1/ Some thoughts going into the $EVO $EVVTY Q2 tomorrow morning, my largest holding at ~19%.

Evolution has killed expectations *every quarter* since their IPO in 2015, and I've been a happy (and lucky) shareholder since 2018 somewhere. So, what's in store for tomorrow?

Evolution has killed expectations *every quarter* since their IPO in 2015, and I've been a happy (and lucky) shareholder since 2018 somewhere. So, what's in store for tomorrow?

2/ I'm not the guy who creates the most exquisite models at all, and especially not for every quarter. It's no different this time, but I'm obviously always a little curious if expectations feels too high, or too low.. so here goes a few guesses👇🏼

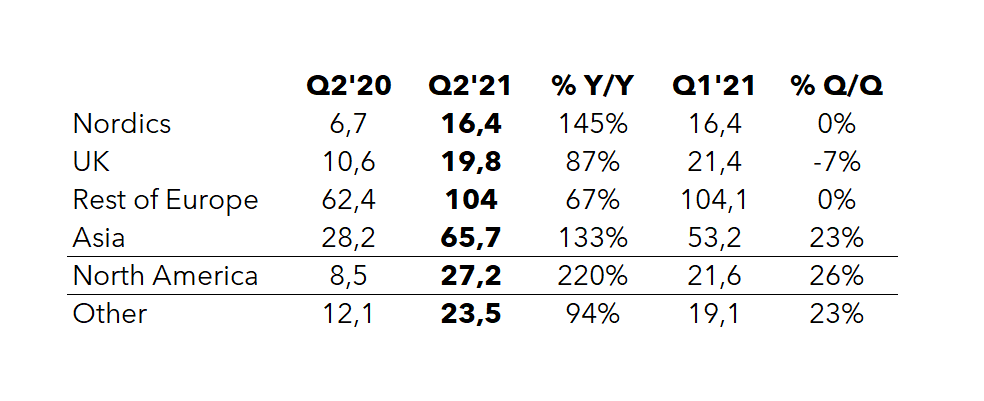

3/ Large sporting events during the period will of course hold back at least Europe this quarter, but that's not a secret. Analysts assume the q/q growth will land around 6.5% - that's half the rate of Q1 which was driven by an acceleration of Live Casino (+60% y/y, +15% q/q).

4/ My best guess is that Asia (+27% q/q, +156% y/y in Q1) together with North America (+72% q/q, +206% y/y and great updates yesterday from MI & PA) will offset the short-term pressure in EU, and together drive Live to at least 10% q/q.

5/ RNG (NetEnt/Red Tiger) is the hardest part for me to estimate since I haven't followed this company as long as $EVO, but my best guess is that it won't be much worse than Q1. +5% q/q? For the group total I don't see €260M as all that crazy tbh.

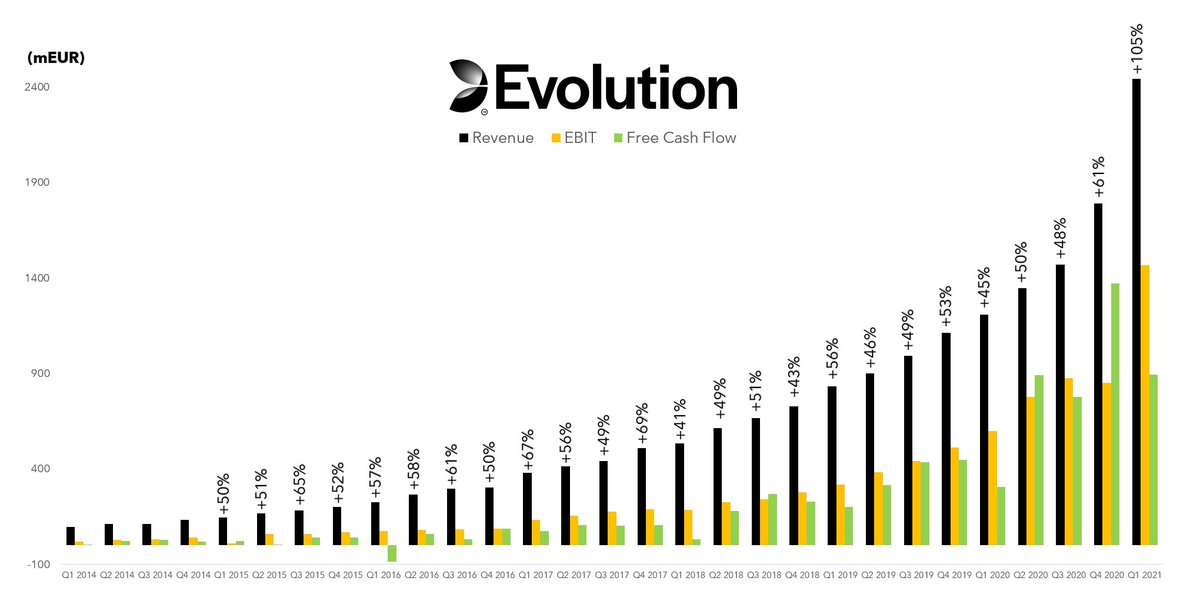

6/ Either way, I think regardless if this particular quarter is a 10% "beat" or a 10% "miss", this is an insane performance. Just insane. I mean, look at this chart.

