I know crypto chart takes are 2 a penny these days so mine are equally worthless, but... we all know that log charts are the right way to look at these...1/

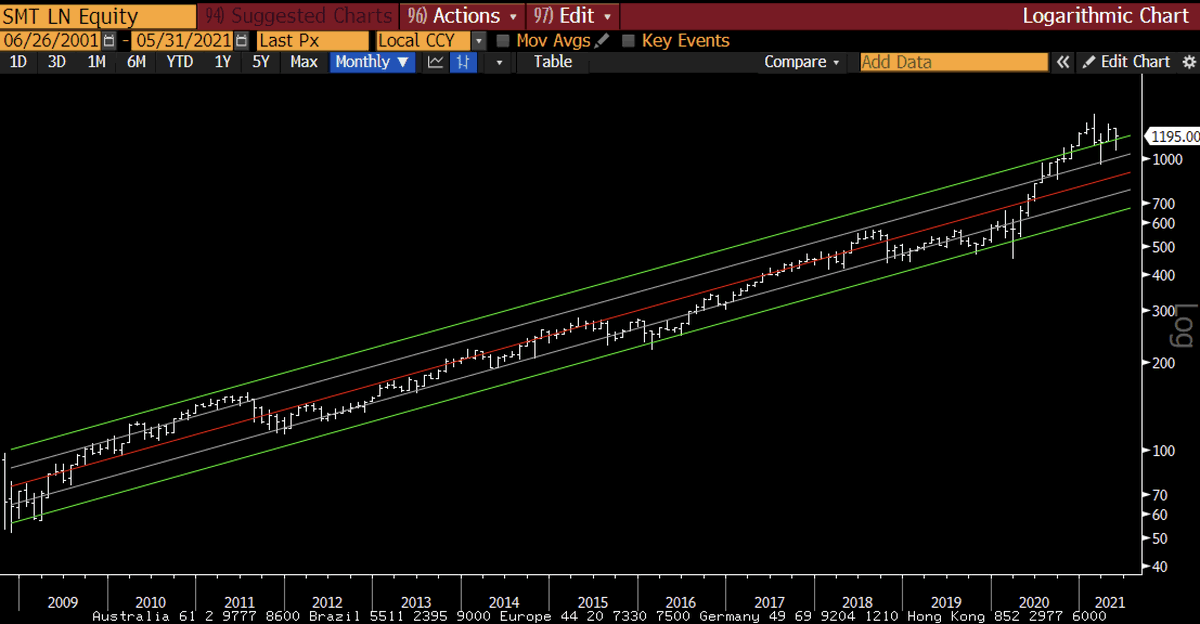

Bitcoin seems to have negated the Head and Shoulders pattern, on-chain data suggest huge accumulation and better market dynamics, Metclafes Law valuations are increasing, and time and price have now met the log trend...2/

• • •

Missing some Tweet in this thread? You can try to

force a refresh