.

I was far from the only one concerned by tech influencers promoting what I see as a shady-looking testosterone company.

I heard from Founders, Angels, VCs, Employees, Peers.

But very few were willing to call them out publicly.

I was far from the only one concerned by tech influencers promoting what I see as a shady-looking testosterone company.

I heard from Founders, Angels, VCs, Employees, Peers.

But very few were willing to call them out publicly.

Which I 100% get.

I was extremely hesitant to start this fight.

And I’m an unfunded, employer-less guy who sits in his backyard writing about crypto.

There’s a big risk to calling out influencer investors.

I was extremely hesitant to start this fight.

And I’m an unfunded, employer-less guy who sits in his backyard writing about crypto.

There’s a big risk to calling out influencer investors.

This is unfortunately the situation VC culture and Twitter have put us in.

Everyone can see someone doing something questionable, but if there’s any chance that person might impact our job or company’s financial future, we won’t call them out on it.

Everyone can see someone doing something questionable, but if there’s any chance that person might impact our job or company’s financial future, we won’t call them out on it.

I don’t think the investors who promoted Hone had bad intentions.

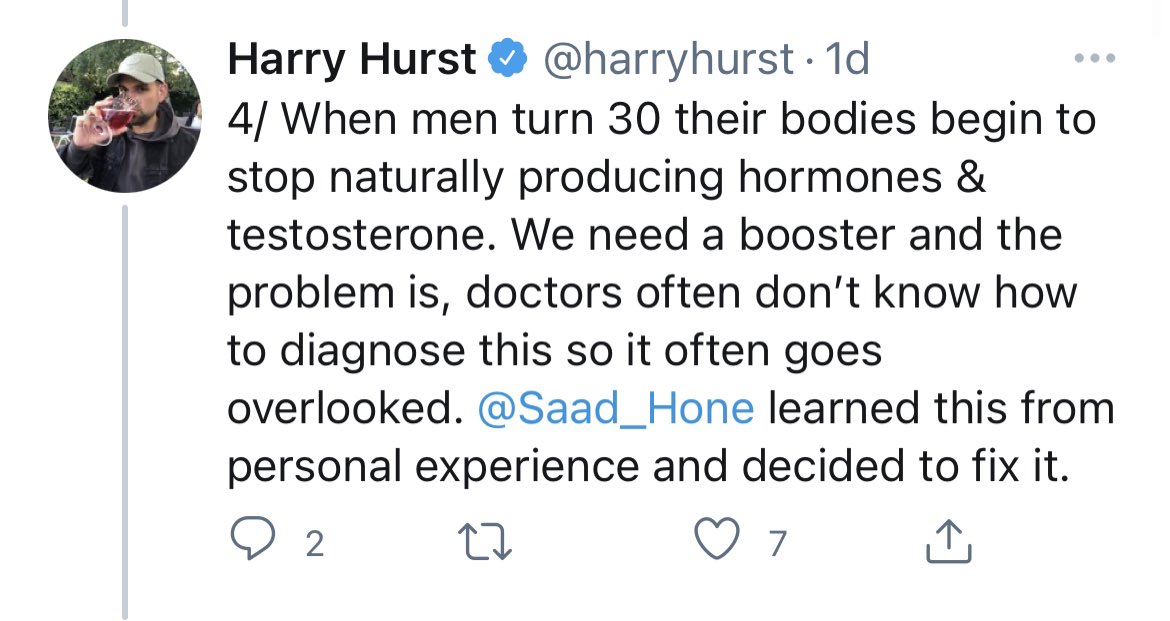

But I do think it was irresponsible to promote a company that looks like this.

And to promote it the way it was done.

But I do think it was irresponsible to promote a company that looks like this.

And to promote it the way it was done.

If I had promoted Hone and now had second thoughts, here’s what I’d say:

“Hey everyone, on Tuesday, I announced my investment in Hone, a company that I believe is working on an incredibly important mission around improving men's health.”

“Hey everyone, on Tuesday, I announced my investment in Hone, a company that I believe is working on an incredibly important mission around improving men's health.”

“But concerns were raised by members of the community over some of this company’s practices.

I’ve reviewed them, and I agree, these are important questions for them to answer to ensure there are no worries about their ethics or legitimacy.”

I’ve reviewed them, and I agree, these are important questions for them to answer to ensure there are no worries about their ethics or legitimacy.”

https://twitter.com/nateliason/status/1415745565611147264

I want to thank @theSamParr for already agreeing these are important questions for Hone to answer, and for talking about this with me publicly

https://twitter.com/theSamParr/status/1415811310504353793?s=20

Everyone else, @ankurnagpal @Maidenberg @austin_rief @brezina @shl @3LAU @schlaf @packyM @nikitabier @harryhurst @APompliano @maccaw @ShaanVP @CyrusMassoumi @gogoSlava

My DMs are open if you want to talk about this at all.

My DMs are open if you want to talk about this at all.

I’ve already had some great conversations with a few of you, and I believe that we all want the same thing:

To help men live healthier lives.

To help men live healthier lives.

• • •

Missing some Tweet in this thread? You can try to

force a refresh