And remember: it's not companies that misses estimates, it's analyst's who get estimates wrong.

And remember: it's not companies that misses estimates, it's analyst's who get estimates wrong.

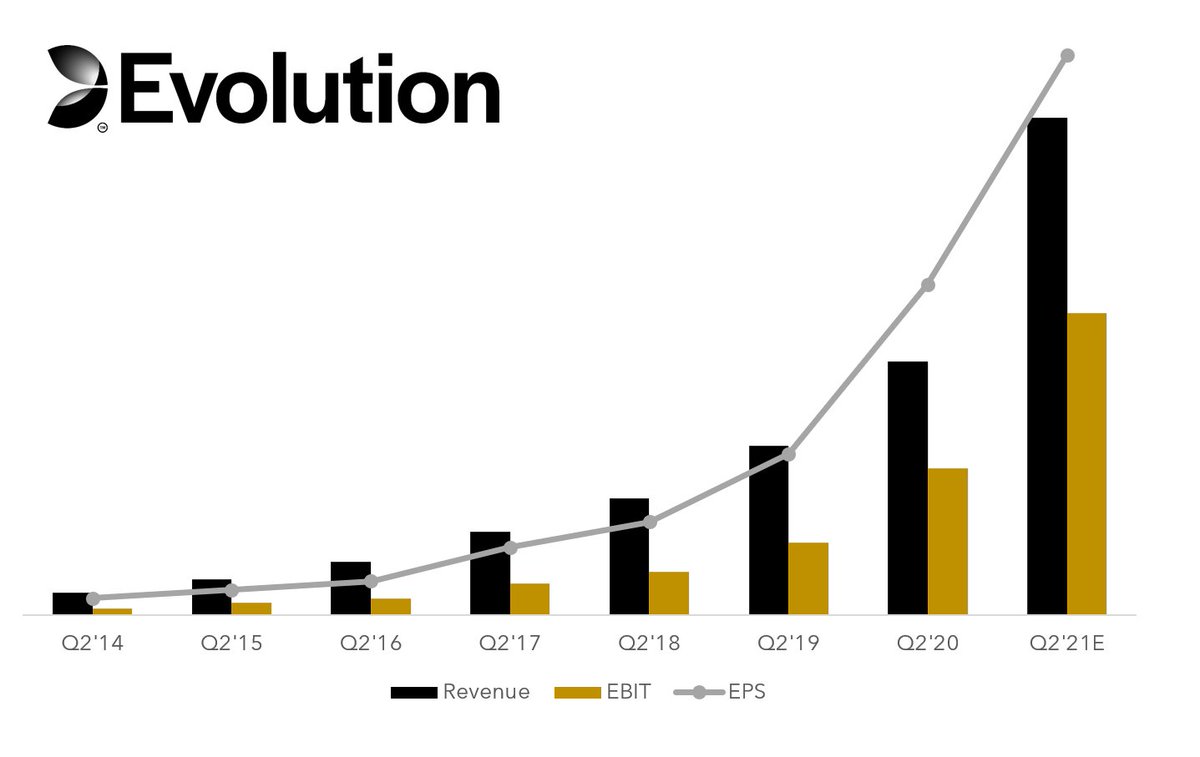

7/ Looking out a few more quarters, on my estimates $EVO's still trading at <30x EV/EBIT 22E, and ~20-24x the year after that. And even if the margin expansion story most likely is over soon (75% EBITDA?), the growth story has almost just started.

8/ This (Live) is a niche that's taking market share *every* year, growing at least by 30%, in one of the largest offline-to-online shifts globally by far. $EVO is ~$30B today, but can definitely turn into a $300B company over the next decade with the right execution.

9/ My point is that $EVO, despite what Mr Market says tomorrow, is one of the best growth stories out there - with almost unmatched fundamental performance - still trading at a fairly reasonable valuation. I'm not selling any time soon (as long as the story's intact).

10/ Here's the consensus estimates +past five quarters btw, for anyone interested (h/t @Quartr_App):

11/ In the first tweet the chart says “mEUR”, but it’s actually in mSEK. That’s also why some growth rates might differ a few percentage points from the reported numbers, depending on EUR/SEK exchange rates. Also noticed that Factset has 0.73 on consensus EPS (+87% y/y).

12/ Seems like my ~€260M (actual; 257M) revenue guess wasn’t too crazy after all, even though it was a bit high. Here’s my report summary:

https://twitter.com/Prof_Kalkyl/status/1417719855659290625

• • •

Missing some Tweet in this thread? You can try to

force a refresh