$EVO Q2'21💥

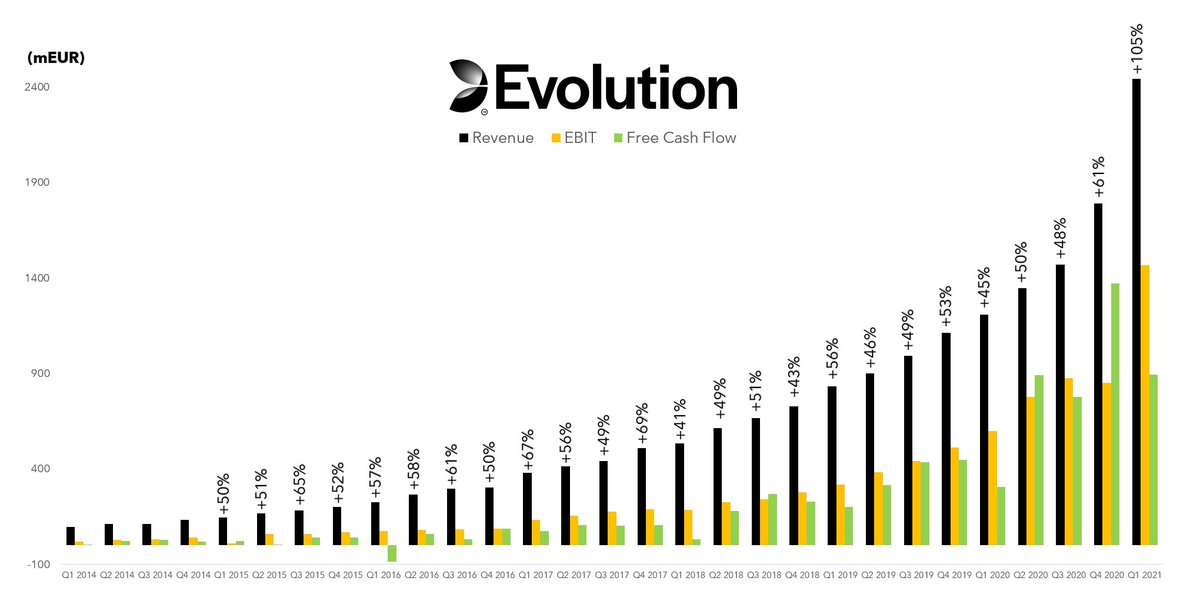

Revenue +100%

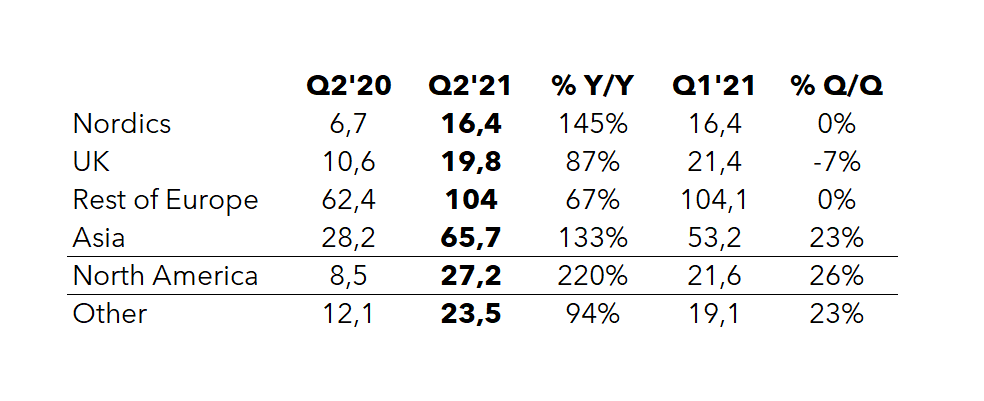

*North America +220%

*Asia +133%

*Live +59%

*RNG -2%

EBITDA +115%

*marg. 68.0% (63.2)

EBIT +110%

*marg. 60.7% (57.8)

Net Profit +105%

*marg. 56.3% (54.9)

EPS +75%

Revenue +100%

*North America +220%

*Asia +133%

*Live +59%

*RNG -2%

EBITDA +115%

*marg. 68.0% (63.2)

EBIT +110%

*marg. 60.7% (57.8)

Net Profit +105%

*marg. 56.3% (54.9)

EPS +75%

"After the end of the period, the new Michigan studio was approved and is ready for launch"

The number of bet spots from end users amounted to 17.5 billion (11.9), +47% y/y

• • •

Missing some Tweet in this thread? You can try to

force a refresh